-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Market Calms After BoJ Shock

Highlights:

- Markets calmer after BoJ surprise, JPY holds bulk of recent rally

- Implied Fed rate path close to post-FOMC levels

- Canadian CPI, US existing home sales next up

TSYS: Modestly Richer With Data, 20Y Re-open Ahead

- Cash Tsys trade with a bull steepening, with the front end to belly rallying 2bps and outperforming core EU FI but the long end making minimal progress at reversing yesterday’s post-BoJ shake-up.

- 2YY -2.4bps at 4.230%, 5YY -2.6bps at 3.761%, 10YY -0.6bps at 3.677% and 30YY -0.3bps at 3.738%.

- TYH3 trades 2 ticks higher at 113-19 on notably below average volumes. It’s off an overnight low of 113-09+ that cleared the 50-day EMA of 113-15, the former now setting initial support after which lies the key short-term 112-11+ (Nov 21 low). Resistance meanwhile is seen at 114-23 (Dec 19 high).

- Data: Second tier but important data releases with existing home sales (1000ET) giving another look at housing after yesterday’s much weaker than expected building permits. Also includes the Conference Board consumer survey (1000ET) plus weekly MBA mortgage data (0700ET) and the Q3 current account (0830ET).

- Bond issuance: US Tsy $12B 20Y Bond auction re-open (912810TM0) – 1300ET

- Bill issuance: US Tsy $33B 17W bill auction – 1130ET

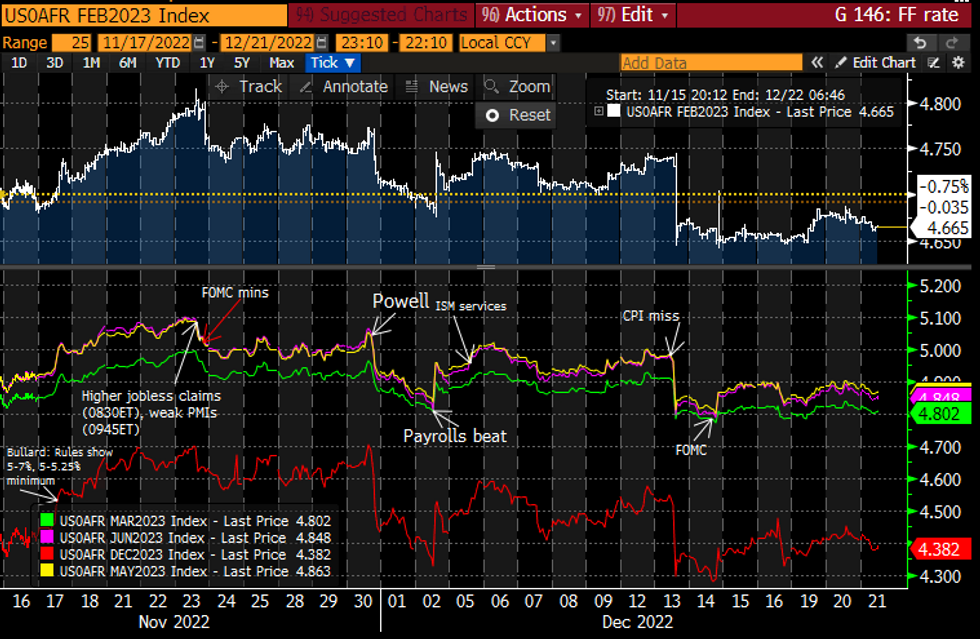

STIR FUTURES: Fed Rate Path Close To Post-FOMC Levels

- Fed Funds implied hikes have eased overnight but sit within the week’s range, including keeping inversion just under 50bps from the May peak to end-2023.

- 33bp for Feb (-0.5bp), a cumulative 47bp to 4.80% for Mar (-1bp), terminal 4.86% May (-1.5bp) and 4.38% Dec (-2.5bp).

- No scheduled Fedspeak sees second tier data releases as potential drivers.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOREX: USD More Stable, But Close to Last Week's Lows

- The USD Index is very modestly higher headed through into US hours, but is holding the majority of the post-BoJ losses. USD strength is most strongly noted against the NZD, with NZD/USD off 0.85% for the day and below 0.6300. This marks slippage through uptrend channel support and the 20-day EMA (0.6311).

- NZ survey data has been quite poor this week, with ANZ's consumer sentiment index falling sharply in December. The trade position also remained comfortably in deficit. The currency is receiving little relief from firmer commodities prices, with oil and gold both seen stronger on the day. While NZD is weaker, NOK is gaining alongside the oil price rally.

