-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curves Adapts to Higher For Longer Message

Highlights:

- Treasury curve continues to factor in higher of longer Fed policy

- USD on an early tear, puts USD Index close to year's best levels

- Munich security conference kicks off, with a number of European leaders set to speak

US TSYS: Higher For Longer Continues

- Cash Tsy yields have continued to move higher today after Bullard late yesterday wouldn’t rule out supporting a 50bp hike in March in a bid to hit a 5.25-5.5% rate soonest, with further support from hawkish commentary in European hours from ECB’s Schnabel.

- The move sees front end to belly yields rise to the highest levels since Nov and with 2YY earlier getting within 10bps of cycle highs of 4.799%. 2YY +4.5bp at 4.685%, 5YY +3.5bp at 4.108%, 10YY +3.5bp at 3.896% and 30YY +2.9bp.

- TYH3 trades 13 ticks lower at 111-16 on solidly above average volumes. It’s off lows of 111-08+ and through support at 111-19+ (lower 2.0% Bollinger Band) to open 110-21+ (2.0% 10-dma envelope).

- Fedspeak: Barkin (0830ET), Bowman (0845ET)

- Data: International trade prices for Jan (0830ET) and Leading index for Jan (1000ET)

Source: Bloomberg

Source: Bloomberg

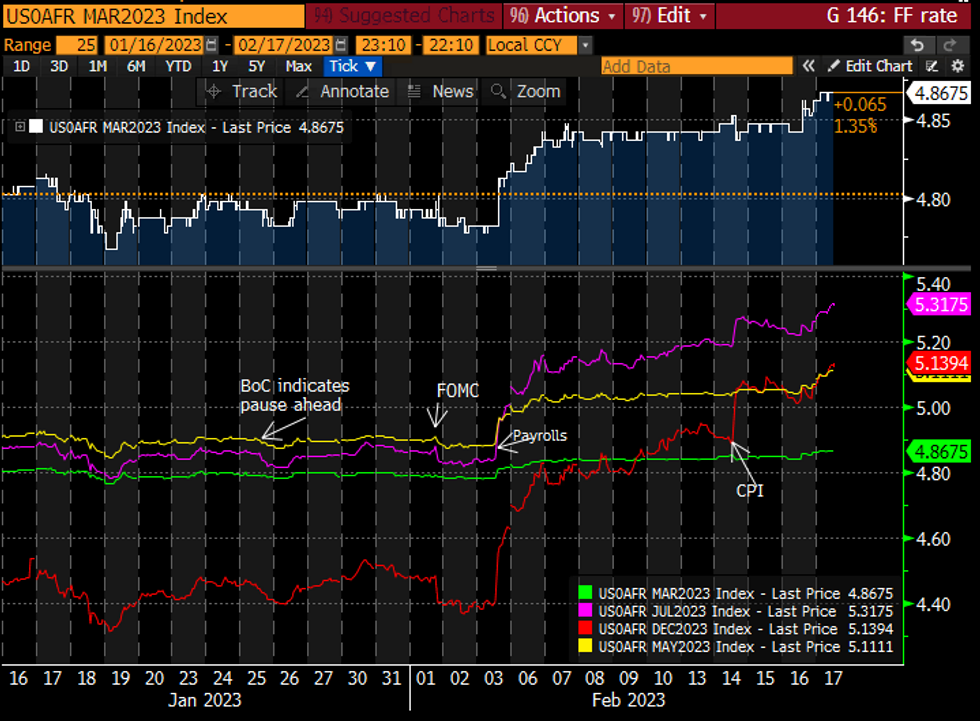

STIR FUTURES: Fed Rate Path Continues Post-Bullard Push Higher

- Fed Funds implied hikes continued to push higher overnight after being driven later yesterday by Bullard (non-voter) saying he wouldn’t rule out supporting a 50bp hike in March having advocated.

- It has fully priced 2x25bp hikes over the next two meetings whilst also sees new cycle highs for both terminal and end-2023 rates.

- 28bp for Mar (+0.5bp), cumulative 52.5bp for May (+3.5bp), 73bps to a terminal 5.32% in July (+5.5bp) before 19bp of cuts to 5.13% Dec (+7bp).

- Barkin (’24 voter) and Gov Bowman (voter) ahead having both already spoken this week and neither with text. Barkin specifically on the labor market before Gov Bowman speaks at a credit conference which could limit mon pol discussions again.

