-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: UST Yields Surge

MNI US MARKETS ANALYSIS: UST Yields Surge

Highlights

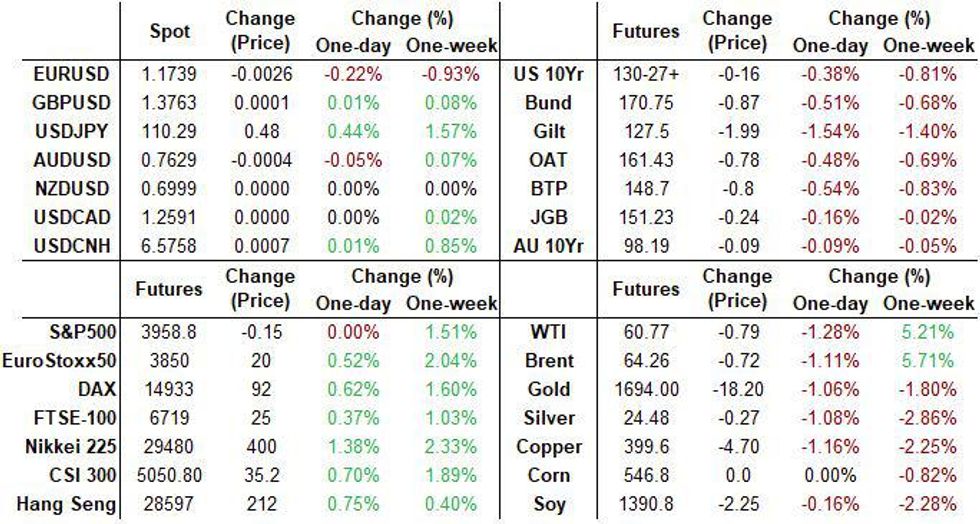

- UST yields surge on positive stimulus/vaccination outlook

- Post-Suez blockage and pandemic treaty further bolsters risk sentiment

- Equities broadly higher and USD on the backfoot.

US TSYS SUMMARY: Fresh Highs For 5s / 10s Yields

Treasury yields have retraced after hitting post-Mar 2020 highs in European trade, though overall the direction of travel still appears to be upward.

- 5-Yr yields hit post-Feb 2020 high (0.9488%) and 10s post-Jan 2020 high (1.7742%) before retracing slightly. Pretty steady weakness overnight in Asia-Pac, accelerating a bit on the London open.

- No particular trigger, but overall the global reflation trade appears alive and well, with attention swiftly turning to Pres Biden's next stimulus and associated supply + macro implications.

- The 2-Yr yield is up 1.4bps at 0.1544%, 5-Yr is up 5.5bps at 0.9424%, 10-Yr is up 5.9bps at 1.7671%, and 30-Yr is up 4.2bps at 2.4472%. Jun 10-Yr futures (TY) down 15.5/32 at 130-28 (L: 130-26 / H: 131-13.5).

- Equities in the green (Nasdaq futs notably in the red), dollar higher.

