-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US MARKETS ANALYSIS - EUR Looks Through Firmer CPI as ECB Pricing Fades

Highlights:

- EUR looks through higher-than-expected Eurozone CPI as ECB pricing fades

- Further evidence of Chinese FX intervention, with reports of further state-bank selling of USD

- MNI Chicago PMI expected to improve, but remain in contractionary territory

US TSYS: Firmer On EGB Lead, Albeit Lagging

Tsys have drawn light support from the bid flagged in EGBs (lagging European peers), sitting a little shy of best levels at typing.

- ECB speak and Eurozone CPI have been the driving forces for bonds pre-NY, while activity in the European short-end was also noted from early London trade.

- TYZ3 +0-03+, operating in a 0-07+ range, cash Tsys 1-2bp richer.

- Atlanta Fed’s Bostic (’24 voter) reiterated his view that monetary policy is already restrictive enough to get inflation on track toward 2% whilst stressing that he doesn't see the need for easing any time soon. Recall that whilst separate to Bostic's vote as President for the Fed Funds target range, the Atlanta Fed Board was in favour of holding the discount rate unchanged in July.

STIR FUTURES: Fed Implied Rates Near Post-JOLTS Lows

- Fed Funds implied rates are unchanged overnight for Sep and Nov meetings and otherwise drift lower helped by ECB speak and EZ CPI but keep within yesterday’s range. The terminal 5.45% with Nov remains 5.5bp lower than pre-JOLTS levels whilst 2H24 implied rates are at least 20bps lower.

- Cumulative hikes: +3bp for Sep, +12bp for Nov to 5.45% terminal.

- Cuts from Nov terminal: 2.5bp to Dec (from 2bp yesterday), 50bp to Jun’24 (from 48bp) and 122bp (from 120bp).

- Collins (non-voter) is next up at 0900ET although remarks don’t sound mon pol-focused. She said Aug 24 that may need additional increments or may be near the hold point and that whilst it’s “not helpful” to map out a preset path for on rates, it’s extremely likely the Fed has to hold for some time.

CHINA: Exporter Preference for FX Swaps Fulfils Both Commercial, FX Management Needs

Several reports on CNY FX intervention remain a focus for Chinese markets, with Reuters reporting that Chinese exporters are using currency swap deals to hold USD, while state-owned banks are selling USD in spot markets to support the currency.

The structure and use of these FX swaps is fulfilling several requirements:

- Exporters' preference to hold USD exposure given the appreciation in USD/CNY

- Exporters' need to pay local suppliers, settle tax bills in CNY

- Provision of USD to state-owned banks, which can sell in spot markets to pressure USD/CNY

The FX swaps structure allows exporters to place FX earnings (namely USD) with state banks and swap for CNY - with a fixed term, allowing them to conduct business in local currency, then swap back to USD at a later date and earn carry in the process. This is further incentivized by lower returns in USD deposit accounts, for which rates have been cut in recent months.

Regulators allow the swap contracts as they provide banks with USD, with which they can in turn sell in the spot market and stem CNY weakness

