-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Belly Underperforming, 5y Yield at New High

HIGHLIGHTS:

- US five year yields rise to a fresh post-pandemic high

- USD Index dragged off year's best levels

- UMich Sentiment and Fed's Williams the sole highlights

US TSYS SUMMARY: Belly Underperforming As Cash Trade Resumes

The belly of the Tsy curve is underperforming Friday in the return of cash trading following Thursday's holiday, catching up to movement in futures.

- 5Y yields hit post-pandemic highs (1.2617%) upon reopening of trade, retraced to 1.2358% by the European open, and have since climbed back up ~2bp. No particular headline drivers overnight.

- Latest levels: 2-Yr yield is up 2.9bps at 0.5416%, 5-Yr is up 4.1bps at 1.257%, 10-Yr is up 3.1bps at 1.5801%, and 30-Yr is up 2.3bps at 1.9225%.

- Dec 10-Yr futures (TY) up 2/32 at 130-12.5 (L: 130-10 / H: 130-18.5), within Thursday's narrow range and on unremarkable volumes (~290k).

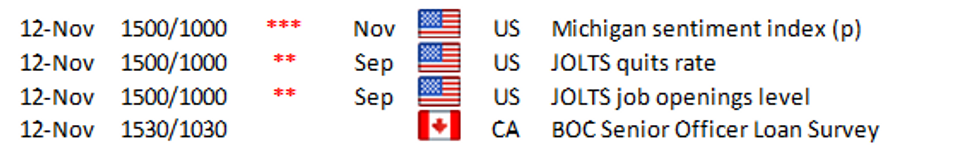

- The last data releases of the week are at 1000ET: September JOLTS and prelim UMichigan sentiment.

- NY Fed Pres Williams at 1210ET is the only scheduled FOMC speaker.

- There's no supply today. And no NY Fed operational purchases - though we get the next release schedule at 1500ET, which will reflect last week's asset purchase tapering decision.

EGB/GILT SUMMARY: Core Markets Respect Recent Ranges as US Return

- Core EGBs trade largely inside the Thursday range, with market focus on the gyrations earlier in the week that saw peripheral spreads blow out wider. Italian and Greek 10-year spreads are over 3bpwider on the day to Bunds while the Euribor strip has underperformed both the short sterling and Eurodollar strips as inflation concerns are hitting European markets more today (after having seen larger moves in short sterling and Eurodollar futures earlier this week, these moves can largely be seen as a catch up).

- The Gilt curve trades modestly steeper in a minor reversal of the week's price action so far, helping lift GBP off the lowest levels of the session. Some market focus on the Gilt roll, after the spread traded 88k outright yesterday. First notice is on Nov 29th, 29/11.

- UMich Confidence data is the highlight for the Friday session, with markets on watch for any acceleration in consumer concerns surrounding inflation expectations - a particular focus given the multi-decade high print in CPI on Wednesday.

EUROPE OPTION FLOW SUMMARY

Eurozone:

SX7E 16th Dec 2022 120c, trades 3.30 in 37.5k

SX7E 16th Dec 2022 140c, trades 0.80 and 1.10 in 46.875

US:

FVZ1 121.00p, bought for 11 in 15k

FOREX: GBP Leads Bounce to Drag DXY Off Cycle High

- The greenback traded solidly across Asian hours, helping the USD Index print a fresh YTD high for a third consecutive session. Markets have moderated since, with the bounce led by the beleaguered GBP, which has snapped a four session losing streak ahead of Friday's NY crossover.

- SEK is the poorest performing currency so far, helping EUR/SEK climb toward the highest levels of the week, prompting a test of the 76.4% retracement level at 8.7516.

- USD/CHF has quietly printed a new weekly this morning at 0.9231, with CHF continuing to trade poorly against most others. A recovery and close above 0.9229 opens gains toward 0.9262, the 61.8% retracement of the October-November downtick.

- Prelim UMich sentiment numbers take focus Friday, with markets expecting an improvement in the expectations component, but weakness in current conditions. ECB's Lane, BoE's Haskel and Fed's Williams are all due to speak.

