-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Spurred to New Weekly Highs Pre-NFP

Highlights:

- JPY spurred to new weekly highs as BoJ rate hike speculation swirls

- Low response rates to NFP survey could add scope for NFP revisions

- UK poll shows Conservatives could face electoral wipeout given poor response to budget

US TSYS: Mildly Bid Awaiting Payrolls On Final Day Before FOMC Blackout

- Cash Tsy yields sit 0.5-1.5bp lower on the day, whilst 2s10s consolidate yesterday’s twist steepening at -41.7bps, awaiting a US docket entirely centered around the payrolls report.

- Treasuries underperform European FI as ECB Governing Council rhetoric has indicated a growing consensus concerning a June cut.

- TYM4 trades close to session highs of 111-26+ on strong volumes of 350k. It stopped just short of yesterday’s 111-27, which had met resistance at 50% of the Feb 1-23 bear leg. Clearance here would open 112-04 (Feb 7 high).

- Data: Payrolls Feb (0830ET) – preview here: https://roar-assets-auto.rbl.ms/files/60262/USNFPMar2024Preview.pdf

- Fedspeak: NY Fed’s Williams in moderated discussion (0700ET), final day before FOMC blackout

- No Tsy issuance

Low Response Rates Add To Scope For NFP Revisions

- One factor worth considering as to why two-month revisions should be watched so closely, is the continued recent decline in survey response rates.

- January saw a 1st response rate of 56% after the 49.4% in Dec was one of the lowest first reads since the early 1990s.

- The 2nd response rate for December meanwhile of 80.1% was its lowest since 2003.

- This is for the Current Employment Statistics (CES) program, which captures nonfarm employment, hours worked and earnings of payrolled workers.

- MNI Payrolls Preview here: https://roar-assets-auto.rbl.ms/files/60262/USNFPMar2024Preview.pdf

STIR: Fed Rate Path Drifts Lower With Payrolls In Focus

- Fed Funds implied rates have nudged a little lower to extend yesterday’s decline (helped by some dovish-leaning data) before today’s NFP report, back close to almost fully pricing a first cut in June.

- Cumulative cuts: 1bp Mar, 7bp May, 24bp Jun, 40bp Jul and 93bp Dec.

- Today’s sole scheduled Fedspeak comes from NY Fed’s Williams, early on at 0700ET in a moderated discussion at LSE (no text). Williams said on Feb 28 that he thought three cuts in 2024 was a "reasonable starting point" with cuts not being tied to quarterly SEP meetings.

- Potential for pop-up appearances after payrolls ahead of the media blackout starting midnight ET, but we’d be surprised if it differed from the message from the FOMC to Congress that its waiting for “greater confidence that inflation is moving sustainably toward 2 percent” is before cutting.

TSYS: OI Points To Limited Positioning Movement Ahead Of NFPs

Yesterday's twist steepening of the U.S Tsy futures curve and preliminary OI data points to the following net positioning swings as markets assessed the latest ECB decision and day two of Fed Chair Powell’s semi-annual testimony:

- Net long setting: TU, TY & UXY

- Net short cover: FV & US

- Net long cover: WN

- The impending U.S. NFP release may have limited fresh position setting.

| 07-Mar-24 | 06-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,650,966 | 3,623,949 | +27,017 | +1,053,863 |

| FV | 5,781,986 | 5,785,736 | -3,750 | -162,346 |

| TY | 4,272,558 | 4,244,751 | +27,807 | +1,855,879 |

| UXY | 2,045,443 | 2,039,975 | +5,468 | +494,255 |

| US | 1,473,912 | 1,474,015 | -103 | -13,992 |

| WN | 1,585,480 | 1,593,996 | -8,516 | -1,834,899 |

| Total | +47,923 | +1,392,761 |

STIR: OI Points To Mix Of SOFR Long Setting & Short Cover On Thursday

Yesterday's uptick in SOFR futures and preliminary OI data points to a mix of net short cover and long setting in the whites, with the latter dominating in net pack terms.

- The reds through blues were titled towards net short cover, although pockets of net long setting were also seen.

- The latest ECB decision and Fed Chair Powell's latest comments dominated ahead of today's NFP release.

| 07-Mar-24 | 06-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,226,003 | 1,227,153 | -1,150 | Whites | +10,412 |

| SFRH4 | 1,040,442 | 1,079,962 | -39,520 | Reds | -2,184 |

| SFRM4 | 1,089,041 | 1,085,494 | +3,547 | Greens | -26,816 |

| SFRU4 | 926,706 | 879,171 | +47,535 | Blues | -7,244 |

| SFRZ4 | 1,131,470 | 1,118,413 | +13,057 | ||

| SFRH5 | 679,038 | 673,664 | +5,374 | ||

| SFRM5 | 714,182 | 719,345 | -5,163 | ||

| SFRU5 | 640,466 | 655,918 | -15,452 | ||

| SFRZ5 | 688,437 | 712,328 | -23,891 | ||

| SFRH6 | 466,701 | 475,591 | -8,890 | ||

| SFRM6 | 483,100 | 476,870 | +6,230 | ||

| SFRU6 | 339,671 | 339,936 | -265 | ||

| SFRZ6 | 336,935 | 336,317 | +618 | ||

| SFRH7 | 189,726 | 189,915 | -189 | ||

| SFRM7 | 181,447 | 184,304 | -2,857 | ||

| SFRU7 | 147,824 | 152,640 | -4,816 |

MNI UK Issuance Deep Dive: Budget 2024 Review

- Chancellor of the Exchequer Jeremy Hunt’s Budget statement on Wednesday saw little in the way of surprises in terms of the measures announced but there were surprises in terms of the syndication breakdown.

