-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fed Pricing Fading Pre-CPI Print

Highlights:

- JPY on top as post-payrolls/Ueda bounce fades

- Global equities firm further ahead of US CPI print

- Treasury futures extend rally following digestion of double note auction

US TSYS: Post Auction Rally Extended Ahead Of CPI, Further Supply

- Cash Tsys trade 2.5-4.55bp richer, extending yesterday’s rally seen after double note issuance, which despite both 3s and 10s tailing appeared to be met by investors happy to re-enter longs at more favorable levels after the sell-off instigated by an on balance stronger than expected payrolls report.

- TYH4 at 110-20+ (+10) sits just off the day’s high of 110-22. The trend structure remains bullish, with resistance at the bull trigger of 111-09+ (Dec 7 high) after which lies 111-19 (Fibo projection of Oct- Nov price swings).

- CPI clearly headlines today (preview), before likely some further attention on supply, this time at the very long end, but all with tomorrow’s FOMC decision on the horizon (preview).

- Data: CPI Nov (0830ET), Real Av Earnings Nov (0830ET), Mthly Budget Statement Nov (1400ET)

- Note/bond issuance: US Tsy $21B 30Y Bond auction R/O (912810TV0) – 1300ET

- Bill issuance: US Tsy $70B 42D bill CMB auction – 1130ET

STIR: Fed Rate Path Drifts Lower Pre-CPI

- Fed Funds implied rates have pulled back further overnight, with softer-than-expected UK wage data adding to momentum from yesterday’s post-auction rally.

- Ahead of US CPI, there is back to 50/50 odds of a first cut coming in March, just shy of two cuts with the June FOMC (47bp cumulative) and 116bp cuts to end-2024 (vs ~125bp in the build up to Friday’s payrolls) – see table.

- Re-upping the CPI Preview: https://roar-assets-auto.rbl.ms/files/58423/USCPIPrevDec2023.pdf

TSYS: OI Points To Mixed Positioning Swings On Monday

The combination of the preliminary OI data and yesterday’s twist steepening of the Tsy curve points to the following positioning swings on the day:

- Net short cover: TU & FV:

- Net long setting: TY & UXY

- Net short setting: WN

- We can’t offer much inference when it comers to net positioning swings in US futures given the unchanged priced status on the day.

- A reminder that the space pared losses after the 10-Year auction, which resulted in mixed net price action on the day.

- 30-Year Tsy supply follows today's CPI release.

| 11-Dec-23 | 08-Dec-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,997,099 | 4,014,533 | -17,434 | -677,370 |

| FV | 5,721,647 | 5,734,024 | -12,377 | -537,972 |

| TY | 4,438,788 | 4,414,541 | +24,247 | +1,560,780 |

| UXY | 1,982,679 | 1,975,621 | +7,058 | +644,591 |

| US | 1,299,948 | 1,305,091 | -5,143 | -689,361 |

| WN | 1,581,254 | 1,572,932 | +8,322 | +1,767,523 |

| Total | +4,673 | +2,068,191 |

SOFR: OI Points To Mixed SOFR Positioning Swings Ahead Of CPI

The combination of Monday’s price action and preliminary OI data point to the following net positioning swings at the start of the week:

- Whites: An apparent mix of long setting (SFRU3), short setting (SFRZ3), long cover (SFRH4) & short cover (SFRM4).

- Reds: An apparent mix of short cover (SFRU4-SFRH5) and short setting {SFRM5), with the former dominating in net terms.

- Greens: An apparent mix of modest long cover (SFRU5) and short setting (SFRZ5-M6), with the latter dominating in net terms.

- Blues: A mix of short setting (SFRU6 & M7) & long cover (SFRZ6-H7), with the latter dominating in net terms.

- The mix of positioning swings comes ahead of today's CPI release and after long setting dominated in recent weeks alongside the dovish Fed repricing (which has moved back from extremes).

| 11-Dec-23 | 08-Dec-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 1,186,679 | 1,175,653 | +11,026 | Whites | +28,582 |

