-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - German 10y Yield Crests at New High

Highlights:

- German 10y yield crest at new cycle high, despite slowing German regional inflation

- Last minute deal to avert government shutdown seen as unlikely

- USD uptrend eases, helping alleviate oversold condition in EUR/USD, GBP/USD

US TSYS: Tsy Curves Extend Steeper, New 16Y High 10Y Yield 4.6447%

- Cash Tsys are trading mixed, short end firmer (TUZ3 +.88) as curves add to Wednesday's move back to mid-May highs (3M10Y +3.037 at -86.342, 2Y10Y +3.738 at -49.469). Similarly, 10Y Treasury yields climb to new 16Y high of 4.6427% (+.0373).

- The bear trend in Treasuries with TYZ3 futures extending losses, currently at 107-17.5 (-1 ). Moving average studies remain in a bear mode position, highlighting a clear downtrend with focus on 107-05+ and 106-23, the 1.382 and 1.50 projections of the Jul 18 - Aug 4 - Aug 10 price swing. On the flipside, firm resistance is at 109-13, the 20-day EMA.

- Economic data includes weekly claims, GDP and PCE figures at 0830ET, Pending Home Sales at 1000ET followed by Kansas City Fed Mfg at 1100ET.

- Scheduled Fed speakers kicks off with Chicago Fed Goolsbee moderated Q&A at 0900ET. Later this afternoon, Fed Gov Cook attends a banking forum at 1300ET, while focus is on a livestreamed townhall event with Fed Chairman Powell at 1600ET. Richmond Fed Barkin on monetary policy at a Money Markets event at 1900ET.

- US Treasury supply wraps up the week with $85B 4W and $75B 8W bill auctions at 1130ET, $37B 7Y Note auction (91282CHZ7) at 1300ET.

EUROPE ISSUANCE UPDATE:

Italy 5/10-Yr BTP and CCTeu Result

- E5bln of the 4.10% Feb-29 BTP. Avg yield 4.41% (bid-to-cover 1.36x)

- E3bln of the 4.20% Mar-34 BTP. Avg yield 4.93% (bid-to-cover 1.42x)

- E750mln of the 0.50% Apr-26 CCTeu. Avg yield 4.12% (bid-to-cover 2.00x)

- E750mln of the 0.75% Oct-30 CCTeu. Avg yield 4.89% (bid-to-cover 1.99x)

FOREX: EUR Shrugs Off Softer German Regional CPIs, Takes Lead from Yields

- Focus ahead turns to the national German CPI print after this morning's regional releases pointed toward an inline-with-expectations print. Consensus looks for 0.3% M/M and 4.6% Y/Y. Markets generally shrugged off the softer-than-previous North-Rhine Westphalia and Bavaria inflation data, with EUR instead watching the inexorable rise in 10y yields across Germany: the 10y Bund yield has risen to fresh cycle highs, touching the best level since 2011.

- GBP/USD defying the bearish near-term outlook to rise to a session high of 1.2175 in recent trade, benefiting from the softer USD backdrop and allowing EUR/GBP to post a second session of losses after the cross rejected a test of the key 200-dma resistance at 0.8710.

- Any further faltering of the USD rally should allow overbought technical conditions to subside: EUR/USD, GBP/USD (and to a lesser extent, USD/JPY) had posted their most oversold technical backdrop since April last year earlier this week - meaning markets are likely undergoing a corrective recovery, but the medium-term USD uptrend remains intact regardless.

- The AUD is outperforming modestly, allowing AUD/USD to bounce off the cycle lows posted yesterday at 0.6331. Nonetheless, yesterday's highs remain intact for now at 0.6409.

- Outside of Europe, weekly US jobless claims are on the docket as well as the tertiary read for Q2 GDP - expected to be notched slightly higher to 2.2% from 2.1% previously.

