-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US MARKETS ANALYSIS - GBP Inching Higher as Sunak Victory Looks Likely

Highlights:

- GBP inching higher as Sunak victory looking likely

- Fed rate path continues to ponder Dec stepdown

- Hong Kong stocks, China currency spirals after Xi's third term confirmation

US TSYS: Bull Flattening With PMIs Headlining The Session

- Cash Tsys have seen a mixed overnight with equally mixed China data plus markets trading an increasingly likely announcement of Sunak as PM in the UK as a sign of stability. The net result has been a bull flattening, with the front-end consolidating lower in Fed rate expectations and the long-end and particularly very long-end retracing after notable pressure on the 30YY late last week saw the US re-overtake the UK.

- 2YY +0bps at 4.473%, 5YY -3.6bps at 4.306%, 10YY -4.6bps at 4.171%, and 30YY -4.8bps at 4.286%.

- TYZ2 trades 9 ticks higher at 110-02+ on above average volumes, off overnight highs of 110-15 that came close to testing resistance at the 20-day EMA of 110-16+.

- Data: Preliminary PMIs for October headline the docket at 0945ET but there is also Chicago Fed national activity index at 0830ET for September.

- Bill issuance: US Tsy $57B 13W, $45B 26W bill auctions – 1130ET

STIR FUTURES: Fed Rate Path Continues To Ponder Dec Stepdown

- Fed Funds implied hikes are off overnight lows but hold near late Friday levels after WSJ focus on a potential stepdown to a 50bp hike in Dec and a dovish Daly.

- 77bp for Nov 2, 137bps to 4.45% Dec, terminal 4.87% for May’23 (off highs of 5.02% early Fri) and 4.57% for Dec’23.

- Little reaction in ECB pricing to the miss for EA PMI mfg flash let alone spillover to the US, but remains to be seen if that’s the case with the US flash PMIs at 0945ET. Fed in media blackout.

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

CNH at Record Lows as Hong Kong Stocks Spiral

- The tough local finish for the Hang Seng (down 6%) and CSI-300 (down 2.7%) summarises the market view of confirmation for a third term for Xi Jinping - and the reshuffle of the politburo standing committee (including the removal of Li Keqiang and Wang Yang).

- Most analysts across both markets and politics are pointing to the removal of pro-reform voices and those arguing for market/economic liberalisation as the key factor behind the move, with some of the largest decliners including the likes of Alibaba and Tencent, both of which fell over 9% in Hong Kong trade.

- Moves have been exacerbated by reports of foreign investors being net sellers of a record $2.5bln in Chinese equity markets today, via stock connect link data.

- This puts USD/CNH north of 7.30 for the first time on record and will keep markets on watch for any further intervention. State banks were said to be selling dollars to contain the rise in the onshore USD/CNY rate last week, with the 7.25 level being defended.

FOREX: GBP Builds Off Lows as Sunak Seen as Likely PM

- Markets have largely shrugged off a dire set of PMI manufacturing and services numbers from across the UK, German and France, with conviction light ahead of the ECB rate decision on Thursday.

- GBP is firmer ahead of the likely victory for Rishi Sunak in the race to be head of the Conservative party and new UK PM. Markets are clearly of the view he will take a steadier approach to public finances, helping relieve Gilt yields and steady UK currency markets. He is the current front-runner, with polling closing later today and markets on watch to see if Penny Mordaunt garners sufficient backing from MPs to take the race to the next stage.

- JPY is the poorest performer headed into the European open as markets bounce after suspected intervention on Friday (and possibly overnight). Authorities rolling out now familiar language on FX vigilance, but is having little impact on the pair which continues to inch higher having recovered off 145.56 overnight lows.

- Nearby tech levels are scant given the acute volatility Friday/Overnight, with 149.71 marking the first upside level ahead of Friday's 151.95. BoJ policy meeting Friday now the focus, with bank exp. To boost CPI forecast, cut growth view.

- With the Fed and ECB inside their pre-meeting media blackout periods, there are few central bank speakers to note, with focus turning to the prelim October US PMI release.

