-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - AUD Plumbs New YTD Lows as RBA Open Door for a Pause

Highlights:

- Treasury yields under pressure ahead of Powell's semi-annual testimony

- AUD sinks to YTD lows as RBA open possibility of a pause

- EGBs rally as dovish RBA, position-squaring and roll flow make for a short squeeze

US TSYS: Treasuries Rally On External Factors With Powell Eyed

- Cash Tsys have unwound a large part of yesterday’s sell-off, with spillover first from a dovish RBA overnight and then more recently EGBs after a sharp pullback in the ECB monthly consumer inflation expectations survey.

- 2YY -3.5bp at 4.851%, 5YY -3.3bp at 4.219%, 10YY -3.3bp at 3.925% and 30YY -3.4bp at 3.859%. 2s10s of -92.5bps sit fractionally off fresh multi-decade lows.

- TYM3 trades 11+ ticks higher at 111-11, just off highs of 111-12 but with volumes fading recently whilst awaiting Powell. Resistance is seen at 111-23+ (Feb 28 high) and then 112-03 (Feb 24 high) whilst support is at the bear trigger of 110-12+ (Mar 2 low).

- Fedspeak: Powell is due to start speaking in the Senate at 1000ET but no set time to potential pre-release of remarks and with mixed historical precedent.

- Data: Wholesale trade sales/inventories for Jan/Jan final (1000ET), Consumer credit for Jan (1500ET)

- Note/bond issuance: US Tsy $40B 3Y Note auction (91282CGR6) – 1300ET

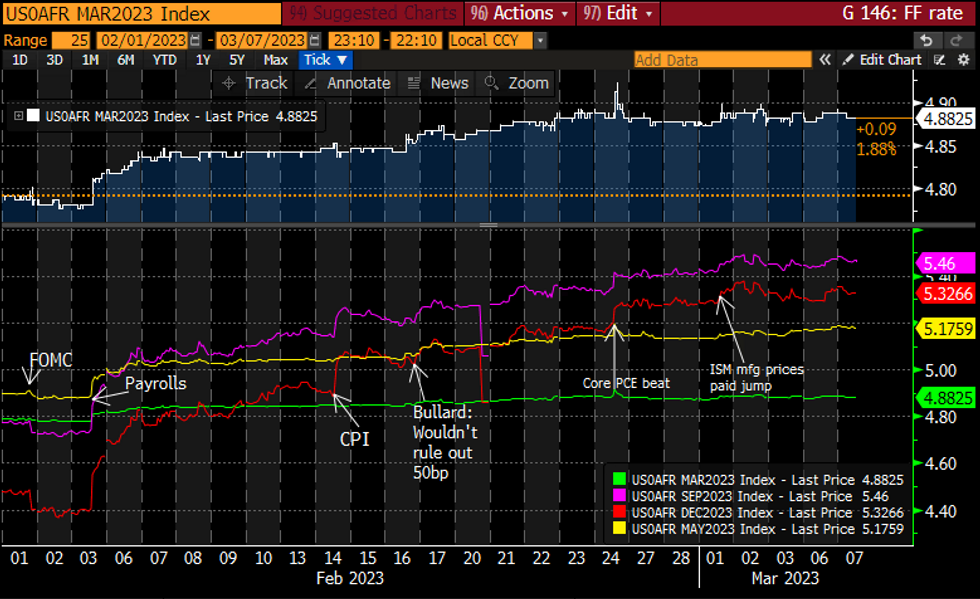

STIR FUTURES: Modest Cooling In Fed Rate Path Ahead Of Powell

- Fed Funds implied hikes have drifted lower overnight to chip away at yesterday’s potential ECB-related increase.

- 30.5bp for Mar (-0.5bp), cumulative 60bp for May (-0.5bp), 89bp to 5.47% terminal in Sep (-1bp) before 14bp of cuts to 5.33% year-end (-1.5bp). The terminal and year-end remain near levels after the latest step higher from the surprising strength of ISM prices paid, and with the terminal not far off Thursday highs of 5.51%.

- Powell in focus, due to start with the Senate at 1000ET but no set time to potential pre-release of remarks.

Source: Bloomberg

Source: Bloomberg

GBP/AUD Nears YTD High, Would Confirm Bullish Break

- The post-RBA pullback in the AUD persists through to NY hours, with AUD holding its position as the poorest performer across G10 so far Tuesday. Despite GBP/USD's pullback off the overnight high, GBP/AUD remains particularly firm and is approaching horizontal resistance at 1.8030 - the Feb28 and YTD high.

- Any break north of this level will open levels last seen in late December, with 1.8276 the longer-term upside target.

