-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI US CLOSING FI ANALYSIS: Strong Retail Sales, Brexit Talk Weighs

US TSY SUMMARY: Better Than Exp Retail Sales, Brexit Headlines Drove Vol Friday

Rates traded weaker by the bell but off early session lows to near middle session range amid modest overall volumes (TYZ w/ 825k -- a tepid pace with volumes in the 10Y futures at 290k on the open). Brexit headline and data related risk drove session vol: Retail sales beating expectation while US IP missed the survey. Salient factors spurring trade today:

- Drug maker Pfizer hopes of vaccine provided mild risk-on tone;

- UK PM Johnson Brexit comments spurred decent 2-way, rates quickly reversed gains after Australia-style deal intimated

- Better than expected retail sales weighed on rates (support for equities) Tsys bounced on UK PM spokesman Slack comment:

- NO POINT IN TRADE TALKS IF EU DOESN'T CHANGE POSITION, Bbg, and "`TRADE TALKS ARE OVER' BECAUSE EU EFFECTIVELY ENDED THEM", Bbg. More Brexit Headline Induced Vol

- Midday bounce in Tsys w/below exp IP data and recent comments from UK PM spokesman Slack intimating Brexit negotiations are over spurred a quick round of short covering, long end back to narrow overnight range.

- The 2-Yr yield is up 0.2bps at 0.1411%, 5-Yr is up 0.3bps at 0.3169%, 10-Yr is up 0.8bps at 0.7406%, and 30-Yr is up 1.1bps at 1.5247%.

TECHNICALS

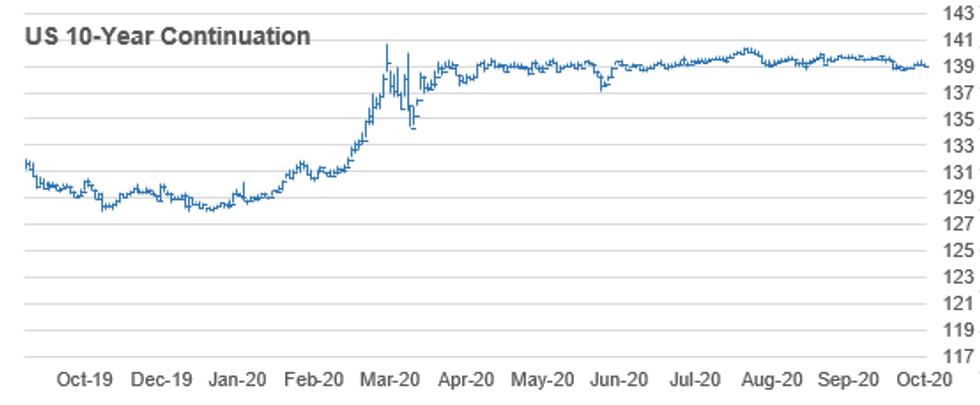

US 10YR FUTURE TECHS: (Z0) Bullish Outlook Remains Intact

- RES 4: 139-26 High Sep 29 and a key resistance

- RES 3: 139-25 High Oct 2

- RES 2: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-14 High Oct 15

- PRICE: 139-02 @17:23 BST Oct 16

- SUP 1: 138-31 Intraday low

- SUP 2: 138-28+ Low Oct 13

- SUP 3: 138-20+ Low Oct 7 and the bull trigger

- SUP 4: 138-18+ Low Aug 28 and bear trigger

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.840 - All time High Oct 6, 15 and the bull trigger

- PRICE: 99.830 @ 17:20 BST Oct 16

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.265 @ 17:08 BST Oct 16

- SUP 1: 99.075 - Low Oct and the key support

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

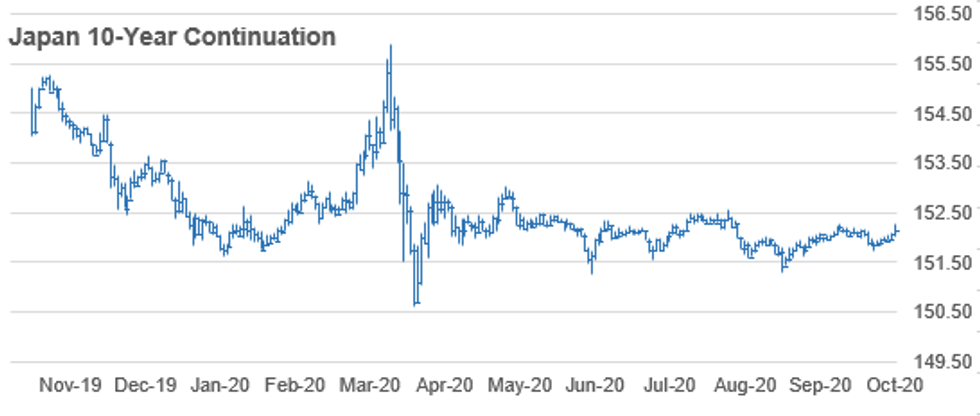

JGB TECHS: (Z0) Bullish Focus

JGB TECHS: (Z0) Bullish Focus

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.18 @ 17:12 BST Oct 16

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

Weaker But Off Early Lows

Rates traded weaker by the bell but off early session lows to near middle session range amid modest overall volumes (TYZ w/ 825k -- a tepid pace with volumes in the 10Y futures at 290k on the open). Brexit headline and data related risk drove session vol: Retail sales beating expectation while US IP missed the survey Yld curves mixed, well off early flatter levels, update:

