-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US MARKETS ANALYSIS - Focus Remains On Jobs

Highlights:

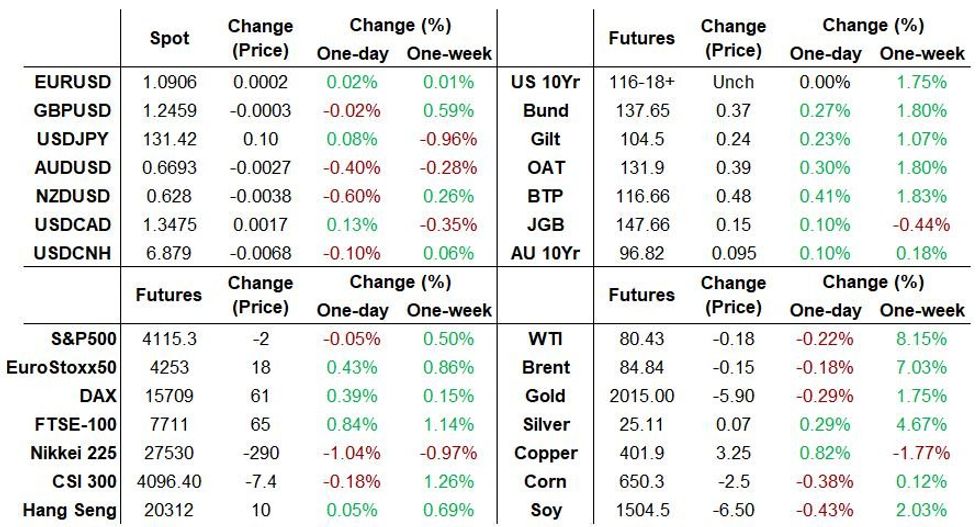

- Equities and bonds gained slightly in European morning trade, but have moved off highs as US desks come in

- The US dollar is trading mixed, with NZD and AUD underperforming in the FX space

- Focus is on US jobless claims and Canadian jobs data, ahead of the US employment report Friday

US TSYS: Consolidating Yesterday’s Rally, More Employment Data Lined Up

- Cash Tsys are off highs but nevertheless have unwound some of yesterday’s second half paring of gains, with the downside surprises in ADP employment and ISM services setting the tone ahead of payrolls landing tomorrow on Good Friday. In the interim, further employment data are in focus today in an otherwise light docket, with initial claims and Challenger job cuts.

- 2YY -5.2bp at 3.727%, 5YY -4.5bp at 3.326%, 10YY -2.6bp at 3.285% and 30YY -0.9bp at 3.562%.

- TYM3 trades unchanged at 116-18+ in a relatively narrow range, still off yesterday’s high of 116-30 which stopped just short of the bull trigger at 117-01+ (Mar 24 high).

- Data: Challenger Job Cuts Mar (0730ET), weekly jobless claims (0830ET)

- Fedspeak: Bullard (1000ET) with text + Q&A

- Bill issuance: US Tsy $60B 4W, $50B 8W bill auctions (1130ET)

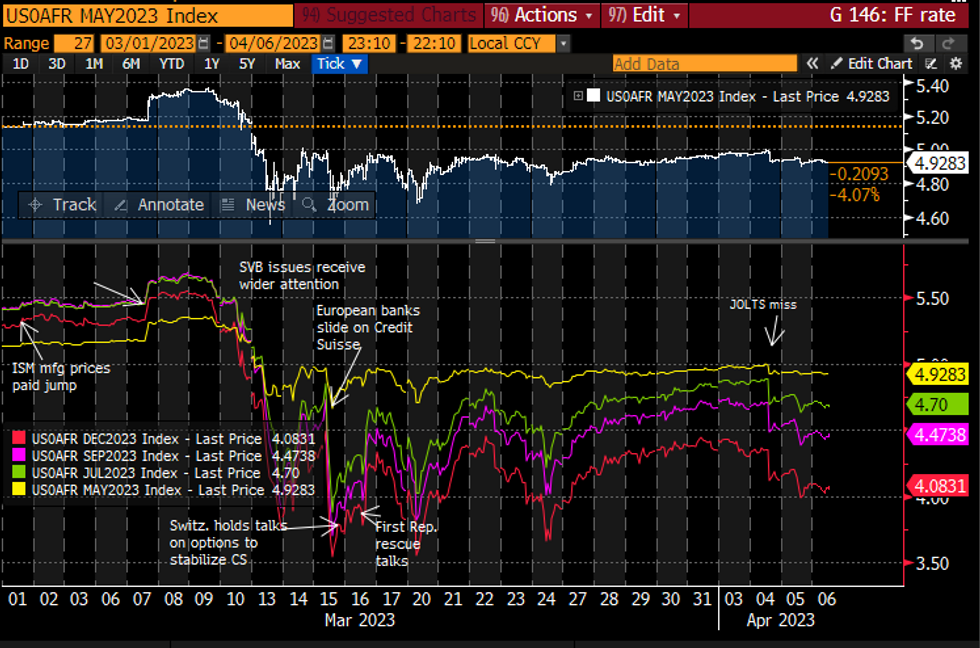

STIR: Fed Rate Path With Three Cuts To Year-End

- Fed Funds implied rates consolidate yesterday’s push off post-ADP/ISM service lows.

- 10bp hike from the effective 4.83% for May (-0.5bp), 13bp of cuts to Jul (unch), 36bp of cuts to 4.47% Sep (-0.5bp) and 75bp of cuts to 4.08% year-end (-1bp). The latter is down from 4.36% before JOLTS on Tue.

- Fedspeak: Bullard (non-voter) speaks 1000ET with text + Q&A but follows comments on Monday that the reaction to bank turmoil has been swift and appropriate and the Fed can proceed with mon pol to tackle inflation.