- Short-end yield spreads remain a key underlying driver, with the 2yr UK-AU yield spread pressing higher in recent sessions and helping aide the strength in the cross since the RBA overnight.

- On a technical basis, momentum in the cross is yet to reach overbought levels, with the 14-day RSI still below the 70 handle. The last time the cross was technically overbought was October last year, which presaged a near 3% pullback in the pair.

FOREX: AUD Hits YTD Lows as RBA Statement Opens Possibility of Pause

- The Reserve Bank of Australia hiked the policy rate by 25bps to 3.60% overnight, alongside expectatons. Markets took more interest in the accompanying policy statement, however, which raised the likelihood of a pause to the policy tightening cycle at the upcoming meetings. As a result, AUD trades markedly weaker, with the currency softer against all others in G10.

- AUD/USD has plumbed fresh YTD lows in recent trade at 0.6674, with the pullback in prices accelerating on the break below last week's lows of 0.6695 and the Jan 3 low of 0.6688. This bearish break opens mid-Dec lows at 0.6629 for direction.

- JPY is at the other end of the table, sitting firmer amid a general risk-off backdrop. Equities hold well below yesterday's highs, with European markets similarly lower. The US yield curve sits lower and modestly flatter, with 10y off 2.5bps, while 20y drops 3.5bps ahead of NY hours.

- The USD has gained in tandem with the JPY, helping drag most major pairs off overnight highs. EUR/USD and GBP/USD have both ebbed lower through the European morning in price action to mimic profit-taking ahead of Powell's appearance later today.

- Focus ahead turns to the appearance of Fed's Powell in front of the Senate as he presents his semi-annual testimony later today. He appears in front of the lawmakers at 1500GMT/1000ET, however a release of text is possible ahead of time. There are no notable data releases for the duration of the Tuesday session.

FX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0570-85(E1.3bln), $1.0620-30(E1.0bln), $1.0675-85(E922mln), $1.0710-30(E938mln), $1.0740-45(E1.0bln), $1.1000(E1.4bln)

- USD/JPY: Y136.00-10($783mln), Y136.50-65($774mln)

- GBP/USD: $1.1950(Gbp572mln), $1.1975(Gbp721mln), $1.1994-00(Gbp1.0bln)

- USD/CAD: C$1.3600-15($1.3bln)

- USD/CNY: Cny6.9500($1.4bln)

EQUITIES: Eurostoxx Futures Test 4323.0 Bull Trigger, Clear Break Needed to Resume Uptrend

- Eurostoxx 50 futures have recovered from recent lows and importantly, this has left a key support intact - the base of a bull channel drawn from the Oct 13 low. The line intersects 4221.20. While channel support holds, the broader uptrend remains intact. Monday’s gains resulted in a test of 4323.00, the Feb 16 high and bull trigger. A clear break would resume the uptrend. On the downside, a breach of the channel base alters the picture.

- S&P E-Minis trend conditions are bearish, however, the strong bounce late last week has eased bearish pressure. Note that the contract has traded above both the 20- and 50-day EMAs. An ability to hold on to its latest gains would signal scope for a recovery towards 4100.20, a Fibonacci retracement. On the downside, key support has been defined at 3925.00, the Mar 2 low. A break of this level would reinstate the recent bearish theme.

COMMODITIES: WTI Future Trend Conditions Bullish Ahead of Key $82.89 Resistance

- WTI futures remain bullish following last week’s appreciation and the contract started this week on a positive note. Price is through resistance at the 50-day EMA which intersects at $78.09 today. The breach reinforces short-term bullish conditions and paves the way for a climb towards $82.89, the Jan 23 high and a key resistance. On the downside, a breach of support at $73.80 is required to reinstate the recent bearish theme. First support is at $75.83.

- Trend conditions in Gold remain bearish, however, the metal traded higher last week and breached resistance at $1846.4, the 50-day EMA. A clear break of this hurdle would strengthen short-term bullish conditions and signal scope for an extension higher - this would open $1870.5, the Feb 14 high. On the downside, key short-term support has been defined at $1804.9, the Feb 28 low. A break would resume recent bearish activity.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2023 | - | *** |  | CN | Trade |

| 07/03/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/03/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/03/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 07/03/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/03/2023 | 2000/1500 | * |  | US | Consumer Credit |

| 08/03/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 08/03/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/03/2023 | 0930/0930 |  | UK | BOE Dhingra at Resolution Foundation | |

| 08/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2023 | 1000/1100 | * |  | EU | Employment |

| 08/03/2023 | 1000/1100 |  | EU | ECB Lagarde at Women's Day WTO Event | |

| 08/03/2023 | 1000/1100 |  | EU | ECB Panetta Intro at Euro Cyber Resilience Board | |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.