-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI US MARKETS ANALYSIS - Copper Hits Highest Since 2014

HIGHLIGHTS:

- Cautious trade as concerns raised over Oxford/AstraZeneca vaccine data

- US markets see early close for Thanksgiving

- Copper hits new multi-year high on perceived Chinese demand

US TSYS SUMMARY: Cash Stronger Amid Subdued Re-Opening Tone

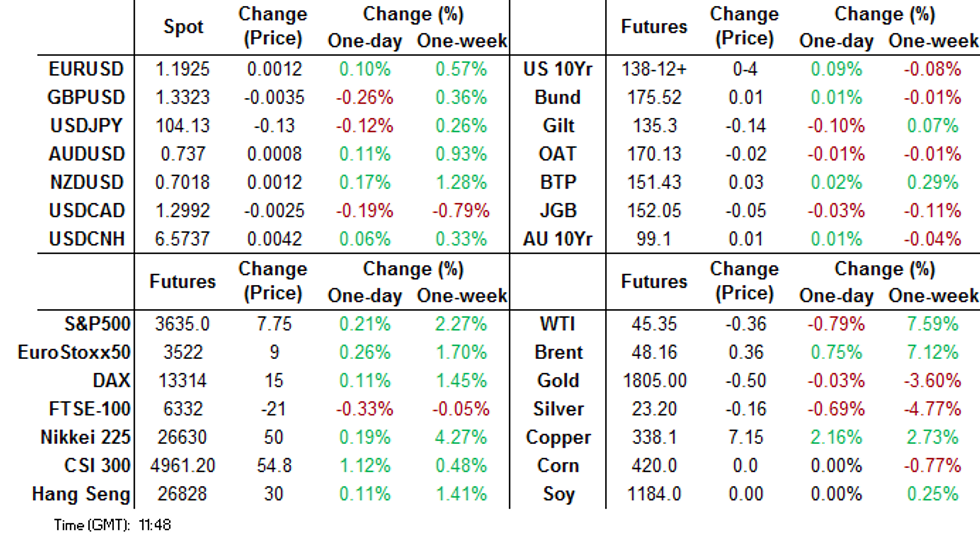

Cash Treasuries are stronger on the return from the Thanksgiving holiday with some bull flattening as the long end heads higher, but futures - which traded Thursday - are fairly steady.

- Not much on the headline drivers front, and Tsys have gained despite a bounce in equities from overnight lows. A fairly cautious tone overall (largely COVID and Brexit-watching) but on predictably subdued trading tone.

- The 2-Yr yield is down 0.6bps at 0.1524%, 5-Yr is down 1.6bps at 0.3782%, 10-Yr is down 2.5bps at 0.8569%, and 30-Yr is down 3.5bps at 1.5888%.

- Dec 10-Yr futures (TY) up 4.5/32 at 138-13 (L: 138-07.5 / H: 138-17.5). Note, TY Mar21 contract volume has eclipsed Dec20 as the roll is all but over (1st notice on Monday).

- Reminder that there's an early Black Friday close for bond/equity trading, most markets closed at 1300ET.

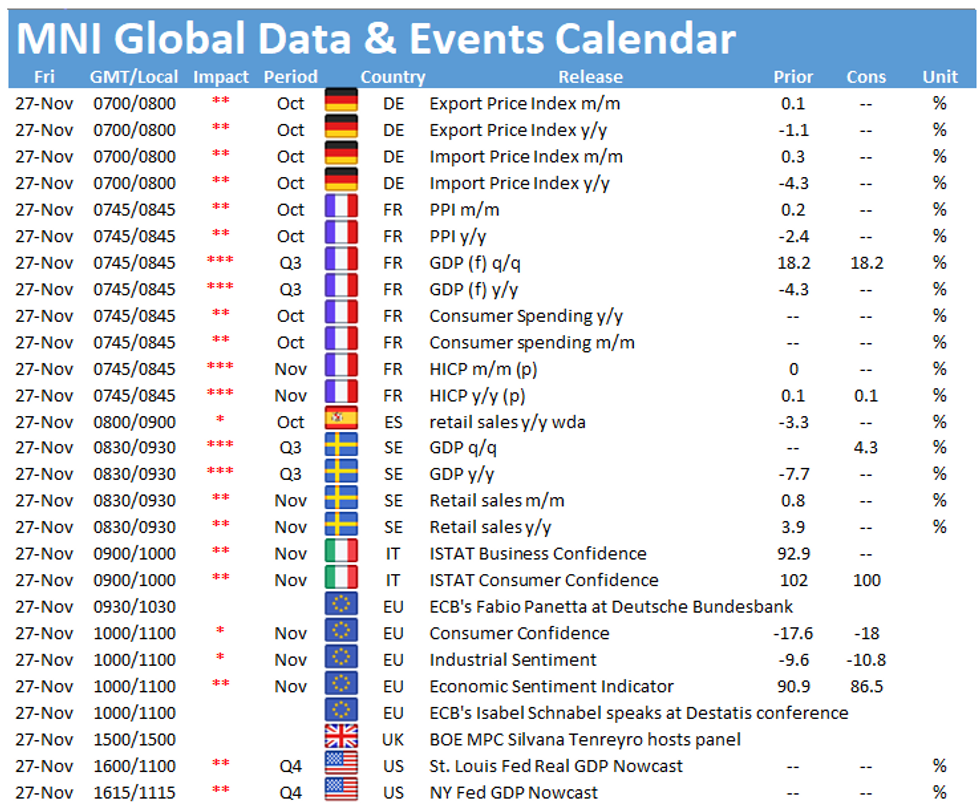

- No key data, speakers, or supply on the agenda.

