-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI US MARKETS ANALYSIS - USD Selling

MNI US MARKETS ANALYSIS - USD Selling

HIGHLIGHTS

- European PMIs came in broadly better than expected and follows yesterday's ECB meeting which was a touch dovish.

- The dollar is on the backfoot against G10 FX.

- Equities have inched lower. The Markit US PMIs now come into focus.

US TSYS SUMMARY: Reversing Overnight Weakness, PMIs / New Home Sales Eyed

Treasuries have bounced from overnight lows in European trade Friday but remain off Asia-Pac highs, all the while well within Thursday's ranges. A light schedule lies ahead.

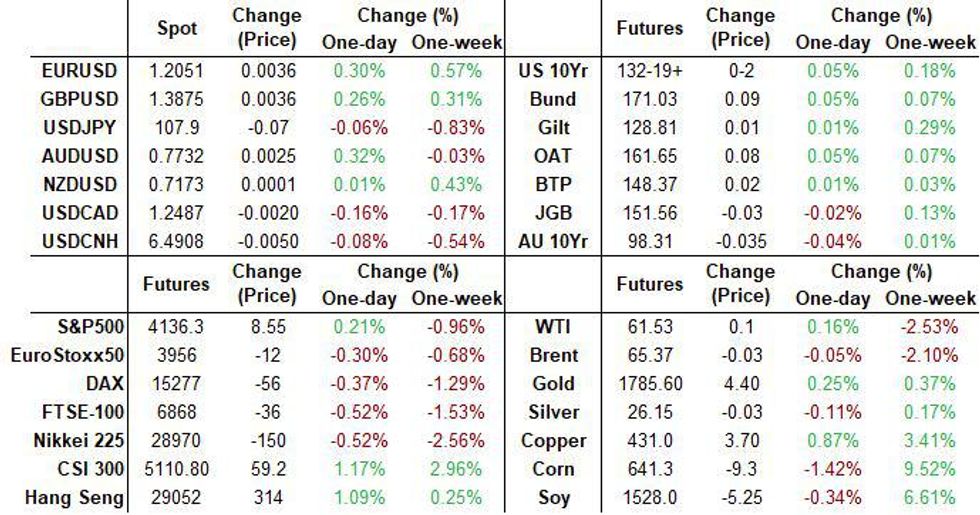

- Jun 10-Yr futures (TY) up 2.5/32 at 132-20 (L: 132-13.5/ H: 132-21), on light volumes (~230k).

- We saw a bit of a dip on strong French flash PMIs and a bounce from lows on a miss on the German reading in sympathy with Bunds, all in the space of about 15 minutes (0315-0330ET). TYs have been rising steadily since then.

- The 2-Yr yield is up 0.2bps at 0.1493%, 5-Yr is up 0.2bps at 0.7921%, 10-Yr is up 0.6bps at 1.5437%, and 30-Yr is up 1.2bps at 2.2301%.

- Equity futures have stabilized following Thursday's reports that the Biden administration could pursue capital gains tax hikes. Attention has already turned to how serious the White House is about these proposals and whether there's sufficient Dem support for passage.

