-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fed's Cook to Provide Last Look Pre-Blackout

Highlights:

- PMIs paint mixed picture, with services strong but manufacturing stuttering

- Fed's Cook to provide last look at comms ahead of the FOMC media blackout

- Equities on track for modest weekly decline

US TSYS: Bull Steepening With TYM3 Also Testing Session Highs, Flash PMI Ahead

- Cash Tsys have seen a mixed overnight but one that is currently marked by a bull steepening after a recent rally that continues to extend with 2YY now down almost 6bps intraday. It sees outperformance of core EU FI after flash composite PMIs beat expectations with strong services offsetting weak manufacturing.

- Latest tax data from late yesterday marginally pushed back on x-date fears, whilst ahead, the flash US PMI headlines today’s docket and Procter & Gamble pre-market are the highlight of today’s earnings.

- 2YY -4.2bp at 4.101%, 5YY -3.0bp at 3.597%, 10YY -1.3bp at 3.519%, 30YY -0.6bp at 3.734%.

- TYM3 trades 6 ticks higher at 114-27 on subdued volumes of 220k. It’s has just dipped off a high of 114-27+, eyeing resistance at the 20-day EMA at 114-29 after which lies 115-23 (Apr 14 high).

- Data: S&P Global US PMI Apr prelim (0945ET)

- Fedspeak: Gov Cook (1630ET, text/Q&A). Policy blackout starts midnight.

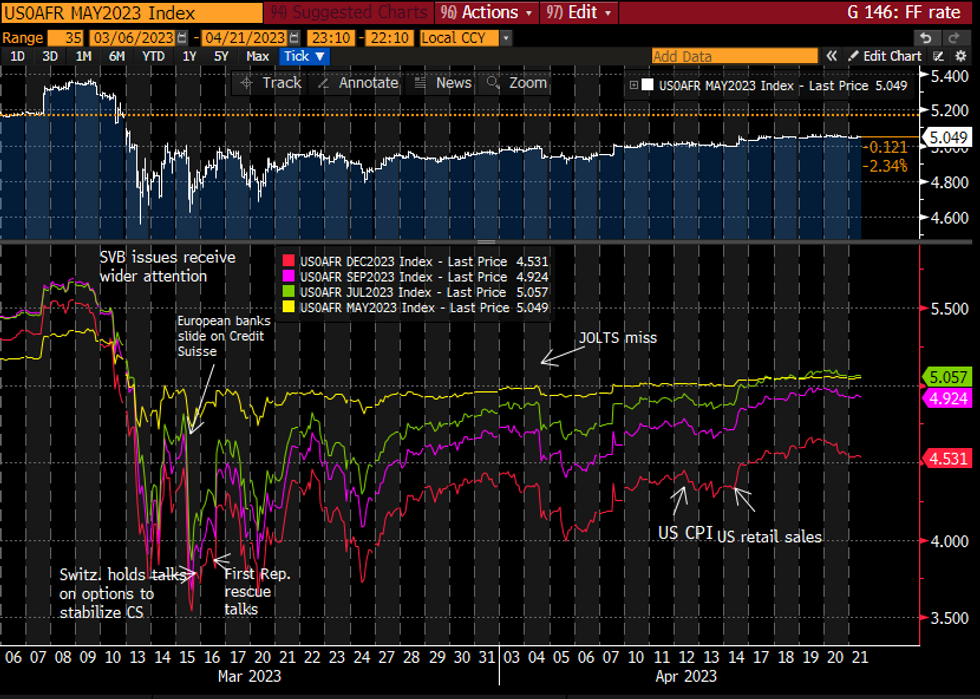

STIR FUTURES: Cook The Final Speaker Scheduled Ahead Of FOMC Blackout

- Fed Funds implied rates have seen minimal change overnight after yesterday's decline, with no spillover from European PMIs showing strong services offsetting weak manufacturing.

