-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Bonds Underpinned & JPY On Defensive

- Bunds probe resistance, light bull steepening for Tsys.

- JPY struggling vs. G10 peers.

- Central bank speak and lower tier data due for rest of day. BoJ due in Asia.

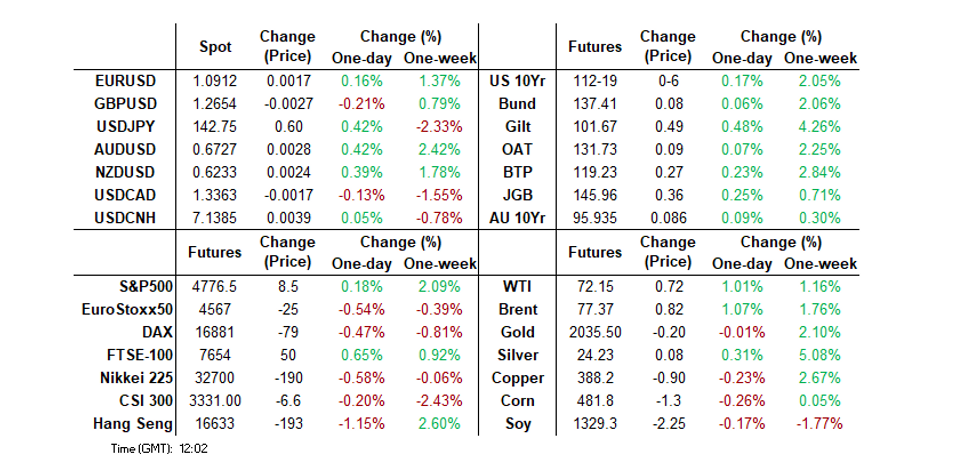

US TSYS: Mildly Bull Steeper Ahead Of A Light Docket

- Cash Tsys trade 0-2.5bp richer on the day, with strength led by the front end for a modest bull steepening that was seen with the open and maintained ever since. 2s10s at -51bps is off Friday’s low of -54.7bps that otherwise marked the lowest since late September.

- TYH4 at 112-18 has pulled off an earlier high of 112-21+. The trend needle points north with resistance at 112-28+ and 113-12+ (Fibo projections of the Oct 19 – Nov 3 – Nov 13 price swings).

- Today sees a light docket, led by the NAHB housing index and solid bill issuance, with flow and headlines likely in the driving seat. Goolsbee's interview with CNBC is of less note after his weekend remarks.

- Data: NY Fed Services Dec (0830ET), NAHB housing index Dec (1000ET)

- Fedspeak: Goolsbee on CNBC (0830ET)

- Bill issuance: US Tsy $75B 13W, $68B 26W bill auctions (1130ET)

US TSY FUTURES: OI Indicates Mixed Positioning Swings Ahead Of Weekend

The com,bination of Friday’s twist flattening on the Tsy futures curve and preliminary OI data points to the following positioning swings ahead of the weekend.

- Long cover: TU & TY futures.

- Short setting: FV futures.

- Long setting: US & WN futures.

- Positioning swings in UXY futures are harder to define given the lack of net price movement on the day,

- A reminder that the mix of well-documented comments from NY Fed President Williams, softer-than-expected Eurozone PMIs and mixed vs. exp. U.S. PMIs provided the headline fundmanetal inputs on the day.

| 15-Dec-23 | 14-Dec-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,833,832 | 3,900,460 | -66,628 | -2,585,138 |