- We summarise the measures that were introduced along with estimates of the costings.

- We outline our expectations for which gilts will be sold across FY24/25 and the wider fiscal year and include a calendar of auction dates including our expectation of syndication dates.

- We also discuss the potential new gilts that could be sold through the fiscal year - with particular focus on the gilts under consideration for syndicated sales.

- Finally, we analyse the political implications of the Budget.

UK: Gov't May Look For 2nd '24 Fiscal Event Given Poor Voter Response To Budget

A headline-grabbing opinion poll released by People Polling on 8 March could set a fire under the idea of the gov't looking to deliver a second 'fiscal event' in 2024 ahead of any general election in an effort to turn around the centre-right Conservative party's low support. People Polling: Labour: 46% (+1), Conservative: 18% (-2), ReformUK: 13% (+1), Liberal Democrats: 10% (=), Green: 7% (-2), Fieldwork 7 March, chgs w/25 Jan.

- It should be noted that this poll is an outlier, with the March average showing the Conservatives on 23.8%. Secondly, over the past year People Polling has consistently given the Conservatives its lowest support level out of any pollster in the British Polling Council.

- Should the election reflect these numbers, the Electoral Calculus' predictor model (usually inaccurate by around 50 seats) shows the following outcome (out of 650): Labour 537 (+340), Liberal Democrats 48 (+40), Conservatives 24 (-352), SNP 18 (-30), Plaid Cymru 3 (+1), Green 2 (+1), Northern Ireland parties 18 (=), Reform UK 0 (=).

- While polling in itself is not market-moving, the impact of polling such as this could spur market-moving events. The date of the next election is not set, but in our view a vote in late-2024 or even Jan 2025 is more likely than May. The Budget was billed as the last major 'fiscal event' pre-election, but if polling does not turn around the gov't could look to an autumn statement in a final effort to boost support, with a new set of fiscal measures for markets to assess.

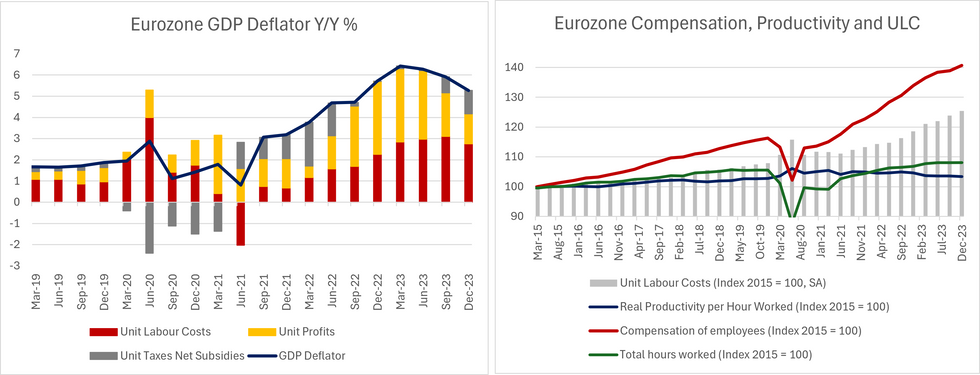

ECB: Q4 Accounts Underscore Need For Q1 Data Before Easing Begins

The final Q4 national accounts confirmed a deceleration of the Eurozone GDP deflator to 5.3% Y/Y (vs 5.9% in Q3). Details suggest that unit profits buffered rises in unit labour costs (ULCs), consistent with the ECB's central projections in its updated forecasts.

- However, the Q4 readings of wage growth and productivity remain incompatible with the 2% HICP inflation target, underscoring the majority of the Governing Council's view that an analysis of Q1 2024 developments is required before starting the policy easing cycle.

- The ECB's March macroeconomic projections looked for a Q4 GDP deflator rise of 5.4% Y/Y.

- Of the 5.3% Y/Y rise in the GDP deflator, MNI's calculations suggest ULCs contributed 2.75pp (vs 3.11pp in Q3), while unit profits contributed 1.42pp (vs 2.04pp in Q3).

- ULCs rose 5.8% Y/Y in Q4 (vs 6.5% in Q3) and 1.3% Q/Q (vs 1.6% prior). The Y/Y rise was in line with the ECB's projections.

- The moderation in ULCs came after the growth in total compensation of employees fell to 5.0% Y/Y from 6.3%, while real productivity per hour worked (-1.2% Y/Y fall) and total hours worked (1.2% Y/Y rise) broadly offset each other.

