-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS : ECB In Focus

MNI US MARKETS ANALYSIS: ECB In Focus

- Focus today is on the ECB meeting.

- No policy change expected, but communication on weekly PEPP purchases will be monitored.

- EGBs have traded weaker through the morning with equities inching higher.

US TSYS SUMMARY: Turning Lower Ahead Of ECB, Jobless Claims

Treasuries have turned lower in the European morning after gaining in Asia-Pac trade overnight, but limited price action overall with the European Central Bank decision eyed at 0745ET (press conf at 0830ET).

- Jun 10-Yr futures (TY) down 1/32 at 132-16 (L: 132-15.5 / H: 132-24.5). Highs hit overnight on a variety of headlines, including on US-Iran talks perhaps not as advance as had been suggested; COVID soaring in India; US fiscal (wrangling over infra bill size; Senate Republicans staking out showdown over debt ceiling).

- The 2-Yr yield is unchanged at 0.1472%, 5-Yr is up 0.8bps at 0.805%, 10-Yr is up 0.7bps at 1.5627%, and 30-Yr is up 0.5bps at 2.2551%.

- Equities trading sideways and the dollar failing so far to find decisive direction.

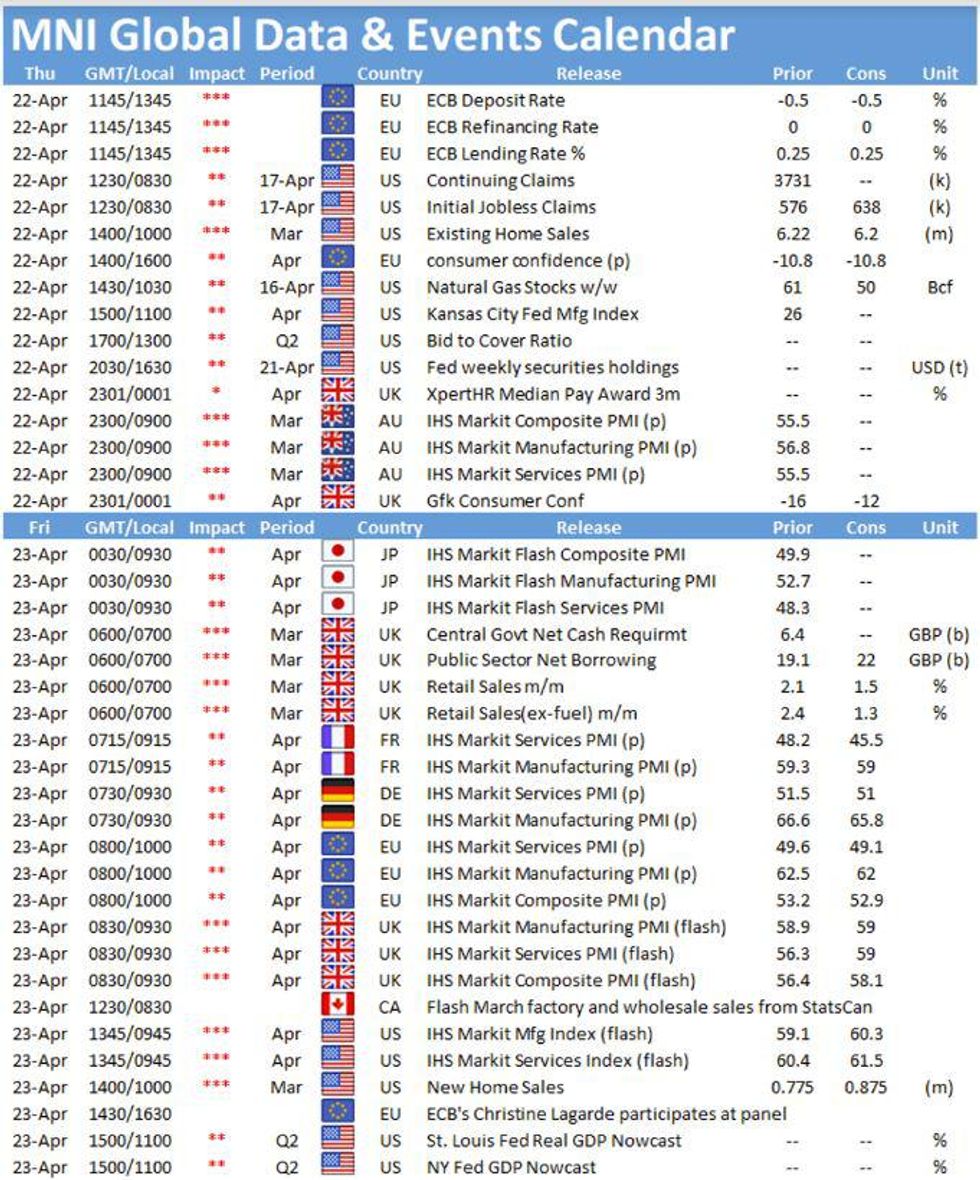

- We get data for the first time this week: jobless claims at 0830ET; at same time we get Chicago Fed nat'l activity index. Later at 1000ET is existing home sales and Mar leading index, followed at 1100ET by KC Fed manufacturing.

