-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - WTI Slips on Reserve Release Plans

Highlights:

- Equities steady, but off highs as Russia/Ukraine talks continue

- Oil slips as Biden eyes further reserve release, presser later today to confirm

- MNI Chicago PMI seen inching higher to 57.0

US TSYS SUMMARY: Treasuries Extend Yesterday's Rally

- Cash Tsys have rallied 3-4bps across most of the curve with only the very long end lagging, a continuation of the sharper rally in the second half of yesterday’s session.

- 2YY -3.0bps at 2.276%, 5YY -4.0bps at 2.398%, 10YY -3.3bps at 2.316%, 30YY -1.3bps at 2.461%.

- Front end yields have fallen 18bps from March 29 highs, seemingly as Russia rotates towards greater focus on the Donbas and less so on Kyiv and other areas, even though peace talks remain far from complete.

- TYM2 sits up 12+ ticks on the day at 123-00+ with average volumes. The trend direction is bearish but the contract remains in a corrective phase, eyeing initial resistance at 123-12 (Mar 23 high) whilst support is the bear trigger of 120-30+ (Mar 28 low).

- Fedspeak: NY Fed’s Williams (voter) gives opening remarks at a conference on the future of NYC.

- Data: February core PCE inflation (cons +0.4% M/M after +0.5%) and personal incomes & spending plus the March MNI Chicago PMI are the picks today.

- Bill issuance: US Tsy $35B 4W, $30B 8W bill auctions (1130ET)

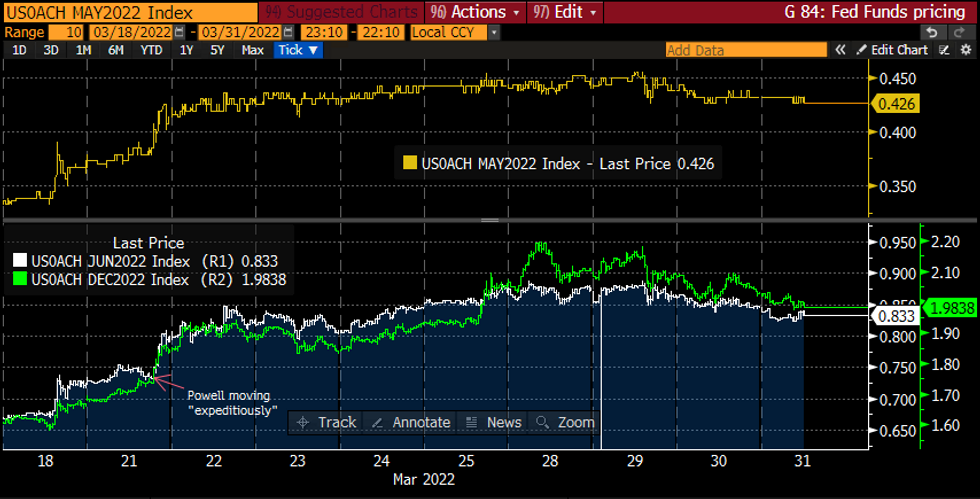

STIR FUTURES: Fed Hike Expectations Dip Below 200bp To Year-End

- Fed hike expectations continue to nudge lower with 198bps to year-end (just below fully pricing a Fed Funds range of 2.25-2.5%).

- It’s down from highs of 220bps at the start of this week but continues to price one extra 25bp hike since prior to Powell’s “expeditious” pivot.

- More immediately, there is 42.5bps for May 4 and 83bps for June 15. UBS and JPM late yesterday switched to calling back-to-back 50bp hikes in May and June, joining at least ABN, GS and MS whilst Citi and Danske have gone one further with three consecutive 50bp hikes.

- NY Fed’s Williams (voter) is the sole speaker today with opening remarks on the future of NY city (text expected, no Q&A) after non-committal comments around the prospects for a 50bp hike last week.

FOMC-dated Fed Funds futures cumulative hikes (bps)Source: Bloomberg

FOMC-dated Fed Funds futures cumulative hikes (bps)Source: Bloomberg

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXK2 157/156/155.5 put fly, bought for 21 in 3k

OEM2 127.50/126.50ps 1x1.5, bought for 11.5, 12 and 12.5 in 40k

DUM2 111.00/111.50 cs bought for 9.25 in 4.7k

DUM2 111.10/111.60cs, bought for 8 in 5k

DUK2 110.90/111.40 cs, bought for 10 in 13.5k total

ERZ2 99.875/100.125/100.375 call fly, sold at 4 in 5k

FOREX: Minor Bounce in Greenback

- The greenback is staging a minor bounce Thursday, rising against all others in G10 but doing little - so far - to work against the downtick posted since the beginning of the week. Strength in the USD comes alongside furtive gains for equities. Futures markets point to a positive open on Wall Street later today, with Biden's plans to relieve the spike in gas prices helping buoy sentiment.

- EUR, JPY and GBP trade more mixed, with GBP/USD holding either side of the 1.3100 handle after better-than-expected final GDP data early Thursday.

