-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Eurozone Inflation Hits a Record High

HIGHLIGHTS:

- European peripheral bond spreads blow out further

- Eurozone CPI well ahead of expectations, tops 4% to highest level on record

- MNI Chicago PMI, PCE data on the docket

US TSYS SUMMARY: Data Eyed For Inflation Clues

US Rates broadly weaker with EGBs, curves bear steepening for a change (for the moment at least) as bonds currently extending overnight lows (30YY tapped 2.0231%) amid robust volumes (TYZ1>490k, USZ1>125k). Equities in the red (ESZ1 -25.0 at 4562.5), Gold -2.85, WTI crude up slightly.

- Carry-over widening in sovereign spds on the back of Thu's ECB policy annc (mkt underwhelmed w/ECB Lagarde presser: "not for her to say" if markets had got ahead of themselves; specs piling on rate hike bets targeting 3Q'22.

- Currently Greece 10Y vs. Bunds +18.8, Italy +12.5, Portugal and Spain wider by single digits.

- It's largely inflation-related data that will be eyed today: 0830ET sees the Q3 Employment Cost Index, as well as the Sept personal income / spending report, which includes the Fed's preferred PCE price gauge.

- At 0945ET we get Oct MNI Chicago PMI, with the final Oct UMich Sentiment to wrap up the week in data.

- No supply; NY Fed buys ~$1.425B in 10-22.5 Tsys.

- The 2-Yr yield is up 2.6bps at 0.5148%, 5-Yr is up 3.1bps at 1.2155%, 10-Yr is up 2.8bps at 1.6084%, and 30-Yr is up 3.1bps at 2.0125%.

EGB/GILT SUMMARY - Big moves in peripheral

- Most of the action has been in peripheral spreads for EGBs.

- BTP/Bund is now wider by over 10nps, and Greece/Bund by 18bps, and widest since November 2020.

- Bund remains offered ahead of the US inflation data.

- Gilts have mostly traded inline with Bund, albeit 0.9bp wider.UK 5/30s lean steeper, but we still trade at multi year low.

- Looking ahead, US Core PCE, MNI Chicago PMI and Final Michigan are the data release.

- Gilt futures are down -0.61 today at 124.88 with 10y yields up 4.8bp at 1.053% and 2y yields up 3.2bp at 0.671%.

- Bund futures are down -0.90 today at 168.16 with 10y Bund yields up 4.4bp at -0.93% and Schatz yields up 2.0bp at -0.603%

- BTP futures are down -2.24 today at 148.20 with 10y yields up 15.3bp at 1.203% and 2y yields up 10.7bp at -0.8%.

- OAT futures are down -1.22 today at 164.09 with 10y yields up 6.5bp at 0.278% and 2y yields up 1.2bp at -0.642%.

EUROPE OPTION FLOW SUMMARY

Eurozone:

ERH3 100.125^^, bought for 51 in 1.5k

UK:

3LZ1 98.625p, bought for 4 in 10k

FOREX: Dollar Clawing Back Small Portion of Losses

- The greenback trades toward the top-end of the G10 table so far Friday, with the dollar inching higher against most others. This reverses a small part of the Thursday weakness, dragging EUR/USD off the 1.1692 highs to trade either side of the 1.1650 level ahead of NY hours.

- Equity indices generally trade lower, with European markets off 0.5-0.8%. This has worked in favour of CHF which puts USD/CHF at fresh multi-month lows. This keeps focus on the 0.9100 handle, with EUR/CHF adding downside pressure. EUR/CHF has traded through the lows printed earlier in the week, putting the cross in close proximity to the 1.0607 level printed in July 2020.

- NOK, NZD and SEK are the poorest performers, with the greenback, CHF and CAD among the strongest so far.

- The US personal income/spending and PCE data later today takes focus, with PCE deflator seen inching higher to 4.4% for the Y/Y reading. MNI Chicago PMI crosses shortly afterwards, with markets seeing a moderation to 63.5. Canadian GDP and a joint meeting between G20 finance and health ministers are also due.

FX OPTIONS: Expiries for Oct29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1480-00(E842mln), $1.1595-00(E1.3bln), $1.1645-55(E933mln)

- USD/JPY: Y113.00($674mln), Y113.75-90($1.3bln), Y114.60-75($1.4bln)

- NZD/USD: $0.7210(N$645mln)

- USD/CAD: C$1.2300($982mln), C$1.2345($610mln)

- USD/CNY: Cny6.4750($600mln)