Friday Market Early Close Info

The trading schedules for the major U.S. exchanges are available via the below links. To summarize: Tsys/rates/equity trading see an early close (1300ET for the most part) Friday.

- CME: https://www.cmegroup.com/tools-information/holiday-calendar.html

- ICE: https://www.theice.com/holiday-hours

- NASDAQ: https://www.nasdaq.com/solutions/nasdaq-canada-holiday-calendar

- NYSE: https://www.nyse.com/markets/hours-calendars

- SIFMA: https://www.sifma.org/resources/general/holiday-schedule

EGB/Gilt SUMMARY: Cautious Following Recent Equity Gains

Markets are trading in a more caution fashion following the recent burst of equity gains and some uncertainty over the rollout of Covid vaccines following the admission from Oxford AstraZeneca that its vaccine trial data was published with error.

- Gilts have traded a touch weaker with cash yields up to 1bp higher and the curve close to flat overall.

- Bunds are trading close to unch on the day. Last yields: 2-year -0.7654%, 5-year -0.7723%, 10-year -0.5889%, 30-year -0.1844%.

- OATs trade in line with bunds.

- BTPs similarly trade close to unch on the day. Last yields: 2-year -0.4186%, 5-year 0.0261%, 10-year 0.6025%, 30-year 0.9704%.

- Supply this morning came from Italy (BTP/CCTeu, EUR8.0bn).

- Both the UK and EU continue to assert that significant differences remain in the effort to negotiate a Brexit trade deal. Chief EU negotiator Michel Barnier is due to travel to the UK for talks, despite the lack of progress.

OPTION SUMMARY:

UK:

L Z0 99.875/100.00/100.125cl fly, sold at 7.5 in 6k

EUROZONE:

RXG1 175.50p vs 179.50/180.5cs, bought the put for 10 in 1.1k

DUF1 112.50/60 cs vs 112.30/112.20ps, bought the put spread for 1 in 8k

FOREX: Defensive Feel Bleeds Into Second Session

For a second session, USD/JPY is inching lower, helping keep JPY close to the top of the G10 pile in early trade. This helps cement the modest risk-off theme amid holiday-thinned markets - the US sees only a partial day of trade as Thanksgiving celebrations extend into Friday. The greenback is generally weaker, but moves are modest after the first few hours of European trade.

This is mirrored in muted European equity markets this morning, although most indices have been spared any further declines. The UK's FTSE-100 underperforms, down around 0.75% at pixel time.

There remains the risk of Brexit headlines crossing later today, as EU's Barnier concludes meetings with EU ambassadors this morning and heads back to London later today to continue negotiations.

The calendar ahead is quiet, with no tier one releases or central bank speakers of note.

Expiries for Nov27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1695-01(E838mln), $1.1850-60(E1.2bln), $1.1925(E550mln), $1.1975(E418mln-EUR calls)

- USD/JPY: Y103.00($680mln-USD puts), Y104.50-51($506mln), Y105.15-25($756mln), Y105.42($500mln)

- GBP/USD: $1.3400(Gbp388mln), $1.3500(Gbp396mln)

- EUR/GBP: Gbp0.8900(E386mln-EUR puts)

- AUD/USD: $0.7250(A$1.8bln), $0.7325-30(A$1.3bln-A$1.27bln AUD calls), $0.7430(A$813mln-AUD calls)

- AUD/NZD: N$1.0504(A$340mln-AUD puts)

- EUR/AUD: A$1.6190(A$340mln-EUR puts)

- NZD/USD: $0.6950(N$676mln), $0.7050(N$865mln-NZD calls)

- USD/CAD: C$1.3000($600mln), C$1.3165-75($584mln)

- USD/CNY: Cny6.54($500mln-USD puts)

EQUITIES: Mixed Showing in Europe as Continental Markets Outperform UK

Core markets in Europe are broadly steady/slightly higher with France's CAC-40 up around 0.3% while the UK's FTSE-100 lags, edging lower by 0.8%. Newsflow and datapoints have been few and far between early Friday, leaving markets to consolidate, although UK equities lag given the continued dragging-of-heels by Brexit negotiators on both sides, as talks continue to see little progress.

In Europe, real estate and consumer discretionary sectors are offered, with energy and tech names at the top of the table.

Spanish banks trade heavy, with Banco de Sabadell off around 13% after merger talks with BBVA concluded with no resolution on price disagreements. At the other end of the scale, EdF outperform on reports that France and the EU have made progress in nuclear regulation talks, which could allow the company to unlock their nuclear unit to be nationalized.

COMMODITIES: Mixed Performance for Oil, Copper Outperforms

Oil markets are mixed, with the November rally holding for most contracts. WTI futures still sit just above the $45/bbl mark, with nearest support cutting under at $43.28, the 23.6% retracement of the November rally.

Copper futures cleared the 2017 highs this morning to mark the best level for the metal since 2013. Stops appear to have been triggered on the way through 2017's 332.20, with support stemming from further evidence of Chinese demand, as Shanghai stockpiles continue to deplete, falling to their lowest levels in over 5 years.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.