-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY958.4 Bln via OMO Wednesday

MNI ASIA OPEN: December CPI Housing & Core Goods in Focus

MNI US MARKETS ANALYSIS - Equities Revisit Friday Lows

HIGHLIGHTS:

- Risk rally hits reverse as Moderna warns omicron likely to evade jabs

- Equities revisit Friday lows, WTI breaks 200-dma support

- Powell on the docket, appearing alongside Yellen to testify on CARES

US TSYS: Treasury Rally Resumes On Renewed Omicron Fears

- Cash Tsys have continued Friday’s rally after a mild sell-off yesterday, as fears mount over the effectiveness of existing vaccines against the Omicron variant.

- The rally has been belly-led again, with 2Y yields down -2.4bps at 0.461%, 5Y -5.8bps at 1.094%, 10Y -6.1bps at 1.438% and the 30Y -2.9bps at 1.826%. The 10Y has pulled back from session lows but remains very close to month lows.

- TYZ1 futures have rallied strongly, up 27 ticks on the day to 131-28, also slightly off session highs having earlier tested the resistance level of 131-30+ (Nov 5 high).

- The broader macro picture has a similar theme to Friday, with oil down circa -2.5% on the day, S&P E-minis -1% and DXY -0.4%.

- Some key Fed members speaking today but potentially limited mon pol discussion: Chair Powell testifies in the Senate on CARES Act at 1000ET/1500GMT, Williams at 1030ET (food-insecurity event) and Vice Chair Clarida at 1300ET (Fed Independence).

- Today’s data: MNI Chicago PMI for Nov at 0945ET plus consumer confidence and house prices.

- NY Fed buy-ops: Tsy 7Y-10Y appr $2.825B at 1030ET, Tsy 22.5Y-30Y appr $1.600B at 1120ET.

- Issuance is solely bills-focused today: $30B 21D and $34B 52W at 1130ET.

EGB/Gilt: Risk Off... Again

While markets partially reversed last week's risk off move on Monday, equities are once again pushing lower alongside gains for European FI.

- Gilts are outperforming EGBs with cash yields 4-8bp lower on the day and the curve bull flattening.

- The long end of the bund curve has similarly outperformed, with the 2s30s spread 2bp narrower.

- OATs trade boradly in line with bunds with the long end of the curve 3bp flatter.

- French and Italian CPI for November came in above expectations, with the latter beating by a wide margin (4.0% Y/Y vs 3.3% consensus). This follows closely on the heels of yesterday's bumper 6.0% Y/Y German CPI print.

- Supply this morning came from Germany (Bund, EUR2.308bn allotted), Italy (BTP/CCTeu, EUR5.75bn).

EUROPE ISSUANCE UPDATE

Germany allots €2.308bln 0% Nov-28 Bund, Avg yield -0.53% (Prev. -0.31%), Bid-to-cover 0.89x (Prev. 1.00x), Buba cover 1.15x (Prev. 1.26x)

Italy sells:

- E2bln 0% Aug-26 BTP, Avg yield -0.09% (Prev. 0.28%), Bid-to-cover 1.52x (Prev. 1.53x)

- E2.25bln 0.95% Jun-32 BTP, Avg yield -0.02% (Prev. 1.05%), Bid-to-cover 1.47x (Prev. 1.35x)

- E1.5bln 0.65% Apr-29 CCTeu, Avg yield 0.030% (Prev. -0.010%), Bid-to-cover 1.49x (Prev. 1.73x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXF2 174/176.5cs 1x2, sold at 62 in 1k

RXF2 171.5/170/169.5p ladder, sold at 5 in 1k

RXF2 176/177/177.5c fly, bought for 13 in 5.7k

RXF2 176/177/177.5c fly, bought for 13 and 13.5 in 12k

RXF2 172/171ps, bought for 14/15.5/16 in 22k

OEG2 133.5/132ps 1x1.5, bought for 18 in 1.5k

OEF2 135/135.5cs 1x2, bought for 4.5 in 1k

UK:

SFIF2 99.55/99.65/99.70c fly, bought for 3.5 in 4k

CFTC: GBP Position Deteriorated to New 12m Low in Last Week's CoT Report

Yesterday's CFTC release (delayed from the usual Friday release due to Thanksgiving holidays) showed a further build in the market's net long USD position, while 10y Treasury futures positioning slips to a new low.

Fixed Income:

- Markets trimmed positioning in the very short-end, with the 2yr net short increasing by around 2% of OI, but overall position still minor relative to the extremes seen in the past 12 months.

- While positioning in 10y is relatively little changed, it still marks the largest net short across the past 12 months, explaining the sizeable negative Z-score for that contract.

Currencies

- Given recent strength in spot, the increasing net short position in CHF is notable, with markets pushing the CHF net short to just over 20% of open interest.

- The GBP position continues to deteriorate, with markets increasing the net short by around 3,000 contracts to a new 12m low of 16.2% of open interest.

- AUD, MXN were the only currencies to see their positioning improve across the week.

FOREX: Monday's Risk Rally Reversed at Expense of AUD, CAD, NOK

- Risk sentiment took a knock during Asia-Pac hours, with Moderna's CEO pouring some water on hopes that the current suite of vaccines would retain effectiveness in the face of new variants. Equities were solid, Treasuries were bid and CHF, JPY gained at the expense of AUD, CAD and NOK.

- EUR/USD resumes the upswing seen on Friday, with the pair topping 1.1350 as markets continue to work against pricing that sees a Fed rate hike in Q3 next year. The pair's correction also runs counter to the recent multi-month trend of rising equities and rallying US yields, so could suggest further position squaring as another catalyst for the move.

