-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US MARKETS ANALYSIS - EZ CPIs Snap EUR Winning Streak

Highlights:

- USD Index bounces as Eurozone CPIs fall short of expectations

- US curve sits bear steeper ahead of PCE, jobless claims, MNI Chicago PMI

- EUR/USD rally snaps, breaking streak of higher highs/higher lows

US TSYS: Bear Steeper Ahead With PCE and Jobless Claims Landing First

- Cash Tsys trade 1-4bp cheaper, led by 10s, with the steepening pushing 2s10s back to yesterday’s highs and currently at -36bps (+3bps).

- Treasuries underperform EGBs after mostly softer than expected readings including Eurozone CPI, a surprise lift in the German unemployment rate and a downward revision for French GDP.

- Monthly PCE and weekly jobless claims both at 0830ET are likely to set the tone for the session but there is still notable events afterwards including NY Fed’s Williams and the MNI Chicago PMI before heavy bill issuance. Quarterly core PCE data were yesterday revised lower back in Q3, whilst weekly claims surprisingly dropped last week although by our rough guide it looked to be on a beneficial seasonal adjustment which could bias an upward surprise this week.

- TYH4 at 110-04+ (-5+) is close to the day’s low of 110-03+ but remains within yesterday’s range. The modest decline on the day doesn’t alter the recently reinforced bullish theme, with resistance at yesterday’s high of 110-15+ and then 110-25 (Fibo projection) but in the event of hawkish surprises today support is seen at 109-05+ (Nov 28 low).

- Data: PCE Oct (0830ET), Weekly jobless claims incl payrolls ref. week for continuing (0830ET), MNI Chicago PMI Nov (0945ET), Pending home sales Oct (1000ET)

- Fedspeak: Willams (0915ET) – see below for details.

- Bill issuance: Tsy to sell $80B 4-week bills, $80B 8-week bills (1130ET)

STIR: Fed Rate Path Consolidates Slide With Key Data and Williams Ahead

- Fed Funds implied rates have consolidated most of yesterday’s further push lower, which sees a first cut landing with the May FOMC (26.5bp cumulative) and close to 50/50 odds it comes in March (11.5bp). There are 116bp of cuts priced for 2024 as a whole.

- Data is first in focus, starting with the monthly PCE report (after a surprise downward revision to Q3 for core PCE) and jobless claims (after last week’s surprise declines).

- NY Fed’s Williams (permanent voter) then follows at 0915ET. The topic, Innovations in Central Banking, could limit monetary policy relevance in the prepared text although subsequent Q&A and especially media availability could be more notable.

- Whilst typically at the dovish end of the FOMC spectrum, any further dovish commentary is unlikely to have as much sway as Waller’s musings on Tuesday, but his comments are still worth watching. Markets have been particularly sensitive to anything dovish of late and likely remain so, but it opens scope for a surprise in not being as dovish as expected, e.g. pushing back on the potential for nearer-term rate cuts.

- Providing a chapter of a BIS publication released Tue, he noted the recent decline in inflation has been encouraging and that "recent news about the long-run anchoring of inflation expectations in the United States is mostly reassuring".

- Chair Powell is however set to have the last say tomorrow before the FOMC blackout period begins.

STIR: OI Points To Long Cover Dominating On SOFR Strip On Wednesdays

The combination of yesterday’s move higher on the SOFR strip and preliminary open interest data point to net long setting as the dominant factor on the day.

- That theme prevailed across all packs, although pockets of short cover were also seemingly apparent.

- This came as the dovish Fed repricing extended on a mix of global impulses and the net impact of recent Fedspeak.

| 29-Nov-23 | 28-Nov-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 982,700 | 965,259 | +17,441 | Whites | +31,216 |

| SFRZ3 | 1,478,364 | 1,455,455 | +22,909 | Reds | +71,454 |

| SFRH4 | 1,132,513 | 1,151,048 | -18,535 | Greens | +5,313 |

| SFRM4 | 980,773 | 971,372 | +9,401 | Blues | +5,579 |

| SFRU4 | 1,010,444 | 935,837 | +74,607 | ||

| SFRZ4 | 900,215 | 892,187 | +8,028 | ||

| SFRH5 | 535,247 | 539,172 | -3,925 | ||

| SFRM5 | 598,101 | 605,357 | -7,256 | ||

| SFRU5 | 647,631 | 663,971 | -16,340 | ||

| SFRZ5 | 546,785 | 551,873 | -5,088 | ||

| SFRH6 | 411,475 | 402,029 | +9,446 | ||

| SFRM6 | 349,619 | 332,324 | +17,295 | ||

| SFRU6 | 312,956 | 309,763 | +3,193 | ||

| SFRZ6 | 251,800 | 249,239 | +2,561 | ||

| SFRH7 | 146,954 | 146,288 | +666 | ||

| SFRM7 | 138,166 | 139,007 | -841 |

EUROPE ISSUANCE UPDATE:

Portugal reverse auction results - IGCP buys:- E50mln of the 5.65% Feb-24 OT (ISIN: PTOTEQOE0015) at 100.39

- E198mln of the 2.875% Oct-25 OT (ISIN: PTOTEKOE0011) at 100.199

- E249mln of the 2.875% Jul-26 OT (ISIN: PTOTETOE0012) at 100.650

- E150mln of the 4.125% Apr-27 OT (ISIN: PTOTEUOE0019) at 104.490

MNI UK Issuance: DMO FQ4 (Jan-Mar) Ops Update

- In this document we set review the DMO’s latest issuance operations update. See the end of the document for a table-pack including the updated issuance calendar, a list of all gilts in issue (and how much is owned by the market and BOE), previous issuance profiles and details of the BOE sales operations.

- There was only one very minor surprise in the DMO's FQ4 operations - there will be no reopening via auction of the new 30-year gilt (due to be launched via syndication in January).

- But we will see an auction of the 30-year 4.00% Oct-63 - the longest maturity gilt auction since 2021. We had thought we may have seen this via a tender rather than an auction.

For the full document see: https://roar-assets-auto.rbl.ms/files/58262/MNI_UK...

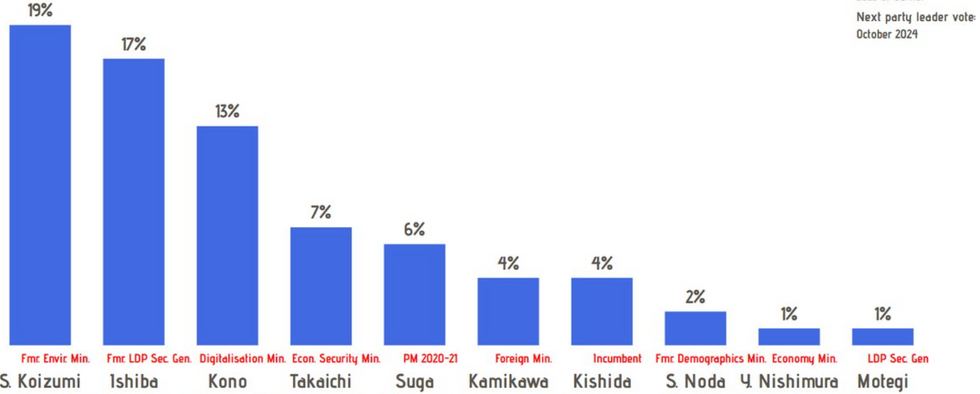

Lack Of Clear Frontrunner To Take Over LDP Could Aid PM Kishida

Japanese PM Fumio Kishida remains under significant pressure within his governing conservative Liberal Democratic Party (LDP) amid multi-year low approval ratings. This has led to speculation that powerful factions within the LDP could seek to oust Kishida at or ahead of the Oct 2024 LDP leadership conference in order to bolster the party's chances in the next general election due by 2025.

- However, the latest polling from ANN - carried out 25/26 Nov - shows there is no one potential leadership candidate that is overwhelmingly popular with the public (see chart below). Former Environment Minister Shinjirō Koizumi, son of former PM Junichirō Koizumi, leads the poll despite garnering just 19% support among the respondents (although this is up 4% on the September survey).

- Hawkish former minister Shigeru Ishiba sits in second place with 17% support, while Digitalisation Minister Taro Kono is the highest-polling current Cabinet member with 13% support. Kishida sits in joint-sixth place with just 4% of respondents picking him as their preferred PM.

- The lack of public support for a single candidate could depress the chances of Kishida facing a leadership challenge.

- It should be noted, though, that the LDP's complex internal faction system does not always bend to public popularity. In the 2021 LDP leadership contest, Kono was the clear favourite among grassroot party members and prefectural chapters, but Kishida won through with the backing of Diet members.

Source: ANN, @asiaelects. Fieldwork: 25-26 Nov, 1,015 respondents.

Source: ANN, @asiaelects. Fieldwork: 25-26 Nov, 1,015 respondents.

FOREX: Softer French, Dutch CPI Undermine EUR Rally

- The single currency is among the poorest performers in G10 early Thursday, undermined by a series of lower-than-expected CPI prints from France and the Netherlands - releases which spelled downside risks vs consensus for the Eurozone CPI Estimate. As a result, the lower-than-expected Eurozone-wide figure failed to meaningfully move market in either direction, with as easier ECB rate pricing across 2024 persists across the morning.

