-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fed Rate Cut Pricing Tilts Against May Meeting

Highlights:

- Fed rate cut pricing tilts against first Fed cut pricing for May

- US curve resumes trade to be bumped higher, mimicking European trade

- Thanksgiving prompts an early close in the US, making Friday a likely quiet session

US TSYS: Bear Steeper Partly On Post-Thanksgiving Catch Up, But Off Lows

- Cash Tsys are off cheapest levels but maintain a bear steepening on the day, sitting 3.8-6.2bps cheaper across the curve with 2s10s at -47bps (+2bps) vs an earlier high of -45bps. Moves are a combination of post-Thanksgiving catch-up after yesterday’s Gilts/EGBs-led cheapening, before further EU-focused spillover today.

- TYZ3 at 108-15 (-11) trades at the low end of today’s range with a low of 108-12, extending yesterday’s decline for a step closer to support at 108-05+ (50-day EMA).

- A bullish theme is deemed intact with the latest pullback considered corrective, with resistance at the bull trigger of 109-08+ (Nov 17 high). Volumes are artificially inflated by quarterly roll activity.

- Data: S&P Global US PMIs (09450ET), likely receiving more attention than usual with such a light docket.

- No Tsy issuance.

STIR FUTURES: Post-US CPI Low For 2024 Cuts

- Fed Funds implied rates are little changed from pre-Thanksgiving levels for the next two meetings, with 3.5bp of cumulative tightening with January.

- They’ve drifted higher further into 2024 though, biased by yesterday’s EU price action, moving further away from a first cut in May (cumulative 14bp) which is still seen in June (27bp).

- With the Dec'24 implied rate rising 4bps since Wednesday's close, the cumulative 85bp of cuts from current levels to end-2024 is the lowest since US CPI on Nov 14, vs 75bps at the Nov 13 close and having touched 100bps after the release.

STIR: ECB Pricing Little Changed As Core Global FI Stabilises

Early Friday comments from ECB’s Holzmann generated some misleading headlines on the wires (that read more dovishly than what he actually said). Looking at the details, he noted that for him, “the probability that interest rates will rise again is no less likely than the odds of a cut.” The hawk stressed that inflation levels remain high, also alluding to “other dangers.” The details, coupled with the previously covered, wider cheapening in core global FI markets, dripped into OIS pricing.

- That was before an uptick from session cheaps in core global FI halted, and then reversed, most of the limited hawkish move in OIS.

- Contracts covering ECB decisions through ’24 are flat to 1bp firmer on the day as a result, with no further rate hikes priced into the strip.

- Further out, the first full 25bp cut is still priced come the end of the June ’24 meeting, with a cumulative ~82bp of cuts then showing through ’24 on the whole.

- ’24 cumulative cut pricing is a little over 20bp off last week’s dovish extremes, but that is more to do with repricing re: global central banks over that horizon, as opposed to ECB-specific matters.

- Late Thursday, Holzmann’s fellow Governing Council member Villeroy once again pointed to no further rate hikes unless surprises materialise.

- More recently, President Lagarde reiterated the degree of caution that the ECB holds re: further immediate progress on inflation, alongside a re-flagging of the distance already travelled on that front.

- Scheduled ECB speak de Guindos & de Cos present the regional highlights ahead of the weekend.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Dec-23 | 3.906 | +0.4 |

