-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Dollar Gives Back Monday Strength

Highlights:

- Dollar gives back Monday strength as equities improve further

- E-mini S&P within range of early February highs

- Canadian CPI expected to slow to 4.3% from 5.2% in February

US TSYS: Sitting Modestly Richer, With Further Bank Earnings and Tax Collection Data In Focus

- Cash Tsys trade slightly richer across the curve, with gains coming through European hours after no real cheapening impetus from stronger than expected China Q1 GDP that was muddied by mixed March activity figures.

- There has however most recently been a slight mover cheaper on strong BofA earnings results for Q1 (FICC trading revenue ex DVA $3.43B vs $2.62B exp) after inline BNY Mellon adj EPS figures ($1.12). GS to follow at 0730ET.

- Housing data and less so this time Fedspeak headline the regular docket but we'd argue more focus is on daily tax collection later today for 1600ET (see here and here on the latter).

- 2YY -2.7bp at 4.167%, 5YY -2.1bp at 3.677%, 10YY -1.5bp at 3.585% and 30YY -1.0bp at 3.801%.

- TYM3 trades just two ticks higher at 114-13+, having touched yesterday’s joint low of 114-08 and stopped just shy of a key support at 114-07 (Mar 29/30 low).

- Data: Building permits/housing starts Mar (0830ET), NY Fed Services business index Apr (0830ET)

- Fedspeak: Bostic CNBC interview (1100ET), Gov Bowman on digital currencies (1300ET).

- Bill issuance: US Tsy $34B 52W bill auction (1130ET)

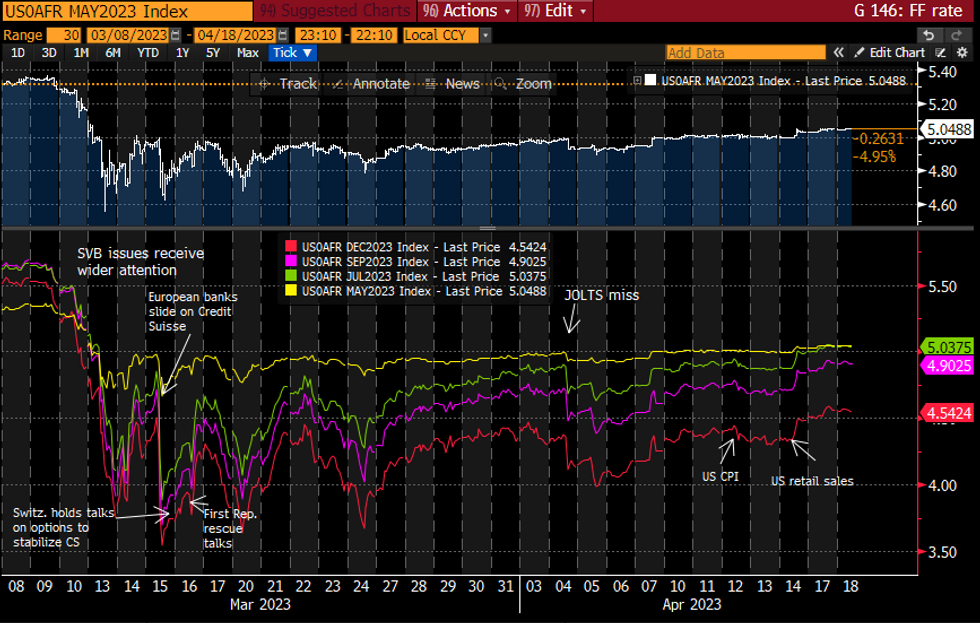

STIR FUTURES: Fed Rate Path Holding Yesterday's Push Higher

- Fed Funds implied rates broadly consolidate yesterday’s further climb following a large beat for an equally volatile Empire State manufacturing index.

- 22bp hike for May (unch) and cumulative 28bp hike for Jun (unch), fully reversed with Nov at -11bps from current levels (-2bps) and 29bps with Dec (-2bps).

- Fedspeak: Bostic (’24) is interviewed on CNBC at 1100ET ahead of Gov Bowman on digital currencies at 1300ET. Bostic last week saw the Fed hitting the mark and holding after one more hike. Bowman seems less likely to discuss mon pol but last spoke on monitoring market developments Mar 14 and before than on mon pol in mid-Feb.