| SFRZ3 | 1,529,234 | 1,499,521 | +29,713 | Reds | -16,284 |

| SFRH4 | 1,109,528 | 1,109,837 | -309 | Greens | +8,677 |

| SFRM4 | 989,870 | 1,001,718 | -11,848 | Blues | -3,140 |

| SFRU4 | 896,481 | 906,259 | -9,778 | ||

| SFRZ4 | 977,048 | 987,008 | -9,960 | ||

| SFRH5 | 554,637 | 556,514 | -1,877 | ||

| SFRM5 | 611,283 | 605,952 | +5,331 | ||

| SFRU5 | 603,037 | 603,119 | -82 | ||

| SFRZ5 | 569,286 | 561,953 | +7,333 | ||

| SFRH6 | 413,637 | 413,367 | +270 | ||

| SFRM6 | 370,286 | 369,130 | +1,156 | ||

| SFRU6 | 319,620 | 319,096 | +524 | ||

| SFRZ6 | 243,578 | 245,874 | -2,296 | ||

| SFRH7 | 147,436 | 149,858 | -2,422 | ||

| SFRM7 | 141,792 | 140,738 | +1,054 |

UK: PM Sunak Faces Test Of Authority In Rwanda Bill Vote

Prime Minister Rishi Sunak is facing a significant backbench rebellion from the right of his governing Conservative party in a parliamentary vote that could test his authority as leader. The issue surrounds legislation related to the proposed deportation of some asylum seekers to Rwanda. The legislation itself is not market-moving, but the impact of the vote on the stability of the UK gov't and the potential date of the next general election could have a broader impact. The vote is expected later on the evening of 12 Dec.

- A Supreme Court ruling in November judged the gov'ts immigration plans to be in breach of UK law, resulting in new legislation being proposed. This legislation could be opposed by a number of right-wing Conservative factions what say is does not go far enough in ensuring deportation flights to Rwanda will take place and small boat crossings of the English Channel are stopped. The largest faction, the ERG, is set to meet at 1700GMT to discuss the legislation.

- On the evening of 11 Dec, the moderate One Nation Conservatives grouping signaled its, albeit reluctant, support for the bill, removing one potentially hazardous obstacle for Sunak.

- A defeat for the gov't could embolden challengers on the right to seek to depose Sunak ahead of the next general election.

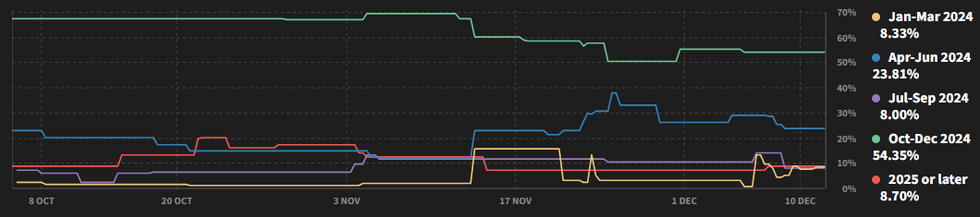

- Political betting markets continue to have Q424 as the most likely time for the next election, with a 54.4% implied probability. Q224 comes in second with a 23.8% chance, with the remaining options (Q124, Q324, and January 2025) all around the 8% implied probability mark.

Source: Smarkets

Source: Smarkets

EUROPE ISSUANCE UPDATE:

Gilt auction result- GBP3.75bln of the 4.50% Jun-28 Gilt. Avg yield 4.041% (bid-to-cover 2.53x, tail 0.9bp)

- E633mln (E550mln allotted) of the 2.90% Feb-33 RAGB. Avg yield 2.751% (bid-to-cover 2.36x)

FOREX: JPY Firmer as USD/JPY Rolls Off Recovery High

- JPY is the firmest performer in G10 as markets roll off the USD/JPY top at yesterday's high of 146.59. The move in JPY looks largely idiosyncratic, as equities across the continent trade higher, and US futures point to a positive close on Wall Street. USD/JPY's fade off highs has reversed the entirety of the sources report-inspired rally early Monday, marking 144.78 as weak intraday support ahead of 144.52 and the 38.2% retracement of the post-Ueda move at 143.85.

- The USD trades poorly headed into the NY crossover, with short-setting and profit-taking evident after resistance at 104.262/263 failed to give way in the USD Index across the Friday/Monday sessions. This leaves the greenback in consolidation mode, but has allowed EUR/USD to improve, narrowing the gap with the 200-dma in the process at 1.0825.

- Antipodean currencies are trading well, taking the lead from firmer equity and, to a lesser extent, commodities prices. AUD/USD remains anchored to the 200-dma of 0.6576, with 0.6608 the first modest intraday resistance - which markets failed to meaningfully break back above after the payrolls release on Friday.

- US inflation data takes focus going forward, with markets expecting CPI to slow 0.1ppts to 3.1%, although caveated with a steady Y/Y core rate at 4.0%. ECB's Villeroy is also set to appear, however is unlikely to muse on monetary policy given the proximity to this Thursday's ECB decision.

EGBS: Off Intraday Highs But Remain Firmer; Peripheries Mixed

- Core/semi-core EGBs are off intraday highs after beginning the day firmer, lagging Gilts in the process.

- Softer-than-expected average weekly earnings data out of the UK alongside a JGB-inspired rally in the Asia-Pac session provided the initial dovish impetus.

