-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Backtracks Small Part of Post-Fed Strength

Highlights:

- NFP report seen showing slower, but still solid labour market

- Dollar backtracks small part of post-Fed strength

- Chinese equities soar as re-opening rumours circulate further

Oct Nonfarm Payrolls: What Is Expected

Nonfarm payrolls (released 0830ET/1230UK - our full preview is here) are seen rising 200k in October per the Bloomberg survey median after the 263k in Sept was about as close to consensus as you get. Estimates range from 100k-300k, with the “whisper” number at 250k.

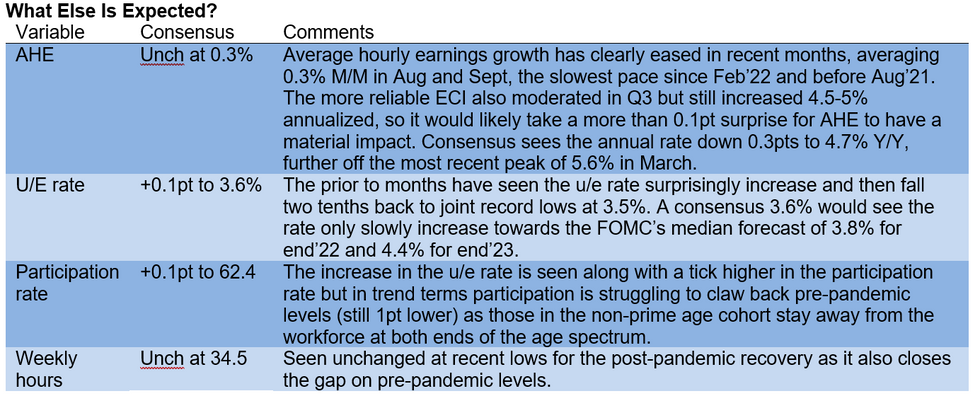

- The graphic below shows expectations of other indicators released in the Employment Report:

US TSYS: October Employment Data Focus, Fed Speakers Resume

Tsys trading moderately lower, yields mixed (30YY +.009 at 4.191%, 10YY -.0053 at 4.1416%) in lead-up to this morning's employment data for October (+195k est vs. +263k prior).

- While an in-line reading or higher would deliver a modestly hawkish reaction, with the FOMC meeting this week renewing policymakers’ concern that they haven’t yet seen much softening in the labor market -- impending layoffs in tech sector (Twitter) may be start of broader based slow-down.

- Fed speak resumes: Boston Fed Collins on economy/policy outlook (text and Q&A) and CNBC interview Richmond Fed Pres Barkin both scheduled at 1000ET.

- STIR: Terminal Funds rate has climbed to 5.18% - consistent with Powell's message that the FOMC will likely raise its terminal rate estimates at the next meeting, and that it's "very premature to be thinking about pausing".

- Dec 2022: 135bp further cumulative hikes to 4.43% (61bp prior)

- Feb 2023: 177bp cumulative hikes to 4.85% (102bp prior)

- Mar 2023: 199bp cumulative hikes to 5.07% (125bp prior)

- May 2023: 209bp cumulative hikes to 5.17% (134bp prior)

- Peak now split between May and June 2023 (5.17%-5.18%)

BOE: Should have more info on temporary holdings sales in a "week or two"

- Hauser asked if the Bank will sell its temporary holdings this year. He has said we will "try and announce" a plan "shortly" and that we will should more information in a "week or two".

- Nothing in the Hauser speech about changes to gilt maturity buckets for active gilt sales (we have seen some in the market argue that given the collateral shortages the Bank should consider selling 1-3 year gilts).

- He says: "QE unwind is not the MPC's active tool for monetary policy tightening. That role is played by Bank Rate. But it does support that tightening process. And it has other important benefits too. It helps alleviate collateral shortages distorting market functioning. It reduces the size of the central bank balance sheet. It helps return public sector interest rate risk exposure to levels closer to those initially envisaged. And it increases the headroom available for future QE, should that ever be needed."

