-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Implied Vols Surge Pre-Meeting

Highlights:

- JPY implied vol surging as markets wary of out-sized market moves post-BoJ

- Fed rate expectations pick up where they left off after extended US weekend

- Goldman Sachs, Morgan Stanley get earnings underway once more

US TSYS: Bear Steepening With Earnings and Empire Ahead

- Cash Tsys have bear steepened from Friday’s after yesterday’s MLK day closure, with the front end unchanged but long end yields drifting 4-6bps higher in a continuation of Friday’s paring of gains seen after Thursday’s in-line CPI print. Moves are potentially buoyed by stronger than expected China data and German ZEW sentiment overnight although it’s not reflected in near-term Fed pricing.

- A lighter docket today ahead of tomorrow’s stacked session (plus the BoJ overnight) although equity earnings resume, including Goldman and Morgan Stanley before the NY open today.

- TYH3 edges slightly lower from yesterday’s thin session to trade 7 ticks lower from Friday’s close at 114-17+, with modestly below average volumes. The trend signal remains bullish with resistance at 115-15+ (Jan 13 high) and support at 113-26+ (20-day EMA).

- Data: Empire mfg Jan (0830ET)

- Fedspeak: NY Fed’s Williams (1500ET) welcoming remarks, no text

- Bill issuance: US Tsy $60B 13W, $48B 26W bill auction (1130ET)

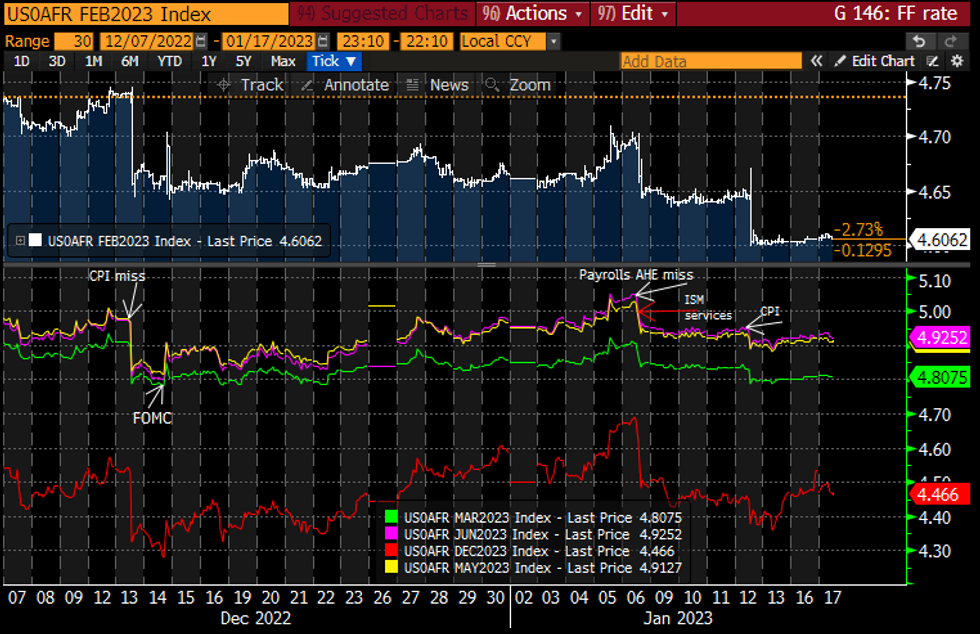

STIR FUTURES: Fed Rate Path Where It Left Off Friday

- Fed Funds implied hikes have seen surprisingly little spillover from stronger than expected China data and German ZEW sentiment earlier.

- 27.5bp for Feb, cumulative 48bp for Mar, 60bp to terminal 4.92% Jun before 46bp of cuts to 4.47% Dec, all unchanged or within 0.5bp of Friday’s close.

- Williams (voter) welcoming remarks perhaps limited with no text and late at 1500ET, before Fedspeak resumes in earnest Wed with four speakers plus the Beige Book.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

JPY: Run Higher in Implied Vols Show's Market Concern of Acute JPY Volatility Post-BoJ

- Difficult to overstate the run higher in JPY implied vols ahead of this week's BoJ decision. Overnight vols began to capture the BoJ decision today, and have rallied from ~18 points yesterday to north of 50 vol points this morning.

- The contract hasn't traded this high since July 2016, in a session that captured a disappointing BoJ decision, a soft US GDP print as well as a warning from Japan's MoF on the strength of the JPY.

