-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR/USD at New Pullback Lows on ECB Lending Survey

Highlights:

- EUR/USD at new pullback lows as ECB lending survey shows sharp contraction in corporate loan demand

- US 10y yields creep toward 3.90% for first time in a fortnight

- 5Y supply offers some interest after yesterday’s 2Y saw a small tail

US TSYS: Bear Steepening With Second Tier Data And 5Y Supply On The Docket

- Cash Tsys trade 1-2bp cheaper for a mild bear steepening, although one that sees a much sharper adjustment in 2s10s to -98bps from yesterday’s -105bp owing to the switch to the new 2Y.

- 5Y supply offers some interest after yesterday’s 2Y saw a small tail after trading through in the prior two. With only second tier data beyond that, markets are already looking to tomorrow's FOMC policy decision, and to a lesser extent the ECB and BoJ meetings on Thu and Thu pm/Fri am.

- 2YY +1.2bp at 4.872%, 5YY +1.8bp at 4.169%, 10YY +2.2bp at 3.894%, 30YY +2.2bp at 3.945%.

- TYU3 trades 9 ticks lower at 111-25, just off a low of 111-23+ having more earnestly pushed through prior support at 112-00 (Jul 20 low) having only probed it yesterday. Next support seen at 111-22+ (50% retrace of Jul 7-18 rally) after which lies 111-11 (61.8% retrace). Volumes are still on the low side but near recent averages at 240k.

- Data: Philly Fed non-mfg Jul (0830ET), FHFA house prices May (0900ET), S&P CoreLogic house prices May (0900ET), Conf Board consumer confidence Jul (1000ET), Richmond Fed Jul (1000ET)

- Note/bond issuance: US Tsy $43B 5Y Note auction

- Bill issuance: US Tsy $50B 42-Day CMB auction

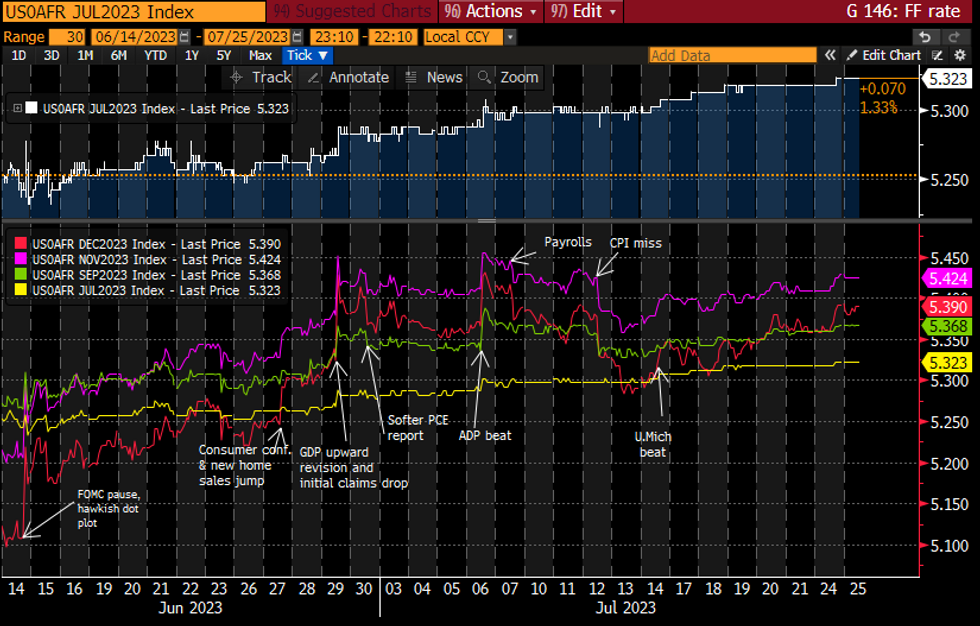

STIR FUTURES: Fed Implied Rates Consolidate Yesterday’s Trimming Of Cuts

- One day out from the FOMC decision, the Fed Funds implied rate path is near unchanged overnight after yesterday’s trimming of 2024 rate cuts. Yesterday’s drivers help set the tone with the US service PMI showing resilient prices whilst its weaker than expected activity was offset by China stimulus hopes.

