-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: AUD/NZD Still Driven By Central Bank Divergence

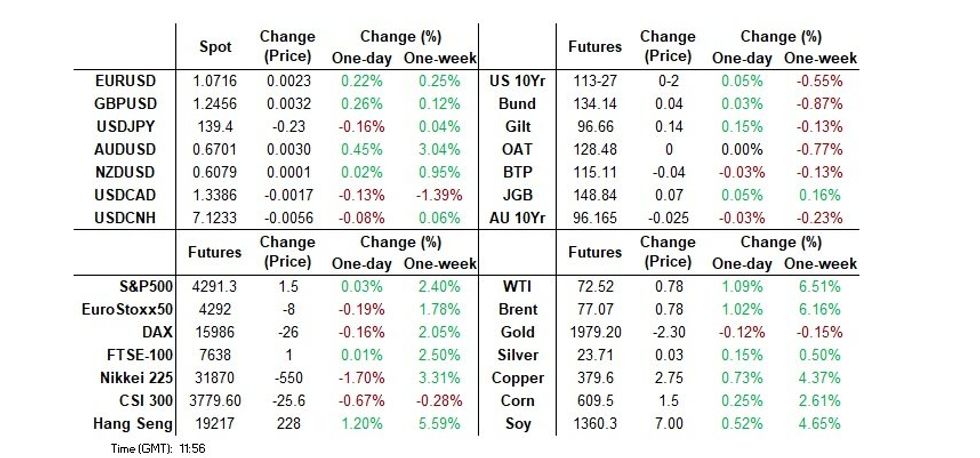

- €-denominated IG & sovereign supply dented fixed income early on, before some stabilisation, aided by U.S. Tsy futures block flow, was seen.

- Steady FX trade has left little material dent in market prices ahead of the NY crossover, with the DXY a touch lower on the day.

- U.S. trade balance data marks the sole data release Wednesday ahead of the Bank of Canada rate decision. The BoC is seen having a close decision between hiking this week or waiting five weeks until July.

US TSYS: EGB-Led Bear Flattening Ahead Of Light Docket

- Cash Tsys sit cheaper on the day but are within both session and yesterday’s ranges, lead by 3s for a modest bear flattening with 2s10s of -82.5bps back at lows since Mar 10 in the early days of regional banking woes. Broader impetus appears derived from EGBs, with front end pressure coming earlier in the session but then further supported by ECB’s Knot not being convinced that current tightening is sufficient.

- Ahead sees a light docket and further bill issuance, with potential spillover from the tight BoC decision.

- 2YY +3.2bp at 4.510%, 5YY +3.2bp at 3.839%, 10YY +2.3bp at 3.683% and 30YY +1.1bp at 3.855%.

- TYU3 trades just 2+ ticks higher at 113-27+ on subdued volumes of 200k. It sees a bearish outlook, with support eyed at 113-10 (Jun 5 low) whilst resistance is seen at 114-19 (20-day EMA).

- Data: Weekly MBA mortgage data (0700ET), Trade balance Apr incl historical revisions (0830ET) and Consumer credit Apr (1500ET).

- Bill issuance: US Tsy $46B 17W bill auction (1130ET)

STIR: Fed Rates Nudge Higher Overnight But Don’t Change Narrative

- Fed Funds implied rates have firmed in European hours to leave them slightly higher than yesterday but with Monday’s ISM Services miss still weighing for now.

- Cumulative change from 5.08% effective: +6bp Jun (+1bp), +19.5bp Jul (+1bp), +16bp Sep (+1bp), +5bp Nov (+2bp), -9bp Dec (+2bp) and -26bp Jan (+2bp).

- A light data docket sees potential spillover from today’s BoC decision at 1000ET with the market pricing 50/50 between holding or hiking for the first time since Jan at a time the Fed’s ‘skip’ narrative is firmly in place. US CPI on Jun 13 remains the main hurdle ahead of the Jun 13-14 FOMC meeting.

BOC: MNI BoC Preview, Jun'23: A Decision To Hike Now Or In July

EXECUTIVE SUMMARY

- The BoC is seen having a close decision between hiking this week or waiting five weeks until July. Consensus leans to no change although market pricing has increased to 50/50 chance of a hike and we edge into the hike camp this week.

- It comes down to the strength of domestic data vs the timing of BoC commentary with the far more thorough MPR landing with the July meeting and the recently emerged Fed skipping narrative.

- We expect hawkish language in the single page statement either way, but outright market reaction is likely larger in the event of a dovish surprise.

- There is circa 40bps of hikes priced to October from current levels and a large higher rates for longer push has seen Canada 2Y OIS exceed that of the US for the first time since Sep, whilst there has also been an apparent sizeable trimming of CAD net shorts.

- PLEASE FIND THE FULL REPORT HERE: BOCPreviewJun2023.pdf

CHINA DATA: Export Growth Unhelpful For The Yuan, Imports Still Negative But Above Expectations

China's May trade data saw export growth catch up to the downside. Base effects from last year, coupled with softer global growth has weighed on external demand momentum. At -7.5% y/y, export growth back close to late 2022/early 2023 lows. It remains above the pace of other NEA economies though, where export growth is still running at a negative double digit pace.

