-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY195.3 Bln via OMO Wednesday

MNI ASIA OPEN: Late Rate & Stock Rally, 5Y Sale Well Received

MNI ASIA MARKETS ANALYSIS: Tsys Rebound Late Session Highs

US TREASURY AUCTION CALENDAR: 5Y Stops Through

MNI US MARKETS ANALYSIS - Light Data Calendar Keeps Focus on Tues CPI

Highlights:

- Japanese stocks slide off highs as JPY strength hampers exporters

- CFTC data shows markets trimmed JPY shorts pre-spot rally

- Light data calendar Monday, keeping focus on Tuesday's CPI

US TSYS: Twist Flatter In Thin Volumes, Treasury Issuance Headlines Light Docket

- Cash Tsys have pulled back off highs seen in European hours to sit close to lows shortly after the Asia open. Yields sit between 1.7bp higher (2s) and ~0.5bps lower (20s and 30s) for a modest flattening on the day with 2s10s at -41bps only slightly steeper than pre-NFP levels.

- TYM4 sits at 111-25 (+ 01+) on low cumulative volumes of 215k. Friday’s payrolls-induced volatility saw a wide range of 111-08 to 112-04+, the latter marking resistance with the bull cycle remaining in play. Next resistance would be 112-10+ (61.8% retrace of Feb 1-23 bear leg).

- Treasury issuance headlines an otherwise particularly light docket today, with macro focus firmly on tomorrow’s US CPI as markets watch to extent the January acceleration was down to one-off factors.

- Data: NY Fed Inflation Expectations (1100ET)

- No Fedspeak - media blackout

- Note/bond issuance: US Tsy $56B 3Y Note auction - 91282CKE0 (1300ET)

- Bill issuance: US Tsy $79B 13W, $70B 26W bill auctions (1130ET)

MNI: US Employment Insight, Mar'23: Downward NFP Revisions Rule, But Trend Still Strong

- We have published and e-mailed to subscribers the MNI US Employment Insight.

- Please find the full report including MNI analysis and views from 20 analysts here: https://roar-assets-auto.rbl.ms/files/60281/USEmploymentReportMar2024.pdf

STIR: Fed Rates Remain Little Changed From Pre-Payrolls Levels

- Fed Funds implied rates are little changed since Friday’s close, consolidating the post-payrolls recovery from the initial decline - see table.

- Cumulative cuts: 0.5bp Mar, 7bp May, 23bp Jun, 39bp Jul and 94bp Dec. At one point after payrolls, there had been 103bp of cuts priced for 2024.

- The FOMC is now in blackout ahead of the Mar 19-20 meeting, with today’s light docket seeing attention firmly on tomorrow’s CPI release.

TSYS: OI Points to Mix Of Positioning Swings Around NFPs, Long Setting In FV Most Notable

Friday’s twist steepening of the Tsy futures curve and preliminary OI data points to the following net positioning swings:

- Long setting: TU & FV futures

- Short cover: TY & UXY futures

- Short setting: US futures

- Long cover: WN futures

- The only meaningful net positioning swing came in FV futures.

- A reminder that the NFP report drove price action on Friday.

| 08-Mar-24 | 07-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,664,545 | 3,647,620 | +16,925 | +659,525 |

| FV | 5,855,496 | 5,781,257 | +74,239 | +3,214,263 |

| TY | 4,264,747 | 4,271,806 | -7,059 | -471,312 |

| UXY | 2,039,450 | 2,045,343 | -5,893 | -532,645 |

| US | 1,475,177 | 1,473,997 | +1,180 | +159,978 |

| WN | 1,581,132 | 1,585,470 | -4,338 | -932,925 |

| Total | +75,054 | +2,096,885 |

STIR: OI Points To Friday Cover In SOFR Whites & Reds, Long Setting Further Out

The combination of Friday's flattening of the SOFR futures strip and preliminary OI data points to the following positioning swings around NFPS:

- Whites: Seemed to be dominated by position squaring, with apparent rounds of net short and net long cover providing the most prominent positioning swings.

- Reds: Short cover was seemingly seen in all contracts.

- Greens: Net long setting seemed to dominate.

