-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Busy CB Slate Makes Up For Lack of Data

HIGHLIGHTS:

- Strong start in Asia results in new alltime highs for the e-mini S&P

- Oil rangebound ahead of this week's OPEC+ meeting

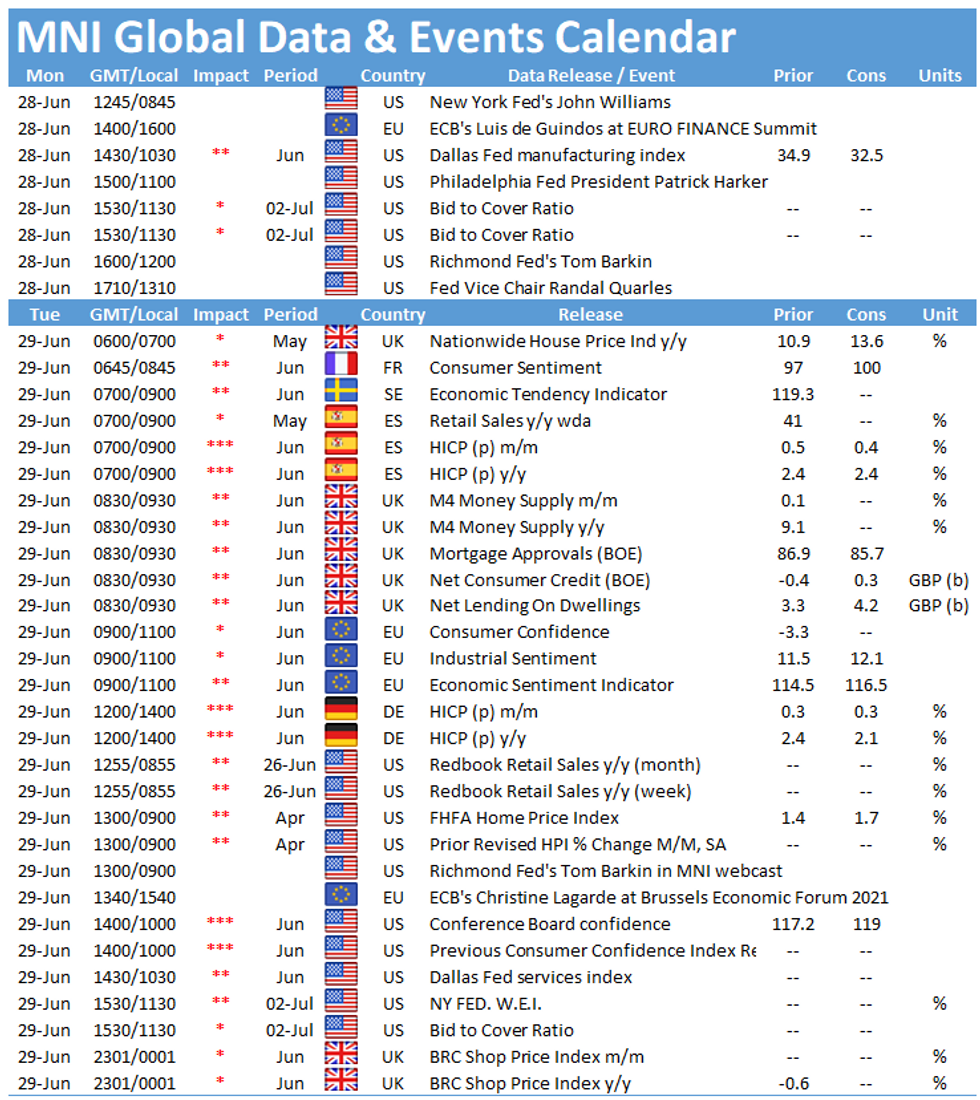

- Deluge of ECB, BoE & Fed speakers make up for empty data calendar

US TSYS SUMMARY: Edging Higher With Fed Speakers Ahead

Treasuries are modestly stronger to open the week, with stock futures flat/lower and the dollar a little weaker. Fed speakers provide the session's focus, with Friday's employment report and Wednesday's month-/quarter-end looming.

- Sep 10-Yr futures (TY) up 4.5/32 at 132-00 (L: 131-28.5 / H: 132-01), limited volumes (~182k).

- The 2-Yr yield is down 0.4bps at 0.2622%, 5-Yr is down 0.3bps at 0.9183%, 10-Yr is down 0.7bps at 1.5173%, and 30-Yr is down 0.6bps at 2.1425%.

- Fed speakers include NY's Williams (0900ET), Richmond's Barkin (1200ET), and VC Quarles (1310ET).

- Overnight attention was on an FT interview w Boston Fed's Rosengren who identified potential for "boom and bust" in the housing market and called for reducing MBS buys at the same pace as Tsys when it came time to taper.

- Only data is Jun Dallas Fed Manufacturing at 1030ET.

- Supply today is $111B of 13-/26-week bills at 1130ET. NY Fed buys ~$1.425B of 10Y-22.5Y Tsys.

EGB/GILT SUMMARY: Firm Start

European government bonds have firmed at the beginning of the week with equities edging lower following a weak session for Asian stocks. Political ructions in the UK and Sweden have provided some background noise.

- The gilt curve has slightly flattened with the 2s30s spread 1bp narrower.

- Bunds rallied soon after the open, before sliding back towards the Friday close.

- OATs have firmed while similarly trading near the previous close.

- BTP yields are broadly 1bp lower across much of the curve.

