-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - SOFT START

MNI US MARKETS ANALYSIS - SOFT START

HIGHLIGHTS:

- Sovereign bonds have broadly pushed lower at the beginning of the week.

- Focus will on be on this Thursday's ECB meeting; particularly any potential adjustments to the PEPP pace.

US TSYS SUMMARY: Week Opens With Slightly Bearish Tone

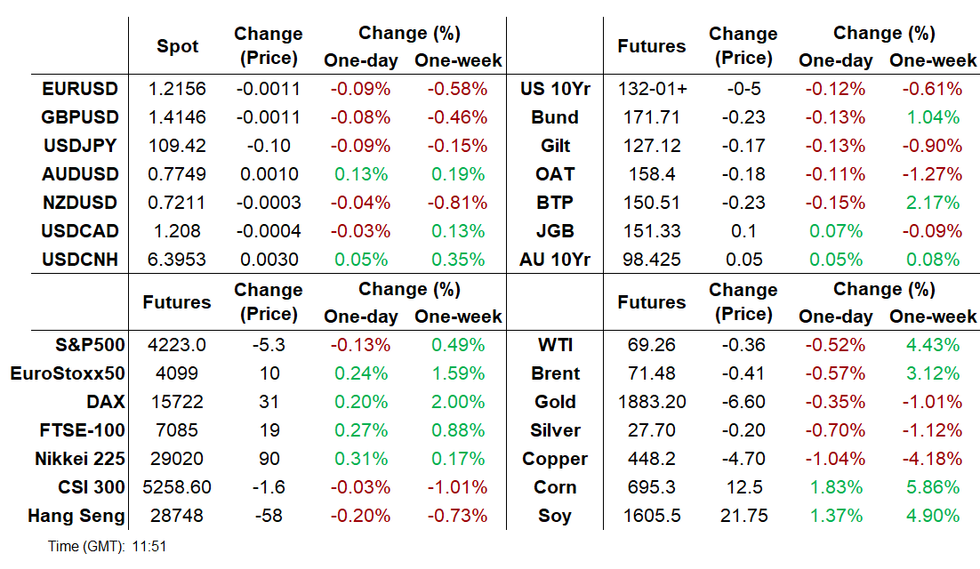

Treasuries have edged lower in orderly fashion to start the week, with economic reopening progress being weighed between Friday's weaker-than-expected payrolls figure and this coming Thursday's inflation print.

- Sep 10-Yr futures (TY) down 5/32 at 132-01.5 (L: 132-00.5 / H: 132-07). Some bear steepening in the curve: 2-Yr yield is up 0.6bps at 0.1507%, 5-Yr is up 1.8bps at 0.7965%, 10-Yr is up 2.7bps at 1.5806%, and 30-Yr is up 3bps at 2.261%.

- While Tsys have held on to most of Friday's post-payrolls gains, the tone is a little weaker with Treas Sec Yellen's comments over the weekend that "a slightly higher interest rate environment ...would actually be a plus for society's point of view and the Fed's point of view" in reference to Pres Biden's spending ambitions.

- On that note, Biden-Sen Capito infra talks continue today; House of Reps will begin marking up an infra bill Wednesday, with or without bipartisan support (per US Energy Sec Granholm).

- The other weekend news of note was the G7's agreement on broader implementation of a minimum corporate tax rate structure (weighing a little on tech stocks).

- Apr consumer credit the only data point (1500ET); no Fed speakers (pre-FOMC blackout).

- Tsy sells $111B of 13-/26-week bills at 1130ET; NY Fed buys ~$3.625B of 7-20Y Tsys.

EGB/GILT SUMMARY: Trading Weaker; Focus On Thursday ECB Meeting

European sovereign bonds have broadly traded lower at the beginning of the week alongside uneven trading in equities. Focus this week will be on the Thursday ECB meeting with markets paying particular attention to potential adjustments to the PEPP purchase rate and whether the current "significantly higher" pace will be maintained.

- Gilt yields are 1-2bp higher with the curve bear steepening.

- The German bond curve has similarly marginally steepened with the 2s30s spread 1bp wider on the day.

- OATs have followed bunds lower with the long end also underperforming.

- It is a similar story for BTPs where cash yields are 1-2bp above the Friday close.

- Supply this morning came from Germany (Bubills, EUR5.586bn allotted) and the Netherlands (EUR3.04bn).

EUROPEAN ISSUANCE UPDATE

GERMAN T-BILL AUCTION RESULTS: 3/9-month bubills

| Type | 3-month bubill | 9-month bubill |

| Maturity | Sep 29, 2021 | Mar 23, 2022 |

| Allotted | E2.773bln | E2.813bln |

| Previous | E2.941bln | E2.852bln |

| Avg yield | -0.6441% | -0.6450% |

| Previous | -0.6273% | -0.6364% |

| Bid-to-cover | 2.14x | 2.75x |

| Previous | 1.55x | 1.54x |

| Buba cover | 2.31x | 2.94x |

| Previous | 1.58x | 1.62x |

| Previous date | May 03, 2021 | May 03, 2021 |

| Total sold | E3bln | E3bln |

DUTCH T-BILL AUCTION RESULTS: 3.5/5.5-month DTCs

| Maturity | Sep 29, 2021 | Nov 29, 2021 |

| Amount | E1.45bln | E1.59bln |

| Target | E1-2bln | E1-2bln |

| Previous | E1.04bln | E1.3bln |

| Avg yield | -0.635% | -0.630% |

| Previous | -0.631% | -0.625% |

| Bid-to-cover | 1.59x | 1.25x |

| Previous | 2.28x | 1.58x |

| Previous date | May 17, 2021 | May 17, 2021 |

FOREX - USD pare some gains

A calmer start for FX as we start the week and attention turning squarely towards ECB meeting and US CPI, both released on Thursday.