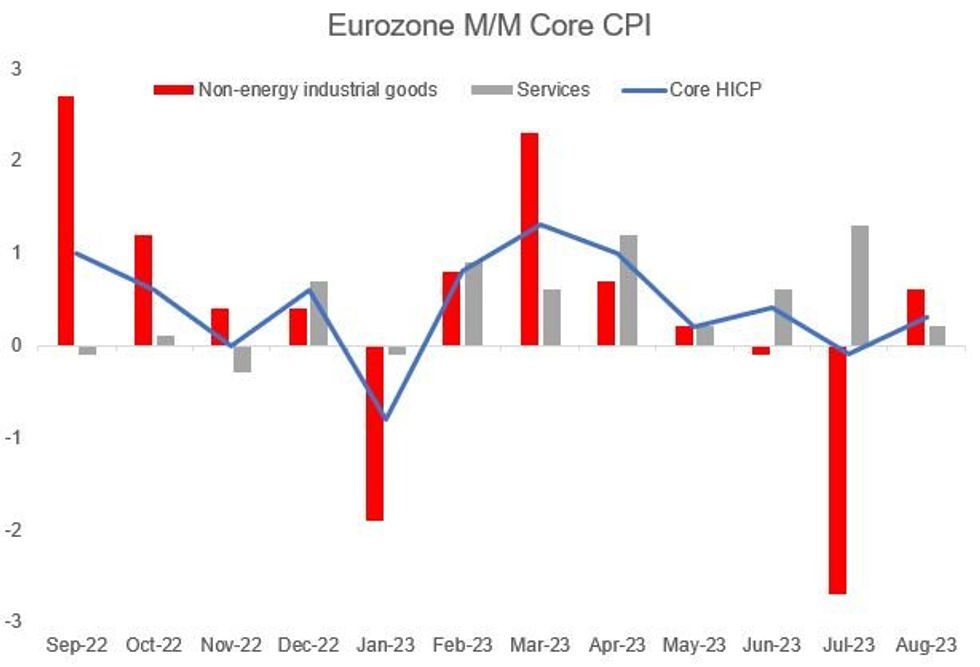

EUROZONE: Softening Services Underline Signs Of A Peak In Core Inflation

The flash readings of Eurozone inflation came in at/slightly above consensus estimates coming into the week, but were mostly in line with the expectations formed after national-level prints received prior. All in all, core pressures remain uncomfortably high, but appear to be settling down to a sequential pace that is closer to 2% than to the 4-5% suggested by prints earlier in the year.

- Headline HICP printed at 5.3% Y/Y (5.26% unrounded, 5.3% Jul), and 0.6% M/M (0.56% unrounded, -0.1% July). Those were above the 5.1% / 0.4% consensus but accorded with MNI's estimates based on earlier national prints.

- Likewise the 5.3% Y/Y core HICP reading (5.29% unrounded, 5.5% Jul) with core at 0.3%% (0.34% M/M unrounded) were in line with MNI's expectation coming into the reading, and matched previous expectations - potentially reflecting marginal upside surprises to German and Spanish core, with softer French and Italian readings offsetting.

- On the headline front: energy prices rose 3.2% M/M, bringing the Y/Y rate to -3.3% from -6.1% in July, as various base effects reversed and oil prices rose. Unprocessed food prices fell 0.6% M/M, with procesed food/alcohol/tobacco up 0.3% - both Y/Y figures moderated (processed 10.4% vs 11.3% prior; unprocessed 7.8% vs 9.2% prior).

- As for core items, non-energy industrial goods prices continued deflating Y/Y, to 4.8% (5.0% prior), with services likewise a touch lower (5.5% vs 5.6% prior).

- While sequential NEIG deflation in the prior 2 months (incl -2.7% M/M in Jul) reversed to inflation (+0.6% M/M Aug), part of this may be due to effects of shifting sales periods.

- Additionally, services rose just 0.2% M/M - joint-lowest since January - vs 1.3% in July. The latter was boosted by statistical factors that should fade going forward. Indeed some had expected services would mark another Y/Y high in August before an inevitable fading in September onward - this report marked a positive development on the disinflation front in that regard.

Source: Eurostat, MNI

Source: Eurostat, MNI

UK: Highlights from DMO calendar

- No big surprises in the DMO issuance operations announcement.

- No linker syndication to be held in FQ3 (but that was looking less likely after the consultation).

- The main surprise was the explicit feedback request regarding 30+ year conventional and/or linker tenders in the quarter. The DMO last held a tender in August 2022 (for a 3-year gilt) with the tender before that in December 2020 (for a 30-year linker).

