-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Chinese Equity Volatility Dominates Pre-NFP Trade

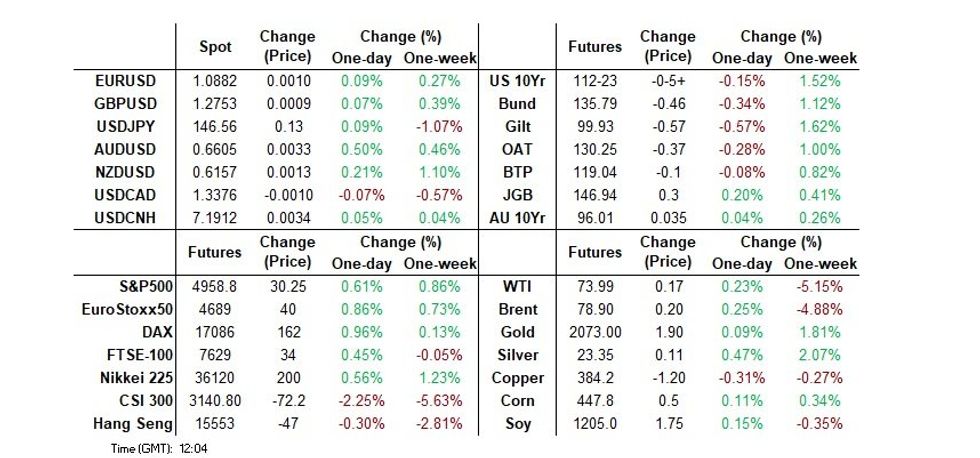

- BBDXY and bonds a touch lower on the day.

- Volatile end to session for Chinese stocks catches attention.

- U.S. NFPs, Fedspeak & ISM services due, along with BoE rhetoric from Pill.

MNI US Payrolls Preview: A Potential Test Of Powell’s Higher Bar To A March Cut

EXECUTIVE SUMMARY

- Bloomberg consensus sees nonfarm payrolls rising 185k in January, primary dealers see a median 205k.

- All change from revisions: The establishment survey will be affected by annual benchmark revisions, new seasonal factors and updated estimates for the net birth/death model, whilst the household survey (e.g. unemployment rate) will be adjusted for new population controls.

- The unemployment rate is seen increasing a tenth to 3.8%, flattered by rounding, whilst average hourly earnings are seen moderating with some looking for a larger slowing in what would be increasingly dovish after latest data reveal continued strong productivity growth.

- Fed Chair Powell has raised the bar to a first cut in March, but with traders also weighing NYCB’s troubles are wider ranging, this report carries large two-sided risk (although we’d fade an AHE hawkish surprise).

- PLEASE FIND THE FULL REPORT HERE: USNFPFeb2024Preview.pdf

MNI Eurozone Inflation Insight - January 2024: Core Goods Disinflate Further, But Services Progress Stalls

EXECUTIVE SUMMARY

Eurozone flash January HICP decelerated as expected versus December’s largely base-induced uptick, but printed slightly above the 2.7% Y/Y consensus at an unrounded 2.752% (vs 2.929% prior). Core inflation was an unrounded 3.275% Y/Y (vs 3.426% prior) – slightly above expectations of 3.2% but the 6th consecutive fall.

- The main core categories mirrored December’s results, with services at 4.0% Y/Y for the 3rd month in a row (and -0.1% M/M NSA) while non-energy industrial goods disinflated further at 2.0% Y/Y (vs 2.5% prior).

- Analysts were slightly surprised by the stickiness in services inflation, though there was some debate as to its significance. Some identified one-off factors including the increase in German restaurant VAT as the reason for sustained strength, but others cautioned that it appears services inflation overall is stabilising at a relatively high rate.

- Medium-term market-implied ECB rate cut expectations ended up slightly reduced over the 3 days of Eurozone inflation releases (Jan 30, Jan 31, Feb 1), with markets currently expecting 140bps of cuts through 2024 versus 145bp at the close on Jan 29.

- FOR FULL PDF ANALYSIS: Jan2024EZCPIReview.pdf

US TSYS: Twist Flatter With Payrolls Looming

Cash Tsys trade twist flatter, ranging from 2.5bp cheaper (2s) to 1bp richer (20s and 30s) with a pivot at 10s. Thursday's renewed regional bank worry seems to have moderated, with most still seeing the NYC Bancorp issues as fairly contained.