- Blues: Net long setting was seemingly seen in all contracts.

| 08-Mar-24 | 07-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,224,307 | 1,225,970 | -1,663 | Whites | -41,102 |

| SFRH4 | 1,029,794 | 1,045,908 | -16,114 | Reds | -40,367 |

| SFRM4 | 1,095,196 | 1,088,377 | +6,819 | Greens | +9,855 |

| SFRU4 | 893,441 | 923,585 | -30,144 | Blues | +2,956 |

| SFRZ4 | 1,124,815 | 1,131,445 | -6,630 | ||

| SFRH5 | 669,332 | 679,037 | -9,705 | ||

| SFRM5 | 700,257 | 714,651 | -14,394 | ||

| SFRU5 | 630,828 | 640,466 | -9,638 | ||

| SFRZ5 | 698,262 | 689,346 | +8,916 | ||

| SFRH6 | 462,154 | 466,583 | -4,429 | ||

| SFRM6 | 484,463 | 482,896 | +1,567 | ||

| SFRU6 | 343,472 | 339,671 | +3,801 | ||

| SFRZ6 | 339,388 | 337,702 | +1,686 | ||

| SFRH7 | 190,667 | 189,719 | +948 | ||

| SFRM7 | 181,548 | 181,447 | +101 | ||

| SFRU7 | 148,045 | 147,824 | +221 |

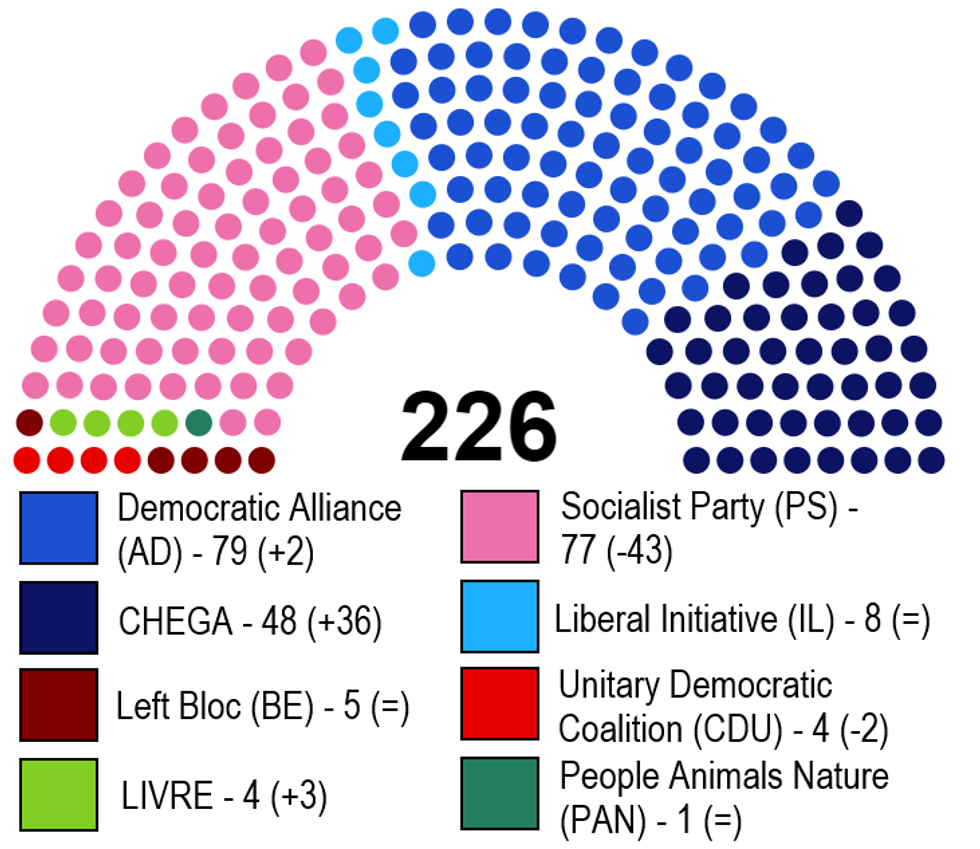

AD Claims Victory, Faces Tough Challenge In Securing Support To Govern

The centre-right Democratic Alliance (AD) won a plurality in Portugal's 10 March general election, but now faces a difficult challenge in winning a confidence vote in the Assembly of the Republic having fallen well short of a majority. AD leader Luis Montenegro's options will be to rely on the support either of the incumbent centre-left Socialist Party (PS) or the right-wing CHEGA (Enough) in a confidence and supply agreement.

