-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - 2y Yields March Higher with Supply in Sight

Highlights:

- 2y yields continue march higher, with debt ceiling, supply and Powell in focus

- NOK nears key downside level as household inflation expectations retreat

- Prelim PMIs, new home sales and regional Fed indices make up data slate

US TSYS: 2Y Yields At Mid-March Highs Ahead Of Supply, PMIs and Powell Lunch

- A grinding higher in Fed rate expectations has set the tone for the early morning session of a bear flattening after Biden and McCarthy expressed optimism for a debt ceiling deal but with no notable movement towards a resolution yet. Recent headlines flagging a Deere filing to sell $36bn of medium-term notes biased the space cheaper still although there has been some paring of most recent losses.

- 2YY +6.9bp at 4.384%, 5YY +5.3bp at 3.815%, 10YY +2.7bp at 3.742% and 30YY +1.2bp at 3.978%. 2Y yield session highs of 4.4015% were highest since Mar 15 in early days of the regional bank fallout.

- TYM3 trades 7+ ticks lower at 113-07+ off a recent low of 113-04+, breaching initial technical support from the Mar 15 low and opening 112-30 (61.8% retrace of Mar 2-24 rally).

- Fedspeak: Logan ('23 voter) at 0900ET and Chair Powell NDC lunch at 1230ET

- Data: Philly Fed non-mfg May (0830ET), S&P Global US mfg & service PMIs May prelim (0945ET), New home sales Apr (1000ET) and Richmond Fed mfg index May (1000ET).

- Note/bond issuance: US Tsy $42B 2Y Note auction (91282CHD6) – 1300ET

- Bill issuance: US Tsy $35B 21 day CMB auction – 1130ET

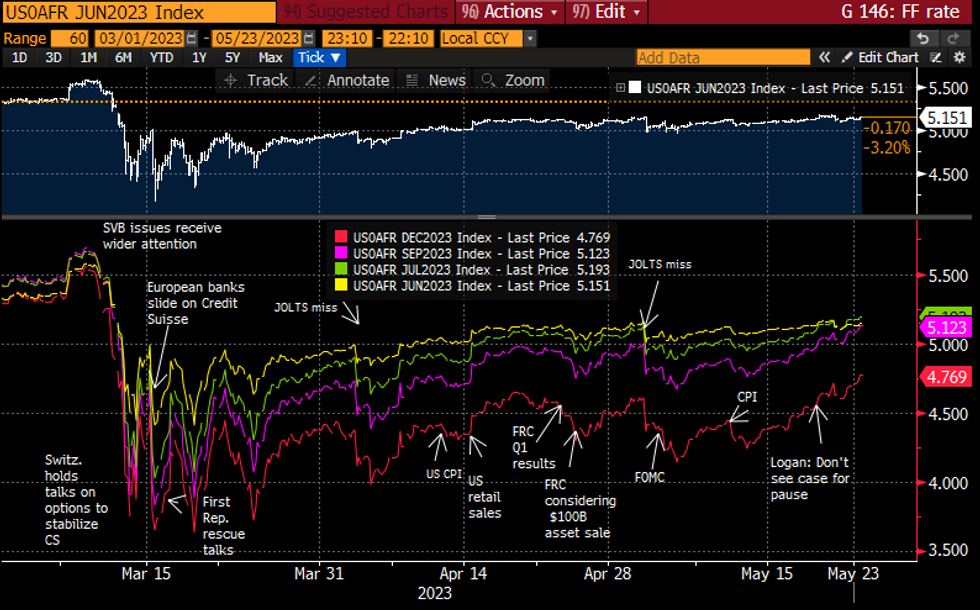

STIR FUTURES: Fed June Pricing Lags Whilst Later Meetings Clear Prior Debt Talk Impasse Levels

- Fed Funds implied rates have stepped higher through European hours, with June pricing back closer to yesterday’s high of +9bps but still below Friday’s pre-debt talk impasse levels of 10-11bps.

- There are larger relative increases further out though, with the 4.77% for Dec’23 the highest since Mar 13.

- Cumulative moves from current effective 5.08%: +6.5bp Jun (+0.5bp), +11.5bp Jul (+1.5bp), +4bp Sep (+4bp), -12bp Nov (+6bp), -31bp Dec (+7.5bp) and -49bp Jan (+8.5bp).

- Logan (’23 voter) gives welcoming remarks 0900ET after on Thu saying she doesn’t yet see a case for pausing. Chair Powell speaks to the New Democrat Coalition lunch potentially at 1230ET. If similar to the March lunch with the Republican Study Committee, participants could tweet discussion points.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE:

Italy syndication update:

- New 15-year May-39 BTPei. Size: EUR benchmark (MNI expects E4-5bln); spread set at 0.10% May-33 BTPei RY +27bps

Netherlands auction result

- E2.205bln of the 0.75% Jul-28 DSL. Avg yield 2.67%.

