-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - ECB Hike Inching Higher

Highlights:

- December ECB pricing at 50/50 for 50bps vs. 75bps hike

- PBOC RRR cut leaves little dent in CNH

- Thanksgiving extends into Friday, with another early US close

US TSYS: Modestly Cheaper Ahead Of A Bare Docket

- Cash Tsys sit relatively little changed from Wednesday’s close, having opened richer post-Thanksgiving before cheapening through European hours as they ECB and Fed hike pricing alike edged higher. The PBOC cutting the RRR rate by 25bp was anticipated.

- 2YY unchanged at 4.477%, 5YY +2.3bps at 3.906%, 10YY +1.8bps at 3.711%, and 30YY +1.5bps at 3.743%.

- TYZ2 trades 3 ticks lower from Wednesday’s close at 112-27+, pulling back after yesterday clearing 113-11 (Nov 16 high). It continues to trade above the 50-day EMA of 112-14+ (initial support) whilst resistance is seen at yesterday’s high of 113-15. Decent volumes overnight, with over half of the front month spread-related.

- No Fedspeak, data or supply today.

- Bloomberg and MS month end extensions see solid increases of 0.13yrs/0.11yrs respectively.

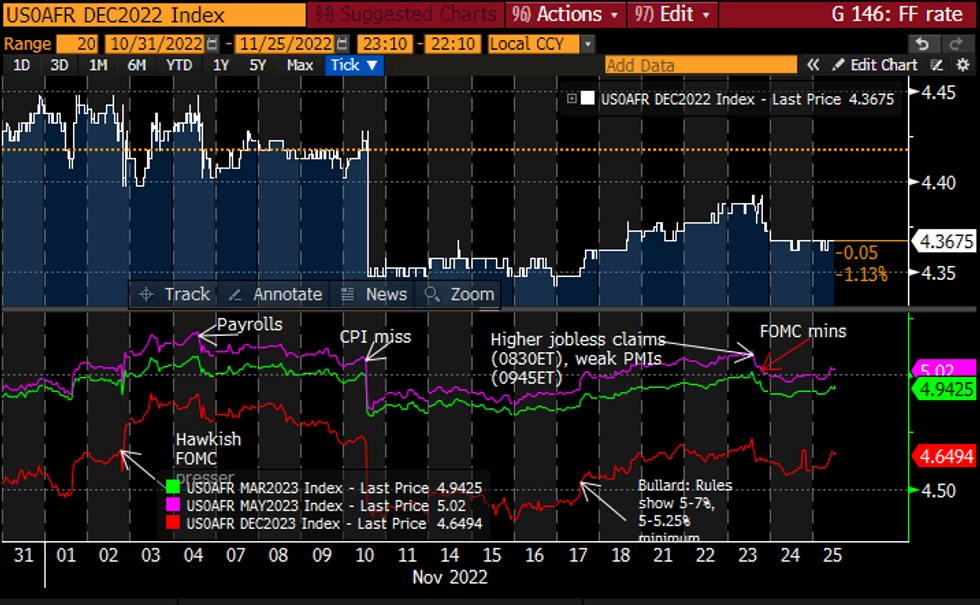

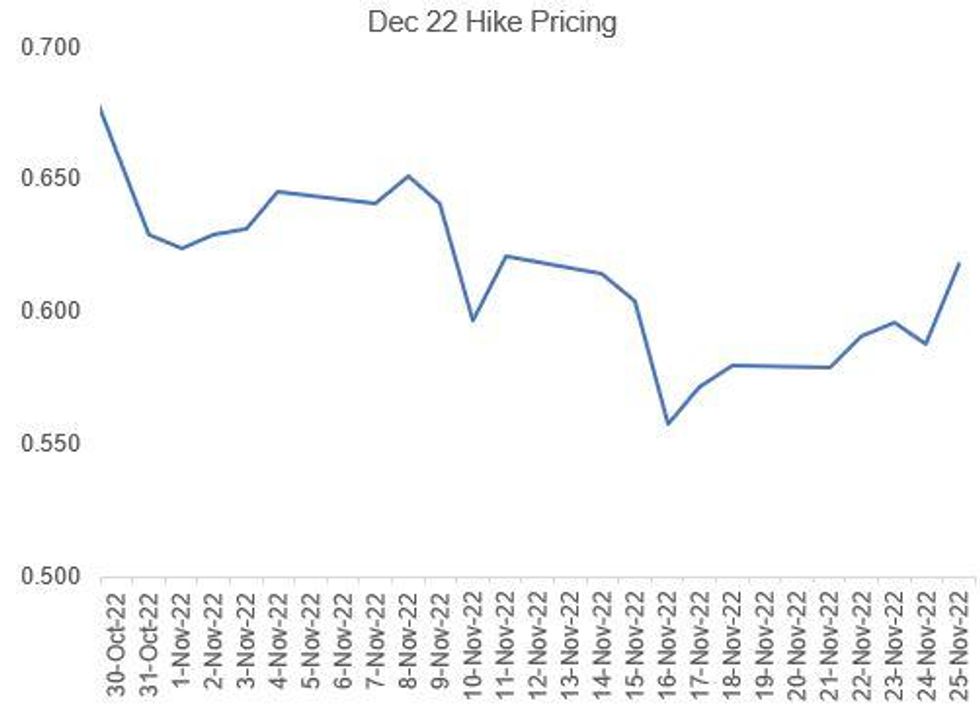

STIR FUTURES: Terminal Fed Rate Unwinds FOMC Minutes Dip

- Fed Funds implied hikes have unwound the FOMC minutes decline for 2023 rates, with a terminal seen in the middle of the post Nov 2 FOMC range of 4.85-5.19%.

- 52bp for Dec (-0.5bp from Wed close), 91.5bp to 4.76% for Feb’23 (unch), terminal 5.02% May/Jun’23 (+1bp) and 4.65% Dec’23 (+2bp).

- No Fedspeak scheduled today with Williams/Bullard next on Mon and Powell of note on Wed.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

SPAIN: Tax On Energy Firms To Raise EUR400mn Less Than Expected-Budget Min

Amendments made to a bill imposing a windfall tax on energy firms profits will see the levy bring in EUR400mn less than was originally intended according to Budget Minister Jesus Montero. Reuters reportsthat the changes "exempt large utilities' domestic regulated activities and foreign operations."

- The changes came at the behest of minor parties in the north of Spain such as the Basque Nationalist Party and the Regionalist Party of Cantabria. Maintaining the support of these parties is important to keeping PM Pedro Sanchez's centre-left minority gov't in power, giving the regionalist groups outsized influence despite their relatively small number of seats.

- A number of energy firms have hinted that they will seek to challenge the levy in court, even with the changes made to the legislation. A further obstacle could come in the Senate, with approval of the bill as-is required to allow it to progress into law. Should Senators demand amendments, the bill will return to the Congress of Deputies, delaying its implementation further.

ECB: 75bp Dec Hike Pricing Justifiably Back At 50/50

Dec ECB hike pricing on OIS is now closer to 50/50 for 75bp vs 50bp (62bp), with a 3bp increase this morning.

- Conditions have been there the last few days for a move higher: on balance communications have leaned hawkish, and sentiment / survey data this week incl PMIs have been solid.

