-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Firmer AUD CPI Fails to Spark Currency Rally

Highlights:

- Higher-than-expected AUD CPI fails to ignite the currency

- Equities point to a negative open as earnings provide the anchor

- Bank of Canada seen on hold, retaining hawkish poise

US TSYS: Bear Steeper Ahead Of 5Y Supply, New Home Sales Data

Treasuries have cheapened over the course of the European morning session. Yields across the curve currently trade at or near intraday highs in a bear steepening move, with longer-end Treasuries retracing most of Tuesday's rally.

- TY futures sit 4 ticks above Tuesday's lows, at 106-06+ (5 ticks lower on the day). Latest cash levels: 2-Yr yield is up 0.5bp at 5.0811%, 5-Yr is up 2.5bps at 4.8457%, 10-Yr is up 4.7bps at 4.8697%, and 30-Yr is up 5.6bps at 4.994%.

- Overnight highlights included stronger-than-expected Australian inflation data and German IFO business sentiment, helping underpin global yields after Tuesday's poor ex-US PMI data.

- That said, looking cross-asset, it's hardly a risk-on session so far: equity futures have softened after some stability in early Asia trade, while the USD has advanced to its best levels in 2 sessions as the US extends its yield advantage.

- Wednesday's data/speaker docket is fairly light: MBA mortgage apps at 0700ET and new home sales at 1000ET are the highlights.

- While Chair Powell appears after market close (1635ET), it's unlikely to be a market mover as he's expected to respect the pre-FOMC blackout period.

- In supply, auctions for $52B 5Y Note, and to a lesser extent $26B 2Y FRN, are the highlights. The 5Y will be eyed as a bellwether on current Fed "higher-for-longer" sentiment, after a series of mixed Tsy auctions including Tuesday's on-the-screws sale for 2s.

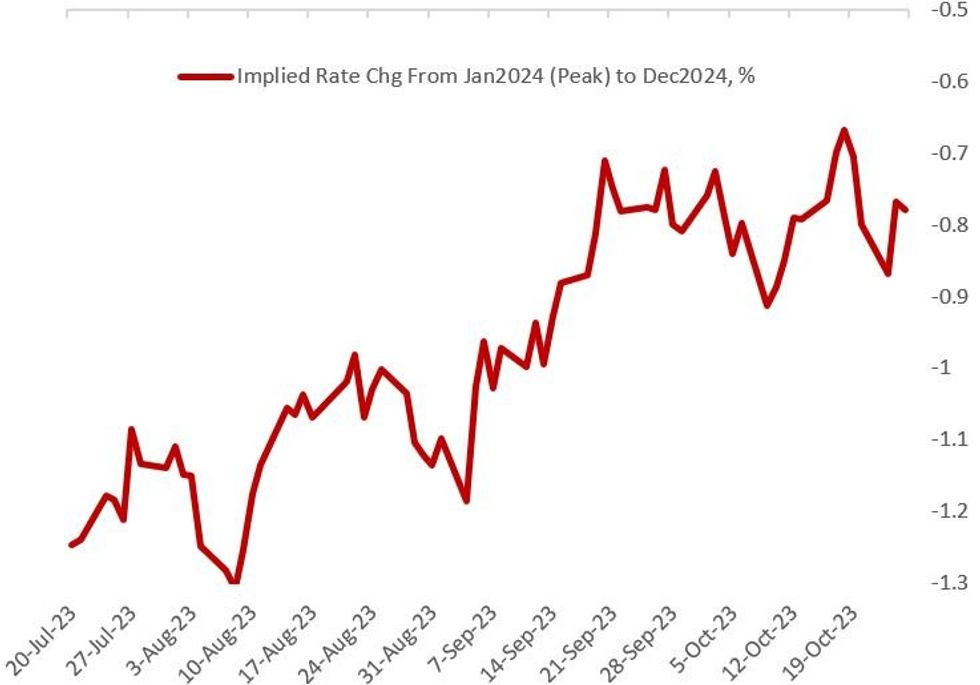

Peak Fed Pricing Ticks Higher On Overseas Data, Still Well Off Highs

Boosted in part by above-expected overseas data (German IFO, Australian CPI) implied Fed peak pricing has ticked higher in overnight trade Wednesday, with the 10-11bp cumulative tightening implied through the Jan 2024 FOMC up from 9-10bp at Tuesday's close.

- That still sits 1bp below Tuesday's post-PMIs peak pricing, but up 3-4bp on the week.

- Implied rate cuts have been fairly steady with around 78bp in reductions seen between peak and the Dec 2024 FOMC, vs 77bp seen at Tuesday's close - the slight movement largely due to the aforementioned peak repricing.

- Immediate attention is on MBA mortgage apps, with Sept new home sales data out later. Fed Chair Powell's appearance after the market close is expected to steer away from market-moving comments as it's in the pre-FOMC meeting blackout period.