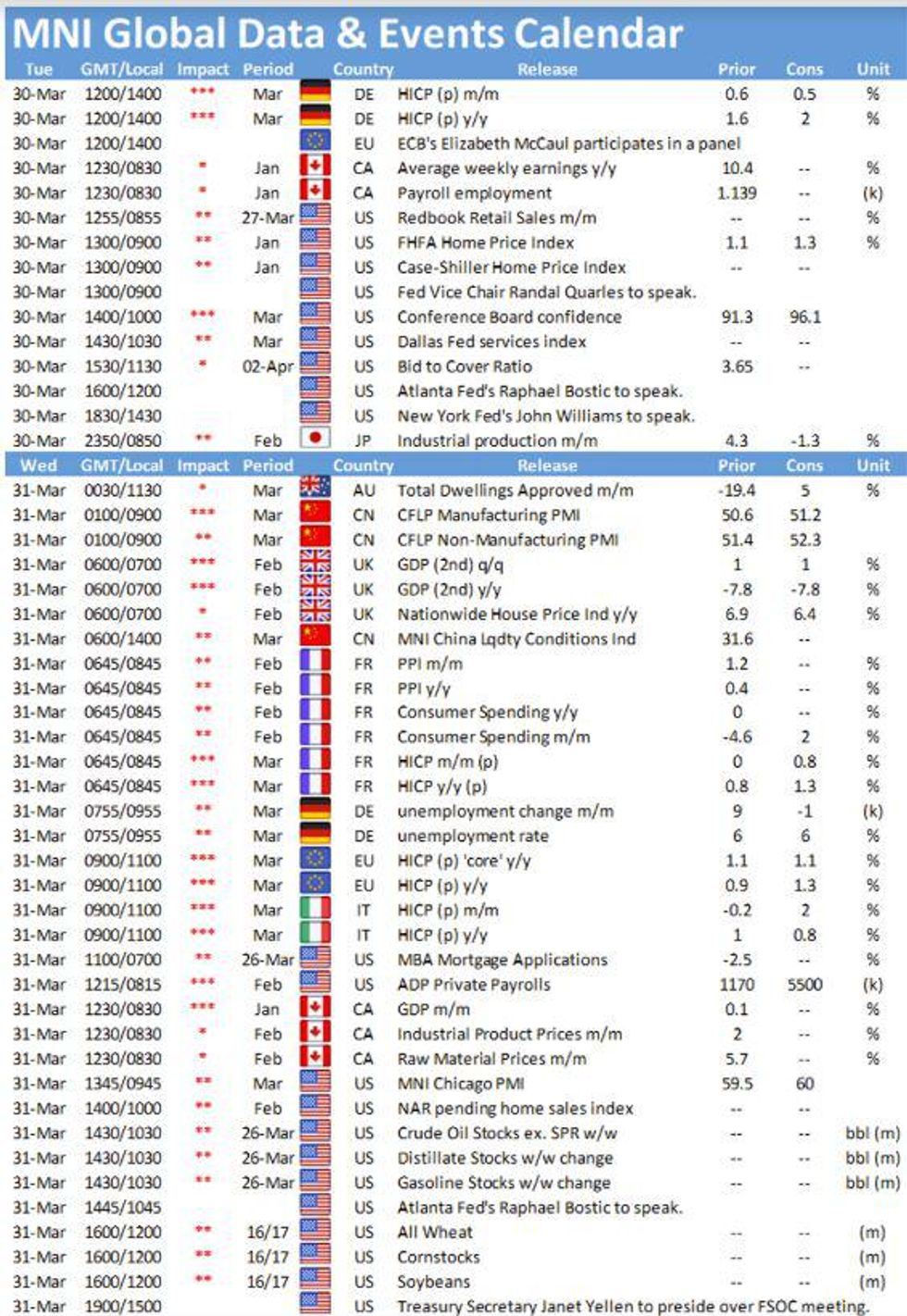

- Some 2nd tier data on the slate, including house price indices at 0900ET and Conference Board consumer confidence at 1000ET.

- Two Fed speakers: VC Quarles at 0900ET, and NY's Williams at 1430ET.

- In supply, $40B 42-day Bill auction at 1130ET. NY Fed buys ~$1.225B of 7.5Y-30Y TIPS.

EGB/GILTS: SUMMARY

A busy session for EGBs and core Bonds.

- Bund price action was mostly led by US treasuries, as the Suez canal is now free, Global trade outlook has been taken positively in the markets and as such EGBs came under pressure.

- Bund has now dropped some 160 ticks from yesterday's high. German 5/30s traded through March high, but we have since faded off the best levels, with more pressure in the shorter end 3 months to 2yr.

- Peripherals have mainly traded in tandem with Bund, albeit a little tighter, with Greece leading at 2.2bps

- Similar price action was seen in the Gilts, with the contract lower, Global trade set to resume and the UK slowly re-opening, as well as vaccination pace has kept a lid on futures.

- US Treasuries were the clear leading market this morning, dragging EGBs and Gilts lower, in turn pushing yields higher.

- The US 10yr yields edged towards levels last seen since 22/01/2020.

- We are nearing that decent resistance area at 1.7811% (50% retracement of Nov 2018-March 2020 fall)

- US 10yr printed 1.7742% high.

- Looking ahead, German national CPI, and US Consumer Confidence are the notable data.

- Speakers, sees Fed Quarles, Williams,ECB Centeno and Riksbank Ingves

FOREX: A Busy Morning Session Across Assets and FX.

- After being mixed overnight, USD is in the Green against all majors, although Kiwi is still holding onto small gains (up 0.09%) versus the USD.

- This was led by higher US yields, after the end of traffic jam at the Suez canal brought back a positive outlook for Global trade.

