-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Cautious Pivot

MNI US MARKETS ANALYSIS

Highlights:

- Markets have pivoted to a more risk-off posture following the initial optimism over the Covid vaccines

- Combined EGB supply from Spain and France was well absorbed

- The Fed's Mester and Bowman will be speaking later today

US TSYS SUMMARY: COVID Caution Carries Over Into Thursday

Caution late in Wednesday's session has carried over into Thursday, with equities heading lower and the dollar higher. COVID lockdown concerns the primary underlying theme. Treasuries have gained slightly against this backdrop, with a bit of bull flattening in the curve.

- That said, volumes unremarkable so far, ~230k in Dec 10-Yr futures (TY) which are up 5.5/32 at 138-11.5 (L: 138-07 / H: 138-13).

- The 2-Yr yield is down 0.2bps at 0.1713%, 5-Yr is down 1bps at 0.3857%, 10-Yr is down 1.8bps at 0.8521%, and 30-Yr is down 2.4bps at 1.5758%

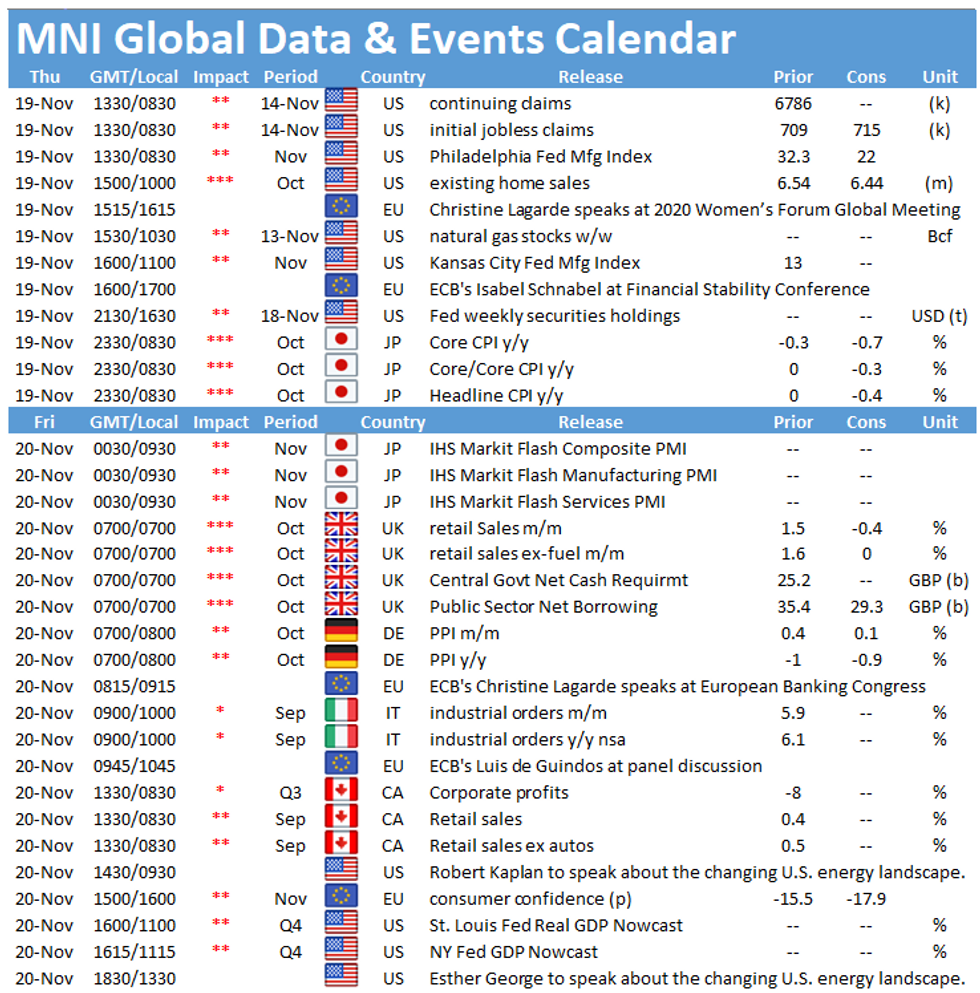

- 0830ET sees weekly jobless claims and November Philly Fed manufacturing, at 1000ET we get Oct existing home sales, and 1600ET Nov KC Fed manufacturing.

- Today's Fed speakers: Cleveland's Mester and Gov Bowman at 1235ET (Mester gives introductory remarks at 0830et), Boston's Rosengren at 1300ET.

- Today rounds out the week's supply, with $65B of 4-/8-wk bills sold at 1130ET, and $12B of 10-Yr TIPS at 1300ET.

- The week's heavy NY Fed operational purchases schedule continues, with buying of ~$3.625B in Tsy 7Y-20Y today.

BOND SUMMARY: Risk Sentiment Fragile

European govies have broadly firmed this morning alongside fresh losses for equities and a resurgent US dollar.

- Gilts rallied from the open, but quickly gave up the early gains and now trade within 1bp of yesterday's close

- The bund rally has been sustained through the morning with the curve bull flattening. The 2s30s spread is 3bp narrower.

- OATs trade broadly in line with bunds. Cash yields are up to 2bp lower on the day.

- BTPs have trade marginally weaker. Last yields: 2-year -0.3866%, 5-year 0.0724%, 10-year 0.6525%, 30-year 1.505%.

- Supply this morning came from France (OATs EUR8.495bn, Linkers EUR1.50bn), Spain (Letras, EUR1.844bn) and Ireland (Bills, EUR0.75bn).

- UK Government spokesman Jamie Davies indicated that trade talks with Canada were at an 'advanced stage', while Trade Secretary Liz Truss stated that negotiations with the US were making 'good' progress.

