-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - GBP Slips, BoE Pricing Eases on Soft Wages

Highlights:

- OER volatility could pose problems for today's core CPI

- GBP slips, BoE pricing eases as wages come in soft

- JPY one-week vols hit new YTD high as contract captures BoJ

US TSYS: Underperforming Gilts, CPI In Focus Before 10Y Supply

- Cash Tsy yields sit just 0.5-1.5bp lower today, underperforming European FI and Gilts in particular, with the latter rallying first on softer labor data before very strong demand for a 10-year auction. The limited commitment behind the move in Tsys comes ahead of today’s key CPI report for February (preview).

- TYM4 trades at 111-20+ (+ 01+) having kept narrow ranges overnight on thin cumulative volumes of 210k. The bull cycle remains in play with resistance at 112-04+ (Mar 8 high) whilst a hawkish CPI report could bring support at 111-02 (20-day EMA) into play.

- The 10-year auction provides interest later in the session, after yesterday's relatively well-received 3-year auction.

- Data: CPI Feb (0830ET), Real av hourly earnings (0830ET), Monthly budget statement Feb (1400ET)

- Note/bond issuance: US Tsy $39B 10Y Note re-open auction, 91282CJZ5 (1300ET)

- Bill issuance: US Tsy $80B 42D CMB (1130ET)

STIR: Still Not Quite Committed To First Fed Cut In June Ahead Of CPI

- Fed Funds implied rates consolidate yesterday’s push higher ahead of today’s CPI report – preview here: https://roar-assets-auto.rbl.ms/files/60293/USCPIPrevMar2024.pdf

- Cumulative cuts from 5.33% effective: 0.5bp Mar, 5.5bp May, 21bp Jun, 37bp Jul and 90bp Dec.

- The latter has recovered from the more than 100bp of cuts briefly touched after payrolls, but remains off the almost 75bp of cuts seen in late Feb that came close to matching the median dot for 2024 from the Dec SEP.

- There’s been little intraday impact from the February NFIB survey which included a range of softer labor indicators along with a moderation in pricing plans.

US CPI Preview: OER Volatility Poses Risks To Expected Core Reversion

- We have published and e-mailed to subscribers the MNI US CPI Preview.

- Please find the full report including MNI analysis and views from 21 analysts here: https://roar-assets-auto.rbl.ms/files/60293/USCPIPrevMar2024.pdf

OI Points To Mix Of Net Short Setting & Long Cover On Monday

The combination of yesterday’s move lower in Tsy futures and preliminary OI data points to a mix of net short setting (TY & US futures) and net long cover (TU, FV, UXY & WN futures) on Monday.

- The positioning swings were close to offsetting in net curve DV01 equivalent terms.

- Some supply-related pressure appeared to be evident during much of the NY morning.

- Overall Tsy positioning seems less short than it did a few weeks ago, so the pockets of net long cover may have represented some profit taking in recently set longs ahead of today's CPI data.

| 11-Mar-24 | 08-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,619,148 | 3,662,362 | -43,214 | -1,679,958 |

| FV | 5,837,924 | 5,854,612 | -16,688 | -720,889 |

| TY | 4,293,279 | 4,261,985 | +31,294 | +2,084,589 |

| UXY | 2,036,872 | 2,039,387 | -2,515 | -226,860 |

| US | 1,475,912 | 1,473,374 | +2,538 | +349,708 |

| WN | 1,578,513 | 1,581,159 | -2,646 | -568,087 |

| Total | -31,231 | -761,497 |

OI Points To Mix Of Net Short Setting & Long Cover In SOFR Futures On Monday

The combination of yesterday's move lower in SOFR futures and preliminary OI data point to net short setting as the dominant factor in the whites, greens and blues, while net long cover dominated in the reds.

- The most meaningful swing in contract specific OI came via apparent net short setting in SFRH4 (the rest of the whites saw modest long cover).

- This may have been linked to hedging against option trades, with little in the way of meaningful outright futures trades seen on the day.