- 2s10s of -35bp (-3bps on the day) touches lows since Jan 11 prior to US CPI, with highs since then of circa -15bps.

- TYH4 has kept to narrow ranges overnight on decent volumes of 330k, and at 112-23 (-05+) sits in the middle of yesterday’s range which saw a high of 113-06+ on further oscillations in regional bank concerns. In clearing 112-26+ (Jan 12 high), it’s exposed a key resistance at 113-12 (Dec 27 high), whilst to the downside sits support at 111-24+ (20-day EMA).

- Data firmly headlines today’s docket, highlighted with a particularly influential payrolls report after Powell raised the bar to a first cut in March, but also followed by final January prints for the U.Mich consumer survey and factory orders.

- Data: Payrolls Jan (0830ET), U.Mich Jan final (1000ET), Factory orders Jan (1000ET)

- There is no Fedspeak scheduled for today, the first day with the media blackout lifted. Powell is currently first to speak on Sunday – see STIR bullet - but don't rule out pop-up appearances.

US TSY FUTURES: OI Points To Mix Of Long Setting & Short Cover On ULC & Banking Sector Worry

The combination of yesterday's rally in Tsy futures and preliminary OI data points to a mix of net long setting (TY & US) & short cover (TU, FV, UXY & WN) on Thursday.

- The overall net curve bias was tilted towards net long setting, largely owing to the apparent positioning swing in US futures.

- The swings in contract-specific and curve-wide OI DV01 equivalent terms were much more contained than that seen on Wednesday, when notable net long setting was seen.

- A reminder that the combination of regional banking sector worry and ULC data provided much of the impulse for the move higher in Tsy futures on Thursday, although the space finished shy of best levels.

| 01-Feb-24 | 31-Jan-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,917,231 | 3,946,545 | -29,314 | -1,069,044 |

| FV | 5,947,270 | 5,950,270 | -3,000 | -128,743 |

| TY | 4,786,964 | 4,774,317 | +12,647 | +813,717 |

| UXY | 2,167,218 | 2,168,986 | -1,768 | -164,200 |

| US | 1,442,260 | 1,425,414 | +16,846 | +2,343,369 |

| WN | 1,648,626 | 1,649,154 | -528 | -116,466 |

| Total | -5,117 | +1,678,632 |

STIR: Payrolls Headlines Before A Re-Run From Powell On Sunday

Fed Funds implied rates have pushed higher overnight, with near-term meetings back at joint post-Powell highs whilst later meetings still make up ground.

- Cumulative cuts from 5.33% effective: 10bp Mar, 33bp May, 60bp Jun and 143bp Dec.

- Today’s payrolls report clearly headlines. Preview here.

- We are now out of the Fed blackout period, opening potential for surprise appearances today.

- For now, Powell is first on the slate with an interview aired on CBS on Sun, Feb 4 at 1900ET – the interview was held yesterday, so after the FOMC decision and possibly seeing some discussion on regional bank concerns (which have fluctuated over the past two days) but won’t have specific post-payrolls insight.

STIR: OI Points To Net Long Setting And Mixed Cover In SOFR Futures On Thursday

The combination of yesterday's twist flattening of the SOFR futures strip and preliminary OI data point to the following positioning swings on Thursday:

- Whites: A mix of net long cover (SFRH4 & M4) and net short cover (SFRU4). It is hard to be sure when it comes to SFRZ3 given the unchanged price status come settlement.

- Reds: An apparent mix of net long setting (SFRH5 & U5) and short cover (SFRZ4 & M5), with the former dominating in net pack terms.

- Greens: An apparent mix of net long setting (SFRH6, M6 & U6) and short cover (SFRZ5), with the former dominating in net pack terms.

- Blues: An apparent mix of net long setting (SFRZ6) and short cover (SFRH7, M7 & U7), with the former dominating in net pack terms.

