-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - Analysts See Scope for Further BoC Hike

Highlights:

- Treasuries sit a touch cheaper ahead of claims data, bill supply

- USD fade extends, putting most major pairs in reach of Weds highs

- BoC analysts see another hike in July

US TSYS: Mildly Cheaper Ahead Of Weekly Claims, Further Heavy Bill Supply

- Cash Tsys sit within session ranges for only slightly cheaper on the day, consolidating at least half of the sell-off seen on the BoC resuming hikes with a 25bp increase and both analysts and markets tilting to another 25bp hike in five weeks.

- 2YY +1.1bp at 4.567%, 5YY +0.7bp at 3.948%, 10YY +1.2bp at 3.807%, 30YY +1.6bp at 3.961%. 2s10s hold at -76bps at the high end of the week’s range.

- TYU3 trades 6+ ticks lower at 113-00+ off a low of 112-30 that probes a key support at 112-29+ (May 26/30 lows). A renewed push lower could open 112-16 (76.4% retrace of Mar 2 – May 4 rally).

- Fed Funds implied rates are little changed overnight as well, still holding the June skip narrative with +8bp for Jun and a cumulative +21bp to a terminal in July after which they price only 25bp of cuts to year-end.

- Data: Jobless claims (0830ET), Wholesale trade sales/inventories Apr/Apr final (1000ET), Household net worth Q1 (1200ET).

- Bill issuance: US Tsy $60B 4W, $50B 8W bill auctions (1130ET)

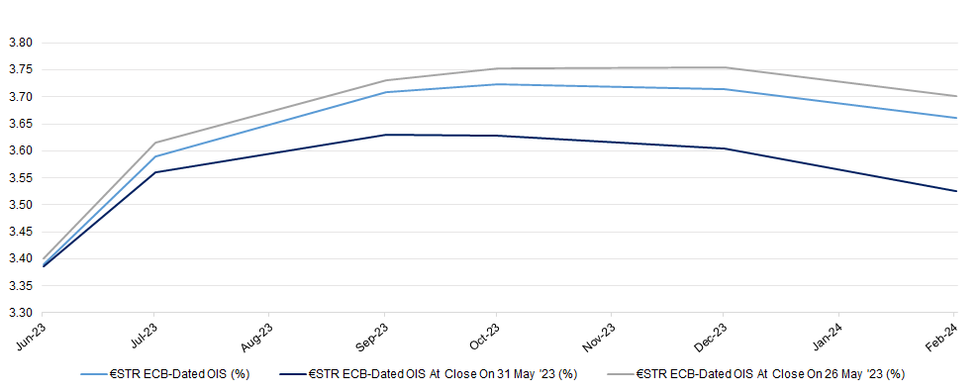

STIR: ECB Pricing Little Changed Heading Into Quiet Period, Shy Of Post-May Meeting Extremes

ECB-dated OIS is essentially unchanged on the day, trading within 1bp of yesterday’s closing levels after the BoC-inspired uptick. That leaves terminal rate pricing around 3.82-83%, just below yesterday’s hawkish extreme and only a handful of bp shy of the post-May meeting closing peak.

- Executive Board member Elderson focused on climate matters in an interview with the FT.

- Governing Council member Centeno rounds off the scheduled ECB speaker slate as the Bank nears its pre-meeting quiet period.

- Final readings of Eurozone GDP & Employment data covering Q1 did little for the space.

- The observance of the Corpus Christi holiday across various European countries/regions will hamper liquidity in EUR assets today.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jun-23 | 3.389 | +24.5 |

| Jul-23 | 3.590 | +44.6 |

| Sep-23 | 3.708 | +56.4 |

| Oct-23 | 3.724 | +58.0 |

| Dec-23 | 3.714 | +57.0 |

| Feb-24 | 3.661 | +51.7 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

BOC: Analysts Tilt To Another 25bp BoC Hike In July

A majority of analysts surveyed below see another 25bp hike in July after yesterday’s hike caught most off guard.

- Most then imply a terminal rate of 5% although a Laurentian and RBC openly discuss the option of further hikes beyond then.

- JPM and potentially CIBC stand out on the dovish side, with JPM calling for a terminal at the latest 4.75%.

- Views fleshed out in the upcoming MNI Review.