- 22bp hike for May 3 (unch), a cumulative 27.5bp hike for Jun (unch), 10bp of cuts from current levels for Nov (-1bp) and 30bp of cuts from current to 4.53% (-1.5bp).

- After yesterday’s Fedspeak deluge, only Gov Cook (voter) scheduled today at 1635ET on economic research with text and Q&A, before the blackout starts at midnight. She last spoke Apr 3, i.e. before CPI, noting that the disinflationary process is happening but we’re not there yet with inflation coming from a still tight labor market.

Source: Bloomberg

Source: Bloomberg

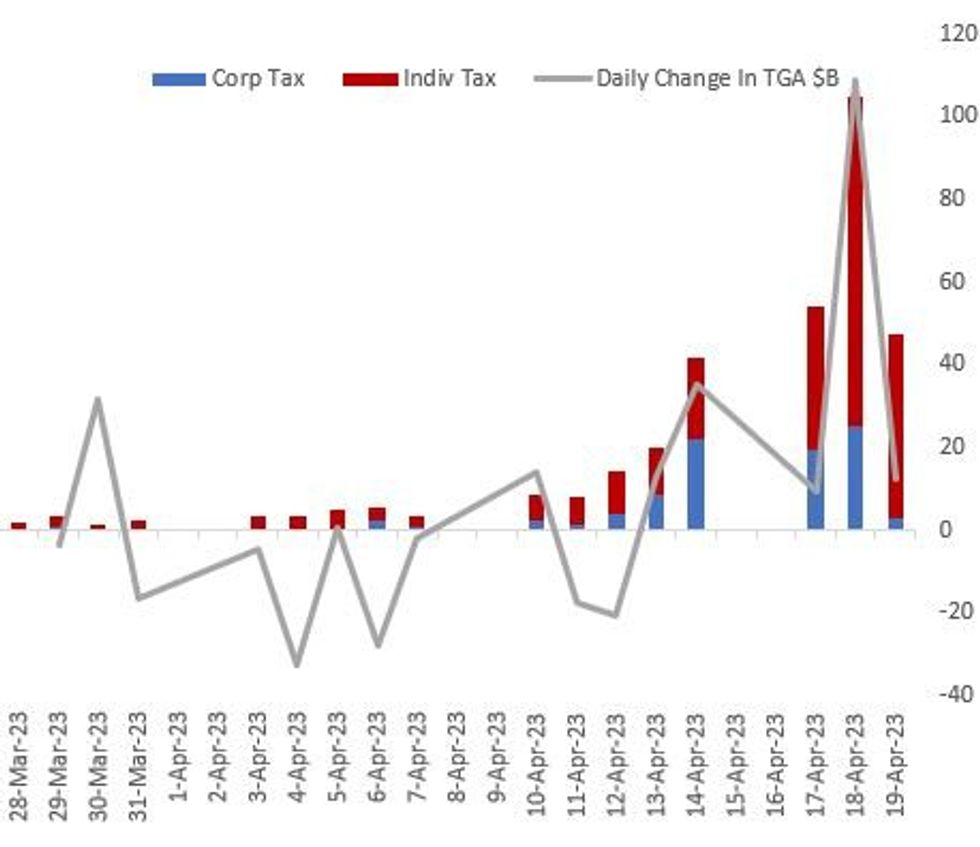

Latest Tax Data Marginally Pushes Back On X-Date Fears

The Treasury raked in a total of $47B in "tax season" revenues on April 19. That included $2.7B in corporate taxes and a combined $44.4B in individual income tax, which was higher than the Apr 17 collection of $35B though as expected below April 18's $80B haul.

- Overall, Wednesday's transactions boosted the Treasury's cash pile by a net $12.5B, with the TGA rising to $265B (up $178B in a week, and the highest in a month).

- While some analysts had expected a very strong tax figure for the 19th, others were more skeptical; in general this should reduce concerns over an x-date being reached in early June.

- Wrightson ICAP noted this morning that their subjective probability of such an outcome - which had risen to 20% following the prior day's weaker-than-expected tax take - had fallen to 15% on the basis of Apr 19's numbers.