Source: BBG, MNI

Source: BBG, MNI

MNI BoC Preview, Oct'23: Expecting A Hawkish Watch And Wait

EXECUTIVE SUMMARY

- The BoC is almost unanimously seen keeping its policy rate on hold at 5% on Wednesday for the second meeting running.

- Unusually heavy BoC speak since the Sep 6 decision has lent slightly hawkish but mixed data should see similar guidance.

- Instead, we focus on updated forecasts for when the Bank sees excess supply (July forecast early 2024) and when it sees inflation returning to the 2% target (July forecast mid-2025).

- There is only up to 1/3 odds of another hike by January whilst CORRA futures have seen cut expectations rise in the past few days off recent lows to a little under 50bp of cuts to end-2024. The long end of the GoC curve could be unusually sensitive after 10Y yields have increased almost 35bps since the last meeting.

- Initial market reaction to any surprises could be dulled by the current heightened sensitivity to geopolitical risk, but any surprises should help guide the trend further out.

PLEASE FIND THE FULL REPORT HERE:

EUROPE ISSUANCE UPDATE:

Italy Auction Results - BTP Short Term and 6Y BTPei

- E2.5bln of the 3.60% Sep-25 BTP Short Term. Avg yield 3.99% (bid-to-cover 1.58x)

- E1.5bln of the 1.50% May-29 BTPei. Avg yield 2.24% (bid-to-cover 1.55x).

- E750mln (E602mln allotted) of the 0% May-35 Bund. Avg yield 2.94% (bid-to-cover 2x)

- E1.25bln (E999mln allotted) of the 1.00% May-38 Bund. Avg yield 3.05% (bid-to-cover 1.6x).

- GBP3bln of the 3.75% Jan-38 Gilt. Avg yield 4.871% (bid-to-cover 2.97x, tail 0.4bp)

- The auction of the 3.75% Jan-38 Gilt saw strong demand with the fourth highest bid-to-cover at a nominal gilt auction of 2023. (The other auctions to exceed today's 2.97x bid-to-cover were either benchmark 10-year auctions or green). The tail of 0.4bp is also relatively tight, the highest for over 3-month excluding the 1.125% Oct-73 gilt tender.

- There was only a minor movement higher in the price of the 3.75% Jan-38 gilt on the result publication, and we now trade close to the LAP of 88.526.

FOREX: USD Index Steadies Above Key Support, GBP Fails to Recover

- AUD/USD has now reversed the entirety of the CPI-inspired run higher, retreating over 50 pips from the session high of 0.6400. The Tuesday NY lows of 0.6344 are giving way at typing, opening the Monday and weekly lows of 0.6289. AUD/NZD is mimicking the price action, retreating back to flat after printing a tenth consecutive session of higher highs. A negative close Wednesday would be only the second in 11 days.

- The pullback in AUD, against both USD and NZD, shows how US yields remain a more influential factor for the currency relative to domestic developments, with intraday price action closely following the creep higher in the US 10y yield so far Wednesday.

- The USD Index is seen firmer, snapping a four session streak of lower highs after markets found firm support ahead of the 50-dma of 105.285 yesterday. The longer prices hold above this mark (which is trending higher), the more likely a resumption of the M/T uptrend drawn off the July low.

- The single currency trades well, helping pressure the Monday high in EUR/GBP. Strength through 0.8726 opens the bull trigger of 0.8741 for direction, a level that could come into focus in the coming week, which covers both the ECB and BoE rate decisions.

- The Bank of Canada decision takes focus going forward, with the board seen unanimously keeping its policy rate on hold at 5% for the second meeting running. We focus on updated forecasts for when the Bank sees excess supply (July forecast early 2024) and when it sees inflation returning to the 2% target (July forecast mid-2025).

- Outside of the BoC, new home sales data for September is set to cross, and while both ECB's Lagarde and Fed's Powell are set to make appearances, they will steer clear of comments on monetary policy given the respective media blackout periods for both the ECB and the Fed.

FX OPTIONS: Expiries for Oct25 NY cut 1000ET (Source DTCC)

As EUR/USD drifts back to flat and back below 1.06 in early Wednesday trade, spot drifts within range of more sizeable strikes at 1.0550-60, but seen bigger below with E1.0bln rolling off at the 1.05 handle at today's NY cut:

- EUR/USD: $1.0500(E1.0bln), $1.0550-60(E602mln), $1.0600-20(E998mln), $1.0650-55(E656mln)

- USD/JPY: Y149.75($527mln), Y150.25($593mln), Y151.00($1.3bln)

- GBP/USD: $1.2125-40(Gbp911mln)

- EUR/GBP: Gbp0.8658-75(E1.0bln)

- AUD/USD: $0.6300(A$652mln)

EGBS: Core EGBs and Gilts Slightly Cheaper

Core EGBs and Gilts sit flat to a touch cheaper this morning, as better-than-expected German IFO numbers do not provide much impulse in either direction.