EUROZONE ISSUANCE UPDATE: 10/30-Year IGBs

| 1.30% May-33 IGB | 1.50% May-50 IGB | |

| ISIN | IE00BFZRPZ02 | IE00BH3SQB22 |

| Amount | E300mln | E950mln |

| Previous | E400mln | E900mln |

| Avg yield | 2.840% | 3.359% |

| Previous | 0.401% | 2.646% |

| Bid-to-cover | 2.97x | 1.6x |

| Previous | 1.50x | 1.71x |

| Avg Price | 86.84 | 67.39 |

| Pre-auction mid | 86.700 | 66.959 |

| Prev avg price | 110.51 | 77.70 |

| Prev mid-price | 110.398 | 77.139 |

| Previous date | 13-May-21 | 01-Sep-22 |

FOREX: Greenback Fade Tilts Major Pairs Toward Weds Highs

- The softer USD outlook from the off has helped support most major pairs early Thursday, with EUR/USD building a base above the 1.07 handle and NZD/USD showing back above the 0.6050 that failed to support prices yesterday.

- For now, the moves are somewhat shallow are markets tread water ahead of US data releases later Thursday and continue to digest the surprisingly hawkish turnouts from the Australian and Canadian rate decisions earlier in the week.

- USDJPY sits just above session lows at the NY crossover, as markets continue to partially pullback the gains posted Wednesday. For now, spot holds within this week's traded range (139.03/140.45), with sizeable option interest at the Y140.00 level potentially limiting losses at this stage.

- USD/CNH broke through 7.1500 late yesterday, and progressed further to touch another fresh YtD high of 7.1557 overnight. CNH has managed to regain some poise since, however bulls remain in control, even though the cross remains technically overbought. Initial resistance comes in at the top of the trend channel (7.1679).

- Weekly jobless claims data provides the highlight of the NY docket today. It is also worth noting that post-meeting comments from BoC Deputy Governor Beaudry will probably get more attention than usual, after the Bank caught most off guard yesterday.

- The observance of the Corpus Christi holiday may limit liquidity a little today, with some participants across Germany, Spain, Portugal, Austria & others set to take a holiday.

FX OPTIONS: Expiries for Jun08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E1.3bln), $1.0690-00(E2.6bln), $1.0800(E1.0bln)

- USD/JPY: Y140.00($2.9bln)

- AUD/USD: $0.6650-55(A$538mln), $0.6710-15(A$532mln)

- USD/CAD: C$1.3350($716mln), C$1.3400($860mln)

EQUITIES: E-Mini S&Ps Conditions Still Bullish Following Recent Break of Bull Trigger

- Eurostoxx 50 futures continue to trade above 4216.00, the May 31 low and a key support. For now, the recent move higher appears to be a correction. Price action last week reinforced a bearish theme - support at 4252.00, the May 25 low, has been breached. The contract has also pierced support at 4233.00, the May 4 low and a key short-term level. Resistance to watch is 4362.00, May 29 high, a break would be a bullish development.

- S&P E-minis are in a consolidation mode but the trend condition is bullish following recent gains. Resistance at 4244.00, Feb 2 high and a bull trigger, has recently been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. The focus is on 4327.50 next, the Aug 16 2022 high (cont). The 50-day EMA, at 4155.00 remains a key support. A break is required to signal a reversal.

COMMODITIES: Gold Trades Below Trendline Support at $1953.5

- WTI futures traded higher Monday, piercing resistance at $74.73, the May 24 high. However, the contract failed to hold on to its gains. A clear break of $74.73 would strengthen a bullish condition and signal scope for an extension higher. This would open $76.74, the Apr 28 high. For bears, a stronger reversal would instead highlight a top and expose key support at $63.90, the May 4 low. First support to watch is $70.00, the Jun 2 low.

- The bear cycle in Gold remains intact. The yellow metal traded lower yesterday and has once again pierced trendline support drawn from Nov 3 2022. The trendline intersects at $1953.5. A clear breach of this line would reinforce bearish conditions and open $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this level would signal a short-term reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 08/06/2023 | 0900/1100 | * |  | EU | Employment |

| 08/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/06/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/06/2023 | 1920/1520 |  | CA | BOC Deputy Beadury speech | |

| 09/06/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/06/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/06/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 09/06/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 09/06/2023 | 0800/1000 |  | EU | ECB de Guindos in Capital Requirements Seminar at EU Parliament | |

| 09/06/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/06/2023 | 1400/1000 | * |  | US | Services Revenues |

| 09/06/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/06/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.