- Today's CPI release will obviously be key for price action.

| 11-Mar-24 | 08-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,223,236 | 1,224,125 | -889 | Whites | +62,703 |

| SFRH4 | 1,097,620 | 1,031,962 | +65,658 | Reds | -20,723 |

| SFRM4 | 1,094,903 | 1,095,366 | -463 | Greens | +12,900 |

| SFRU4 | 888,747 | 890,350 | -1,603 | Blues | +6,628 |

| SFRZ4 | 1,110,446 | 1,122,560 | -12,114 | ||

| SFRH5 | 674,297 | 677,603 | -3,306 | ||

| SFRM5 | 707,904 | 710,144 | -2,240 | ||

| SFRU5 | 627,765 | 630,828 | -3,063 | ||

| SFRZ5 | 693,940 | 697,861 | -3,921 | ||

| SFRH6 | 468,840 | 459,955 | +8,885 | ||

| SFRM6 | 490,344 | 484,259 | +6,085 | ||

| SFRU6 | 345,286 | 343,435 | +1,851 | ||

| SFRZ6 | 343,360 | 339,355 | +4,005 | ||

| SFRH7 | 191,709 | 190,650 | +1,059 | ||

| SFRM7 | 180,972 | 181,548 | -576 | ||

| SFRU7 | 150,185 | 148,045 | +2,140 |

EUROPE ISSUANCE UPDATE:

Netherlands DSL auction results

- E2.05bln of the 2.50% Jan-30 DSL. Avg yield 2.481%.

- Very strong gilt auction with the second highest bid-to-cover of this year (just below the 3.62x seen in January for the 4.75% Oct-43 gilt). Bigger picture, it is also the second highest bid-to-cover since April 2020 (which was the last time there was a higher bid-to-cover at a 10-year auction). The tail of 0.2bp was also tight.- The price of the 4.625% Jan-34 gilt has risen from 105.581 pre-auction to a high of 105.792 post-auction.

- Gilt futures spiked 20 ticks higher on the auction results to a high of 100.17 (but have pared half of that gain at writing).

- GBP3.75bln of the 4.625% Jan-34 Gilt. Avg yield 3.927% (bid-to-cover 3.61x, tail 0.2bp).

- Decent Schatz auction with the lowest accepted price of 99.415 above levels seen in the 5 minutes before the auction close. Very little market reaction to the publication of the results or the auction closing.

- E4.5bln (E3.647bln allotted) of the 2.50% Mar-26 Schatz. Avg yield 2.8% (bid-to-offer 2.14x; bid-to-cover 2.64x).