Source: Bloomberg

Source: Bloomberg

MNI RBNZ Review - April 2023: Surprise 50bp, Data Moderation To Determine May Outcome

- The RBNZ unexpectedly hiked rates 50bp to 5.25%, in contrast to the RBA’s pause at 3.6%. It was widely expected that rates would rise 25bp, following recent overseas banking turmoil and very soft Q4 GDP. 25bp was considered by the Committee but it opted for 50bp because inflation remains “too high and persistent” and the labour market too tight.

- With inflation still too high and the labour market too tight, and Q1 CPI (April 20) and wages/employment (May 3) data due before the May 24 meeting, which will also include updated forecasts, another 25bp is likely then.

- Click to view the full review:

MNI

RBNZ Review - April 2023

EUROPE SUPPLY: 10/20/30-year OATs

That was a decent French LT OAT auction with the lowest accepted price above the pre-auction mid-price for both OATs that were reopened. This was the launch auction for the 10-year 3.00% May-33 OAT and the first auction of both the 20-year 2.50% May-43 OAT (launched via syndication in September) and the 3.00% May-54 OAT (launched via syndication in February).

| 3.00% May-33 OAT* | 2.50% May-43 OAT | 3.00% May-54 OAT | |

| ISIN | FR001400H7V7 | FR001400CMX2 | FR001400FTH3 |

| Amount | E6.664bln | E2.068bln | E2.268bln |

| Previous | E5.055bln | E5bln | E5bln |

| Avg yield | 2.70% | 3.06% | 3.12% |

| Previous | 3.20% | 2.596% | 3.130% |

| Bid-to-cover | 2.03x | 2.22x | 2.01x |

| Previous | 2.27x | ||

| Avg Price | 102.64 | 91.64 | 97.69 |

| Low Price | 102.60 | 91.47 | 97.40 |

| Pre-auction mid | 91.33 | 97.34 | |

| Prev avg price | 90.09 | 98.471 | 97.422 |

| Prev low price | 90.03 | ||

| Prev mid-price | 89.90 | ||

| Previous date | 02-Mar-23 | 06-Sep-22 | 07-Feb-23 |

| Previous ISIN | FR001400BKZ3 | ||

| Previous bond | 2.00% Nov-32 OAT |

FOREX: Attention turns to the Canadian Employment data

- A mixed start for the USD, was in the green overnight, then pared some gains during the early European session, after Equities found a bid.

- The Dollar is now back on the front on the margin, leading against the Kiwi, up 0.52%, and trading circa flat versus the NOK, JPY, EUR, GBP.

- CHF still holds onto 0.20% gains versus the Greenback.

- Turnovers and volumes are on the low during this Easter week and ahead of the long Bank Holiday weekend.

- Most of the early action has been in Bond futures moving higher across the board, with some desks likely positioning for the US NFP release tomorrow.

- Note that all the markets in Europe and the UK will be closed, and US exchange will close early post the NFP release.

- Looking ahead, there's no tier 1 data for the EU and the US, but all the attention will be on the Canadian employment data, which has always good potential to move the CAD.

- Note that there's large option expiry for today in USDCAD, with 5.47bn between 1.3430/1.3500.

FX OPTION EXPIRY (updated)

Of note:

EURUSD 3.95bn between 1.0875/1.0950.

USDCAD 5.47bn between 1.3430/1.3500.USDJPY 1.85bn at 131.00/131.50.AUDNZD 1.09bn at 1.0650 (tue).- EURUSD: 1.0875 (1.02bn), 1.0890 (256mln), 1.0895 (563mln), 1.0900 (219mln), 1.0915 (301mln), 1.0920 (733mln), 1.0925 (287mln) 1.0950 (574mln), 1.1000 (255mln).

- USDJPY: 130.00 (740mln), 130.50 (698mln), 131.00 (925mln), 131.40 (460mln), 131.50 (460mln), 132.00 (566mln).

- USDCAD; 1.3430 (913mln), 1.3435 (1.02bn), 1.3455 (2.02bn), 1.3480 (423mln), 1.3500 (1.09bn).

- AUDUSD: 0.6725 (648mln).

EQUITIES: S&P E-Minis Short-Term Trend Needle Still Points North

- In the equity space, S&P E-Minis maintains a bullish tone and pullbacks are considered corrective. Price has recently breached 4119.50, the Mar 6 high, reinforcing a bullish theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4039.75, the 50-day EMA.

- EUROSTOXX 50 futures maintain a firmer tone despite the latest pullback. Price has recently pierced resistance at 4268.00, Mar 6 high and a key hurdle for bulls. A clear break of this level would strengthen bullish conditions and open 4300.00 next. Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4173.00, the 20-day EMA.

COMMODITIES: WTI Bull Cycle Remains In Play

- On the commodity front, the trend condition in Gold remains bullish and this week’s resumption of the uptrend reinforces current conditions. The yellow metal has cleared resistance at 2009.7, the Mar 20 high, to post fresh YTD highs and signal scope for a climb towards $2034.0 next, the 2.00 projection of the Sep 28 - Oct 4 rally from Feb 28. On the downside, key support has been defined at $1934.3, the Mar 22 low - a break would highlight a potential reversal.

- In the Oil space, WTI futures remain in a bull cycle and Monday’s gap higher strengthens this current condition. The contract has touched a high of $81.81 this week, above key resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and the gap low on the daily chart. A pullback, if seen, would be considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/04/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/04/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2023 | 1400/1000 |  | US | St. Louis Fed's James Bullard | |

| 06/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/04/2023 | 1230/0830 | *** |  | US | Employment Report |

| 07/04/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.