- Sour oil markets continue to pressure NOK, with the currency touching its lowest level against the USD of the year, despite markets continuing to expect another rate hike from the Norges Bank at the upcoming December meeting.

- Data due Tuesday includes MNI Chicago PMI, seen moderating to 67.0 from 68.4, with Canadian monthly GDP and November US consumer confidence.

- Fed's Powell is due to make an appearance alongside Treasury Secretary Yellen, although their policy-specific commentary could be limited as they're due to be testifying on the CARES act relief program. Fed's Clarida could be of more relevance, speaking on Fed Independence at 1800GMT/1300ET.

FX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-55(E905mln),$1.1350(E550mln), $1.1445-50(E1.5bln)

- USD/JPY: Y113.80($1.2bln), Y115.00($2.8bln)

- USD/CNY: Cny6.3800($525mln), Cny6.3900($552mln), Cny6.4300($891mln)

Price Signal Summary - Oil Remains On The Back Foot

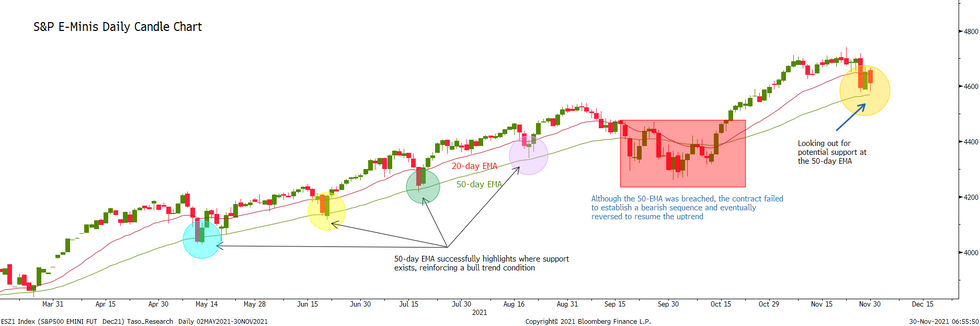

- In the equity space, S&P E-minis remain vulnerable following Friday’s sharp sell-off. Attention is on the 50-day EMA at 4567.25. This average has in the past proved to be a reliable support and represents a key pivot level. While it holds, recent weakness is considered a correction. A clear break though would strengthen bearish conditions. EUROSTOXX 50 futures also sold off sharply Friday and despite currently trading above last week’s low, still appears vulnerable. A resumption of weakness would open 4004.00, Oct 12 low.

- In FX, EURUSD objectives remain; 1.1185 Jul 1, 2020 low and 1.1128, 1.764 projection of the Jan 6 - Mar 31 - May 25 price swing. For now, the pair continues to strengthen as the correction extends. Resistance to watch is 1.1374, Nov 18 high and the 20-day EMA. GBPUSD continues to consolidate. Trend signals remain bearish and the next objective is 1.3216, 1.236 projection of the Sep 14 - 29 - Oct 20 price swing. USDJPY remains under pressure following Friday sharp sell-off and has probed support at 112.73, Nov 9 low. A clear break would strengthen the bearish case. Initial resistance is at 114.12, the 20-day EMA.

- On the commodity front, Gold remains inside its recent range. The short-term outlook is bearish within the bull channel drawn from the Aug 9 low. Attention is on the channel base, at $1758.8 today. WTI futures reversed course Friday and have continued to trade lower this week. The recent break of a number of support levels suggest scope for a continuation lower short-term. The focus is on $66.21, 76.4% of the Aug 23 - Oct 25 rally.

- In the FI space, Bund futures continue to recover from recent lows. Resistance at 172.57, Nov 22 high has been probed. A break would open 172.95, 76.4% retracement of the Aug - Nov sell-off. Key support is at 170.31, Nov 24 low. Gilts rallied Friday and the contract maintains a firmer tone. Futures have cleared resistance at 126.23, high Nov 9 and attention is on the 127.00 handle next.

EQUITIES: Stocks Revisit Friday Lows as Moderna Warn Omicron Could Dodge Jabs

- Equity markets traded lower across Asia-Pac hours, with Japan's Nikkei 225 and Hong Kong's Hang Seng closing lower by around 1.5%. This sentiment carried through the European morning and is weighing on US futures ahead of the bell. The primary catalyst for the sell-off were comments from the Moderna CEO, who talked up the possibility of the omicron variant being able to dodge vaccine-acquired immunity, thereby prompting the need for a fresh jabs programme if the new strain takes hold.

- The risk-off theme pressed the e-mini S&P to 4582.00 on the dip, but found support ahead of Friday's 4577.25. Futures remain lower, but the price action serves as another reminder that the buy-the-dip strategy remains fragile, with near-term volatility likely given the uncertainty surrounding variants.

- Europe's energy and consumer discretionary names are leading losses, but all sectors are in the red. The more defensive healthcare firms are trading more favourably, but the sector remains lower by around 0.6% at the midpoint.

COMMODITIES: Crude Returns Lower, Implied Vol Running at Highest Since Mid-2020

- Both Brent and WTI crude benchmarks have dropped early Tuesday, with futures off 2.5-3.0% in response to renewed concerns that the omicron variant could dodge vaccine-acquired immunity. As a result, sentiment is largely risk-off across equities, fixed income and commodities, favouring gold at the expense of energy products.

- WTI briefly showed below Friday's lows, printing a lower low of $67.06/bbl and cracking the 200-dma on the F2 future at $67.45/bbl.

- With prices resuming recent weakness, implied vol measures remain well bid, with a 1m 50-delta measure now tracking at its highest level since mid-2020.

- Gold is still consolidating but remains vulnerable. The yellow metal sold off sharply early last week extending the move lower from $1877.2, the Nov 16 high. Price has also traded below the 20- and the 50-day EMAs.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.