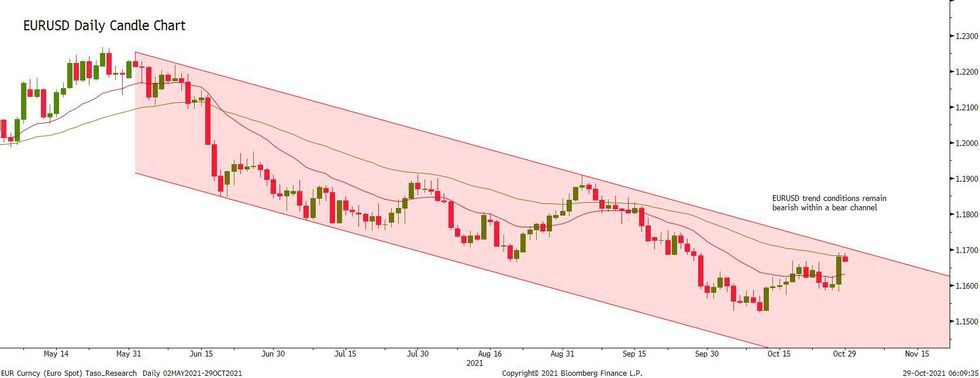

Price Signal Summary - EURUSD Bear Channel Top Remains Intact

- In the equity space, S&P E-minis are consolidating but remain in a clear uptrend. The next objective is 4591.25, the 1.00 projection of the Jul 19 - Aug 16 - Aug 19 price swing. Scope is also seen for a break of the 4600.00 handle. Support to watch is at 4543.75, Wednesday's low. EUROSTOXX 50 futures yesterday probed key resistance at 4223.00, Sep 6 high and the bull trigger. A clear break would confirm a resumption of the broader uptrend and open 4290.50, 1.00 projection of the Jul 19 - Sep 6 - Oct 6 price swing. The outlook remains bullish.

- In FX, EURUSD rallied yesterday and did probe the 50-day EMA. While this is a positive development, a key resistance at 1.1706 remains intact, the bear channel top drawn off the Jun 1 high. A channel breakout is required to signal a more decisive reversal. Initial support lies at 1.1582, yesterday's low. GBPUSD short-term bullish conditions remain intact and corrections so far have been shallow. The focus is on 1.3913, Sep 14 high and a key resistance. Support to watch is at 3710, Wednesday's low. USDJPY remains below recent highs but maintains a bullish tone. Scope is seen for a climb towards 114.99, 1.50 projection of the Apr 23 - Jul 2 - Aug 4 price swing. The support zone to watch is 113.14-00, the 20-day EMA and Oct 12 low respectively.

- On the commodity front, Gold is consolidating but maintains a positive short-term tone. Scope is seen for a climb towards $1834.0, the Sep 3 high. Initial support is at$1780.8, the 50-day EMA. WTI broader trend conditions are unchanged although futures have faced selling pressure this week. Support to watch is at $80.58, the 20-day EMA and yesterday's low.

- In the FI space, price action was extremely volatile yesterday. Bund futures sights are on 167.79, 2.50 projection of the Sep 9 - 17 - 21 price swing. Key resistance at 169.92, Oct 14 high, remains intact. Gilts breached and closed above resistance at 152.57 Wednesday, Oct 14 high. This confirmed a double bottom reversal on the daily chart and signals scope for a climb towards 126.39, 50.0% retracement of the Aug - Oct downleg. Initial support is at 124.55, Oct 27 low. BTPs continue their slide, extending yesterday' sharp sell-off. The focus is on 148.04 1.236 projection of the Sep 23 - Oct 6 - 14 price swing.

EQUITIES: Stocks Sag On Apple/Amazon Earnings Reports

- Asian stock markets closed mixed, with Japan's NIKKEI up 72.6 pts or +0.25% at 28892.69 and the TOPIX up 1.52 pts or +0.08% at 2001.18. China's SHANGHAI closed up 28.919 pts or +0.82% at 3547.336 and the HANG SENG ended 178.49 pts lower or -0.7% at 25377.24

- European equities are weaker, with the German Dax down 116.77 pts or -0.74% at 15696.33, FTSE 100 down 29.93 pts or -0.41% at 7249.47, CAC 40 down 27.36 pts or -0.4% at 6804.22 and Euro Stoxx 50 down 29.3 pts or -0.69% at 4233.87.

- U.S. futures are lower following disappointing quarterly results from giants Amazon and Apple, with the Dow Jones mini down 76 pts or -0.21% at 35537, S&P 500 mini down 23.25 pts or -0.51% at 4564.25, NASDAQ mini down 133.5 pts or -0.85% at 15631.25.

COMMODITIES: Precious Metals Weaken As Dollar Regains Some Ground

- WTI Crude down $0.01 or -0.01% at $82.84

- Natural Gas down $0 or -0.03% at $5.735

- Gold spot down $7.24 or -0.4% at $1797.29

- Copper down $2.2 or -0.5% at $442.15

- Silver down $0.2 or -0.85% at $23.9036

- Platinum down $3.15 or -0.31% at $1017.75

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.