- Australian CPI upside surprise as well as Country Garden's USD bond default (largely anticipated) will have provided pressure early on, and impending supply from Italy, Germany and the UK also provided headwinds.

- OATs underperform, with cash benchmarks flat to 1-3bps cheaper, while cash Bunds are 0-2bps cheaper across tenors.

- The UK 2s10s curve is seen twist flattening almost 2bps today, currently at -25.5bps. Gilt futures sit at 92.76, and currently sit at the 200-day EMA of 92.74. The Oct 24 high of 93.34 as the first resistance and the Oct 24 low of 92.44 the first support.

- Periphery spreads are seen mixed, with the 10-year BTP/Bund spread 2.3bps wider at 202.1bps and Spain/Bund spreads 0.8bps wider at 111.8bps. Aforementioned Italian supply will have provided pressure here, while earlier Spanish PPI did not move the needle. Greek and Portuguese spreads are 3bps and 0.4bps tighter respectively this morning.

- The remaining data calendar is light today, with no scheduled MPC and ECB speakers. The BoC decision and US new home sales are the highlight in the North American session.

EQUITIES: US Stocks Point to Softer Open, Earnings Provide the Anchor

- The diverging fortunes of Microsoft and Alphabet in after-market reports yesterday is still being felt ahead of the open. Pre-market, Alphabet have extended losses to 6.8%, while Microsoft are indicated to open higher by 3.7%. Tech expected to remain a focus among today's reports, with T-Mobile, Boeing due ahead of the open, while Meta Platforms (Facebook) and IBM follow after the close. Full earnings schedule here: https://roar-assets-auto.rbl.ms/files/56296/MNIUSE...

- The e-mini S&P trades largely rangebound, but has drifted off the overnight best levels. Yesterday's NY low of 4241.75 undercuts today, ahead of more solid support at the week's lows of 4213.25. Volumes are a touch below average for this time of day, with the Dec23 future seeing ~150k contracts traded vs the 170k you'd expect to see at this point.

- A stronger Asia-Pac close (Hang Seng +0.6%, Nikkei 225 +0.7%) failed to prop prices across Europe, with softer real estate and consumer discretionary names undermining European indices so far (CAC-40, Eurostoxx50 both down 0.4%, Spain and Italy underperform, down 0.7% and 1.1% respectively).

EQUITIES: Outlook in Eurostoxx 50 Futures Remains Bearish

- A bearish theme in Eurostoxx 50 futures remains in play and last week’s extension lower reinforces current conditions. Support at 4082.00, the Oct 4 low and a bear trigger, has been cleared. This confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. The focus is on the 4000.00 handle. Initial firm resistance is at 4148.00, the 20-day EMA.

- S&P e-minis maintain a softer tone and the contract started this week on a bearish note. Support at 4235.50, the Oct 4 low and bear trigger, has been breached. The break confirms a resumption of the downtrend and opens 4194.75, the May 24 low. Price remains below resistance at the 50-day EMA, at 4399.13. A clear breach of this average is required to strengthen a bullish condition. Initial resistance is at 4341.49, the 20-day EMA.

COMMODITIES: WTI Futures Trade Lower Again as Pullback from Last Friday’s High Extends

- WTI futures traded lower Tuesday as the pullback from last Friday’s $89.85 high extends. The medium-term trend condition is bullish and the latest pullback appears to be a correction. A resumption of gains would expose the bull trigger at $92.48, the Sep 28 high. Clearance of this hurdle would confirm a resumption of the uptrend. For bears, a move through $80.20, the Oct 6 low, would instead highlight a short-term top.

- Gold is holding on to the bulk of its recent gains and reversal from $1810.5, the Oct 6 low. The yellow metal has breached key resistance at $1953.0, the Sep 1 high, and $1987.5, the Jul 20 high. The break strengthens a bullish theme and opens $2003.4, a Fibonacci retracement point. Initial firm pivot support lies at $1912.7, the 50-day EMA. Clearance of this level is required to signal a short-term top and a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/10/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/10/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/10/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 25/10/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/10/2023 | 2035/1635 |  | US | Fed Chair Jerome Powell | |

| 26/10/2023 | 0030/1130 | ** |  | AU | Trade price indexes |

| 26/10/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/10/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 26/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 26/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/10/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 26/10/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/10/2023 | 1230/0830 | *** |  | US | GDP |

| 26/10/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2023 | 1245/1445 |  | EU | Press conference post- governing council meeting of ECB | |

| 26/10/2023 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 26/10/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 26/10/2023 | 1415/1615 |  | EU | ECB's Lagarde presents monetary policy decisions via Podcast | |

| 26/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/10/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/10/2023 | 1645/1745 |  | UK | BoE's Cunliffe Speaks at Fed Conference | |

| 26/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.