Source: Bloomberg

Source: Bloomberg

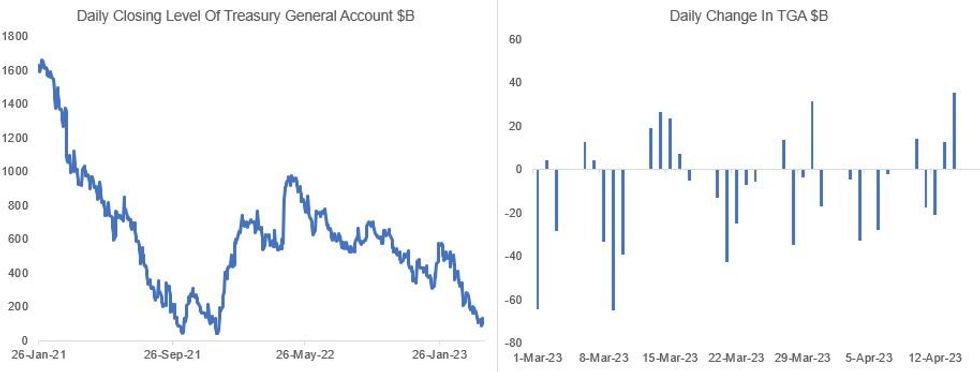

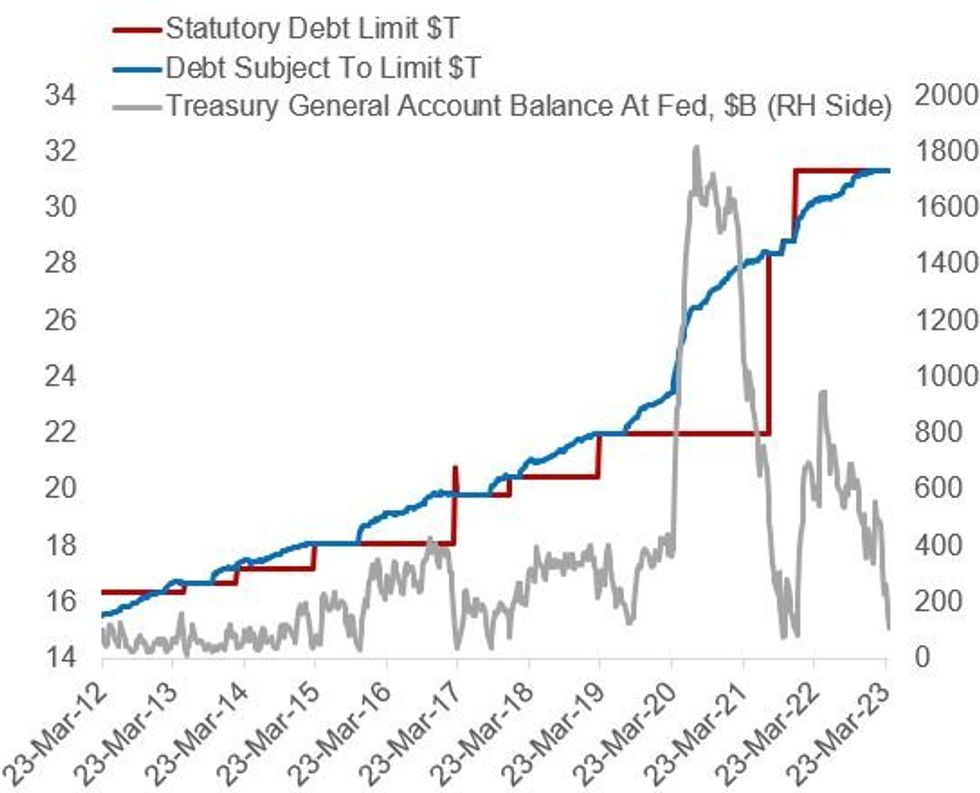

Tax Collection Data Looms Large Today And Tomorrow

The biggest US data release of the next couple of sessions is arguably the Daily Treasury Statement, which will provide a snapshot of the resources available to Treasury going into the summer and whether the "x-date" in which it runs out of cash will arrive sooner rather than later.

- Data for April 17 and 18 are the most important in the cycle, with the latter marking the main tax collection deadline of the year. We get those data later today and tomorrow, respectively (est 4pm ET). The daily data is available at this link.