- In supply, we get $80B in 4-/8-week bills at 1130ET, with $18B 5Y TIPS auction at 1300ET - and note end-of-month coupon announcement at 1100ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILTS SUMMARY

EGBs started the session in the green, but we have since faded, as the US start to come in, on positioning and likely squaring heading into the ECB.

- Bund are leaning bear steeper, with upside limited by early Spanish and French supplies.

- Peripheral have traded in tandem with core and as such spread trade mostly flat versus the German 10yr.

- Gilts have held onto gains, with the Pound coming under small pressure, but very little new in terms of clear catalyst.

- Looking ahead, focus turns to the ECB and presser, EC Consumer Confidence is the last EU data left on the calendar.

- On the other side of the pound, US IJC is the most notable data

- Bund futures are down -0.05 today at 170.83 with 10y Bund yields up 0.4bp at -0.259% and Schatz yields up 0.5bp at -0.696%.

- BTP futures are down -0.05 today at 148.26 with 10y yields up 0.8bp at 0.760% and 2y yields up 1.2bp at -0.352%.

- OAT futures are down -0.06 today at 161.48 with 10y yields up 0.5bp at 0.078% and 2y yields up 1.0bp at -0.653%.

- Gilt futures are up 0.09 today at 128.76 with 10y yields down -0.4bp at 0.734% and 2y yields up 0.6bp at 0.038%.

EUROPE ISSUANCE UPDATE

Spain Sells E5.25bn of Bono/Obli (Vs Up To E6bn Target)

| 0% May-24 Bono | 1.50% Apr-27 Obli | 0.10% Apr-31 Obli | |

| Amount | E1.788bln | E1.238bln | E2.227bln |

| Previous | E2.13bln | E1.67bln | E1.87bln |

| Avg yield | -0.411% | -0.132% | 0.368% |

| Previous | -0.396% | 0.473% | 0.351% |

| Bid-to-cover | 2.50x | 2.34x | 1.92x |

| Price | 101.283 | 109.852 | 97.363 |

| Previous | 101.275 | 107.150 | 97.503 |

| Pre-auction mid | 101.242 | 109.749 | 97.235 |

| Previous date | 18-Mar-21 | 19-Mar-20 | 04-Mar-21 |

France Sells E10.99bln Nominal OAT (vs E10-11bn Target)

| 0% Feb-24 OAT | 0% Feb-27 OAT* | 0.50% May-29 OAT | |

| Amount | E3.035bln | E4.304bln | E3.655bln |

| Previous | E4.99bln | E3.10bln | E3.04bln |

| Avg yield | -0.610% | -0.360% | -0.180% |

| Previous | -0.610% | -0.480% | -0.250% |

| Bid-to-cover | 2.70x | 2.21x | 1.90x |

| Price | 101.740 | 102.150 | 105.500 |

| Previous | 101.820 | 106.290 | |

| Pre-auction mid | 101.718 | NEW | 105.434 |

| Previous date | 18-Mar-21 | 18-Mar-21 | 18-Feb-21 |

| *Previous shows auction of 0% Feb-26 OAT |

France Sells E2bln Linker OAT (vs E1.5-2.0bn Target)

| 0.10% Mar-26 OATei | 0.10% Mar-36 OATi | 0.10% Jul-47 OATei | |

| Amount | E1.197bln | E0.393bln | E0.406bln |

| Previous | E1.03bln | E0.28bln | E0.50bln |

| Avg yield | -1.770% | -1.100% | -0.900% |

| Previous | -1.700% | -0.980% | -0.880% |

| Bid-to-cover | 2.18x | 2.30x | 2.14x |

| Price | 109.540 | 119.490 | 129.900 |

| Previous | 109.370 | 117.490 | 129.190 |

| Pre-auction mid | 109.488 | 119.368 | 129.665 |

| Previous date | 18-Mar-21 | 18-Feb-21 | 18-Feb-21 |

EUROPE OPTIONS FLOW SUMMARY

Eurozone

DUM1 112.30/20/10/00p ladder, bought for 6.5 in 5k

3RZ1 99.87/99.62/99.50 broken put ladder, trades again in 1.5k.