- The first chart below overlays export growth against CNY NEER (J.P. Morgan Index) y/y changes, with this series inverted on the chart. The NEER fall looks too weak relative to the export trend, but there are other factors at play in terms of weaker growth conditions more broadly, which is fueling easing expectations.

- In any case, weaker than expected export growth will be difficult to be seen as a positive for the local FX. Also, the export miss helped weaken the trade surplus position, back to $65.81bn, which is still very elevated by historical standards but was below expectations.

Fig 1: China Exports Y/Y & CNY NEER Y/Y (Inverted)

Source: J.P. Morgan/MNI - Market News/Bloomberg

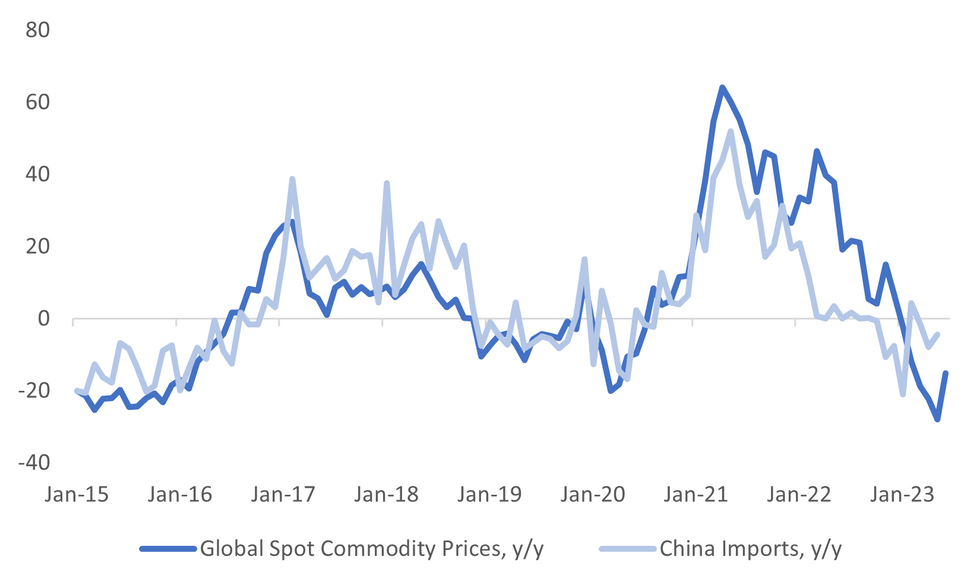

- On the import side, things were a little bit better relative to expectations, growth at -4.5% y/y, versus -8.0% forecast. Some of the headlines showed impressive y/y bounces in commodity imports (such as iron ore and oil), but coal imports were still reportedly down versus April levels.

- The second chart below overlays China import growth against the spot commodity price changes. The two series are reasonably linked with each other.

- The market may want to see further improvement in domestic demand indicators/and or fresh stimulus measures before it turns more constructive on the China demand outlook than just a modest import beat.

Fig 2: China Import Growth & Global Spot Commodity Prices (Y/Y)

Source: MNI - Market News/Bloomberg

EUROPEAN ISSUANCE UPDATE

Germany: 0% Oct-25 Green Bobl Auction Results

Total of E936mln of the 0% Oct-25 Green Bobl allotted, with E1.0bln sold in total:

- Average yield: 2.66%

- Bid-to-offer 3.35x

- Bid-to-cover 3.58x

- Average Price 94.04

- Lowest Acc. Price 94.03 94.04

- Pre-auction Mid 94.014

France: 15Y OATi Linker: Final Terms

E3bln EUR Benchmark Long 15Y Fixed (March 1, 2039) at OAT+13bps

- Guidance: OAT+14bps Area

- Books > E21.5bln (including JLM interest)

- Indexation: Linked to the French Consumer Price Index (excluding tobacco)

- Settlement: June 14, 2023

Italy: BTP Valore Orders Nearing E13bln Total

Orders for the 4-year BTP Valore haven't shown much evidence of slowing in the third day of sales. They stand at E2.111bln through midday CEST (per Borsa Italiana data), when added to the previous two days' E10.627bln in orders makes a combined E12.74bln so far.

- That's very strong: as we have pointed out before, another comparative retail issue - the 5-year BTP Italia - saw a total of E8.6bln over 3 days, which has easily been eclipsed by the Valore.

- Placement will continue through 9 June (could theoretically be an early end to the sale at the discretion of the MEF, but not before end of play today).