FX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1320-25(E934mln), $1.1460(E1.2bln), $1.1485-00(E1.0bln), $1.1540-50(E2.0bln)

- USD/JPY: Y112.95-00($750mln), Y113.90-00($2.2bln)

- GBP/USD: $1.3320(Gbp690mln)

- AUD/USD: $0.7370-85(A$1.4bln)

- NZD/USD: $0.6780(N$1.1bln)

- USD/CAD: C$1.2450-65($1.2bln), C$1.2490($1.3bln), C$1.2510-15($1.1bln), C$1.2620-25($507mln)

Price Signal Summary - Equity Space Retracements Considered Corrective

- In the equity space, the outlook is unchanged in the S&P E-minis and a bullish theme remains intact. This week's pullback is still considered a correction. The focus is on 4717.00 next, 1.50 projection of the Jul 19 - Aug 16 - Aug 19 price swing. Initial support to watch is 4590.86, the 20-day EMA. EUROSTOXX 50 futures remain below recent highs and this week's activity still appears to be a bull flag. The trend needle points north and sights are on 4371.00, 1.236 projection of Jul 19-Sep 6-Oct 6 2020 swing (cont).

- In FX, a sharp sell-off in EURUSD this week confirmed a resumption of the downtrend and conditions remain bearish within the bear channel drawn off the Jun 1 high. The focus is on 1.1423, Jul 21 2020 low. GBPUSD remains vulnerable following Wednesday's sharp sell-off. The break of 1.3412, Sep 29 low, opens1.3334 next, 1.00 projection of the Sep 14 - 29 - Oct 20 price swing. Wednesday's candle pattern in USDJPY is a bullish engulfing reversal. This pattern signals scope for a climb towards key resistance at 114.70, Oct 20 high. Key support has been defined at 112.73, Nov 9 low.

- On the commodity front, Gold rallied sharply higher Wednesday and remains firm. The focus is on $1877.7 next, Jun 14 high ahead of the $1900.00 handle. {7I} WTI gains stalled Wednesday and the key resistance of $85.41, Oct 25 high, remains intact. A break would confirm a resumption of the uptrend. On the downside, key short-term support to watch is $78.25, Nov 4 low.

- In the FI space, Bund futures maintain a bullish short-term tone despite remaining below recent highs. The recent break of 169.83, Oct 27 high and clearance of the 50-day EMA, opens 171.95, 61.8% of the Aug - Nov sell-off. Gilts also maintain a firmer tone. The focus is on a climb towards 127.69 next, Sep 21 high. The recent pullback is considered corrective.

EQUITIES: Markets Stable Ahead of Final Session of the Week

- The e-mini S&P trades broadly flat and wholly inside the Thursday range, giving few fresh clues to the trend direction Friday. The data calendar and speaker slate is relatively quiet, keeping focus on some of the larger stories from earlier in the week - namely the inflation outlook and Treasury curve, Elon Musk selling further his stake in Tesla, as well as the well-received Rivian IPO on Wednesday.

- This week's pullback in S&P E-minis is considered corrective and a bull theme remains intact. Another all-time high print on Nov 5 confirmed a resumption of the uptrend and the focus is on 4717.00 next, a Fibonacci projection. Trend signals such as moving average studies remain in a bull mode, reinforcing current conditions and market sentiment.

- European equity markets are mixed-to-stronger, with France's CAC-40 higher by 0.4%, while the FTSE-100 gives back recent gains to shed around 0.5% at the midway point. Europe's energy and utilities sector is leading declines, while consumer discretionary and communication services sectors sit at the top.

COMMODITIES: Commodities under pressure this morning, led by oil

- WTI Crude down $1.40 or -1.72% at $80.15

- Natural Gas down $0.06 or -1.22% at $5.089

- Gold spot down $8.42 or -0.45% at $1853.36

- Copper down $1.55 or -0.35% at $437.8

- Silver down $0.27 or -1.08% at $24.9827

- Platinum down $15.64 or -1.44% at $1072.89

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.