- With 99.01% of votes counted, of the 230 seats in the Assembly the AD (an alliance of three centre-right parties) won 79 seats, up two on the previous election in 2022. The PS is on 77 (down 43), while Chega is the big winner of the election with its seat total up to 48 from 12 previously.

- As the vote count continued through the night, Montenegro claimed that his party would not work or do a deal with CHEGA in order to take power. However, this stance could come under significant pressure in the days and weeks ahead. The right of his party is likely to pressure Montenegro to seek support from CHEGA in a confidence vote required to form a gov't, rather than relying on the PS.

- There remains the prospect of a period of political uncertainty as efforts are made to feel out parties on both sides of the political spectrum. An emergingwar of words between CHEGA leader Andre Ventura and President Marcelo Rebelo de Sousa risks further divisions.

Source: Interior Ministry, MNI

Source: Interior Ministry, MNI

EUROPE ISSUANCE UPDATE:

ESM syndication:

- E2bln WNG of the Sep-29 ESM-bond.

- Books closed in excess of E10.5bln (ex JLM interest). Spread set at MS+6bps (guidance was MS+8bps area)

CFTC: Markets Trimmed JPY Shorts Pre-Spot Rally

- Friday's CFTC report confirmed that markets had seen an improvement in the JPY net position ahead of the latest spot rally. Markets added ~14k contracts in the week ending March 5th, lifting the net position off the 52w low of net short 133k contracts. This marked a 5.1% improvement as a % of open interest.

- GBP and AUD positions also edged higher, putting the GBP net long at the largest in a year, although the AUD position remains net short overall.

- The most eye-catching positioning swing was seen in CAD - where a broadly neutral position flipped to net short of ~11% of open interest.

- The MXN, NZD positioning Z-scores remain the highest among the currencies surveyed (+1.82, +1.76 respectively), and CHF, EUR the lowest (-1.66, -1.64 respectively).

Full CFTC data here:

FOREX: JPY Firmer, Extending Outperformance on BoJ Policy Bets

- JPY is again the firmest performing currency across G10, pressuring USD/JPY toward last week's pullback lows and narrowing the gap with support at Friday's Y146.49 and the 200-dma below at Y146.22. Speculation continues to circulate over a Bank of Japan policy switch as soon as the March meeting - with MNI Policy eyeing the potential for an undisclosed yield cap measure for JGBs should Japan exit negative interest rate policy this month.

- Weakness through 146.22 in USD/JPY would extend the drop off YTD highs to close to 500 pips - and go a long way to reversing the bull leg posted off the late December lows.

- AUD trades among the poorest performers so far Monday, with weakness across industrial metals undermining the currency somewhat. Singapore-listed iron ore futures are lower by as much as 7% in Asia trade, helping conclude the sharp strength posted toward the tail-end of last week. 0.6573 is the level to watch on weakness, and move through here would confirm last week's bounce as corrective in nature.

- The data calendar is typically quiet for a Monday, with just the NY Fed's 1yr inflation expectations release of note. BoE's Catherine Mann is set to speak - among the most hawkish members of the MPC - just after the London close at 1700GMT/1300ET.

FX OPTIONS: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.6bln), $1.0825-40(E1.0bln), $1.0890-00(E1.2bln), $1.0930-50(E1.2bln), $1.1000(E738mln)

- USD/JPY: Y150.00($1.3bln)

- USD/CNY: Cny7.2995-3000($1.1bln)

EGBS: Little Changed Amid Limited Newsflow; Peripheries Mixed

Core/semi-core EGBs are little changed to begin the week, with limited market moving newsflow over the weekend following last week's ECB meeting and US labour market report.

- ECB's Kazimir joined last week's contingent of speakers who prefer waiting till June before beginning the easing cycle, noting that upside risks to inflation remain.