- The Dollar was mostly better bid overnight, with risk tilted to the downside, following G7 ministers agreeing on a minimum 15% corporate tax.

- USD has given back of of its gains, as Equities edge back to flat during our morning European session.

- NOK, SEK, AUD and JPY are trading in the Green at the time of typing.

- AUDUSD hovers near session high at 0.7750, buoyed by S&P's rating, revising the long term outlook for the country to stable from negative.

- NOK leads against the greenback in G10, albeit just up 0.28%, despite lower Oil.

- WTI is seeing a corrective pullback towards %69, after hitting highest levels since 2018 at $70 overnight.

- The British Pound is struggling somewhat, down versus all majors,

- Focus for the UK going forward will be on the re-opening date of the 21st June, with some news report that the government is considering pushing back the next set of lifting of restrictions to July 5,

- A date by when over 40s are expected to have had their 2nd vaccinations.

- Looking ahead, no tier 1 data are scheduled

- Speakers sees BoE's Breeden speaking on Greening the Financial System, while Fed speakers are now on blackout period.

- ALL EYES are on Thursday's event/Data.

FX OPTION EXPIRY

- EURUSD: 1.2175 (591mln), 1.2215 (624mln)

- USDJPY: 109.50 (1.25bn), 110 (1.03bn)

- EURGBP: 0.8615 (275mln)

- AUDUSD: 0.7700 (543mln)

Price Signal Summary - E-minis Key Resistance Remains Exposed

- In the equity space, S&P E-minis are trading close to the all-time high of 4238.25 May 10 high. This remains a key resistance and the trigger for a resumption of the uptrend. Initial support is at 4165.25, Jun 3 low.

- In the FX space, EURUSD remains vulnerable following last week's price action. The focus is on 1.2099, the 50-day EMA. GBPUSD remains below last week's high of 1.4248 on Jun 1. A deeper pullback would expose 1.4006, May 13 low. Note the 50-day EMA intersects at 1.4012 and also represents a key support level. USDJPY sold off sharply Friday and attention is on support at 109.33, Jun 1 low. A break would threaten the recent uptrend and expose 108.56,May 25 low.

- On the commodity front, Gold faced strong selling pressure Jun 3 and together with the recent overbought condition, the move lower suggests scope for a deeper corrective pullback. The next support is $1852.3, May 19 low. Trend conditions in Oil remain bullish. Brent (Q1) gains have opened $73.00 next, a round number resistance. WTI (N1) has today tested the $70.00 psychological level. A break would open $70.22, 2.618 projection of the Mar 23 - 30 - Apr 5 price swing

- Within FI, Bunds (U1) have tested the 50-day EMA at 172.01 but have not yet confirmed a clear break. While it holds, the outlook is bearish. Support to watch is at 170.99. May 31 low. Gilts (U1) remains below resistance at 127.74/82, highs between Apr 20 and May 26. A bearish risk remains present.

EQUITIES: Cautious Start; NASDAQ Underperforming

Stocks have started the week on a fairly cautious note. Tech stocks are underperforming in part due to the weekend's G7's agreement on broader implementation of a minimum corporate tax rate structure (which are widely seen as impacting tech).

- Asian markets closed mixed, with Japan's NIKKEI up 77.72 pts or +0.27% at 29019.24 and the TOPIX up 1.66 pts or +0.08% at 1960.85. China's SHANGHAI closed up 7.696 pts or +0.21% at 3599.541 and the HANG SENG ended 130.82 pts lower or -0.45% at 28787.28

- European equities are slightly higher, with the German Dax up 28.3 pts or +0.18% at 15651.38, FTSE 100 up 21.13 pts or +0.3% at 7069.04, CAC 40 up 13.96 pts or +0.21% at 6515.66 and Euro Stoxx 50 up 10.17 pts or +0.25% at 4079.6.

- U.S. futures are flat/lower, with the Dow Jones mini up 21 pts or +0.06% at 34764, S&P 500 mini down 5.5 pts or -0.13% at 4222.75, NASDAQ mini down 53 pts or -0.39% at 13713.5.

COMMODITIES: USD Strength, Higher Rate Potential Weighs On Metals

While commodites are weaker across the board, Copper is underperforming as market participants weigh the potential for tighter monetary policy (US Treas Sec Yellen saying over the weekend that higher rates would be a 'plus'). Dollar strength weighing in general.

- WTI Crude down $0.38 or -0.55% at $69.25

- Natural Gas down $0.01 or -0.16% at $3.087

- Gold spot down $6.01 or -0.32% at $1884.13

- Copper down $4.6 or -1.02% at $448.2

- Silver down $0.2 or -0.73% at $27.5964

- Platinum down $2.22 or -0.19% at $1164.88

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.