- The situation remains ambiguous; we reiterate that we'll have a clearer view by the end of next week, by which time the vast majority of April tax collections will be in.

- Also note: our full Fed Balance Sheet Tracker will be released later today.

EUROPE ISSUANCE UPDATE

Italy sells:- E2.5bln of the 3.40% Mar-25 BTP Short Term. Avg yield 3.58% (bid-to-cover 1.52x)

- E2.5bln of the 1.50% May-29 BTPei. Avg yield 1.7% (bid-to-cover 1.31x)

FOREX: Solid Services Compensate for Lagging Manufacturing

- Prelim PMI data from across the Eurozone and UK all painted a similar theme, with services proving resilient, but manufacturing lagging behind consensus. The data tilted most composite readings ahead of forecast, painting a slightly rosier economic picture ahead. Nonetheless, markets proved largely unreactive, as currency markets adopt a modest risk-off posture ahead of the final US session of the week.

- The JPY is the firmest currency in G10, gaining alongside shakier US equity trade, despite a Reuters report suggesting the BoJ will stick to their ultra-loose policy stance at next week's meeting.

- The greenback is slightly firmer in tandem, but the USD Index remains below yesterday's and the week's best levels at 102.126 and 102.228 respectively.

- The poorest performers are AUD, NZD across the European morning, undoing the late rally across AUD/USD and NZD/USD into the Thursday close. NZD/USD printed down at 0.6127 ahead of the NY crossover, the lowest level since early March, to narrow the gap with key support of 0.6085.

- Canadian retail sales and the prelim US PMI data are the highlights on the schedule going forward, with some focus on the speaker slate also: ECB's Elderson and de Guindos are on the docket, while Fed's Cook speaks after the close - providing the last look at FOMC comms ahead of the pre-meeting media blackout at the end of the day.

FX OPTIONS: Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0973-80(E920mln), $1.1050(E1.7bln)

- GBP/USD: $1.2350(Gbp545mln)

- USD/JPY: Y134.00-20($829mln)

- AUD/USD: $0.6795-00(A$521mln), $0.6845(A$1.4bln)

- USD/CAD: C$1.3520-40($670mln)

- USD/CNY: Cny7.0100($740mln)

EQUITIES: E-Mini S&P Futures Trade Lower Friday, But Respects Recent Ranges

- Eurostoxx 50 futures are consolidating. The uptrend remains intact and recent gains have reinforced the bullish significance of the break of 4268.00, the Mar 6 high and a former key resistance. The breach confirmed a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. Sights are on 4381.50, the Jan 5 2022 high (cont). Initial firm support lies at 4257.40, the 20-day EMA.

- The trend outlook in S&P E-minis remains bullish and the latest move lower (from Tuesday’s high) is considered corrective. Support to watch lies at 4119.30, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4077.86, the 50-day EMA. Attention is on the 4200.00 handle where a break would resume the uptrend and open 4205.50,Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

COMMODITIES: WTI Futures Target $75.83 March 31 Support Level

- WTI futures are trading lower this week. This has resulted in a breach of support at $79.04, the Apr 3 low and the gap high on the daily chart. The continuation lower has also resulted in a break of both the 20- and 50-day EMAs. This signals scope for a move to $75.83, the Mar 31 high and a gap low on the daily chart. On the upside, key short-term resistance has been defined at $83.38, the Apr 12 high. A break would resume the recent uptrend.

- Trend conditions in Gold remain bullish, however, the yellow metal has entered a short-term corrective cycle. Price has breached initial firm support at $1987.3, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break of this level would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/04/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/04/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/04/2023 | 1430/1630 |  | EU | ECB Elderson at Peterson Institute Climate Event | |

| 21/04/2023 | 1745/1945 |  | EU | ECB de Guindos at Colegio de Economistas de Madrid Event | |

| 21/04/2023 | 2035/1635 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.