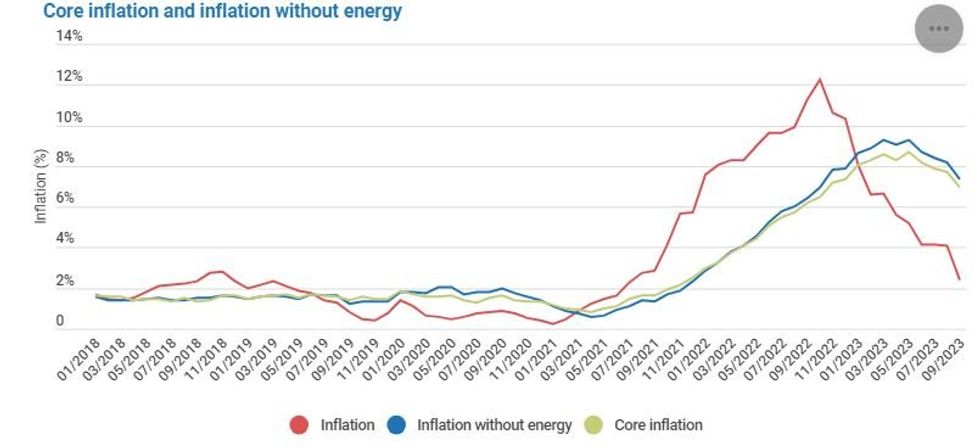

Inflation Slows Sharply To 2+ Year Lows

Belgian flash September CPI came in at 2.39% Y/Y (vs 4.09% prior), the lowest since July 2021, with a M/M drop of 0.69%. Core CPI dropped to 6.95% Y/Y vs 7.70% prior (and an 8.7% peak in May).

- The disinflation evidenced by HICP was even more dramatic, with an estimate of just 0.7% Y/Y vs 2.4% in August. That would mark the lowest Y/Y reading since February 2021.

- Belgium is the 6th highest weighting in the Eurozone HICP basket at 4% and thus this presents an additional disinflationary risk to Friday's consensus euro estimate of 4.5% Y/Y (following on from slightly softer-than-expected German state and Spanish prints).

- Per StatBel, the biggest contributors to inflation in September were alcoholic beverages, motor fuels, and travel. Pulling down inflation were airfares, confectionery, bread and cereals, hotel rooms, natural gas, vegetables, meat, non-alcoholic beverages, fruit, and dairy products.

Source: Statbel

Source: Statbel

Cable Climb Narrows Gap With Sizeable Option Strike

- GBP/USD spot improving further in recent trade, keeping GBP among the strongest performing currencies in G10 Thursday. A positive close for GBP/USD today would be first in seven sessions -and has allowed the technically oversold condition to abate slightly.

- Spot has narrowed the gap with the most notable option strike for the pair - which may have helped aide the move higher - £1.8bln rolling off at 1.2195-00 today.

- Nonetheless, there are few signs of a broader reversal just yet, with GBP/USD still below the weekly high at 1.2265 as well as the more notable resistance levels of 1.2354 - marking the 23.6% retracement for the July-September downleg.

FX OPTIONS: Expiries for Sep28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E593mln), $1.0665-70(E910mln)

- USD/JPY: Y144.90-00($1.2bln), Y145.70-76($2.0bln), Y146.60($1.5bln), Y147.50-70($1.2bln)

- GBP/USD: $1.2000(Gbp1.2bln), $1.2200(Gbp1.4bln)

- EUR/GBP: Gbp0.8640(E770mln)

- AUD/USD: $0.6600(A$782mln), $0.6650(A$832mln), $0.6685(A$521mln)

- USD/CAD: C$1.3450($682mln), C$1.3530-35($561mln)

- USD/CNY: Cny7.3070($1.1bln)

BONDS: Gilts Lead Global Rout

Global core FI has sold off relentlessly in European morning trade Thursday in a continuation of the recent "higher-for-longer" bearish price action, with Gilts leading the way lower in a steepening move.

- UK yields are up double-digits across most of the curve, and rates markets are beginning to re-price another full 25bp hike from the BoE in this cycle. MNI's event with BoE's Hauser has just gotten underway; we hear from the MPC's Greene later.