| 01-Feb-24 | 31-Jan-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,184,736 | 1,197,120 | -12,384 | Whites | -49,350 |

| SFRH4 | 1,157,819 | 1,157,934 | -115 | Reds | +13,820 |

| SFRM4 | 1,070,029 | 1,096,348 | -26,319 | Greens | +18,371 |

| SFRU4 | 942,733 | 953,265 | -10,532 | Blues | +9,893 |

| SFRZ4 | 1,053,756 | 1,056,939 | -3,183 | ||

| SFRH5 | 573,364 | 560,080 | +13,284 | ||

| SFRM5 | 653,199 | 654,201 | -1,002 | ||

| SFRU5 | 599,712 | 594,991 | +4,721 | ||

| SFRZ5 | 655,480 | 660,088 | -4,608 | ||

| SFRH6 | 420,463 | 413,957 | +6,506 | ||

| SFRM6 | 429,121 | 414,073 | +15,048 | ||

| SFRU6 | 299,235 | 297,810 | +1,425 | ||

| SFRZ6 | 278,093 | 266,119 | +11,974 | ||

| SFRH7 | 136,565 | 136,696 | -131 | ||

| SFRM7 | 155,348 | 156,051 | -703 | ||

| SFRU7 | 145,294 | 146,541 | -1,247 |

FOREX: Attention remains squarely on the US Employment data

The Dollar leans in the red going into the European session, weighted by the recovery in Equities Yesterday and into the overnight session.

- The Greenback tested intraday low against the GBP, EUR, and resistance in Cable seen towards 1.2775 High Jan 24, held in early trade, after printing a 1.2772 high, now at 1.2760.

- Overall the USD is down across G10s over a 5 days period, and today, AUD is the best performer, up 0.37%, aided by the recovery in Risk.

- The pound extended some gains against the Dollar, still not yet the best performer, but slowly catching the AUD, AUD leads up 0.47%.

- The Yen saw some unwind, after trading at its highest in 12 sessions against the Dollar, and despite the lower US Yield, the Yen is on the back foot against the EUR, GBP, USD, AUD, and is the only Currency down against the Dollar in G10, with the NOK.

- Some market participants will look at 147.11, Yesterday's high for initial resistance in the USDJPY.

- Looking ahead, focus is squarely on the US NFP/AHE.

FX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0800 (945mln), 1.0805 (300mln), 1.0825 (410mln), 1.0900 (428mln).

- GBPUSD: 1.2700 (341mln).

- USDJPY: 146.00 (496mln), 146.75 (551mln), 147.00 (363mln).

- USDCAD: 1.3315 (918mln), 1.3320 (309mln), 1.3345 (400mln), 1.3350 (237mln), 1.3400 (320mln).

- AUDUSD: 0.6600 (363mln).

- AUDNZD: 1.0800 (1.06bn).

- USDCNY: 7.1700 (225mln), 7.1800 (345mln).

EUROPEAN ISSUANCE UPDATE

Belgian ORI auction result

- E218mln of the 1.25% Apr-33 Green OLO. Avg yield 2.62% (bid-to-cover 1x).

- E290mln of the 3.45% Jun-43 OLO. Avg yield 3.172% (bid-to-cover 1.28x).

BONDS: Yields Hold Higher On The Day, NFPs & BoE’s Pill Eyed Later

A relatively contained round of trade for core global FI markets early on Friday, with the pullback from yesterday’s U.S. regional banking sector worry-/data-inspired best levels generally developing a little further.

- Broader macro focus remains on the impending U.S. NFP release.

- The previously covered swings in Chinese equity markets garnered most of the early European attention on the news flow front, although failed to factor into core global FI price swings.

- Bund futures sit ~15 ticks above worst levels, last showing -57 at 135.68. Benchmark German yields are 1-5bp higher across the curve, with some bear flattening seen.

- 10-Year EGB spreads to Bunds are generally little changed to a touch tighter on the day with some modest outperformance seen for peripherals alongside an uptick in equity benchmarks.

- Gilt futures are -57 at 99.93, ~15 ticks off lows, while cash gilt yields run 3-8bp higher on the day as the curve bear flattens. An uptick in Citi/YouGov inflation expectations surrounding the geopolitical tension in the Middle East added a local input to the pressure. BoE chief economist Pill will speak later today (12:15 London).

- Both EUR & GBP STIR markets operate off yesterday’s dovish session extremes, with the ECB-dated OIS strip showing ~139bp of cuts through ’24, while the BoE-dated OIS strip shows ~107bp of cuts over the same horizon. These moves factor into the bear flattening of the curves outlined above.

CROSS ASSET: Latest Round Of Regional Bank Worry Leaves Footprints In X-ccy Basis

The latest round of U.S. regional bank/CRE worry (centred on NYC Bancorp’s Wednesday earnings release/dividend markdown/worry re: certain credit matters) is generally seen as a contained issue, although the KBW index is ~4% lower vs. Tuesday’s closing levels, while the S&P regional bank ETF (KRE) is the best part of 9% lower and Aozora Bank’s Tokyo listing has experienced a heavy sell off in the wake of a warning re: FY net loss due to its exposure to U.S. office loans.