FOREX: EUR Looks Through EZ CPI Uptick as ECB Pricing Fades

- EUR trades lower headed into the NY crossover, with markets shrugging higher-than-expected headline inflation reads from France, Italy and the Eurozone aggregate to re-focus on slowing pace of core inflation, which edged to 5.3% from 5.5%.

- ECB pricing for the September meeting continues to fade, with markets pricing a 1/3 chance of a 25bps hike. ECB's Holzmann summarised the current governing council view, stating the August inflation data is a "conundrum for the ECB".

- The JPY trades well, rising against all others in G10, keeping the pair within range of yesterday's lows of 145.56, a break below which would open 144.54 for direction.

- Scandi currencies underperform, with the NOK softer alongside SEK as the Norges Bank up the pace of daily FX purchases for September to NOK 1.1bln from NOK 1.0bln previously. The purchases are nominally to help the government finance the central government deficit, but markets remain wary of the activities despite their market neutral approach.

- Weekly jobless claims data comes and the July personal income/spending release comes ahead of the MNI Chicago PMI, which markets expect to rise to 44.2 from 42.8 previously.

FX OPTIONS: Expiries for Aug31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E634mln), $1.0925(E624mln), $1.0975-90(E718mln)

- USD/JPY: Y145.00-10($508mln), Y146.50($1.3bln)

- USD/CNY: Cny7.3000($1.0bln)

EQUITIES: E-Mini S&P Extends Corrective Recovery

- Eurostoxx 50 futures traded higher yesterday as the contract extends the corrective recovery from 4187.00, the Aug 18 low. The contract has breached resistance at the 50-day EMA at 4330.6. A continuation higher would signal scope for a climb towards resistance at 4420.00. On the downside, a breach of 4187.00 would be a bearish development and confirm a resumption of the downtrend.

- The E-mini S&P contract traded higher yesterday and is holding on to its recent gains. Price has traded above resistance at 4520.90, the base of a bull channel, drawn from the Mar 13 low that was breached on Aug 16. A clear break of this level would strengthen the upleg and open 4560.75, the Aug 4 high. Initial support to watch lies at 4452.93, the 50-day EMA. A return below the average would be a bearish development.

COMMODITIES: Short Term Correction in Gold Remains in Play

- The uptrend in WTI futures remains intact and recent weakness is considered corrective. Last week’s move lower resulted in a print below support at $78.33, the Aug 3 low, however price action has since recovered. Note that a key support also lies at the 50-day EMA, which intersects at $77.96. A clear break of this level would highlight a stronger bear cycle. Price has pierced resistance at $81.75, Aug 21 high, a clear break would be bullish.

- A short-term correction in Gold remains in play and the yellow metal has breached resistance at the 50-day EMA - at $1931.1. This strengthens the current bull cycle and signals scope for a stronger recovery. Attention turns to $1948.3, 61.8% of the Jul 20 - Aug 21 bear leg. It has been pierced, a clear break would open $1963.3, the 76.4% retracement. On the downside, initial firm support lies at $1903.9, the Aug 25 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/08/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/08/2023 | 1130/1330 |  | EU | ECB MP Meeting Account Publication | |

| 31/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/08/2023 | 1230/0830 | * |  | CA | Current account |

| 31/08/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 31/08/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/08/2023 | 1300/0900 |  | US | Boston Fed's Susan Collins | |

| 31/08/2023 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/08/2023 | 1600/1800 |  | EU | ECB's de Guindos Speaks at Conference | |

| 01/09/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/09/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/09/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/09/2023 | 0630/0830 | *** |  | CH | CPI |

| 01/09/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/09/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 01/09/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/09/2023 | 0900/1100 | ** |  | IT | PPI |

| 01/09/2023 | 1000/0600 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/09/2023 | 1000/1100 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 01/09/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2023 | 1230/0830 | *** |  | US | Employment Report |

| 01/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/09/2023 | 1345/0945 |  | US | Cleveland Fed's Loretta Mester | |

| 01/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2023 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.