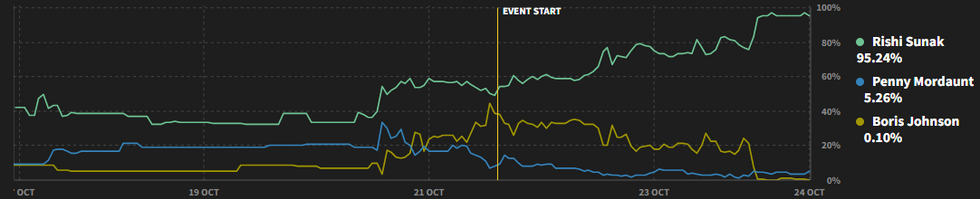

Signals Point To Sunak Coronation As New PM, Mordaunt Struggles For Support

It is looking increasingly likely that former Chancellor of the Exchequer Rishi Sunak will be made the next leader of the Conservative Party at 1400BST (0900ET, 1500CET), when nominations for the leadership contest close, given that he may be the only candidate to gain the required nominations to get onto the ballot.

- Sunak's potential coronation as leader without having to face a members vote comes following the announcement by former PM Boris Johnson that he would not be running in the contest (see 2312BST bullet on 23 Oct).

- The other publicly announced figure in the contest, Leader of the Commons Penny Mordaunt, is well short of the 100 signatures from Conservative MPs to get on the ballot (27 public backers at present according to the Guido Fawkes blog).

- Data from Smarkets shows an implied probability of 95.2% that Sunak becomes the next Conservative Party leader, and therefore PM. While his campaign so far has been a low-key one, he is likely to seek to govern according to his summer campaign that he lost to Liz Truss. This focused on a fairly traditional 'fiscal conservative' model, with maintaining sound public finances put above either tax cuts or broad spending commitments in terms of govt' priorities.

Source: Smarkets

Source: Smarkets

Mordaunt Campaign Says They Have Backing Of 90 MPs-Reports

A number of Westminster journalists reporting comments from an unnamed source within the campaign of Penny Mordaunt stating that she has the backing of 90 Conservative MPs, just 10 short of the 100 threshold required to get onto the ballot and force a members vote.

- Following the withdrawal of former PM Boris Johnson it appeared that former Chancellor of the Exchequer Rishi Sunak was on course for a coronation, with Mordaunt looking well short of the number of backers required to get onto the ballot, and over half the parliamentary party supporting Sunak.

- Nominations close today 1400BST (0900ET, 1500CET), with the number of backers for each prospective candidate announced shortly afterwards.

- However, if Mordaunt can pull off an unexpected surge and get onto the ballot then it is all to play for, with Mordaunt having the potential to beat Sunak in an online vote of Conservative party members.

- If the contest does go to a members vote, the winner would be announced on Friday 28 October.

- Betting markets still giving an overwhelming +95% implied probability that Sunak becomes next Conservative leader and PM, but if Mordaunt makes the ballot this pricing will change dramatically.

Eyeing A PMI Recovery After October's Political Storm?

An ugly set of October flash UK PMIs, but limited market reaction (Gilts still hovering around session lows, which is where they were prior to the data release).- Perhaps there is a sense that political uncertainty and related impact on interest rates/consumer confidence (political uncertainty is named 7 times in the S&P global press release) could be temporary, with a rebound due in the November survey if/when the UK political landscape calms.

- Indeed, Gilt yields and BoE hike expectations have already calmed considerably already since late September/early October.

- From the release: "Optimism levels hit a two-and-a-half year low in both the manufacturing and service sectors, with the slump in expectations overwhelmingly linked to political uncertainty, rising interest rates and worries about the impact of stubbornly high inflation on customer demand.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2022 | 1300/1400 |  | UK | Deadline for MPs to nominate next Cons leader | |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/10/2022 | 1700/1800 |  | UK | Result of 1st round of MP voting for next Cons leader | |

| 24/10/2022 | 2000/2100 |  | UK | Result of 2nd round of MP voting for next Cons leader | |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0855/0955 |  | UK | BOE Pill at ONS ‘Understanding the cost of living through statistics’ | |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/10/2022 | 1755/1355 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.