DEBT SUPPLY

France Sells E8.495bn of OATs Vs E7.5-8.5bn Target

- E2.890bn of the 1.75% May-23 OAT: Average yield -0.71% (-0.53%), bid-to-cover 2.05x (2.80x)

- E4.120bn of the 0% Feb-26 OAT: Average yield -0.62% (-0.64%), bid-to-cover 1.89x (1.72x)

- E1.485bn of the 2.75% Oct-27 OAT: Average yield -0.57% (-0.59%), bid-to-cover 2.20x (1.54x)

France Sells E1.50bn of Linkers Vs E0.5-1.5bn Target

- E0.644bn of the 0.10% Mar-26 OATEi : Average yield -1.29% (-1.12%), bid-to-cover 3.80x (3.56x)

- E0.432bn of the 0.10% Mar-36 OATi: Average yield -0.94% (-0.63%), bid-to-cover 4.14x

- E0.424bn of the 0.10% Jul-36 OATEi: Average yield -1.14% (-0.99%), bid-to-cover 3.18x (2.20x)

Spain Sells E1.844bn of Bonos/Oblis Vs E1.5-2.5bn Target

- E1.357bn of the 0% Jan-26 Bono: Average yield -0.414% (-0.35%), bid-to-cover 2.00x (2.23x)

- E0.487bn of the 0.80% Jul-27 Obli: Average yield -0.273% (-0.04%), bid-to-cover 7.22x (3.43x).

Ireland Sells E750mn of Apr 19, 2021 Bills

- Average yield -0.57%, bid-to-cover 2.2x

OPTION FLOW SUMMARY

EUROZONE:

Bund downside

RXF1 170p, bought for 1 in 1.6k

Dec20 vs Mar21 cs spread

DUH1 112.40/112.60 cs 1x2 bought for 1.5 in 1.25k vs DUZ0 112.30/112.40cs, sold at 1 in 1.25k

UK

Risk reversal

0LU1 100.12/99.62 RR, bought the call for 2.25 in 5k (ref 99.92)

FOREX: USD Trades On The Front Foot This Morning - A Continuation of the Overnight Session.

- Equity future are better offered, providing some USD lifts

- The Greenback tested high of the session across the board on Safe Haven, as Covid spikes, Lockdown and the lack of stimulus dominates.

- Early European session saw two surprise rate cuts from Asia.

- Indonesia cut rate by 25bps to 3.75% vs unchanged expected at 4%

- The BSP, also cut 25bps to 2% versus unchanged expectation at 2.25%

- GBP is down 0.47% against the Dollar, more a function of the broader USD buying, but also heavy as the window for a Brexit deal continues to narrow.

- Brexit update are expected on Friday, but worth keeping an eye on any potential headline today.

- ALL EYES today on EM FX and especially the CBRT, following Erdogan's comments on "high rates rendering production and export impossible".

- Turkish Lira outperforms across the board, ahead of the awaited CBRT rate decision, when Economists surveyed by Bloomberg expects a 475bps hike to 15%

TECHS: Key Price Signal Summary

- E-Mini S&P futures remain below resistance at 3668.00, Nov 9 high. A break would resume the uptrend to open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle and is a reversal threat. Watch 3506.50, Oct 11 low and key support.

- EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact. A break of 1.1920 resumes the uptrend. On the downside, 1.1603, Nov 4 low is exposed if 1.1746 gives way.

- USDJPY key support lies at 103.18, Nov 11 low and in EURJPY, support lies at 122.69, the Nov 9 low.

- EURGBP trendline resistance is at 0.9032, drawn off the Sep 11 high.

- FI resistance levels to watch:

- Bund fut: 175.62 61.8% of the Nov 4 - 11 sell-off.

- Gilts: Have stalled ahead of 135.15, the 20-day EMA.

- Trendline resistance in Treasuries drawn off the Oct 2 high is at 138.15+, just below yesterday's high of 138-16+.

- Key support in Gold remains $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (F1) at $40.33, the Nov 13 lows.

EQUITIES: Post-Vaccine Trade Fades Once Again

Equities continue to suffer from risk aversion early Thursday, with the post-vaccine trade fading once again (energy and financials underperforming in Europe, Nasdaq slightly outperforming in the US).

- Asian stocks closed mixed, with Japan's NIKKEI down 93.8 pts or -0.36% at 25634.34 and the TOPIX up 5.76 pts or +0.33% at 1726.41. China's SHANGHAI closed up 15.785 pts or +0.47% at 3363.088 and the HANG SENG ended 187.32 pts lower or -0.71% at 26356.97.

- European stocks are lower, with the German Dax down 162.46 pts or -1.23% at 13109.4, FTSE 100 down 55.67 pts or -0.87% at 6340.07, CAC 40 down 45.14 pts or -0.82% at 5485.14 and Euro Stoxx 50 down 41.06 pts or -1.18% at 3456.41.

- U.S. futures are weaker, with the Dow Jones mini down 194 pts or -0.66% at 29197, S&P 500 mini down 22 pts or -0.62% at 3543.25, NASDAQ mini down 70.75 pts or -0.59% at 11826.25.

COMMODITIES: Broad Weakness On Risk-Off, Dollar Strength

There is weakness across the commodity complex early Thursday as risk-off sentiment combines with a rising USD.

- WTI Crude down $0.5 or -1.2% at $41.5

- Natural Gas down $0.05 or -1.77% at $2.668

- Gold spot down $10.95 or -0.58% at $1859.49

- Copper down $1.2 or -0.37% at $320

- Silver down $0.43 or -1.75% at $23.7809

- Platinum down $6.39 or -0.68% at $936.42

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.