| FV | 5,739,399 | 5,688,062 | +51,337 | +2,257,355 |

| TY | 4,495,190 | 4,507,969 | -12,779 | -838,123 |

| UXY | 2,018,470 | 2,002,328 | +16,142 | +1,512,705 |

| US | 1,351,007 | 1,342,356 | +8,651 | +1,212,881 |

| WN | 1,607,671 | 1,599,190 | +8,481 | +1,913,721 |

| Total | +5,204 | +3,473,400 |

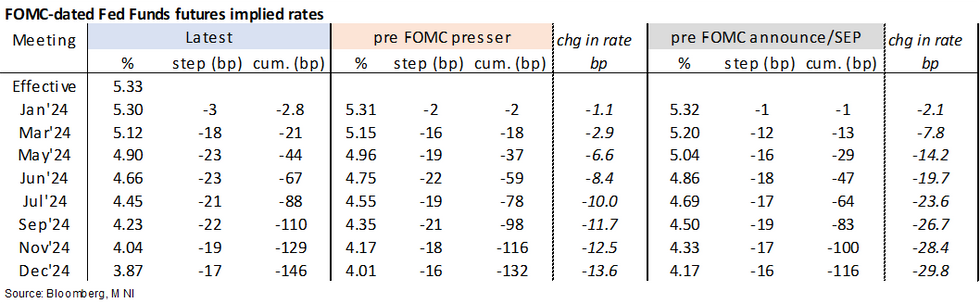

STIR: Fed Rate Path Tilts Lower Again Despite FOMC Pushback

Fed Funds implied rates haven’t taken heed of FOMC participants pushing back on the timing/size of rate cuts over the weekend and earlier today, and instead have slipped lower to reverse a large part of Friday’s lift.

- There is a cumulative 21bp of cuts priced for March, 44bp for May, 67bp for June and 146bp for end-2024. The 3.87% implied effective rate for Dec’24 is close to where it closed after Wednesday’s FOMC decision.

- Goolsbee (’23 voter) yesterday said “We’ve got to get inflation down to target… Until we’re convinced that we’re on path to that, it’s an overstatement to be counting the chickens.”

- The FT this morning ran Mester (’24 voter) saying “the next phase is not when to reduce rates, even though that’s where the markets are at. It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2 per cent", whilst disclosing she was among the members to forecast 3 25bp cuts next year.

STIR: Long Cover Seemed To Dominate On SOFR Strip On Friday

The combination of Friday’s twist flattening on the SOFR strip and preliminary open interest data point to the following positioning swings ahead of the weekend.

- Whites: Long cover seemed to dominate, aided by the well-documented comments from NY Fed President Williams, although pockets of fresh short setting were also seen (SFRU3 & H4).

- Reds: Long cover also seemed to dominate there, with net short setting seemingly only seen in SFRM5.

- Greens: The bias was once again towards apparent long cover, although one round of apparent short setting (SFRM6) tilted the net pack OI swing away from extremes.

- Blues: A mix of long setting and short cover was seemingly seen. It is hard to be definitive when it comes to SFRU6 positioning moves given the unchanged price status on the day.

| 15-Dec-23 | 14-Dec-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 1,114,540 | 1,102,594 | +11,946 | Whites | -59,204 |