FOREX: Greenback Strength Fades, But Holds Bulk of Post-Fed Rally

- The greenback trades on the backfoot, with currency markets reversing a very small part of the week's post-Fed outperformance. EUR/USD remains below the $0.98 handle, but has recovered off the lows of $0.9730 printed yesterday.

- Price action in the pair resulted in a move below a key area of support around 0.9812, marking the top of the bear channel that was breached last week. The breach of this support undermines the recent bullish theme and signals scope for a deeper pullback, towards 0.9633 initially, the Oct 13 low. Firm resistance is seen at 0.9976, the Nov 2 high.

- The beneficiaries of the USD pullback have largely been AUD and NZD, which outperform alongside stronger China equity markets overnight. Moves follow continued speculation that China could ease their COVID policy approach, with reports that authorities are planning to end flight suspensions - a move that could materially increase international travel into/out of China. (Note: China's ForMin have denied any knowledge)

- Focus turns to the October payrolls release later today, with markets expecting job gains of 195k and a modest uptick in the unemployment rate to 3.6%, showcasing a labour market that remains solid, but is sequentially slowing in its expansion. The Canadian jobs data is also on the docket, with BoE's Pill and Fed's Collins also due to speak.

FX OPTIONS: Expiries for Nov04 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E615mln), $0.9790-00(E1.5bln), $0.9825(E650mln), $0.9900(E1.5bln), $1.0000(E2.3bln), $1.0100(E1.2bln)

- USD/JPY: Y146.00($607mln), Y147.00($973mln), Y148.00($580mln), Y149.00($553mln)

- GBP/USD: $1.1500(Gbp591mln)

- USD/CAD: C$1.3695-00($739mln), C$1.3800($689mln)

- USD/CNY: Cny7.2000($874mln), Cny7.3000($530mln)

Price Signal Summary - Gilt Trend Needle Still Points North

- In the FI space, Bund futures traded lower Thursday and maintains a softer tone. The contract has breached support at 137.57, the Oct 27 low. The break of this level undermines a recent bullish theme and signals scope for a deeper retracement. Attention turns to 136.46, the Oct 25 low. Note that key support is still far off at 134.02, Oct 21 low. Key resistance is at the 50-day EMA, at 140.54. Clearance of this average would reinstate a bull theme.

- Gilt futures continue to consolidate and the contract is still trading closer to its recent highs, despite this week’s shallow pullback. Price has recently cleared the 20-day EMA and a key resistance at 100.92, the Oct 4 high. The break strengthens short-term bullish conditions and opens 105.34 next, the Sep 23 high. Key support has been defined at 95.82, the Oct 21 low. Initial support is at 100.38, the Oct 25 low.

GERMANY/CHINA: Politico-Scholz Laments China 'Closing Off' Economic Sectors

Hans von der Burchard at Politico on German Chancellor Olaf Scholz's comments following meeting w/Chinese President Xi Jinping in Beijjing: "In Beijing, Scholz stressed need for cooperation but was also critical:

- China is "closing off" many economic sectors, - Lacking protection of intellectual property, - Sanctions against individual EU countries or MEPs "unacceptable", - Raised human rights [...] Scholz also raised Taiwan, spoke of Germany's "growing concern for stability in the region.[...] China has a special responsibility here. ... I made clear that any change in the status quo of Taiwan must be peaceful and by mutual agreement"."

- Chinese Ministry of Foreign Affairs readout can be found here: https://www.mfa.gov.cn/eng/zxxx_662805/202211/t202...Stated that "...as long as the two sides follow the principles of respecting each other, seeking common ground while reserving differences, maintaining exchanges and mutual learning, and pursuing mutually-beneficial cooperation, bilateral ties will keep going in the right direction on the whole and making steady progress."

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 04/11/2022 | 1215/1215 |  | UK | BOE Pill & Shortall MonPol Report National Agency briefing | |

| 04/11/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 04/11/2022 | 1230/0830 | *** |  | US | Employment Report |

| 04/11/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/11/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 04/11/2022 | 2000/1600 |  | US | Fed's Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.