| Jan-24 | 3.904 | +0.2 |

| Mar-24 | 3.844 | -5.9 |

| Apr-24 | 3.757 | -14.5 |

| Jun-24 | 3.616 | -28.6 |

| Jul-24 | 3.494 | -40.8 |

| Sep-24 | 3.353 | -54.9 |

| Oct-24 | 3.214 | -68.8 |

| Dec-24 | 3.082 | -82.0 |

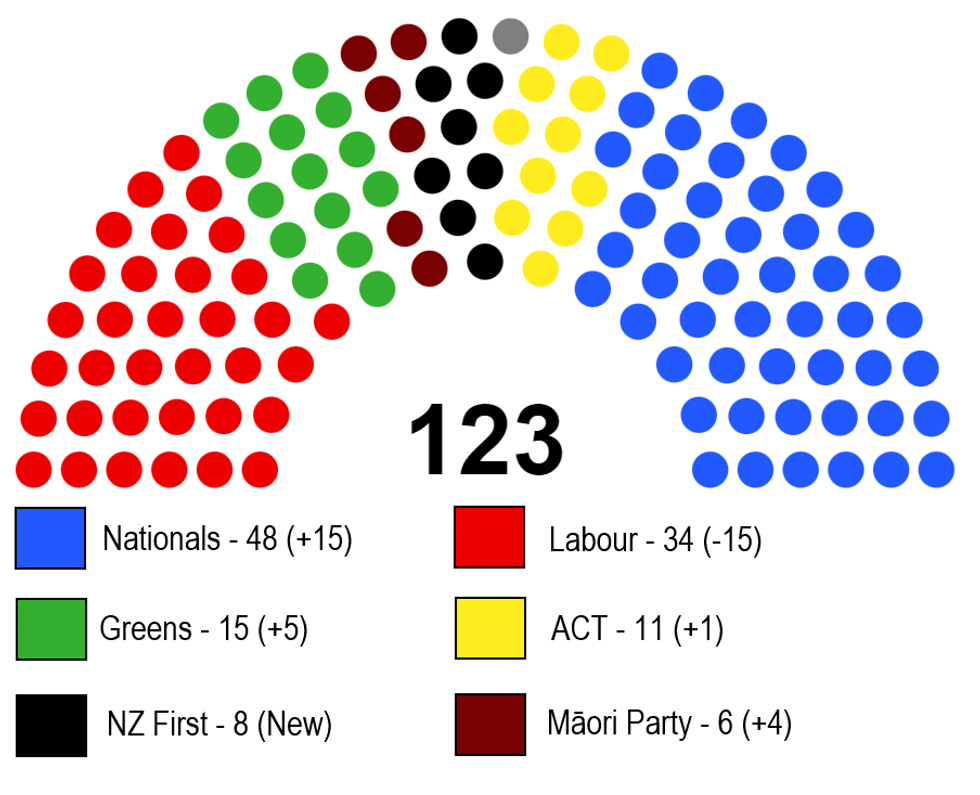

3-Party Gov't Formed; Despite Deal Policy Difference Still Apparent

New Zealand has a new coalition gov't following the agreement announced between incoming PM Christopher Luxon's centre-right National Party, the libertarian ACT, and the populist New Zealand First (NZF) on 24 Nov. As we noted overnight, much market focus will be on the proposed changes to the dual mandate of the RBNZ, with a single mandate of maintaining price stability set to be reinstated.

- The coalition agreement has seen some of the Nationals' major manifestocommitments junkedin order to get NZF on board, namely the plan to reopen the market to foreign property investors with the imposition of taxes on these purchases. The parties have, however, agreed to cuts in personal tax rates.

- Difficulties could become apparent as the gov't gets into budget negotiations. The ACT sits as a small-state, libertarian party favouring major tax and spending cuts, the Nationals as a more conventional conservative party, and NZF as a socially right but economically left-wing party. This could see limits to the extent of cuts in social and welfare spending.

- The coalition agreement sees ACT leader David Seymour serve as deputy PM for the first half of the term, followed by NZF head Winston Peters for the second.

- Peters will also serve as foreign minister. Eastern Daily Press reports: "Peters, [...], said he did not foresee any changes to New Zealand’s current foreign policy on China." In a presser Peters stated that "We expect the Chinese government to treat us the same way, regardless of our size. Size doesn't matter respect does."

Source: Electoral Commission. N.b. Port Waikato seat remains vacant due to death of ACT candidate during campaign and cancellation of vote. By-election takes place 25 Nov, strongly expected that Nationals hold the seat.