German auction result

- It was an average Schatz auction. Not as strong as the previous as noted by the drop in the bid-to-cover but there was still roughly the same amount allotted as a month ago.

- The lowest accepted price and average price were both at a premium to the pre-auction mid-price (but only because the price dipped into the bidding deadline).

- E6bln (E4.889bln allotted) of the 2.80% Jun-25 Schatz. Avg yield 2.82% (bid-to-cover 1.07x).

Gilt auction result

- GBP750mln of the 0.125% Mar-51 linker. Avg yield 1.105% (bid-to-cover 2.82x).

FOREX: EUR/GBP Tilted Higher on Diverging PMIs

- Markets trade with a modest risk-off feel, putting the JPY at the top of the pile alongside the greenback. Equities sit slightly lower ahead of the NY crossover, despite reports of modest progress in negotiations between McCarthy and Biden in sealing a deal on the debt ceiling this week. Markets clearly remain cautious of a breakdown in the talks, with short-end T-bill yields continuing to march higher as we near the so-called X date and the US government can no longer finance day-to-day operations.

- PMI data across Europe painted a mixed picture, with Eurozone services outperforming, while manufacturing lagged. In contrast, UK data was poorer-than-expected, tipping the composite to 53.9 vs. Exp. 54.6. EUR/GBP trades higher on the session, having traded 0.8719 at the high.

- NOK trades at the bottom-end of the G10 table, prompting EUR/NOK to again narrow the gap with the early May highs at 11.9491. A break above here puts the cross at the best levels since the COVID pandemic in Q1 2020. NOK sits weaker following another poor consumer confidence read as well as the Norges Bank's inflation expectations survey, which showed a marked step-down in price pressure forecasts - with households now seeing 12m inflation at 4% - a 2ppts drop from the prior reading.

- Prelim PMI data from the US, new home sales and the Richmond Fed manufacturing index take focus going forward, with speeches scheduled from BoE's Bailey & Haskel, Fed's Logan and ECB's Villeroy & Nagel.

FX OPTIONS: Expiries for May23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0865-80(E607mln), $1.0900-05(E534mln)

- USD/JPY: Y136.50-65($820mln), Y138.00($759mln)

- USD/CAD: C$1.3520-25(C$590mln), $1.3600($1.1bln)

EQUITIES: E-Mini S&Ps Remain Close to Recent Highs Despite Slight Downtick Tuesday

- Eurostoxx 50 futures outlook remains bullish and the contract is trading at its recent highs. Price has recently cleared resistance at 4363.00, the Apr 21 high and a bull trigger. The break confirms a resumption of the bull cycle from Mar 20 and a continuation of the medium-term uptrend. This opens 4409.50, the Nov 18 2021 high on the continuation chart and a key resistance. Firm support is at 4263.00, the 50-day EMA.

- The S&P E-minis trend needle continues to point north. The contract traded higher last week and breached key short-term resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next important resistance. Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

COMMODITIES: Gold Remains in Bearish Cycle and Close to Recent Lows

- A short-term bearish threat in WTI futures remains present and initial resistance at $73.81, the May 10 high, is intact. A resumption of weakness and a break of $69.39, the May 15 low, would strengthen near-term bearish conditions. The recent print below $64.67, the Mar 20 low and a key support, is a key bearish development. A clear break of it would resume the broader downtrend.

- Gold remains in a bearish cycle and is trading closer to its recent lows. The yellow metal last week cleared support at $1976.1, the 50-day EMA and $1969.3, the Apr 19 low. The clear break of this support zone highlights a stronger bearish threat and opens $1934.3, the Mar 22 low and $1926.9, trendline support drawn from Nov 3 2022. Key resistance and the bull trigger is at $2063.0, May 4 high. Initial firm resistance is $2022.6, the May 12 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/05/2023 | 0915/1015 |  | UK | BOE Bailey, Pill, Tenreyro, Mann at MPR Hearing | |

| 23/05/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 23/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/05/2023 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 23/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/05/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/05/2023 | 1445/1545 |  | UK | BOE Haskel Panellist at Richmond Fed Conference | |

| 23/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 24/05/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 24/05/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 24/05/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/05/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 24/05/2023 | 0930/1030 |  | UK | BOE Bailey Keynote Speech at Mansion House Net Zero Summit | |

| 24/05/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/05/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/05/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/05/2023 | 1300/1400 |  | UK | BOE Bailey Frieside Chat at WSJ CEO Council Summit | |

| 24/05/2023 | 1405/1005 |  | US | Treasury Secretary Janet Yellen | |

| 24/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/05/2023 | 1610/1210 |  | US | Fed Governor Christopher Waller | |

| 24/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/05/2023 | 1745/1945 |  | EU | ECB Lagarde Opens Anniversary of ECB Event | |

| 24/05/2023 | 1800/1400 | * |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.