- There were no clear headlines to promote the move off session bests for Bund and OAT futures, while order-related flow likely drove weakness in Bobl and Schatz.

- That still leaves Bund futures up 0.43 ticks today at 135.06, well short of the first resistance of 135.81 (Dec 7 high). Yields are lower across the curve, with 2s10s in France and Germany bull flattening.

- Peripheries are mixed, with the BTP/Bund spread 1.4bps tighter at 177.8bps and Greek/Portuguese spreads to Bunds wider.

- The German and Eurozone ZEW investor surveys both saw increases in their expectations components, with more German respondents looking for ECB rate cuts in the medium term. The German current situation component improved vs November but still fell short of consensus.

- The rest of today's domestic docket is light, with main focus on the US CPI report for November at 1330GMT.

GILTS: Off Early Highs, But Comfortably Firmer on Day

Gilt futures are shy of early bests, with the AHE-driven rally running out of steam alongside a pullback from best levels in Bunds.

- The latest 5-Year gilt auction saw an extension of the recent trend of generally sub-par demand, which wouldn’t have aided bulls.

- Futures last print +95, a little above 98.45. That leaves the contract ~30 ticks shy of the top of its ~50 tick range. Friday’s opening gap lower in the contract was closed during the early rally.

- An extension of the early rally would leave bulls looking to the Dec 6 high (98.97).

- Gilts yields run 7.5-9.5bp lower on the day, with the wings still lagging.

- 10-Year yields found a base around 3.95% before retracing to ~3.97%. Last week’s low at 3.941% (98.84 in futures today) and 3.90% (99.22 in futures today) present the immediate reference points on that front.

- SONIA futures last +0.5 to +12.0.

- BoE-dated OIS is little changed to 11bp softer through ’24 MPC contracts. ~23.5bp of cuts are now priced through the June ’24 MPC. ~85bp of cuts are seen through ’24 on the whole.

- STIRs are off dovish session extremes given the limited pullback in gilts.

- There isn’t much in the way of local event risk to flag for the remainder of today, with broader macro focus set to fall on U.S. CPI data.

- Tomorrow’s monthly economic activity data presents the next domestic point of note but that shouldn’t be a gamechanger for Thursday’s BoE decision.

EQUITIES: E-Mini S&P Trades at Fresh Multi-Month High

- A bullish theme in Eurostoxx 50 futures remains intact and the contract continues to climb. The fresh trend high confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. Moving average studies are in a bull-mode position too, signalling a rising cycle. The focus is on 4561.00, a Fibonacci projection. Support to watch is at 4398.00, the 20-day EMA.

- A bullish theme in S&P e-minis remains intact and the contract has started this week on a bullish note. The break higher confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. Note too that moving average studies are in a bull-mode position, highlighting positive market sentiment. Sights are on 4690.75, the Aug 2 high. Initial support lies at 4592.23, the 20-day EMA.

COMMODITIES: Pullback in Gold Still Considered Technically Corrective

- Bearish conditions in WTI futures remain intact and the latest recovery is considered corrective. The contract has recently cleared support at $72.37, the Nov 16 low. The break lower confirms a resumption of the downtrend and note too that moving average studies are in a bear-mode position, highlighting a clear downtrend. Sights are on $67.28 next, the Jun 23 low. Resistance is seen at $74.46 the 20-day EMA.

- The latest pullback in Gold is considered corrective and this is allowing an overbought trend condition to unwind. The next support to watch is $1978.4, the 50-day EMA. It has been pierced. A clear break would signal scope for a deeper retracement. Last week’s early gains reinforce the primary bullish condition. The yellow metal traded to a fresh all-time high of $2135.4 and this signals potential for a climb towards $2177.6 next, a Fibonacci projection.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/12/2023 | - | *** |  | CN | Money Supply |

| 12/12/2023 | - | *** |  | CN | New Loans |

| 12/12/2023 | - | *** |  | CN | Social Financing |

| 12/12/2023 | 1330/0830 | *** |  | US | CPI |

| 12/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/12/2023 | 1500/1000 | * |  | US | Services Revenues |

| 12/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/12/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/12/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/12/2023 | 2145/1045 | ** |  | NZ | Current account balance |

| 13/12/2023 | 2350/0850 | *** |  | JP | Tankan |

| 13/12/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/12/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 13/12/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 13/12/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/12/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/12/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/12/2023 | 1330/0830 | * |  | CA | Household debt-to-income |

| 13/12/2023 | 1330/0830 | *** |  | US | PPI |

| 13/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/12/2023 | 1900/1400 | *** |  | US | FOMC Statement |

| 14/12/2023 | 2145/1045 | *** |  | NZ | GDP |

| 14/12/2023 | 2350/0850 | * |  | JP | Machinery orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.