- Monday's release for April 14 showed the Treasury's account at the Fed (the Treasury General Account) closed $35B higher Friday at $135B, the highest level since April 6, after hitting a post-2021 low of $87B last Thursday.

- The key lines to look for in the PDF statement on the Treasury page are: the Corporate Income taxes (which were responsible for $21.9B in collection on Friday), non-withheld individual taxes ($16.8B + $2.8B). That was roughly $41.5B of the $57.7B in total deposits to the Treasury on Friday.

- Wrightson ICAP saw Friday's tax collection as having been more robust than they anticipated (vs their $25B expected). But that probably doesn't impact the overall baseline very much as it's seen for now as a timing issue rather than a sign of bigger collections coming.

- And demonstrating the wide range of opinions, in a note out today, Goldman said they saw this month's collections as undershooting expectations, potentially bringing the x-date closer than their early-August estimate.

Source: US Treasury, MNI

Source: US Treasury, MNI

Weak Tax Receipt Figure Could Spur Earlier X-Date Expectations

The main focus in the Treasury data today and tomorrow is whether enough tax has been collected to build up the TGA sufficiently to avoid reaching the "x-date" before the next big tax collection round in mid-June.

- Currently, the x-date is broadly anticipated to arrive in late July to early September, but those estimates will be impacted by this week's data.

- Estimating the Treasury's cash flows is an inexact science, and it's even hard to gauge what consensus is for tax collection this week as different analysts use different metrics for their stated estimates (individual vs total receipts, deposits vs TGA levels, full April collection vs Apr 17+18).

- But roughly speaking, $200B is the level to watch for total collection today and tomorrow, with a range $150-250B fairly neutral.

- Above $200B and certainly $250B+ will be considered sufficient to get through most of July if not August, and well above that would be considered fairly comfortable.

- If under $200B is collected today and tomorrow, in particular if it's toward $150B or less, that will put more market focus on an X-Date in early June.

- There's a range of opinions on that within that spectrum and we would probably only really get a sense by mid-May whether a June x-date is looming.

- As we pointed out in last week's Fed Balance Sheet Tracker, the “official” outlook has been for the x-date to be hit in early June, but that is fairly dated guidance – we may hear more in early May after the tax receipts are collated, perhaps as part of the Treasury’s quarterly refunding announcement on May 3.

Kremlin: Brazil Mediation Plan Deserves Attention

Comments from the Kremlin hitting wires talking up a Brazilian 'mediation plan' for Ukraine discussed by Russian Foreign Minister Sergei Lavrov and Brazilian President Luiz Inácio Lula da Silva in Brazil yesterday.

- Kremlin spox Dmitri Peskov told reporters: "Brazil's Ukraine mediation plan deserves attention."

- Peskov added: "We are not aware of any peace plan for Ukraine conflict proposed by France."

- Lula said this week, following a meeting with Chinese President Xi Jinping in Beijing: "The United States needs to stop encouraging war and start talking about peace, but we also have to talk to the United States and European Union. We have to convince people that peace is the way."

- White House NSC spox John Kirby said Lula's comments were "misguided" by "suggesting the United States and Europe are somehow not interested in peace, or that we share responsibility for the war."

- Bloomberg reported earlier today that French President Emmanuel Macron is preparing to, "approach China with a plan that he believes could potentially lead to talks between Russia and Ukraine."

- BBG: "The French strategy envisions talks between Russia and Ukraine happening as soon as this summer if all goes well..."

EUROPE ISSUANCE UPDATE

Gilt auction result:

- A very strong 30-year gilt auction with the lowest accepted price of 94.195 higher than the market mid-price of the 45 minutes ahead of the auction cutoff time - and considerably higher than the 94.026 seen just ahead of 10:00BST.

- The bid-to-cover and tail were a little smaller and wider respectively than the March auction, but the size of the auction was larger this time, and the price achieved more than outweighs this. The 3.75% Oct-53 gilt rallied on the auction result with gilt futures also moving more than 10 ticks higher in response to hit their highest levels in 90 minutes (and helped to fuel a wider rally across gilts and EGBs).

- GBP2.25bln of the 3.75% Oct-53 Gilt. Avg yield 4.083% (bid-to-cover 2.5x, tail 0.2bp).

Austria dual-tranche syndication update:

- New 6-year Green RAGB: Size E3bln WNG, spread set at MS-17bps, books over E7.5bln, maturity 23 May 2029.