- Bunds are flat at 133.76, with 134.18 (Feb 7 high) the first support. Last week's price action saw a clear break of resistance at the 50-day EMA, signalling scope for an extension.

- German and French cash yields are -0.5bps lower to 1.5bps higher, with the curve lightly twist flattening.

- 10-year periphery spreads to Bunds are mixed, with Spanish/Italian spreads a touch wider and Portuguese/Greek spreads tighter. See our earlier post for details on the impact of this weekend's Portuguese election result.

- This week's regional data calendar is reasonably quiet (though we get final February HICP readings from the four major economies). UK labour market data and US CPI tomorrow will be of interest.

CHINA EQUITIES: Property & Tech Sectors Lead Rally

The CSI 300 finished +1.3%, while the Hang Seng added +1.4%.

- The property sector benefitted from Hong Kong’s weekend property transaction figures and news that China Vanke had deposited cash to repay some debt obligations.

- RTRS sources had already suggested that “China has asked banks to enhance financing support for state-backed China Vanke and called on creditors to consider private debt maturity extension.”

- Solar names rallied on speculation surrounding a potential sector-specific move from policymakers.

- That allowed tech sub-indices to move higher.

- Local reports re: boosting financing to various areas of the tech sector also factored in.

- Several brokerage recommendations generated double digit gains in the related names.

- ZTE & Legend Holdings struggled on earnings matters.

- HK-China Stock Connect links generated CNY10.3bn of net inflows for the mainland.

- The weekend saw the Chair of HK’s Securities & Futures Commission call for an expansion of the Stock Connect schemes.

- Firmer than expected Chinese CPI data and a limited uptick in CGB yields had little impact on equities.

- Broader expectations look for continued policy easing in China.

EQUITIES: E-Mini S&P Trend Condition Bullish Despite Pullback From Friday's High

- A bullish theme in Eurostoxx 50 futures remains intact and last week’s rally and fresh cycle high reinforces this theme. Moving average studies remain in a bull-mode position, highlighting positive market sentiment. Sights are on the psychological 5000.00 handle next. Further out, scope is seen for a climb towards a bull channel top at 5028.80. The channel is drawn from the Oct 27 low. Initial firm support lies at 4853.50, the 20-day EMA.

- The trend condition in S&P E-Minis is bullish and last week’s fresh cycle high reinforces current conditions. Price action continues to highlight the fact that corrections are shallow - this is a bullish signal that highlights positive market sentiment. Support to watch is 5071.70 the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4958.24, the 50-day EMA. Sights are on 5200.00 next.

COMMODITIES: Gold Remains Firm on Back of Latest Rally, Retracement Level Targeted Next

- The WTI futures trend condition remains bullish despite the latest pullback. The recent breach of key resistance at $79.09, the Jan 29 high, reinforces a bullish theme. The clear break highlights potential for a continuation towards $81.70, a Fibonacci retracement. On the downside, support to watch is $76.52, the 50-day EMA. A break of the average would instead signal a possible top. The latest pullback is considered corrective.

- Gold remains firm on the back of its latest rally. The yellow metal last week traded above resistance at $2135.4, the Dec 4 high to deliver a fresh all-time cycle high. The break reinforces bullish conditions and signals scope for a climb towards $2206.6 next, a Fibonacci projection. Short-term conditions are overbought, however, this does not appear to be a concern for bulls - for now. Initial firm support lies at $2088.5, the Dec 28 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/03/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/03/2024 | 1700/1700 |  | UK | BOE's Mann panellist for MonPol ebook launch | |

| 12/03/2024 | 0700/0800 | *** |  | DE | HICP (f) |

| 12/03/2024 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 12/03/2024 | 0800/0900 |  | EU | ECB's De Guindos participates in ECONFIN meeting | |

| 12/03/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/03/2024 | 1100/1100 |  | UK | BOE's Mann on NIESR Panel | |

| 12/03/2024 | 1230/0830 | *** |  | US | CPI |

| 12/03/2024 | 1230/0830 | * |  | CA | Intl Investment Position |

| 12/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/03/2024 | 1445/1545 |  | EU | ECB's Elderson at 'banking sector and climate...' workshop | |

| 12/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/03/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/03/2024 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.