RXM1 173/174.50cs 1x1.5, bought for 13 in 1k

FOREX

USD started the European early session on the back foot, in the red against most G10s, but the Greenback has now pared losses and trend in the Green.

- Turnovers in G10s are running circa 20%-30% of the 5 day averages, with most desk on the sideline ahead of the ECB.

- As our Preview noted: This week's ECB meeting is widely expected to be a low-risk event.

- Nonetheless, competing views on the economic trajectory and the lifespan of PEPP are starting to emerge, which could come into sharper focus by the time of the June meeting.

- The Kiwi and the Pound are the worst performers against the Dollar, down 0.51% and 0.21% respectively.

- Cable led the way lower, with a quick 22 pip drop as we broke the early morning tight range.

- Cable is near yesterday's low, hovering around the 1.3900 figure (1.3886 was yesterday's low).

- The Kiwi is down against all majors, initially led by some AUDNZD buying interest overnight, but picked up further downside momentum versus the NOK this morning, down 0.62% versus the latter.

- Looking ahead, focus turns to the ECB and presser, EC Consumer Confidence is the last EU data left on the calendar.

- On the other side of the pound, US IJC is the most notable data

FX OPTION EXPIRY

FX EXPIRY (updated, closest ones)

Of note: USDJPY: 3.12bn between 108.00-108.40- EURUSD: 1.1980 (405mln), 1.2020 (226mln), 1.2050 (363mln)

- USDJPY: 108.00 (1.59bn), 108.30 (1.29bn), 108.32 (500mln), 108.40 (803mln)

- AUDUSD; 0.7750 (595mln), 0.7820 (480mln)

Price Signal Summary - Directional Triggers Defined In S&P E-Minis

- In the equity space, S&P E-minis key directional triggers have been defined. Support lies at 4110.50, Apr 21 low and resistance is at 4183.50, Apr 16 high.

- In the FX world, a gravestone doji in EURUSD Tuesday warns of a possible top. Key short-term resistance is at Tuesday's high of 1.2080. Key support to watch is 1.1943, Apr 19 low. Gains above 1.2080 would resume the uptrend. GBPUSD traded higher Tuesday but did find resistance at the former bear channel base drawn off the Nov 2, 2020 low. This week's high of 1.4009 marks a key short-term resistance. Support is at 1.3810, Apr 19 low. USDJPY has this week traded through 108.41, Mar 23 low and through the 50-day EMA. The next key support and pivot level is 107.70, a trendline support drawn off the Jan 6 low.

- On the commodity front, Gold maintains a bullish tone. The focus is on $1805.7, Feb 25 high. Brent (M1) remains below Tuesday's high of $68.08. Key support to watch is$63.22, the 50-day EMA. WTI (M1) found resistance this week at $64.38, Tuesday's high. The 50-day EMA at $59.54 is seen as a firm intraday support.

- In the FI space, Bunds (M1) have tested the 20-day EMA. A clear breach of this average would open 171.62, Apr 14 high. Support to watch in Gilts (M1) remains 127.81, Apr 14 low. The key resistance is at 129.27, Mar 2 high and the reversal trigger.

EQUITIES: Tech Outperforming Early

European cash equities have been on the front foot for most of the morning but now off session's best levels.

- Tech has led gains for the Euro Stoxx 600, with energy and financials lagging.

- Little surprise then that in US futures, NASDAQ is lagging the Dow and S&P.

- Asian markets closed mixed, with Japan sharply higher but China/HK flat.

- German Dax up 70.63 pts or +0.46% at 15265.01, FTSE 100 up 9.89 pts or +0.14% at 6906.25, CAC 40 up 47.63 pts or +0.77% at 6243.37 and Euro Stoxx 50 up 27.85 pts or +0.7% at 4003.81.

- Dow Jones mini down 15 pts or -0.04% at 34001, S&P 500 mini down 4.75 pts or -0.11% at 4160, NASDAQ mini down 18.75 pts or -0.13% at 13900.5.

COMMODITIES: Oil Fades; Metals Off Recent Highs

Oil has traded in choppy fashion overnight, buffeted by supply (Iran-US talk pessimism supporting supply concerns) and demand (surging India COVID cases dampening demand) headlines, leaving WTI futures down 0.4%.

- Metals are likewise weaker, fading Wednesday's multi-week highs, with silver and platinum underperforming early Thursday.

Latest levels:

- WTI Crude down $0.25 or -0.41% at $61.03

- Natural Gas down $0.02 or -0.78% at $2.669

- Gold spot down $6.43 or -0.36% at $1791.53

- Copper down $0.25 or -0.06% at $429

- Silver down $0.18 or -0.69% at $26.3904

- Platinum down $8.43 or -0.69% at $1205.4

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.