July 26, 2024 17:21 GMT

MNI U.S. Weekly Macro Wrap: Q2 Demand Strength Will Keep Fed Patient On Cuts

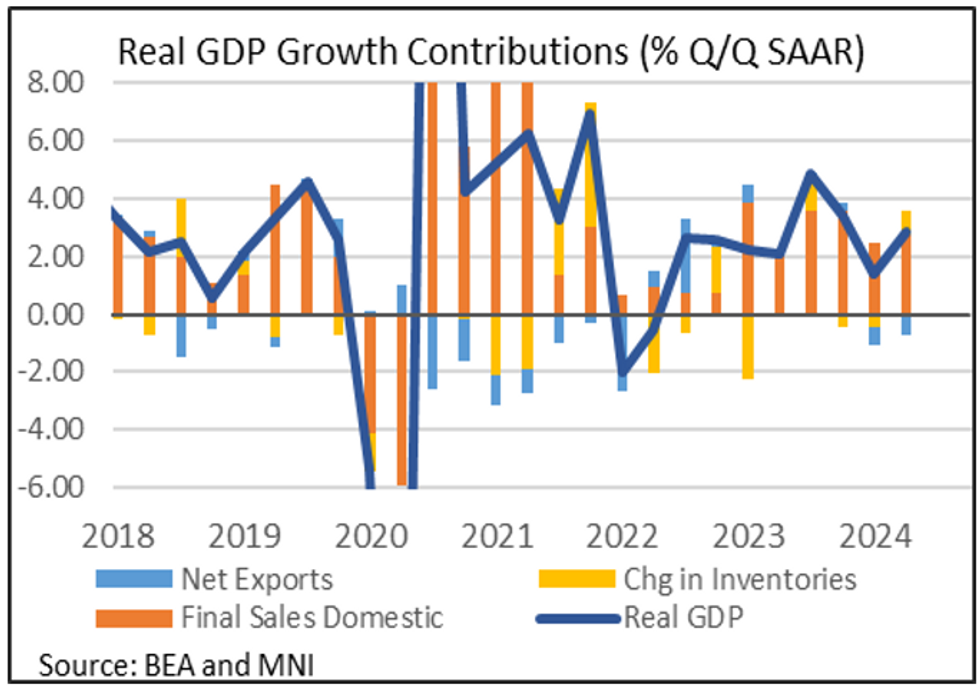

This week's data was mixed, but overall showed that domestic demand remained solid in Q2.

Executive Summary

- Preliminary national accounts data this week showed an unexpectedly strong rebound in GDP growth in the second quarter, with robust underpinnings including a re-acceleration in underlying domestic demand.

- While monthly PCE data showed some potential weaknesses in the solid consumption story as Q2 drew to a close, including moderating personal incomes, spending remained relatively solid overall. Core PCE inflation was as expected in June, at 0.18% M/M, leaving intact the rough trend of disinflation after a particularly strong Q1.

- Elsewhere, activity data was mixed: US PMI readings continued to diverge in the July flash report, with an unexpected contraction in Manufacturing but Services posting a surprise rise, while regional Fed surveys continued the recent theme of unusually wide regional divergences in manufacturing activity.

- June's advance durable goods report was extremely mixed, with solid core readings offsetting severe aircraft-driven weakness in overall orders. Meanwhile, housing market activity continues to slow.

- In combination with the previous week’s data beats, this week’s readings all but shut the door on any lingering speculation that the FOMC could deliver a shock rate cut next week.

- Even so, broader risk-off factors meant Fed rate cut pricing actually increased this week: a first cut remains priced for September, with a total of almost 3 cuts seen by year-end.

PLEASE FIND THE FULL REPORT HERE:

237 words