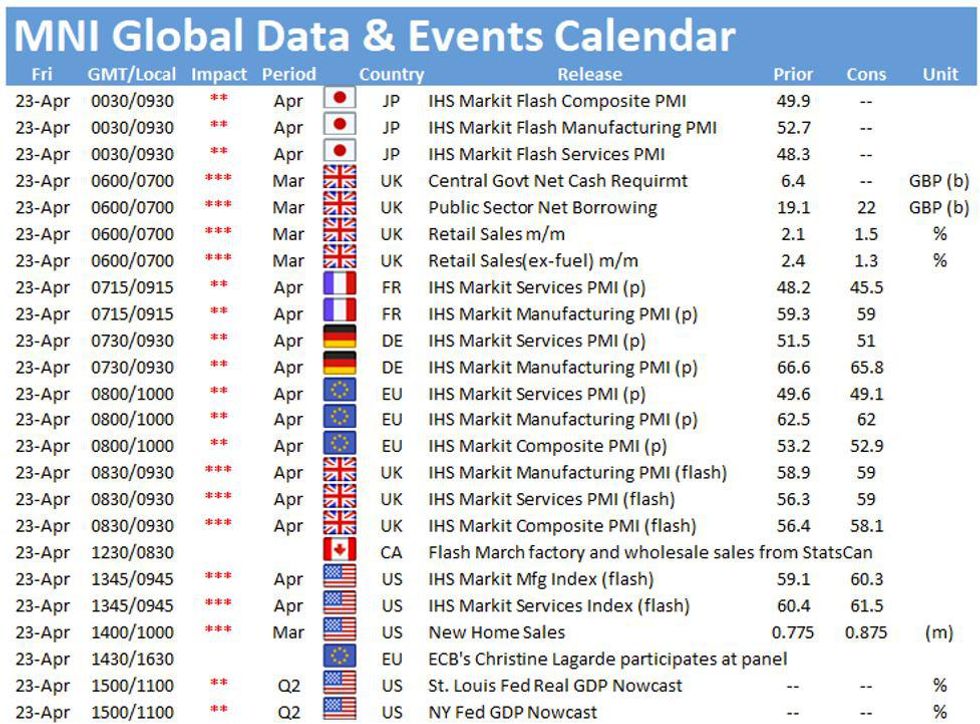

- Flash April PMIs (0945ET) and Mar new home sales (1000ET) comprise the conclusion to the week's limited data slate.

- No supply. NY Fed buys ~$2.425B of 1-7.5Y TIPS.

EGB/GILTS SUMMARY

EGBs have bounced off their lows as the US starts to come in.

- Core Govies came under early pressure following decent beats in European National PMIs releases this morning.

- German curve initially tilted steeper, but have faded and we now sit flat on the day so far.

- Peripheral spreads are wider , with Greece standing at 1.2bps.

- It was a choppy open for Gilts, with early calls calling the contract to open lower, but this quickly changed, and the contract opened higher, after the bigger than expected reduction in the gilt remit for FY21/22.

- GBP43.3bln reduction in gilt sales for the fiscal year to GBP252.6bln. Larger than expected fall.

- Looking ahead, on the data front, US PMIs are the notable release.

- Italy, Mr Draghi is also set to reveal a draft of his recovery plan (EU220bn) to his cabinet sometime today.

- Lagarde and Yellen are on a Bloomberg climate panel

EUROZONE ISSUANCE UPDATE

UK DMO sells GBP3.5bln of UKTBs

| Tenor | 1-month | 3-month | 6-month |

| Maturity | May 24, 2021 | Jul 26, 2021 | Oct 25, 2021 |

| Amount | GBP0.5bln | GBP1bln | GBP2bln |

| Previous | GBP0.5bln | GBP1bln | GBP2bln |

| Avg yield | 0.0270% | 0.0394% | 0.0555% |

| Previous | 0.0259% | 0.0273% | 0.0511% |

| Bid-to-cover | 3.21x | 2.36x | 1.69x |

| Previous | 2.57x | 3.13x | 1.9x |

| Next week | GBP0.5bln | GBP1.0bln | GBP2.0bln |

EUROPE OPTIONS FLOW SUMMARY

Eurozone

DUM1 112.00/112.10cs 1x2, sold at 2.5 in 2k

UK

2LN1 + 2LU1 99.37/99.12ps strip, sold at 9.75 in 4k

0LM1 99.87/99.75ps, sold at 8.25 in 8k (ref 99.775)

FOREX: USD Continuation Selling

USD saw some continuation selling during our early morning European session.

- The Dollar under performing against all G10s, and most EMs, beside the TRY.

- The EURUSD regained most of the drop from yesterday after Lagarde's comment on negative rates.

- The EUR was boosted by the broader USD selling and following this morning's PMIs data beat, which supported constructive recovery views in the street. EURUSD is just short of initial resistance at 1.2080, with the cross printing a 1.2062 high so far today.

- The EUR leads against the USD in G10, up 0.36%, and the currency trades in the green versus all majors

- AUD still leads against the Greenback in G10 following the upbeat unemployment forecast by Westpac, but has faded somewhat, now just up 0.38% after being up 0.43% earlier.

- Next resistance in the AUDUSD comes at yesterday's high 0.7765.