- US 10 yr yields trades above the 2021 high, which was at 1.7525%,

- USDJPY is now trending towards levels last seen since last year.

- Risk on and higher US yields as Global trade are set to re-open is seeing safe haven FX better offered.

- JPY and CHF are down 0.44% and 0.32% respectively on the Risk on tone.

- SEK is also underperforming going into Month End/Quarter End, down 0.37%.

- Next target in the USDJPY cross is seen further out towards 110.63 0.764 proj of Mar - Apr 2020 rally from Jan 6 low

- Also note, that 110.67 is the May 2019 high

- Looking ahead, German national CPI, and US Consumer Confidence are the notable data.

- Speakers, sees Fed Quarles, Williams,ECB Centeno and Riksbank Ingves

FX OPTION EXPIRY

FX OPTION EXPIRY (updated, closest ones)

- EURUSD: 1.1740 (693mln),

- USDJPY: 109.75 (495mln)

- USDCAD; 1.2540 (390mln)

- AUDUSD; 0.7600 (466mln), 0.7640 (839mln)

- EURNOK: 10.07 (570mln), 10.10 (440mln)

Price Signal Summary - USD Bulls In Charge and Yields Climb

- In the equity space, S&P E-minis are holding onto recent gains and remain bullish. Initial resistance to watch is 3978.50, Mar 18 high. A break would resume the uptrend and expose 4000. Key short-term support is at 3843.25. EUROSTOXX 50 has traded to a fresh trend high today. This reinforces the underlying bullish theme and opens 3926.56, 1.764 projection of Dec 21 - Jan 8 rally from Jan 28 low.

- In the FX space, EURUSD maintains a weaker tone. The focus on 1.1711 next, Nov 5 low. The GBPUSD outlook remains bearish and recent gains are considered corrective. The pair last week cleared a bull channel base drawn off the Nov 2 low. The focus is on 1.3641, 38.2% of the Sep 23 - Feb 24 bull cycle. Resistance, at the former channel base, is 1.3864. USDJPY remains bullish and has cleared 110.00. Scope is for a climb to 110.63 Fibonacci projection, 0.764 of the Mar - Apr 2020 rally from the Jan 6 low.

- On the commodity front, Gold is heavy and has cleared near-term supports. This has exposed $1676.9, Mar 8 low and the bear trigger. Brent (K1) has probed resistance at $65.12, Mar 22 high. An extension higher would signal scope for a move towards $68.15, Mar 18 high. WTI (K1) has also probed resistance at $62.04, Mar 22 high. This signals scope for a climb towards $64.88, Mar 18 high

- In the FI space, futures are soft and yields are climbing. Bunds (M1) are sharply lower this morning. Key support to watch is at 170.52, Mar 18 low. Gilts (M1) are trading lower too. The key support and bear trigger is at 126.79, Mar 18 low. Treasuries have traded to fresh trend lows. The focus is on 130-07, Feb 2, 2020 low and the psychological 130-00 handle.

EQUITIES: Nasdaq Lags Broader Rally

- Asian stocks closed mixed, with Japan's NIKKEI up 48.18 pts or +0.16% at 29432.7 and the TOPIX down 15.48 pts or -0.78% at 1977.86. China's SHANGHAI closed up 21.381 pts or +0.62% at 3456.677 and the HANG SENG ended 239.2 pts higher or +0.84% at 28577.5.

- European equities are stronger, with the German Dax up 90.87 pts or +0.61% at 14924.29, FTSE 100 up 35.61 pts or +0.53% at 6781.72, CAC 40 up 37.29 pts or +0.62% at 6053.83 and Euro Stoxx 50 up 18.77 pts or +0.48% at 3908.59.

- U.S. futures are gaining, with the exception of tech: Dow Jones mini up 63 pts or +0.19% at 33095, S&P 500 mini down 1.75 pts or -0.04% at 3957.25, NASDAQ mini down 69.5 pts or -0.54% at 12875.

COMMODITIES: Weaker As Dollar Continues To Gain

- WTI Crude down $0.46 or -0.75% at $61.42

- Natural Gas up $0.02 or +0.83% at $2.646

- Gold spot down $14.05 or -0.82% at $1702.12

- Copper down $1.95 or -0.48% at $400.75

- Silver down $0.15 or -0.59% at $24.5073

- Platinum down $0.43 or -0.04% at $1179.57

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.