- Pricing since the last meeting had bottomed out around 55bp on Nov 17 after a Bloomberg sources article pointed to a 50bp as opposed to 75bp increase. But as we said at the time, 75bp vs 50bp chances still looked evenly balanced, as much will depend on inflation data on Nov 29-30 and could tip the balance either way.

- There are other ways to get to 75bp too - MNI's ECB sources have indicated that doves might offer to back another 75bp hike if in exchange the ECB decides to wait until rates peak before starting QT.

- But until we get the inflation data, 50bp is still the path of least resistance and 75bp probably doesn't merit much higher than 50% prob.

CHINA: China Cuts RRR by 25bps, As Expected

- PBOC confirms they are to cut the reserve requirement ratio by 25bps, with the change effective from December 5th. The bank confirm they are step up the implementation of prudent monetary policy.

- Not too outside of expectations here - speculation/expectations circulated this week surrounding a potential RRR cut after Wednesday's State Council meeting guided towards such a move.

- USD/CNH inches very slightly higher on the headline, but stalls ahead of overnight highs at 7.1785. Again, the move was largely expected at some point Friday (as flagged earlier today).

FOREX: China's RRR Cut Leaves Little Dent in CNH

- JPY is the poorest performer in G10 in early Friday trade, helping snap the losses posted in USD/JPY since the mid-week high at 142.24. For now, the pair oscillates just below the Thursday best of 139.64 and a break above opens the 100-dma at 141.18.

- EUR is trading more favourably after several sessions of losses against GBP. This has prompted a small bounce in EUR/GBP off the Thursday 0.8572 low, but recoveries remain shallow for now. The single currency saw some support off headlines from ECB's Muller, who raised the biggest risk to the ECB being a premature end to the tightening cycle.

- Elsewhere, the Chinese central bank cut the RRR policy rate by 25bps, largely as expected. The rate cut prompted a minor move higher for USD/CNH, but price action was largely contained as the move was inline with expectations.

- Markets see an early close for the US, with Thanksgiving celebrations extending into the end of the week. As a result, there are no notable data releases, keeping focus on a speech by ECB's Visco at 1415GMT / 0915ET.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/11/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 27/11/2022 | - |  | AU | Victoria State Election | |

| 28/11/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/11/2022 | 0900/1000 | ** |  | EU | M3 |

| 28/11/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 28/11/2022 | 1330/0830 | * |  | CA | Current account |

| 28/11/2022 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 28/11/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/11/2022 | 1530/1530 |  | UK | DMO Q1 Consultation Meetings | |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/11/2022 | 1700/1200 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.