- Oil prices remain a key driver for commodity-tied currencies, with NOK and CAD among the weakest in G10. The downtick in WTI prices follows reports late yesterday suggesting the White House could take much more aggressive action to counter the strength in oil prices, with the impact compounded by confirmation that the Norges Bank are to sell as much as NOK 2bln per day in April as part of the government's FX management plans. EUR/NOK has traded a high of 9.7105 so far.

- Weekly US jobless claims data crosses later today, alongside the latest PCE and personal income/spending release. GDP numbers from Canada cross ahead of the MNI Chicago PMI for March. The speaker slate is quieter relative to recent sessions, with just ECB's de Guindos and Fed's Williams on the docket.

FX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E3.4bln), $1.1069-80(E1.2bln), $1.1100(E1.5bln), $1.1110-15(E531mln), $1.1125(E759mln), $1.1200(E1.7bln)

- GBP/USD: $1.3195-00(Gbp804mln)

- USD/JPY: Y121.60($585mln)

- AUD/USD: $0.7400(A$500mln), $0.7500(A$1.5bln)

- USD/CNY: Cny6.3270($750mln), Cny6.3355($631mln)

Price Signal Summary - FI Trend Needle Still Points South

- In the equity space, S&P E-Minis traded higher Tuesday, extending the bull cycle that started Mar 15 and the contract is holding onto its recent gains. The break has opened 4663.50, Jan 18 high. Watch initial resistance at 4633.44, 76.4% of the Jan 4 - Feb 24 downleg. EUROSTOXX 50 futures cleared resistance at the 50-day EMA on Tuesday. This average, at 3863.50 today, represented an important resistance and the break higher confirms a resumption of the bull cycle that started Mar 7. Also, the move higher has confirmed a bull flag breakout on the daily chart. The focus is on 3965.50 next, the Feb 23 high.

- In FX, EURUSD is lower this morning but maintains a firmer short-term tone following this week’s gains and the break of key near-term resistance at 1.1137, Mar 17 high. The break highlights a resumption of the bull cycle that started Mar 7 and paves the way for strength towards 1.1232 initially, 61.8% of Feb 10-Mar 7 sell-off. GBPUSD still appears vulnerable following the pullback from 1.3298, Mar 23 high. Prices have this week breached 1.3120, the Mar 22 low and this opens 1.3000, Mar 15 low and the key support. Key resistance remains the 50-day EMA, at 1.3306. A break would signal a reversal. USDJPY remains below Monday’s high of 125.09 and has traded through initial support at 121.97, the Mar 28 low. A pullback is seen as a much needed correction that would allow an overbought condition to unwind. An extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle.

- On the commodity front, Gold remains vulnerable near-term. The yellow metal traded lower Tuesday but did bounce off the day low. Key support is seen at the 50-day EMA, at $1904.5, just ahead of the Mar 15 low of $1895.3. Both have been probed this week, a clear break would signal scope for a deeper pullback. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI is trading lower today but remains above Tuesday’s low of $98.44. The short-term outlook is bearish and attention is on the 50-day EMA at $97.18. A break would signal scope for a deeper pullback.

- In the FI space, Bund futures remain bearish and the trend needle still points south. The focus is on a move to 156.00 next. Gilts are consolidating - this is seen as a pause in the downtrend. The focus is on 119.75, 123.6% retracement of the Feb 15 - Mar 1 climb.

EQUITIES: Flat Session, With Non-Cyclicals Leading

- Asian markets closed weaker: Japan's NIKKEI closed down 205.82 pts or -0.73% at 27821.43 and the TOPIX ended 21.2 pts lower or -1.08% at 1946.4. China's SHANGHAI closed down 14.393 pts or -0.44% at 3252.203 and the HANG SENG ended 235.18 pts lower or -1.06% at 21996.85.

- European equities are a little weaker, with the German Dax down 21.1 pts or -0.14% at 14585.06, FTSE 100 up 2.64 pts or +0.03% at 7576.94, CAC 40 down 6.74 pts or -0.1% at 6728.52 and Euro Stoxx 50 down 12.61 pts or -0.32% at 3946.78.

- U.S. futures are mixed: Dow Jones mini down 4 pts or -0.01% at 35113, S&P 500 mini up 4.75 pts or +0.1% at 4600.75, NASDAQ mini up 62 pts or +0.41% at 15133.5.

COMMODITIES: OPEC Meeting in Focus After White House Release Reports

The IEA have scheduled an emergency ministerial meeting for Friday to discuss oil supply and decide on a collective oil release:

- The amount of the potential collective release has not been decided. The meeting will set the total volume and per country allocations.

- At the start of this month, the IEA agreed to release 60 million barrels, half of which were released by the US, while Japan was the next largest contributor.

- The initial release did little to dampen crude prices.

- Separate to the IEA announcement, the US are mulling the potential to release 180mn bbls from its SPR, the biggest release in its 50-year history.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.