Spain: EUR Benchmark 10y - Final Terms

E13bln Spain EUR Benchmark Long 10Y Fixed (Oct. 31, 2033) at SPGB +10bps

- Size is in line with MNI's expectations (E10-15bln)

- Initial guidance was SPGB+12bp area

- Order books >E85bn (incl. E7.9bln JLM interest)

- Settlement: June 14, 2023

EUR Benchmark 10Y Fixed (June 14, 2033) mid-swaps +95bp

- Revised guidance: mid-swaps +100bp area (+/-5bp), will price in range

- IPT: Mid-swaps +115bp Area

- Books >E3.7bln (excluding JLM interest):

- Settlement: June 14, 2023

UK: 3.50% Oct-25 Gilt Auction Results

Total of GBP4.00bln of the 3.50% Oct-25 Gilt sold:

- 3.50% Oct-25 Gilt

- Bid-to-cover 2.34x

- Tail 0.6bp

- Avg price 96.953

- Low price 96.940

- Pre-auction mid 96.920

FOREX: Steady FX Trade Leaves Little Dent in Ranges

Steady FX trade has left little material dent in market prices ahead of the NY crossover. The USD Index is a touch softer, sitting just below the 104.00 level at typing. The modestly negative equity backdrop has done little to underpin any strength in haven currencies - with the JPY and CHF distinctly mid-range.

- NOK sits modestly firmer, with USD/NOK just above yesterday's lows. Moves come ahead of this Friday's CPI release, providing the last look at inflation ahead of the June Norges Bank rate decision. Markets look for core inflation to remain sticky, leaving the board with little choice but to hike rates further, and indicate further tightening will be required to rein in inflation.

- Outside of developed markets, TRY's slide has accelerated, with the USD/TRY and EUR/TRY rates spiking to new alltime highs. The moves come as the pace of state bank intervention slows, a firm indication of a return to more orthodox economic management under the new economy minister Simsek.

- US trade balance data marks the sole data release Wednesday ahead of the Bank of Canada rate decision. The BoC is seen having a close decision between hiking this week or waiting five weeks until July.

- Consensus leans to no change although market pricing has increased to 50/50 chance of a hike and we edge into the hike camp this week. Our full BoC preview found here.

AUD/NZD: Swap Spreads Provide Further Indicator of Policy Driver Behind Cross

The rally in AUD/NZD spot persists, hitting a new high at 1.1010 in recent trade - making for 12 consecutive sessions of higher highs for the cross. The 4% rally off the mid-May lows has cleared the April high and now targets 1.1088 (Feb20 high) for direction.

- Diverging rate expectations clearly the driver here, as the contrasting RBA/RBNZ approach underpins the cross rally.

- Hedging markets have been highly active alongside the spot rally: today's AUD/NZD options volume has already cleared the daily average thanks to the sizeable interest in upside protection. 1.1050 call strikes have already seen over A$1bln in notional interest across late Asia/early European trade.

- Shorter-dated options trades are evident, typified by a 1.0850/1.1050 call spread trading at the European open - position expires at the end of June and remains profitable with spot above ~1.0980.

- Swap spreads, AUD/NZD moving in lockstep as mentioned above - another indicator that monetary policy is the key underlying driver here:

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0615-25(E1.2bln), $1.0645-50(E535mln), $1.0730(E1.2bln)

- USD/JPY: Y137.95-05($1.4bln), Y139.00($1.2bln), Y142.00($3.3bln)

- AUD/USD: $0.6620-30(A$718mln), $0.6650(A$541mln), $0.6700(A$1.2bln)

EQUITIES: Eurostoxx 50 Futures, E-Mini S&Ps Respect Recent Ranges

Eurostoxx 50 futures remain above 4216.00, the May 31 low and a key support. For now, the recent move higher appears to be a correction. Price action last week reinforced a bearish theme - support at 4252.00, the May 25 low, has been breached. The contract has also pierced support at 4233.00, the May 4 low and a key short-term level. Resistance to watch is 4362.00, May 29 high, a break would be bullish. S&P E-minis are in a consolidation mode but the trend condition is bullish following recent gains. Resistance at 4244.00, Feb 2 high and a bull trigger, has recently been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. The focus is on 4327.50 next, the Aug 16 2022 high (cont). The 50-day EMA, at 4155.00 remains a key support. A break is required to signal a reversal.

COMMODITIES: Bear Cycle in Gold Intact

WTI futures traded higher Monday, piercing resistance at $74.73, the May 24 high. However, the contract has failed to hold on to its latest gains. A clear break of $74.73 would strengthen a bullish condition and signal scope for an extension higher. This would open $76.74, the Apr 28 high. For bears, a stronger reversal would instead highlight a top and expose key support at $63.90, the May 4 low. First support to watch is $70.00, the Jun 2 low. The bear cycle in Gold remains intact and the yellow metal on Monday once again tested trendline support drawn from Nov 3 2022. The trendline intersects at $1951.3. A clear breach of this line would reinforce bearish conditions and open $1903.5,61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this level would signal a short-term reversal.

COMING UP (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/06/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/06/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 08/06/2023 | 2350/0850 | ** |  | JP | GDP (r) |

| 08/06/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 08/06/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 08/06/2023 | 0900/1100 | * |  | EU | Employment |

| 08/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/06/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/06/2023 | 1920/1520 |  | CA | BOC Deputy Beadury speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.