| SFRZ3 | 1,538,346 | 1,594,351 | -56,005 | Reds | -68,132 |

| SFRH4 | 1,099,594 | 1,092,754 | +6,840 | Greens | -7,985 |

| SFRM4 | 1,001,499 | 1,023,484 | -21,985 | Blues | -2,157 |

| SFRU4 | 934,741 | 950,141 | -15,400 | ||

| SFRZ4 | 905,443 | 956,322 | -50,879 | ||

| SFRH5 | 566,132 | 573,295 | -7,163 | ||

| SFRM5 | 610,615 | 605,305 | +5,310 | ||

| SFRU5 | 592,983 | 596,391 | -3,408 | ||

| SFRZ5 | 567,084 | 578,817 | -11,733 | ||

| SFRH6 | 408,557 | 408,805 | -248 | ||

| SFRM6 | 385,183 | 377,779 | +7,404 | ||

| SFRU6 | 310,644 | 312,356 | -1,712 | ||

| SFRZ6 | 236,782 | 241,129 | -4,347 | ||

| SFRH7 | 145,025 | 143,942 | +1,083 | ||

| SFRM7 | 139,952 | 137,133 | +2,819 |

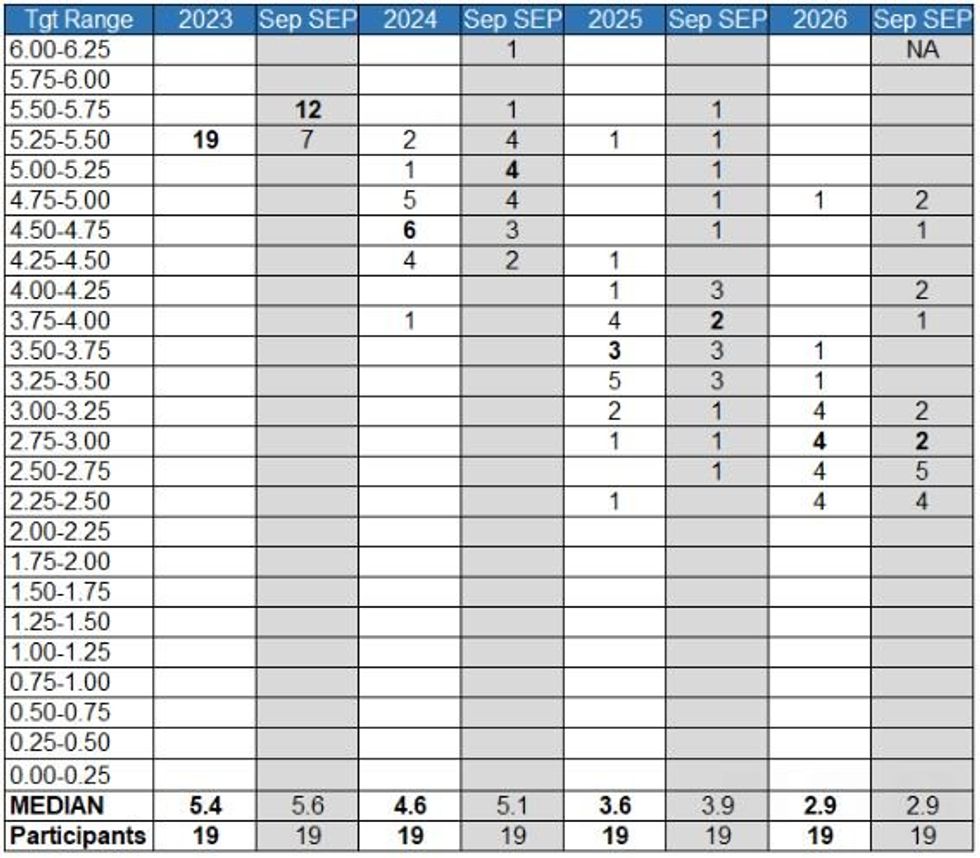

FED: Mester Joins In Rate Cut Pushback...But Few Are More Dovish For 2024

Cleveland Fed Pres Mester joined with colleagues in a pushback against market cut repricing after last week's FOMC meeting, telling the FT in an interview published this morning that the implied path of rates was "a little bit ahead" of where the Fed sees things - "They [markets] jumped to the end part, which is ‘We’re going to normalize quickly’, and I don’t see that.”

- The near 150bp of 2024 cuts currently priced is clearly too much for the FOMC to countenance right now. That being said, as among the more hawkish members of the Committee, it's notable that Mester says she pencilled in three 25bp cuts in 2024 in her Dot Plot, implying a 4.50-4.75% range, in what she called a soft landing. (She's a 2024 FOMC voter but has to retire in June.)

- That's in line w the median Dot and doesn't look that far removed from a dovish pivot across the Committee - in October she "suspected" another rise might be coming by end-2023 (and note Atlanta's Bostic had looked for no change in rates through 2024 but said Friday he now sees 50bp in cuts). Indeed only 5 of 18 FOMC members see rates lower than Mester at end-2024.

- Her logic: "If you don’t take action as expected inflation comes down, then you’re really firming policy...you don’t want to inadvertently become more restrictive than you think is appropriate.”

- That sounds very much like the pretext for cutting used by Chair Powell, Gov Waller, and NY Pres Williams among others. Also echoing Powell's comments last week on the current "question" facing the FOMC, Mester told the FT: "The next phase is not when to reduce rates, even though that’s where the markets are at. It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2 per cent."