- Looking ahead, market participants awaits the Russian Rate decision, when Economists survey expect a 25bps hike to 4.75%.

- On the data front, US PMIs are the notable release.

- Mr Draghi is also set to reveal a draft of his recovery plan (EU220bn) to his cabinet sometime today.

- Lagarde and Yellen are on a Bloomberg climate panel

FX OPTION EXPIRY

FX OPTION EXPIRY (updated, closest ones)

Of note: USDCAD: 1.01bn at 1.2500- EURUSD: 1.1980-1.2000 (1.49bn)

- AUDUSD; 0.7750 (252mln)

- USDCAD: 1.2440 (400mln), 1.2450 (1.26bn), 1.2500 (1.01bn), 1.2510 (210mln) 1.2525 (406mln)

Price Signal Summary - Monitoring The S&P E-Minis Directional Triggers

- In the equity space, S&P E-minis key directional triggers remain intact. They are; support at 4110.50, Apr 21 low and resistance at 4183.50, Apr 16 high.

- In the FX world, a gravestone doji in EURUSD Tuesday warns of a possible top. Key short-term resistance is at Tuesday's high of 1.2080. With the pair firmer this morning, a break of 1.2080 is required to trigger stronger gains that would open 1.2116/22, 76.4% of the Feb 25 - Mar 31 sell-off and the bear channel top drawn off the Jan 6 high. Key support to watch is 1.1943, Apr 19 low. GBPUSD remains below this week's high of 1.4009 from Tuesday and close to the former bear channel base drawn off the Nov 2, 2020 low. A bearish risk dominates while 1.4009 remains intact. Support to watch is at 1.3810, Apr 19 low. USDJPY is sitting on key support at 107.77, a trendline support drawn off the Jan 6 low. This represents a key short-term pivot level.

- On the commodity front, Gold maintains a bullish tone. The focus is on $1805.7, Feb 25 high. Brent (M1) remains below Tuesday's high of $68.08. Key support to watch is $63.31, the 50-day EMA. WTI (M1) found resistance this week at $64.38, Tuesday's high. The 50-day EMA at $59.99 is seen as a firm intraday support.

- In the FI space, Bunds (M1) have tested the 20-day EMA. A clear breach of this average would open 171.62, Apr 14 high. Support to watch in Gilts (M1) remains 127.81, Apr 14 low. The key resistance is at 129.27, Mar 2 high and the reversal trigger.

EQUITIES: S&P Futs Hold Above Support

Stocks / futures have stabilized following Thursday's reports that the US Biden administration will seek higher taxes to pay for new spending initiatives, including large capital gains rates.

- In Europe cash, Health Care and Consumer Staples stocks have dragged indices lower. Materials stocks have outperformed on stronger base metals prices, but are still slightly in the red.

- U.S. futures are a little higher vs Thursday's lows - our tech analyst notes support for S&P eminis at 4110.50, with resistance at 4183.50.

- Asian stocks closed mixed, with Japan lower and China/HK higher.

Latest cash/futures levels:

- German Dax down 61.51 pts or -0.4% at 15279.64, FTSE 100 down 35.7 pts or -0.51% at 6911.81, CAC 40 down 12.39 pts or -0.2% at 6265.44 and Euro Stoxx 50 down 15.71 pts or -0.39% at 4008.67.

- Dow Jones mini up 36 pts or +0.11% at 33745, S&P 500 mini up 8.75 pts or +0.21% at 4136.5, NASDAQ mini up 26.25 pts or +0.19% at 13776.5.

COMMODITIES: Copper Top Of The Pile

Broad dollar weakness has helped buoy the commodity complex in early Friday trade.

- Copper is the standout performer, with an executive at a major Chinese smelter talking up market fundamentals in comments Thursday.

Latest levels:

- WTI Crude up $0.24 or +0.39% at $61.52

- Natural Gas up $0 or +0.15% at $2.756

- Gold spot up $1.96 or +0.11% at $1784.31

- Copper up $4.05 or +0.95% at $431.85

- Silver down $0.05 or -0.18% at $26.1209

- Platinum up $11.51 or +0.95% at $1218.96

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.