- This has evoked memories of the early ’23 U.S. regional banking crisis, with the impending end of the Fed’s BTFP scheme also factoring into discussions as well.

- We stress that most still see this as a fairly contained issue, unlike the early ’23 situation.

- Still, funding markets have seen a bit of a reaction to the news with 3-month USD cross-currency basis metrics (vs. EUR, JPY & GBP) all moving lower on the NYC Bancorp news.

- Here we flag that the moves have been contained, also pointing to a lack of systemic threat, albeit with the access to USD demanding a little more premium than was seen in the early part of the week.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Price Signal Summary - S&P E-Minis Trend Condition Remains Bullish

A broader uptrend in S&P E-Minis remains intact and the latest pullback has proved to be a correction. This week’s fresh cycle highs, reinforce current trend conditions. A resumption of gains would open 4982.62 next, the 1.50 projection of the Nov 10 - Dec 1 - 7 price swing. Initial support to watch lies at 4862.80, the 20-day EMA.

- EUROSTOXX 50 futures remain firm and the contract is holding on to this week’s gains. Key resistance at the Dec 14 high has recently been cleared. The break confirms a resumption of the medium-term uptrend and sights are on the 4700.00 handle next. Initial firm support lies at 4569.00, the 20-day EMA.

CHINA STOCKS: Volatile End To Trade, Fresh Cycle Lows for CSI 300 Before Signs Of State Backed Buying Show Up

MNI (London) - A volatile end to the week saw the CSI 300 and Hang Seng correct off worst levels after an aggressive move lower, but the CSI 300 still finished 1.2% worse off, while the Hang Seng was 0.2% softer on the day.

- The CSI 300 registered another fresh round of intraday and closing lows for the cycle, printing at levels last seen in ’19.

- The latest leg lower didn’t come alongside anything in the way of a meaningful round of headline flow, with well-documented worry and the call for deeper economic and equity-market specific support well engrained by now (continued speculation re: further monetary easing did the rounds via local press outlets).

- Some desks pointed to continued liquidations of leveraged long positions as a trigger, with Chinese margin usage covering A shares already falling ~6.2% in the time since Jan 4 (as of yesterday’s close), per CSFC data.

- When it came to the rebound from worst levels we note that some of the favoured ETFs of the “national team” saw a surge in volume during the move away from lows, pointing to another round of state backed support.

- The property sector outperformed on the back of another uptick in PBoC PSL lending (which we flagged after hours on Thursday), while focus on some regions/cities earmarking development projects for financial support also helped.

- News that hundreds of Chinese firms forecast a notable jump in profits did little for wider sentiment.

- Looking a little more granularly, WuXi listings struggled on continued worry re: U.S. legislation against the name.

- Film-related names moved higher on the back of LNY box office sales data.

- HK-China Northbound Stock Connect links generated CNY2.4bn of net inflows for the mainland, representing a fourth straight day of modest net inflows via those links (totalling a cumulative CNY10.3bn).

COMMODITIES: Gains In Gold Have Strengthened A Bullish Condition

Gold traded higher yesterday and the yellow metal remains above the Jan 17 low of $2001.9. Recent short-term gains have improved a bullish condition and a continuation higher would signal scope for a climb towards $2088.5, the Dec 28 high and a key resistance. For bears, a reversal lower would refocus attention on $2001.9 where a break is required to reinstate the recent bearish theme.

- In the oil space, WTI futures are trading just above this week’s low print of $73.70 (Feb 1). The sharp reversal undermines the recent bullish theme. A continuation lower would expose support at $70.62, the Jan 17 low, and $69.56, the Jan 3 low. For bulls, a reversal higher would refocus attention on the key short-term resistance at $79.29, Jan 29 high. A break of this level is required to reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2024 | 1215/1215 |  | UK | BOE's Pill- MPR National Agency briefing | |

| 02/02/2024 | 1330/0830 | *** |  | US | Employment Report |

| 02/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 02/02/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 05/02/2024 | 0030/1130 | ** |  | AU | Trade Balance |

| 05/02/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/02/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 05/02/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/02/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/02/2024 | 1530/1030 |  | CA | BOC quarterly Market Participants Survey | |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/02/2024 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.