- Cumulative hikes from 5.08% effective: 24.5bp for tomorrow (unch), +28.5bp Sep (unch), +34.5bp Nov (-0.5bp).

- Cuts from Nov terminal: 3bp to Dec’23, 56bp to Jun’24 and 127bp to Dec’24.

Source: Bloomberg

Source: Bloomberg

Kremlin: Grain Deal Can Be Revived If "Agreements Are Honoured"

Comments from the Kremlin hitting wires stating that: "It's impossible to return to lapsed black sea grain deal for now... [but Russian President Vladimir] Putin has made clear grain deal can be revived though if agreements related to Russia are honoured."

- Russian demands are understood to include improved market access for ammonia and potassium-based fertilizer exports which have fallen sharply since the war began.

- Kremlin: "It will be important for Russia to discuss grain supplies with African countries at [July 28-27] Russia-Africa summit [in St Petersburg]."

- The prospect of a return to the deal appears remote. If Putin can outline a credible alternative supply pipeline of Russia grain to African countries exposed to high grain prices, at the summit, it may limit political blowback from the strategically important bloc of African states which maintain a neutral position on the war.

- Recent sustained Russian attacks on grain infrastructure at the Black Sea ports of Odesa and Chornomorsk and alternativeexport hubs on the Danube have reestablished the Russian blockade on Ukrainian grain exports and further damaged the likelihood of a deal.

FOREX: EUR Hits New Pullback Lows on Bank Lending, IFO Data

- The EUR is sinking against all others, with the ECB bank lending survey as well as the soft German IFO release working against the single currency. The ECB bank lending survey showed the fastest contraction on record for corporate loan demand, and also described the tightening impact on the Eurozone so far as 'substantial' - thereby working against expectations of subsequent tightening beyond this week's assumed 25bps hike.

- Compounding the pressure on the EUR was the poorer-than-expected IFO release, with both current assessment and headline business climate releases dropping short of expectations.

- EUR/USD slipped to new pullback lows of 1.1052, extending the correction and moderating the previously overbought condition in the pair. The pair is now lower for the sixth consecutive session.

- The EUR is the poorest performer in G10, while the AUD is the strongest. Underlying expectations of fresh measures to support domestic demand in China (and thereby commodities) is helping support currencies tied to industrial metals as well as oil.

- Focus Tuesday turns to the US Philly Fed Non-Manufacturing Index as well as the July consumer confidence release. The latter is expected to improve from 109.7 previously to 112.0 - the highest since early 2022. There are no central bank speakers on the docket, with both the ECB and the Federal Reserve remaining inside their pre-decision media blackout periods.

FX OPTIONS: Expiries for Jul25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E1.8bln), $1.1225(E684mln)

- USD/JPY: Y140.00($576mln), Y140.40($659mln)

- GBP/USD: $1.2141(Gbp722mln)

- AUD/USD: $0.6715(A$951mln), $0.6770(A$1.0bln)

- USD/CAD: C$1.3200-10($1.1bln), C$1.3375($916mln)

- USD/CNY: Cny7.0500($1.5bln), Cny7.1750($1.2bln)

EQUITIES: E-mini S&P Remains Within Range of Contract Highs

- The E-mini S&P contract is trading below last week’s high of 4609.25 (Jul 19). Prices have recently tested the top of the bull channel drawn off the March 13 low - the channel top intersects at 4622.12 today.

- Eurostoxx 50 futures remain in consolidation mode but continue to trade closer to their recent highs and price is holding above the 50-day EMA at 4351.00. Attention is on key resistance and the bull trigger at 4447.00, the Jul 3 high.

COMMODITIES: Gold Conditions Remain Bullish

- Gold conditions remain bullish for now and the latest pullback is considered corrective. Last week’s print above $1985.3, the May 24 high, reinforces current conditions. A resumption of gains would pave the way for a climb towards $1998.1.

- The uptrend in WTI futures remains intact and yesterday's rally confirmed a resumption of the bull cycle. The break above $77.15, the Jul 13 high signals scope for a climb towards the next key resistance at $81.44.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/07/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/07/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/07/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/07/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/07/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/07/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 26/07/2023 | 0130/1130 | *** |  | AU | CPI inflation |

| 26/07/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/07/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2023 | 0800/1000 | ** |  | EU | M3 |

| 26/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/07/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/07/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 26/07/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.