Source: Electoral Commission. N.b. Port Waikato seat remains vacant due to death of ACT candidate during campaign and cancellation of vote. By-election takes place 25 Nov, strongly expected that Nationals hold the seat.

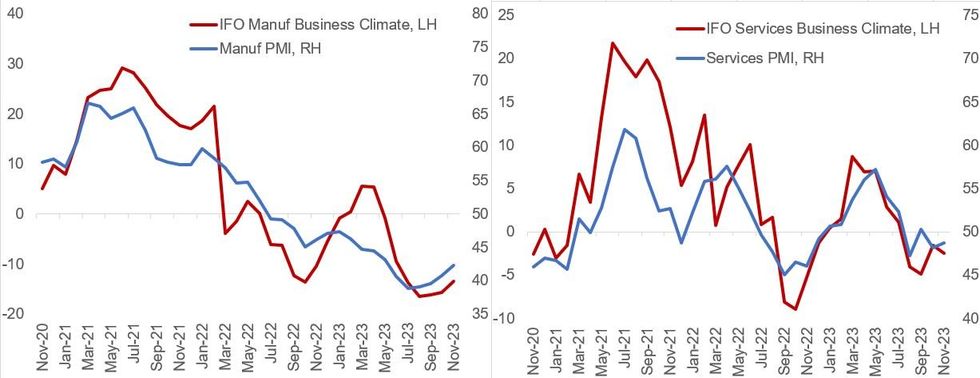

IFO Improving But Suggests Economic Momentum Remains Weak

The IFO Business Climate Index ticked up for the 3rd consecutive month to a 4-month high in November but missed expectations at 87.3 (87.5 consensus, 86.9 prior). The current assessment index came in at 89.4 (89.5 consensus, 89.2 prior) and the expectations index printed 85.2 (85.8 consensus, 84.7 prior).

- Compared to the November flash PMIs, which came in higher than expected including improvements in both Manufacturing and Services activity, the ifo index paints a slightly weaker picture (see chart). But both surveys suggest that activity may have bottomed out over the past few months, albeit at a weak and likely slightly contractionary pace.

- Notably, on the underlying sectoral balances, manufacturing ticked up to -13.5 (-15.7 prior), the best reading since June. Services are still comparatively resilient vs August and September lows but declined to -2.5 (-1.5 prior). The strongest uptick was seen in the trade sector at -22.2 (-27.3 prior), a 5-month high, while the construction sector improved to -29.4 (-30.8 prior), a 4-month high.

- While a bottom may be forming in German activity, signs of recovery momentum remain faint, with the details of the -0.1% Q/Q contraction in Q3 GDP out earlier today confirming a weak picture for a broad set of components. Additionally, the uncertainty of the consequences of the constitutional court ruling might restrain further improvement in confidence in the months ahead.

Source: IFO, BBG, MNI

Source: IFO, BBG, MNI

FOREX: EUR/GBP Flirting With Key Support

- Currency markets and asset markets in general are sanguine and rangebound early Friday, with the USD Index in minor negative territory to start the day.

- AUD, NZD are very modestly firmer, but any gains are anchored by a soft session for Chinese equities, as profit-taking pushed indices lower after property support speculation news earlier in the week.

- EUR/GBP sits toward the bottom-end of the week's range, with the cross narrowing in on key support levels at both 0.8687 as well as 0.8681, marking the 50- and 200-dmas respectively. The former has held as support on several occasions in the past few months, meaning bears could become more confident on a break of the mark to expose 0.8650 and below over the medium-term.

- It's likely to be a second quiet session for US assets, with an early US close as the Thanksgiving break extends into the weekend. There are sporadic data releases, with Canadian retail sales and prelim S&P PMI data for November on the docket. The central bank speaker slate consists of ECB's de Guindos and de Cos both appearing at S'Agaro conference in Spain.