- The USD Index is the main beneficiary, rising through Wednesday's high and narrowing back in on the better levels of the week. The corrective bounce posted over the past two sessions coincides with the 14-day RSI flashing technically oversold - which may mean the market moves are deemed corrective at this stage.

- GBP trades softer, with GBP/USD softer through the Wednesday low, however EUR/GBP managed to maintain the losing streak of nine consecutive lower lows. A break at current or lower levels would mark the first break below the 100-dma since May, a technical break that presaged a ~3% downleg across May and June.

- The MNI Chicago PMI data takes focus going forward, with markets expecting the headline to improve slightly to 46.0 from 44.0 previously. Personal income/spending data also crosses as well as Canadian GDP. The speaker slate is similarly busy, as ECB's Lagarde & Nagel, Fed's Williams and BoE's Greene are all set to make appearances.

FX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0855(E658mln), $1.0895-05(E534mln), $1.0925(E603mln), $1.0965-75(E1.3bln), $1.1000(E589mln), $1.1030(E565mln)

- USD/JPY: Y145.96-10($817mln), Y146.80-85($610mln), Y147.70($1.0bln), Y148.10-30($2.8bln), Y149.00($3.1bln), Y149.50-65($1.9bln), Y149.85-05($1.5bln), Y150.50($730mln), Y151.00($1.0bln)

- GBP/USD: $1.2700(Gbp527mln)

- EUR/GBP: Gbp0.8670-80(E513mln), Gbp0.8700(E662mln)

- AUD/USD: $0.6580-00(A$1.2bln)

- USD/CAD: C$1.3000($2.7bln)

- USD/CNY: Cny7.1000($725mln), Cny7.1700($770mln)

EQUITIES: E-Mini S&P Remains Bullish Despite Yesterday's Slight Pullback

- A bullish theme in Eurostoxx 50 futures remains intact. MA studies are in a bull-mode position signalling a rising cycle and the potential for a continuation higher. The focus is on 4388.00, the Aug 30 high. It has been pierced, a clear break of it would open 4400.00 and 4446.00, the Aug 10 high. Initial firm support to watch is at 4298.50, the 20-day EMA. Note that the trend condition is overbought, a move lower would allow this overbought reading to unwind.

- A bullish theme in S&P e-minis remains intact and the contract traded higher yesterday, before pulling back. The outlook remains bullish. A strong rally on Nov 14 resulted in the break of a trendline drawn from the Jul 27 high. This breach and the subsequent rally, reinforces bullish conditions and opens 4597.50, the Sep 1 high. MA studies are in a bull-mode position highlighting an uptrend. Initial firm support is seen at 4481.71, the 20-day EMA.

COMMODITIES: Corrective Cycle in WTI Futures Still in Play as This Week's Gains Extend

- The trend outlook in WTI futures is unchanged and remains bearish. However, a corrective cycle is in play and the contract has traded higher this week. Resistance to watch is at $79.65, the Nov 14 high. A breach would strengthen a bullish theme and open $83.20, the Nov 3 high. On the downside, the bear trigger lies at $72.37, the Nov 16 low. Clearance of this level would resume the downtrend.

- The trend condition in Gold remains bullish and this week’s strong rally reinforces this set-up. The yellow metal has traded through resistance at $2009.4, the Nov 7 high. The clear break of this hurdle has confirmed a resumption of the uptrend and signals scope for an extension towards 2063.0, the May 4 high and a key resistance. Note the all-time high at $2070.4 (Mar 8 ‘22). Initial firm support is at $1989.5, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/11/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 30/11/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 30/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/11/2023 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 30/11/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/11/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 30/11/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 30/11/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 30/11/2023 | 1330/1430 |  | EU | ECB's Lagarde at 5th ECB Forum | |

| 30/11/2023 | 1405/0905 |  | US | New York Fed's John Williams | |

| 30/11/2023 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 30/11/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 30/11/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 30/11/2023 | 1600/1600 |  | UK | BOE's Greene speech at Leeds University | |

| 30/11/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/11/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/12/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/12/2023 | 0800/0900 | *** |  | CH | GDP |

| 01/12/2023 | 0800/0300 |  | US | Fed Vice Chair Michael Barr | |

| 01/12/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/12/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0900/1000 | *** |  | IT | GDP (f) |

| 01/12/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/12/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/12/2023 | 1000/1100 |  | EU | ECB's Elderson participates in ECB forum panel | |

| 01/12/2023 | 1130/1230 |  | EU | ECB's Lagarde conversation at 5th ECB Forum | |

| 01/12/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 01/12/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2023 | 1500/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/12/2023 | 1600/1100 |  | US | Fed Chair Jerome Powell | |

| 01/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/12/2023 | 1900/1400 |  | US | Fed Chair Powell, Gov. Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.