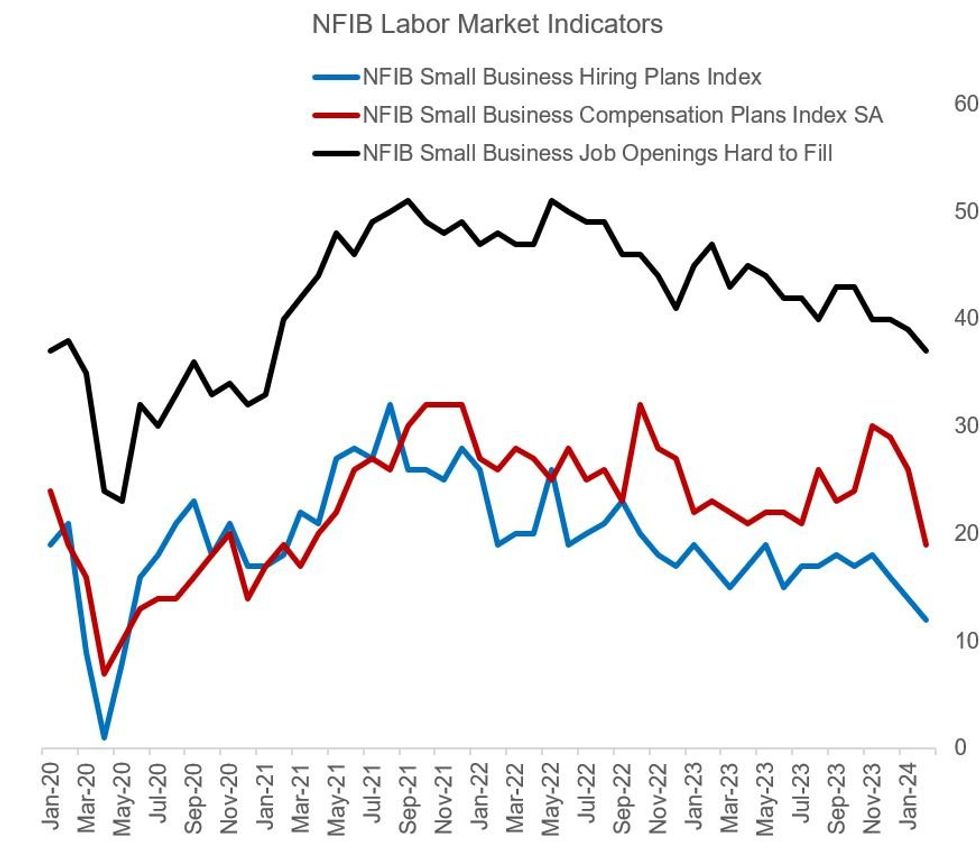

US DATA: Softer Labor Market Figures Stand Out In Weak NFIB Survey

The headline Optimism index in February's NFIB Small Business Economic Trends survey unexpectedly dipped to 89.4 from 89.9 in January, defying consensus expectations for a tick up to 90.5 and the weakest reading since May 2023. Overall the internals of the report were soft, particularly regarding forward-looking expectations for hiring and wages - another set of evidence that the US labor market is loosening from very tight conditions in 2021/22.

- The net percentage of small businesses planning to hire in the next 3 months fell to 12%, down 2pp to the lowest since May 2020. 37% of firms reported that they had job openings they couldn't fill, 2pp down from January and the lowest since January 2021.

- Against this backdrop, wage pressures appear to be diminishing: the net percentage reporting raising compensation fell 4pp to 35%, the lowest reading since May 2021, while just 19% on a net basis plan compensation increases - down 7pp and the lowest since March 2021.

- This brought the percentage of firms reporting labor quality as their "biggest problem" down 5pp to 16% - the lowest since April 2020. Those citing labor costs as their "biggest problem", conversely, ticked higher to 11%, 2pp below the Dec 2021 high of 13% - and 23% cited "inflation", up 3pp and replacing "labor quality" as the "biggest problem".

- While the latter gives some inflationary undertones to the report, it should be noted that the net percent raising selling prices fell 1pp to 21%, lowest since January 2021.

- Given that much of the weak labor data data was released separately last week in the monthly NFIB jobs report, today's release brought fairly limited market reaction, but should add to the case for Fed rate cuts later this year.

Source: NFIB, BBG, MNI

Source: NFIB, BBG, MNI

FOREX: GBP Skids as Wage Data Prompts Reassessment of BoE Trajectory

- GBP trades poorly on the back of a softer-than-expected set of wage numbers, which have prompted markets to re-initiate easing bets for 2024. OIS markets have added close to 6bps of implied easing across this calendar year - making for full pricing of 3x25bps cuts by December. Resultingly, GBP/USD has been marked lower and is refuting the signals triggered by the recent bullish breakout. Pair is through the Monday and Friday lows, and now targets 1.2723 for direction.

- Unwinding some of the recent price action, JPY trades poorly on an intraday basis but is still holding the bulk of the recent strength. An appearance from BoJ's Ueda overnight helping trigger a modest wave of JPY selling, after he stated that he sees weakness in consumption statistics around non-durable goods in Japan - throwing a small dose of coldwater on recent BoJ normalization speculation. Nonetheless, a March hike remains well priced in JPY markets.

- NOK, SEK sit furtively firmer, but are generally trading with little conviction. Risk appetite seems key - and with European and US equity futures broadly rangebound early Tuesday, risk-proxy currencies should follow suit.

- US CPI takes focus going forward, with markets expecting headline Y/Y inflation to hold at 3.1%, but for core to moderate by 0.2ppts to 3.7%. BoE's Mann and Bailey are set to make appearances later today, following from Mann's comments late yesterday, where she reiterated her view that inflation still remains too strong in the UK.

FX OPTIONS: JPY Vols Marked to YTD Highs as One-Week Captures BoJ

- Overall options volumes were more subdued Monday, with total notional of ~$75bln despite a much busier Asia-Pac session. So far Tuesday, activity is faring better, with outsized interest in USD/JPY (again), USD/INR and AUD/JPY leading.