- While the messaging the past few days from across the FOMC Hawk-Dove spectrum has been to push back on market cut pricing after Powell's dovish press conference, we wouldn't characterize the messaging as being that much different from what Powell actually said (same with Williams last week) - but more a walkback of Powell's fairly breezy tone in discussing easing scenarios.

December 2023 FOMC Dot Plot Distribution - Federal Reserve / MNI

December 2023 FOMC Dot Plot Distribution - Federal Reserve / MNI

FOREX: Yen Underperforms

- The Dollar started the overnight session in the red, and some some early continuation into the European open, with Global Yields leaning in the red, near multi month lows.

- NZD and AUD were the early best performer, but have now been joined by the SEK, the 2nd best performer in G10 against the Dollar.

- NZDUSD targeted immediate resistance of 0.6249, the December high and the highest print since 27th July, managed a 0.6251 high, but has lacked momentum, and has now pulled back to 0.6230.

- EURSEK targets the immediate support of 11.1622, the June low and the lowest printed level since March, now trading at 11.1786 at the time of typing.

- The yen has seen broader selling this morning against the USD, GBP, EUR and the AUD, and is the worst early performer against the USD, down 0.41%, as market participants await the BoJ decision tomorrow, although widely expected unchanged.

- Looking ahead, there's no notable data, and focus will be on speakers, today includes, ECB Vujcic, Wunsch, Schnabel, Lane, Fed Goolsbee.

FX OPTIONS: Expiries for Dec18 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0850 (709mln), 1.0885 (230mln), 1.0900 (379mln), 1.0910 (1.38bn), 1.0950 (287mln), 1.0960 (350mln).

- EURGBP: 0.8625 (362mln), 0.8700 (1.16bn)

- USDJPY: 142.50 (600mln), 143.00 (754mln)

- AUDUSD: 0.6685 (438mln), 0.6740 (1.36bn)

- USDCNY: 7.1000 (1.69bn), 7.1435 (472mln).

COMMODITIES: Trend Signals In Oil Futures Remain Bearish

- On the commodity front, Gold traded sharply higher last Wednesday. This signals a S/T reversal and the end of the recent Dec 4 - 13 corrective pullback. Moving average studies remain in a bull-mode position, highlighting an uptrend. A continuation higher would signal scope for a climb toward key resistance and the Dec 4 all-time high of $2135.4. Initial firm support lies at $1973.2, the Dec 13 low.

- In the oil space, bearish conditions in WTI futures remain intact and last Tuesday’s sell-off reinforced this condition. The contract has cleared $69.08, Dec 7 low, to confirm a resumption of the downtrend. This maintains the price sequence of lower lows and lower highs and note that MA studies are in a bear-mode position, highlighting a downtrend. The focus is on $67.07, Jun 23 low. Gains are considered corrective. Resistance to watch is $73.27, the 20-day EMA.

EQUITIES: S&P E-Minis Trend Needle Points North

- In the equity space, a bullish theme in S&P E-Minis remains intact and the contract is trading closer to its recent highs. The rally last week confirmed a resumption of the uptrend that started Oct 27. Note too that the contract has cleared resistance at 4738.50, the Jul 27 high, reinforcing current positive trend conditions. This signals scope for a climb towards 4800.00 next. On the downside, initial firm support lies at 4645.17, the 20-day EMA.

- A bullish theme in EUROSTOXX 50 futures remains intact and the contract traded to a fresh trend high last week. This confirms, once again, a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The focus is on 4636.70, the 76.4% retracement of the 2000 - 2009 downleg (cont). Support to watch is at 4480.80, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/12/2023 | 1330/1430 |  | EU | ECB Schnabel Lectures On EU Fiscal Policy And Governance | |

| 18/12/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/12/2023 | 1500/1600 |  | EU | ECB Lane Chairs Panel on EMU Reforms | |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 19/12/2023 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 19/12/2023 | 0900/1000 |  | EU | ECB Elderson Statement On Banking Risks and Priorities | |

| 19/12/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 19/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/12/2023 | 1300/1300 |  | UK | BOE Breeden Speech At IIF Policy Series | |

| 19/12/2023 | 1330/0830 | *** |  | CA | CPI |

| 19/12/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/12/2023 | 1730/1230 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.