- Soaring implied vol has significantly widened the implied breakeven for overnight ATM straddles, meaning markets would have to see an approx 275 pip move in either direction to cover the premium paid, a sure sign that markets are anticipating acute volatility in the wake of the decision.

- On a tech basis, the path of least resistance remains down for USD/JPY, Moving average studies remain in bear mode, with the 50- and 200-dmas highlighting a potential bearish death cross. The focus is on 126.81, a Fibonacci projection.

FOREX: JPY Implied Vols Surge Pre-BoJ

- Markets have run JPY implied vols considerably higher Tuesday as traders pre-position for the BoJ meeting early Wednesday in Asia-Pac hours. Overnight vols began to capture the BoJ decision today, and have rallied from ~18 points yesterday to north of 50 vol points this morning - the highest level since July 2016.

- The market gyrations mean markets would have to see an approx 275 pip move in either direction to cover the premium paid on an ATM straddle, a sure sign that markets are anticipating acute volatility in the wake of the decision.

- JPY trade slightly lower through the NY crossover, putting USD/JPY just north of the Y129.00 level, but still well within range of the recent lows at 127.23. CHF trades firmest across G10, while USD makes furtive gains amid lower equity markets. Earnings season resumes today, with Goldman Sachs and Morgan Stanley the highlights Tuesday.

- Canadian CPI is the data highlight Tuesday, with markets expecting inflation to slow to 6.4% on a Y/Y basis. Focus should also be paid to the speaker slate, as Fed's Williams appears at an event at the New York Fed, although it remains to be seen whether he'll comment on the economy.

FX OPTIONS: Expiries for Jan17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0645-50(E608mln), $1.0675-80(E1.1bln), $1.0730-50(E771mln), $1.0800-05(E802mln), $1.0825(E825mln), $1.0850(E1.5bln), $1.0900(E798mln)

- GBP/USD: $1.2225-50(Gbp1.4bln)

- USD/JPY: Y127.85-00($665mln), Y129.00($612mln), Y130.00-22($1.0bln)

- AUD/USD: $0.6800(A$2.5bln), $0.7210(A$1.4bln)

- USD/CAD: C$1.3350($555mln), C$1.3400($1.0bln)

- USD/CNY: Cny6.8400-50($540mln)

EQUITIES: Eurostoxx Futures Bullish Conditions Intact as Contract Trades to Fresh Cycle High

EUROSTOXX 50 futures bullish conditions remain intact and the contract traded to a fresh trend high Monday. Futures have recently cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The break represents a key short-term positive development and paves the way for gains towards 4215.00 next, a Fibonacci projection. MA studies are in a bull-mode condition, reinforcing the bull theme. Initial firm support is at 3998.70. S&P E-Minis traded higher last week. The contract has cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price has also traded above the 4000.00 handle to open 4043.00 next, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this support would resume bearish activity.

COMMODITIES: Short-Term Bullish WTI Future Theme Intact

WTI futures traded higher last week and a short-term bull theme remains intact. A continuation higher would signal scope for a test of resistance at $81.50, the Jan 3 high and a bull trigger. Clearance of this hurdle is required to strengthen a bullish theme. The broader trend outlook still appears bearish. A reversal lower would expose the bear trigger that has been defined at $70.31, the Dec 9 low. Trend conditions in Gold remain bullish and the yellow metal traded to a fresh trend high Monday. This confirms an extension on the current uptrend and maintains the positive price sequence of higher highs and higher lows. Note that moving average studies are in a bull mode position - reflecting the uptrend. The focus is on $1934.4 next, the Apr 25, 2022 high. Support to watch lies at $1850.4, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams | |

| 18/01/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 18/01/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 18/01/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 18/01/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 18/01/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 18/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/01/2023 | - |  | JP | Bank of Japan policy decision | |

| 18/01/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/01/2023 | 1330/0830 | *** |  | US | PPI |

| 18/01/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 18/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/01/2023 | 1400/0900 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 18/01/2023 | 1500/1000 | * |  | US | Business Inventories |

| 18/01/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/01/2023 | 1800/1300 |  | US | Kansas City Fed's Esther George | |

| 18/01/2023 | 1900/1400 |  | US | Fed Beige Book | |

| 18/01/2023 | 2015/1515 |  | US | Philadelphia Fed's Pat Harker | |

| 18/01/2023 | 2100/1600 | ** |  | US | TICS |

| 18/01/2023 | 2200/1700 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.