- New 30-year RAGB: Size E2bln WNG, spread set at MS+56bps, books over E4bln, maturity 20 October 2053.

- E1.945bln of the 0% Jan-52 DSL. Avg yield 2.677%.

- E500mln of the 0.50% Sep-28 RFGB. Avg yield 2.836% (bid-to-cover 2.06x).

- E985mln of the 1.375% Apr-47 RFGB. Avg yield 3.064% (bid-to-cover 1.24x).

FOREX: AUD, NZD On Top as China GDP Ahead of Forecast

- The dollar is giving back a large part of the Monday gains ahead of the NY crossover, allowing EUR/USD to trade back to flat on the week and GBP/USD to climb through the Monday high. The later received a boost from pay and jobs data this morning, which showed average weekly earnings beating forecast on both a inc. and ex. bonus basis. Resultingly, GBP is close to the top-end of the G10 table.

- AUD and NZD are outperforming, putting AUD/USD back to cluster resistance at the 200- and 50-dmas of 0.6744 / 0.6739 following the China GDP data overnight: Q1 growth came in ahead of expectations at 4.5% Y/Y and 2.2% on a Q/Q basis. As a result, a number of sell-side outfits have upped their China growth views for 2023.

- Canadian CPI data takes focus going forward, with markets looking for CPI to slow to 4.3% from 5.2% on a Y/Y basis. US building permits and housing starts are also set for release. Nonetheless, more attention likely to be paid to the speaker slate today: ECB's Centeno, BoC's Macklem & Rogers and Fed's Bowman are all on the docket.

FX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0865-70(E1.3bln), $1.1000(E1.5bln), $1.1050-60(E1.4bln)

- AUD/USD: $0.6600(A$686mln), $0.6665-70(A$614mln) $0.6800(A$1.1bln)

- USD/CAD: C$1.3650($889mln)

- USD/CNY: Cny6.7375($1.6bln), Cny6.9500($1.1bln)

EQUITIES: Trend Condition in E-Mini S&P Unchanged and Bullish

- Eurostoxx 50 futures remain in an uptrend and the contract continues to trade closer to its recent highs. Recent gains have strengthened the bullish significance of the break of 4268.00, the Mar 6 high and a former key resistance. Sights are on 4381.50, the Jan 5 2022 high (cont). Moving average studies are in a bull-mode set-up, highlighting a broader uptrend. Initial firm support lies at 4230.20, the 20-day EMA.

- The current trend condition in S&P E-minis is unchanged and remains bullish. Price has recently breached resistance at 4119.50, the Mar 6 high, reinforcing a positive theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for a climb to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4069.41, the 50-day EMA.

COMMODITIES: WTI Futures Remain in Bull Cycle Despite Recent Pullback

- WTI futures remain in a bull cycle despite the latest pullback. Last week’s gains resulted in a break of resistance at $81.81, the Apr 4 high. This confirmed a resumption of the current uptrend. Note that an important resistance at $83.04, the Jan 23 high, has also been breached. The focus is on $85.01, the Nov 14 high. On the downside, key short-term support is seen at $79.00, the Apr 3 low and the gap high on the daily chart.

- Trend conditions in Gold remain bullish and the latest pullback is considered corrective. Support to watch is $1982.3, the 20-day EMA. It has been pierced - a clear break would suggest scope for a deeper retracement and expose $1949.7, Apr 3 low. On the upside, the short-term bull trigger has been defined at $2048.7, Apr 13 high. A break would resume the uptrend and open $2070.4, Mar 8 2022 high. This is just ahead of the all-time high of $2075.5.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/04/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/04/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 18/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/04/2023 | 1300/1500 |  | EU | ECB Elderson in Basel Committee on Banking Supervision | |

| 18/04/2023 | 1500/1100 |  | CA | BOC Governor testifies to House of Commons committee | |

| 18/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 18/04/2023 | 1700/1300 |  | US | Fed Governor Michelle Bowman | |

| 19/04/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/04/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/04/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/04/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/04/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/04/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/04/2023 | 1035/1235 |  | EU | ECB Lane Speech at Enterprise Ireland Summit | |

| 19/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/04/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/04/2023 | 1500/1700 |  | EU | ECB Schnabel Lecture at Leibniz-Zentrum ZEW | |

| 19/04/2023 | 1630/1730 |  | UK | BOE Mann Panellist at Brandeis International Business School | |

| 19/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/04/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.