FX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.2bln), $1.0825(E600mln), $1.0875(E652mln), $1.0895-00(E765mln), $1.0925-30(E1.3bln)

- USD/JPY: Y146.25($500mln), Y147.25-40($1.5bln), Y148.50-65($981mln), Y149.00-20($581mln), Y150.00-10($655mln)

- AUD/NZD: N$1.0850(A$700mln)

- USD/CAD: C$1.3575($1.3bln), C$1.3755($1.6bln), C$1.3770($1.6bln)

- USD/CNY: Cny7.2300($1.0bln)

BONDS: Cheaper Again, But Off Worst Levels

Asian impulses and hawkish reiterations from ECB’s Holzmann & BoE’s Pill helped core global FI lower early on Friday.

- Modest misses were seen in the German ifo data, although the President of the body noted that the German economy has probably moved beyond the depths of the economic downturn, while expressing worry re: the fiscal situation.

- Recent comments from ECB President Lagarde reiterated the degree of caution that the ECB holds re: further immediate progress on inflation, alongside a re-flagging of the distance already travelled on that front.

- EUR 5y5y inflation swaps have extended their bounce from recent multi-month lows, which will have provided some background pressure for bonds.

- Bund futures found a bit of a base around intermediate support before recovering from lows.

- The contract last shows -30, at 130.25, ~15 off the low of its ~50 tick range. German benchmark yields are 2-3bp firmer on the day, light bear steepening seen.

- EGB spreads to Bunds are typically a touch tighter.

- Gilts have breached another technical support level, although the move ran out of steam before bears could get anywhere near a key support zone (94.84/58, the 50-day EMA /Nov 13 low). The contract last prints -55 around 95.40, ~35 ticks off lows.

- Cash gilt yields sit 0.5-4.0bp higher on the day, with the curve bear steepening. SONIA futures and BoE-dated OIS have seen some hawkish moves post-Pill, but haven’t tested yesterday’s extremes.

- ECB speak from de Guindos and de Cos is due later in the day, with the highlight from a Thanksgiving-thinned/curtailed session set to come in the form of the flash U.S. S&P Global PMI readings.

EQUITIES: E-Mini S&P Steadies Close to Cycle Highs

- A short-term bull cycle in Eurostoxx 50 futures remains intact and the contract is holding on to this week’s highs. Moving average studies are in a bull-mode position signalling a rising cycle and the potential for a continuation higher. The recent breach of resistance at 4256.00, the Oct 12 high, reinforced the bullish theme. The focus is on 4388.00, the Aug 30 high. Initial firm support to watch is at 4263.00, the 20-day EMA.

- A bullish theme in S&P e-minis remains intact. Recent gains have resulted in the break of a trendline drawn from the Jul 27 high. This breach reinforces bullish conditions and signals scope for a climb towards 4597.50, the Sep 1 high. Moving average studies are in a bull-mode position highlighting an uptrend. On the downside, initial firm support is seen at 4441.90, the 20-day EMA.

COMMODITIES: Bullish Gold Trades Shy of Key Resistance at $2009.4

- A bearish theme in WTI futures remains in play and recent gains are considered corrective. The break lower last week marked an extension of the downtrend that started late September and this has maintained a price sequence of lower lows and lower highs. Moving average studies are in a bear-mode position, highlighting a downtrend. The focus is on $70.96, a Fibonacci retracement. Key resistance is unchanged at $79.65, Nov 14 high.

- The trend condition in Gold remains bullish and this week’s gains reinforce this condition. The latest recovery signals scope for a test of key short-term resistance at $2009.4, the Nov 7 high. Clearance of this hurdle would confirm a resumption of the uptrend and pave the way for a climb towards $2022.2, the May 15 high. Key support has been defined at $1931.7, the Nov 13 low. A break would signal a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/11/2023 | 1000/1100 |  | EU | ECB's Lagarde participates in "Europe in the Future" event | |

| 24/11/2023 | 1300/1400 |  | EU | ECB's De Guindos remarks and Q&A | |

| 24/11/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 24/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/11/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/11/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/11/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/11/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.