- 3M10Y +1.355, 63.931 (L: 61.169 / H: 65.419)

- 2Y10Y +0.133, 59.257 (L: 58.2 / H: 61.453)

- 2Y30Y +0.328, 137.565 (L: 135.776 / H: 140.511)

- 5Y30Y +0.525, 120.344 (L: 119.014 / H: 122.45); Current futures levels:

- Dec 2Y down 0.12/32 at 110-13.875 (L: 110-13.62 / H: 110-14.5)

- Dec 5Y down 0.25/32 at 125-26.7 (L: 125-25.7 / H: 125-28.7)

- Dec 10Y down 1/32 at 139-3 (L: 138-31 / H: 139-07.5)

- Dec 30Y down 6/32 at 175-2 (L: 174-16 / H: 175-18)

- Dec Ultra 30Y down 17/32 at 219-10 (L: 218-03 / H: 220-12)

US TSY SUPPLY: Preview Next Wk's Auctions

| DATE | TIME | AMT | SECURITY | CUSIP |

| 19-Oct | 1130ET | $54B | 13W-Bill | (9127963V9) |

| 19-Oct | 1130ET | $51B | 26W-Bill | (9127962Q1) |

| 20-Oct | 1130ET | $30B | 42D-Bill CMB | (912796TU3) |

| 20-Oct | 1130ET | $30B | 119D-Bill CMB | (9127964D8) |

| 21-Oct | 1130ET | TBA | 105D-Bill CMB | 20-Oct |

| 21-Oct | 1130ET | TBA | 154D-Bill CMB | 20-Oct |

| 21-Oct | 1300ET | $22B | 20Y-bond/R/O | (912810SQ2) |

| 22-Oct | 1130ET | TBA | 4W-Bill | 20-Oct |

| 22-Oct | 1130ET | TBA | 8W-Bill | 20-Oct |

| 22-Oct | 1300ET | $17B | 5Y-TIPS | (91282CAQ4) |

EURODOLLAR FUTURES CLOSE: Narrow Range

Mostly steady in the short end to marginally mixed by the bell. Lead quarterly holds steady since 3M LIBOR climbed +0.00063 off Thu's all-time lo to 0.21838% (-0.00575/wk). Latest lvls:

- Dec 20 +0.000 at 99.760

- Mar 21 +0.005 at 99.795

- Jun 21 +0.005 at 99.805

- Sep 21 +0.010 at 99.810

- Red Pack (Dec 21-Sep 22) steady to +0.005

- Green Pack (Dec 22-Sep 23) steady

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) -0.01 to -0.005

USD LIBOR FIX

- US00O/N 0.08113 (-0.00012)

- US0001W 0.10075 (-0.00075)

- US0001M 0.15138 (0.00413)

- US0003M 0.21838 (0.00063)

- US0006M 0.25750 (0.00425)

- US0012M 0.33500 (-0.01275)

US TSYS/STIR

FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.10%, $952B

- Broad General Collateral Rate (BGCR): 0.07%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $331B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. whopping $45.582B submission

- Next week's scheduled purchases:

- Mon 10/19 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 10/20 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 10/21 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 10/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 10/23 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

OUTLOOK: Look Ahead To Monday

- US Data/Speaker Calendar (prior, estimate)

- 19-Oct 0800 Fed Chair Powell, panel remarks IMF event "Cross-Border Payment, A Vision for the Future", IMF Mng Dir Kristalina Georgieva moderating

- 19-Oct 1000 Oct NAHB home builder index (83, 83)

- 19-Oct 1130 US Tsy $54B 13W-Bill auction (9127963V9)

- 19-Oct 1130 US Tsy $51B 26W-Bill auction (9127962Q1)

- 19-Oct 1420 Atl Fed Bostic, economic diversity

- 19-Oct 1500 Philly Fed Harker, Covid-19 recovery

PIPELINE: $8B BoA 5pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/16 $8B #Bank of America $2B 4NC3 +63, $500M 4NC3 SOFR+73, $2.5B 6NC5 +88, $2.5B 11NC10 +118, $1B 31NC30 +130

- 10/16 $1B #Morgan Stanley WNG 5NC4 fix/FRN, +55

- 10/16 $500M *China Minsheng Banking 3Y FRN, L+90

- 10/?? $Benchmark Denmark short duration bond

FI OPTIONS

Eurodollar Options:

- 3,000 Blue Dec 91/92/93 put flys

- 5,000 Dec 95/96 put spds vs. Red Mar 93/95 put spds

- +2,000 Blue Jun 90/95 3x2 put spds, 26.0

- -2,500 short Jun 96 puts .25 over Blue Dec 91/93 put spds

- Conditional Bear Steepener

- +2,500 Green Jun 95/96 put spds, 4.5 vs. 99.625/0.22%

- +5,000 Blue Mar 93/95 put spds 1.0 over the short Mar 96/97 put spds -- pre-data

- Overnight trade

- -4,500 short Mar 100.25 calls, 0.5

- 4,800 Dec 95/96/97 put flys

- +5,000 TYZ 139 straddle, 1-27 1-28

- 1,500 TYZ 136/137/138 put flys, 6/64

- +5,000 TYZ 138.5 puts, 35/64

- +7,000 TYZ 138 puts, 20-23, ongoing buyer

- Overnight trade

- +5,000 TYZ 138 puts, 20/64 recently

- over +13,600 TYZ 135 puts, 2/64

- 3,000 TYX 138.75/139 put spds

- 3,600 TYX 139.5 calls

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.