- USD/JPY downside protection has been the dominant theme Tuesday - evident in interest in Y148.00 and Y150.00 put strikes. One-week vols now capture the March BoJ decision, and implied has been marked up to 12.75 points - the highest since December last year and the last 'live' BoJ meeting (although back in Dec, the contract also captured Fed, ECB event risk).

- With implied ticking higher, an ATM straddle implies a break-even of just over 200 pips for a Tuesday expiry - relative to a ~150 pip swing on an option struck to expire one day prior.

- Most notable strike rolling off at today's cut - and just 90 minutes after the US CPI print - include $1.2bln at 1.0900-20 in EUR/USD, $760mln at Y147.40-60 in USD/JPY and A$1.1bln at $0.6330-50 in AUD/USD.

FX OPTIONS: Expiries for Mar12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0785-00(E699mln), $1.0835-50(E596mln), $1.0900-20(E1.2bln), $1.1010-30(E1.1bln)

- USD/JPY: Y147.40-60($759mln), Y148.25($1.9bln), Y149.00($630mln), Y151.50($2.2bln)

- EUR/GBP: Gbp0.8580(E682mln)

- AUD/USD: $0.6530-50(A$1.1bln)

- USD/CAD: C$1.3695-05($900mln)

EQUITIES: Eurostoxx 50 Trend Conditions Remain Bullish, Highlighting Positive Sentiment

- A bullish theme in Eurostoxx 50 futures remains intact and last week’s fresh cycle high reinforces this theme. Moving average studies remain in a bull-mode position - this continues to highlight positive market sentiment. Sights are on the psychological 5000.00 handle next. Further out, scope is seen for a climb towards a bull channel top at 5035.50. The channel is drawn from the Oct 27 low. Initial firm support lies at 4861.00, the 20-day EMA.

- The trend condition in S&P E-Minis is bullish and the latest pullback is considered corrective. Last week’s fresh highs reinforce current conditions. Note that price action continues to highlight the fact that corrections are shallow. This is a bullish signal highlighting positive market sentiment. Support to watch is 5137.36 the 20-day EMA. A clear break of this average would open 5022.53, the 50-day EMA. Sights are on 5300.00 next.

COMMODITIES: Gold Recovers From Monday's Low, Trades Below Recent Highs

- The WTI futures trend condition remains bullish despite the latest pullback - a correction. The recent breach of key resistance at $79.09, the Jan 29 high, reinforces a bullish theme. The clear break highlights potential for a continuation towards $81.70, a Fibonacci retracement. On the downside, support to watch is $76.57, the 50-day EMA. A break of this average would instead signal a possible top.

- Gold remains firm on the back of its latest rally and price is trading just below its recent highs. The yellow metal last week traded above $2135.4, the Dec 4 high, to deliver a fresh all-time cycle high. The break reinforces bullish conditions and signals scope for $2206.6 next, a Fibonacci projection. S/T conditions are overbought, however, this does not appear to be a concern for bulls - for now. Firm support is at $2088.5, the Dec 28 high and 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/03/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/03/2024 | 1100/1100 |  | UK | BOE's Mann on NIESR Panel | |

| 12/03/2024 | - | *** |  | CN | Money Supply |

| 12/03/2024 | - | *** |  | CN | New Loans |

| 12/03/2024 | - | *** |  | CN | Social Financing |

| 12/03/2024 | 1230/0830 | *** |  | US | CPI |

| 12/03/2024 | 1230/0830 | * |  | CA | Intl Investment Position |

| 12/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/03/2024 | 1445/1545 |  | EU | ECB's Elderson at 'banking sector and climate...' workshop | |

| 12/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/03/2024 | 1615/1615 |  | UK | BOE's Bailey panellist at the Banca d'Italia Symposium | |

| 12/03/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/03/2024 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/03/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/03/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/03/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 13/03/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 13/03/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/03/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/03/2024 | 1145/1245 |  | EU | ECB's Cipollone at conference in Milan | |

| 13/03/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/03/2024 | 1400/1000 | * |  | US | Services Revenues |

| 13/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/03/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.