- Bund yields have hit fresh post-2011 highs and 10Ys starting to eye the 3% mark amid heavy futures trading volumes.

- The highlight of the schedule coming into the session was Spanish and German preliminary September inflation, which has come in line if not a touch below expectations, but that's done little to stem the broader bond rout.

- Periphery spreads are a little wider, led by BTPS (10Y/Bund up 2+bp).

- The Tsy curve is also bear steepening but yield moves have been relatively modest, with yields up 1-3bp through 10Y but 30s up 4bp.

- On the US data docket, Initial jobless claims and final Q2 GDP (including historic comprehensive revisions), with Fed speakers including Goolsbee, Cook, and Powell. $37B in 7Y supply is coming up as well.

Latest levels:

- Dec US 10Y futures (TY) down 1.5/32 at 107-17 (L: 107-15.5 / H: 107-27)

- Dec Bund futures (RX) down 94 ticks at 127.70 (L: 127.60 / H: 128.59)

- Dec Gilt futures (G) down 143 ticks at 93.47 (L: 93.43 / H: 94.74)

- Italy / German 10-Yr spread 1.8bps wider at 196.4bps

EQUITIES: Price Action Wednesday Marks Extension of Current Downleg in E-Mini S&P

- Eurostoxx 50 futures maintain a softer tone following last week’s move lower. This week’s extension also reinforces current conditions. Key support at 4210.00, the Sep 8 low, has been breached. The clear break confirms a resumption of the downtrend that started late July and paves the way for a move towards 4109.90, a Fibonacci projection. Key short-term resistance has been defined at 4359.00, the Sep 15 high. A break would be bullish.

- A bear cycle in S&P E-minis remains in play and the contract traded lower Wednesday, extending the current downleg. Last week’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. This breach reinforced bearish conditions and signals scope for a continuation lower. Sights are on 4300.62, a Fibonacci retracement point. Initial firm resistance is 4485.10, the 50-day EMA. Short-term gains would be considered corrective.

COMMODITIES: WTI Futures Eye Resistance at $97.08 Next

- The uptrend in WTI futures remains intact and this week’s recovery has confirmed a resumption of the trend - resistance at $92.43, Sep 19 high, has been cleared. This maintains the bullish price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode position, reflecting the market's positive sentiment. Sights are on $97.08 next, a Fibonacci projection. Key support has been defined at $88.19, the Sep 2 low.

- Gold sold off sharply yesterday, reinforcing bearish conditions. This week’s move lower has resulted in a break of support at $1901.10 and this has been followed by a move through $1884.9, the Aug 21 low. The break confirms a resumption of the downtrend that started off the early May high. Attention turns to $1865.8, a Fibonacci retracement point. On the upside, initial resistance is at yesterday’s high of $1903.9.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/09/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 28/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/09/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 28/09/2023 | 1230/0830 | *** |  | US | GDP |

| 28/09/2023 | 1300/0900 |  | US | Chicago Fed's Austan Goolsbee | |

| 28/09/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 28/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/09/2023 | 1445/1545 |  | UK | BOE's Greene speaks on panel | |

| 28/09/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 28/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 28/09/2023 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 28/09/2023 | 2000/1600 |  | US | Fed Chair Jerome Powell | |

| 28/09/2023 | 2300/1900 |  | US | Richmond Fed's Tom Barkin | |

| 29/09/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/09/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 29/09/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 29/09/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 29/09/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/09/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/09/2023 | 0645/0845 | ** |  | FR | PPI |

| 29/09/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 29/09/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/09/2023 | 0740/0940 |  | EU | ECB's Lagarde speaks at IEA-ECB-EIB Conference | |

| 29/09/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/09/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/09/2023 | - |  | UK | Publication of the Treasury bill calendar for October-December 2023. | |

| 29/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/09/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/09/2023 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 29/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 29/09/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 29/09/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 29/09/2023 | 1645/1245 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.