Source: Bloomberg

Source: Bloomberg

Main Speakers At Munich Security Conference Today

The Munich Security Conference, the most high-profile annual meeting of politicians and officials relating to security issues, gets underway in earnest today. Below we outline the timings of some of the most prominent speakers. Livestream will be available here: https://www.youtube.com/watch?v=PFVNm4VFjss

- German Chancellor Olaf Scholz - Germany in the World - 0815ET/1315GMT/1415CET

- French President Emmanuel Macron - France in the World - 0845ET/1345GMT/1445CET

- UK Secretary of State for Defence Ben Wallace, Sen. Chris Coons (D-DE), Major General (ret.) People's Liberation Army, China Yao Yunzhu - Fallout? Challenges for Transatlantic Defense and the Nuclear Order - 1030ET/1530GMT/1630CET

- EU Commission Exec VP and Trade Commissioner Valdis Dombrovskis, US Trade Representative Katherine Tai - Protectonic Shifts: Global Trade Under Pressure - 1245ET/1745GMT/1845CET

- Swedish PM Ulf Kristersson, Polish PM Mateusz Morawiecki, French Foreign Min Catherine Colonna, Deputy Prime Minister for Restoration of Ukraine Oleksandr Kubrakov, US Senate minority leader Mitch McConnell (R-KY) - Spotlight: Ukraine - 1300ET/1800GMT/1900CET

RATINGS: A Mix of Stable & Negative Outlooks Up For Review Today

Sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+; Outlook Stable) & Slovakia (current rating: A; Outlook Negative)

- Moody’s on Switzerland (current rating: Aaa; Outlook Stable)

- S&P on Estonia (current rating: AA-; Outlook Negative) & Poland (current rating: A-; Outlook Stable)

- DBRs Morningstar On Spain (current rating: A, Stable Trend)

FOREX: Dollar on an Early Run, Nears YTD Highs

- The greenback is on a tear early Friday, rallying against all others in G10. The move is seen as a continuation of late greenback strength Thursday, which followed comments from both Fed's Bullard and Mester raising the possibility of a return to 50bps rate hike steps from the FOMC to contain inflation. The comments have prompted some upside in March Fed rate pricing, with markets now assigning a small likelihood of a larger-than-25bps rate hike.

- The rate re-pricing is working against both bond and equity futures markets, which sit lower and are extending the week's weakness well into Friday trade. US 10y yields are through the early January highs, and a further 10bps rally would put rates at the psychological 4.00% handle.

- EUR is gaining in tandem, with NZD, AUD and NOK among the hardest hit ahead of the NY crossover. USD/NOK is narrowing the gap with resistance and the bull trigger at 10.4335, a break above which would put rates at the best level since mid-November last year.

- US Import/Export price indices are the data highlight Friday, with Canadian industrial product prices also on the docket. This should keep focus on the speaker slate, with ECB's Villeroy and Fed's Barkin & Bowman on the docket.

FX OPTIONS: Expiries for Feb17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.4bln), $1.0665-80(E2.0bln), $1.0695-00(E623mln), $1.0710-20(E542mln), $1.0795-05(E1.1bln), $1.0850-55(E1.4bln)

- USD/JPY: Y133.50($1.9bln), Y134.30-40($1.2bln), Y135.00($3.5bln)

- EUR/JPY: Y142.25(951mln), Y147.00(E1.1bln)

- GBP/USD: $1.2000-20(Gbp692mln), $1.2110-25(Gbp571mln)$1.2400-15(Gbp1.4bln)

- AUD/USD: $0.6800(A$784mln), $0.6870-75($625mln), $0.7000(A$1.2bln), $0.7100(A1.2bln)

- USD/CAD: C$1.3500($651mln)

- USD/CNY: Cny6.7400($1.7bln), Cny6.7590($1.4bln), Cny6.8500($1.1bln), Cny6.8670($1.3bln), Cny7.0000($2.0bln).

EQUITIES: E-Mini S&P Trades Softer Following Thursday Pullback

- EUROSTOXX 50 futures were tilted higher through the Thursday open, before fading slightly into the close. This puts prices just below first resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, but still above 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: Gold Prints 1819.02 YTD Low

- WTI futures showed above the Friday high ahead of the Monday close, marking an extension of the recovery from $72.25, the Feb 6 low. The rally has confirmed a break of the 50-day EMA, at $78.34, strengthening the current bull cycle. Prices have faded slightly since, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $76.52, the Feb 9 low.

- Trend conditions in Gold are bearish for now, and the yellow metal remains in a corrective cycle. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback - towards $1825.2, the Jan 5 low. On the upside, key resistance and the bull trigger is at $1959.7, the Feb 2 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/02/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 17/02/2023 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 17/02/2023 | 1445/0945 |  | US | Fed Governor Michelle Bowman | |

| 17/02/2023 | 1500/1000 | * |  | US | Services Revenues |

| 20/02/2023 | 0300/1100 |  | CN | PBOC LPR | |

| 20/02/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 20/02/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/02/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.