- Swedish Prime Minister Stefan Lofven announced his resignation today after his government lost a no confidence vote in parliament last week. Swedish sovereign yields have edged up 2bp on the day.

- The UK's new Health Secretary Sajid Javid has indicates that he would like to see an end of Covid restrictions as soon as possible. For the Conservative government, Javid's appointment is hoped to quell the turbulence of recent days following Matt Hancock's abrupt departure.

- Supply this morning came from Germany (Bubills, EUR3.521bn), Italy (BOTs, EUR6.5bn) and Belgium (OLOs & Green OLO, EUR3.791bn).

- The data slate has been light this morning with no tier one releases.

EUROPE ISSUANCE UPDATE: Belgian OLO Auction

Belgium sells:

- E1.928bln 0% Oct-31 OLO, Avg yield 0.136% (Prev 0.144%), Bid-to-cover 1.05x (Prev 1.70x)

- E590mln 1.25% Apr-33 Green OLO, Avg yield 0.195% (Prev 0.053%), Bid-to-cover 2.75x (Prev 2.46x)

- E1.273bln 1.70% Jun-50 OLO, Avg yield 0.937% (Prev 0.949%), Bid-to-cover 1.29x (Prev 1.58x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 171.5/170.5ps 1x2, bought for 4.5 in 1k

RXQ1 175c bought for 3 in 3,470

UK:

0LU1 99.62/99.50ps 1x2, bought the 1 for 2 in 2.5k

FOREX: Deluge of CB Speakers Props Up Headline Risk

- GBP is among the better performers in G10, with early gains in GBP/USD coming ahead of the first appearance of Sajid Javid in parliament as the new Secretary of State for Health, and is expected to reaffirm his commitment to a normalization of COVID restrictions as quickly as possible. Early strength in GBP/USD saw the pair touch 1.3940 before retracing, although near-term gains continue to appear corrective.

- Scandi currencies have diverged, with NOK among the weakest in G10 while SEK rises to the top of the pile. As expected, the Swedish PM has announced his resignation, prompting the speaker to seek a new government in lieu of another election.

- There are no tier one data releases due Monday, keeping focus on the speakers slate. There are no fewer than 10 separate ECB speeches - the most important of which being ECB's Weidmann - one of the ECB members speculated to have voted against the PEPP programme at the most recent rate decision. BoE's Haldane and Fed's Williams, Barkin & Quarles are also due.

FX OPTIONS: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-08(E508mln-EUR puts), $1.1915-25(E994mln-EUR puts), $1.1950(E1.1bln-EUR puts), $1.2000(E1.2bln)

- USD/JPY: Y108.50($660mln), Y110.00($481mln), Y110.50($1.5bln, $1.47bln-USD puts), Y111.75($500mln), Y112.00-05($890mln)

- EUR/GBP: Gbp0.8500(E710mln-EUR puts)

- AUD/NZD: NZ$1.0740(A$400mln-AUD puts)

- USD/MXN: Mxn19.85($911mln)

Price Signal Summary - S&P E-Minis Fresh ATH Once Again

- In the equity space, S&P E-minis have traded to fresh all-time highs once again today. Bullish conditions remain intact and the focus is on 4300.00. EUROSTOXX 50 futures found support Jun 21 at 4015.00. Attention is on the Jun 18 sell-off that in pattern terms is a bearish engulfing candle, signaling a potential S/T top. The key directional triggers are; 4015.00, Jun 21 low and 4153.00, Jun 17 and the bull trigger

- In FX, the EURUSD gains are still considered corrective. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable and recent gains are also considered corrective. Attention is on 1.3717 next, Apr 16 low. The bear trigger is 1.3787, Jun 21 low. USDJPY edged higher last week and delivered a fresh 2021 high, following a print above Y110.97, Mar 31 high and the previous bull trigger. This cements the uptrend and maintains a bullish price sequence of higher highs and higher lows. Attention is on 111.30/58, Mar 26, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, Gold continues to consolidate. The outlook remains weak and the current consolidation appears to be a bear flag. This reinforces a bear theme and the focus is on $1756.2, low Apr 29. The Oil market trend condition remains bullish. Brent (Q1) focus is $76.97, 1.23 projection of Mar 23 - May 18 - May 21 price swing. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing.

- Within FI, Bund futures last week probed support at 171.80, Jun 17 low. A stronger sell-off would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is unchanged at 126.70, Jun 3 low and remains an important pivot level.

EQUITIES: Europe Drifts But US Touches New ATH

- Continental stock markets are drifting early Monday, with the Spanish IBEX-35 underperforming having shed 1.3% on local bank stock weakness. Spain is the outlier, however, with most major indices off 0.4% or so.

- Europe's energy names are dragging headline indices, with the consumer discretionary sector also weak. Tech and healthcare names are more solid, but rallies have been insufficient to buoy markets more broadly.

- It's a slightly more mixed picture in US futures space, with the e-mini S&P printing a new alltime high in early Asia-Pac trade at 4278.50. This keeps focus on the first upside level at 4230.

COMMODITIES: Silver on Support

- WTI and Brent crude futures are effectively unchanged. This week's OPEC+ meeting will take some focus, with markets expecting the group to boost output by around 500,000bpd (an increase that falls short of forecasts for the demand recovery) which may remain supportive of oil prices. OPEC meet via videoconference on 1st July.

- Precious metals markets retain their downside bias, with gold and silver on the backfoot. Silver saw early weakness Monday, with prices circling first support at the 25.701 200-dma. A break below here exposes the late June lows of 25.554.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.