- Total compensation per employee, which the ECB forecasts rather than total compensation overall, moderated to 4.6% Y/Y (vs a downwardly revised 5.1% prior). Yesterday's projections saw this at 4.8% Y/Y.

- As indicated in the preliminary national accounts last month, real productivity per employee was -1.1% Y/Y, below the March ECB forecast of -0.9% Y/Y.

BOJ: Details Of Source Reports Not Quite As Hawkish As Initial Headlines

JPY pairs and JGB futures find a base as the details of the previously covered BoJ sources pieces aren’t quite as hawkish as the initial headlines:

- RTRS sources note that no consensus has been formed re: a March BoJ hike and the story reads softer than the hawkish headlines suggested.

- Meanwhile, more recent RTRS headlines covering the JiJi piece suggest that a new quantitative policy framework will see the BoJ continue to buy Y6tn of JGBs per month, in line with recent purchase levels.

FOREX: JPY at New Highs on Fresh Hike Chatter, ECB Members Coalesce Around June

- After a quiet start to Friday trade, JPY is once again the best performer in G10 - tipping USD/JPY over 300 pips off the mid-week high. JPY added to recent gains on the back of concurrent BoJ sources reports from both JiJi News and Reuters - who eye the possibility of a March BoJ rate hike should the wage negotiation phase with unions next week continue to show signs of healthy wage growth. USD/JPY traded well through overnight Asia-Pac lows to extend losses off the weekly high to over 320 pips. A close at current or lower levels would confirm a clean break of both the 50- and 100-dma supports and a print through 146.24 would fully reverse the NFP-inspired rally.

- EUR/JPY pull back was a touch shallower after the cross found support at the 50-dma (160.61 today) - highlighting that USD weakness is also playing a part.

- The single currency is seen softer - weaker against most others - with ECB members out in force this morning following Lagarde's press conference yesterday. Members are coalescing around the June meeting for the first potential ECB rate cut - communication that is inline with market pricing. EUR/GBP has printed a new weekly low this morning, rejected yesterday's early test on 50-dma resistance at 0.8564. Next notable support a little way off, but weakness through 0.8498 would be bearish - exposing the cross to last August's low and the bear trigger at 0.8493.

- Nonfarm payrolls data ahead takes focus, with markets expecting payrolls growth to slow to 200k from January's bumper 353k reading. The unemployment rate is expected to come in unchanged at 3.7%. Central bank speak is seen quieter into US hours, with just Fed's Williams scheduled to appear at a moderate discussion just ahead of the US open.

FX OPTIONS: Hedging Markets Isolate NZD, GBP, ZAR Over NFP Release

- Vol markets have identified NZD, GBP and ZAR as carrying the most sizeable NFP-based vol premium, blowing out break-evens and implied pricing for a post-data swing against the USD.

- An overnight straddle struck yesterday for today’s expiry implied a ~60 pip swing in the pair – suggesting a positive GBP/USD reaction today could test the next area of technical interest: 1.2881 the 76.4% retracement for the Jul 14 – Oct 4 bear leg.

- Overnight vol markets across both G10 and emerging markets saw support yesterday as the contracts captured the Friday expiry – thereby capturing the discrete event risk surrounding the US jobs report.

- Despite this support, however, overall vol remains contained below the levels seen prior to the Feb02 NFP release –suggesting markets may anticipate a more muted response to today's release. We note that today's jobs report should see a return to labour market normality after considerable distortions in the January release.

FX OPTIONS: Expiries for Mar08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.3bln), $1.0750(E782mln), $1.0770(E1.1bln), $1.0800(E1.4bln), $1.0820-35(E2.1bln), $1.0850(E501mln), $1.0900(E778mln)

- USD/JPY: Y146.90-00($1.1bln)

- GBP/USD: $1.2550-80(Gbp951mln)

- USD/CAD: C$1.3500($742mln), C$1.3590-00($1.2bln)

- USD/CNY: Cny7.1000($650mln)

EQUITIES: Crest at New Cycle Highs

- The trend condition in S&P E-Minis is bullish and yesterday’s fresh cycle high reinforces current conditions. Price action continues to highlight the fact that corrections are shallow - this is a bullish signal that highlights positive market sentiment.

- A bullish theme in Eurostoxx 50 futures remains intact and Thursday’s rally and fresh cycle high reinforces this theme. Moving average studies remain in a bull-mode position, highlighting positive market sentiment.

COMMODITIES: Gold Momentum Remains Firm to Record Highs

- Gold remains firm on the back of its latest rally. The yellow metal has this week traded above resistance at $2135.4, the Dec 4 high to deliver a fresh all-time cycle high. The break reinforces bullish conditions and signals scope for a climb towards $2177.6 next.

- The WTI futures trend condition remains bullish and the contract is trading closer to its recent highs. The recent breach of key resistance at $79.09, Jan 29 high, reinforces this theme. The clear break highlights potential for a continuation towards $81.70.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2024 | 1200/0700 |  | US | New York Fed's John Williams | |

| 08/03/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 08/03/2024 | 1330/0830 | *** |  | US | Employment Report |

| 08/03/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.