- JPY trades firmer for a second session, but USD/JPY holds above yesterday's lows at 130.58, which mark the first major support for now. Any break below here opens 130.41, the Aug 2 low and a key support.

- GBP trades poorer. While EUR/GBP is off the day's highs, overnight trade has come within range of first resistance layered between 0.8771-72.

- Canadian CPI and US existing home sales make up the data highlights, with consumer confidence also on the docket. There are no central bank speakers of note.

FX OPTIONS: Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400-10(E890mln), $1.0450(E726mln), $1.0660-75(E744mln), $1.0700(E655mln)

- USD/JPY: Y132.00-25($696mln), Y134.00-05($560mln), Y134.84-00($555mln)), Y136.00-15($1.1bln), Y140.00($1.1bln)

- AUD/USD: $0.6800(A$613mln), $0.6900(A$1.2bln)

- USD/CNY: Cny6.9500($675mln), Cny7.0100($789mln), Cny7.1500($930mln)

BONDS: Finding Stability After Post-BoJ Rout

Global core bonds are steadying after the post-BoJ rout, with Tsys slightly stronger and periphery and semi-core debt outperforming in Europe in a generally risk-on atmosphere.

- 10Y JGB cash yields closed a couple of basis points from the top of the BoJ's new target band.

- Global core FI largely recovered after some further weakness overnight.

- US and German curves have twist steepened, with the UK's bear flattening. Gilts are underperforming following data showing UK public borrowing hit a record in November.

- Data ahead is mostly US housing related, continuing this week's theme: MBA mortgage applications and Existing Home Sales. We also get Conference Board confidence. There are no central bank speakers of note.

- We await 2023 funding plans from key Eurozone countries, including Italy. $12B US 20Y Bond Reopen features on the issuance calendar.

Latest levels:

- Mar 10-Yr US TSY futures (TY) up 1.5/32 at 113-18.5 (L: 113-09.5 / H: 113-21)

- Mar Bund futures (RX) down 2 ticks at 135.89 (L: 135.6 / H: 136.17)

- Mar Gilt futures (G) up 5 ticks at 101.18 (L: 101.08 / H: 101.53)

- Italy / German 10-Yr spread 6.4bps tighter at 210.8bps

EQUITIES: Equity Futures Consolidate Close to Recent Lows

EUROSTOXX 50 futures remain in a bear mode position and yesterday’s low print reinforces this theme. The break lower has resulted in a breach of the 50-day EMA - at 3799.80. Price is back above the EMA but short-term gains are considered corrective. A continuation lower would open 3720.00 next, the Nov 10 low. On the upside, initial firm resistance is seen at the 20-day EMA - it intersects at 3887.20. S&P E-Minis remain soft and yesterday's low print reinforces bearish conditions. The move lower has also reinforced recent reversal signals - a shooting star candle on Dec 13 followed by a break on Dec 15, of support at 3945.75, the Dec 7 low. The focus is on 3778.45, a Fibonacci projection. On the upside, initial firm resistance is seen at 3948.02, the 50-day EMA. A break of this EMA is required to ease bearish pressure.

- Japan's NIKKEI closed lower by 180.31 pts or -0.68% at 26387.72 and the TOPIX ended 12.27 pts lower or -0.64% at 1893.32.

- Elsewhere, in China the SHANGHAI closed lower by 5.356 pts or -0.17% at 3068.41 and the HANG SENG ended 65.69 pts higher or +0.34% at 19160.49.

- Across Europe, Germany's DAX trades higher by 104.27 pts or +0.75% at 13992.12, FTSE 100 higher by 32.81 pts or +0.45% at 7404.29, CAC 40 up 54.04 pts or +0.84% at 6504.47 and Euro Stoxx 50 up 31.75 pts or +0.84% at 3834.24.

- Dow Jones mini up 222 pts or +0.67% at 33277, S&P 500 mini up 22.5 pts or +0.58% at 3871.75, NASDAQ mini up 71.5 pts or +0.64% at 11247.75.

COMMODITIES: Breach of $1805 Confirms Gold Uptrend

Trend conditions in WTI futures remain bearish. Recent gains however, have highlighted a bullish corrective cycle and this has resulted in a test of the 20-day EMA, at $76.80 today. A clear break of this hurdle would signal scope for an extension and open $79.79, the 50-day EMA. On the downside, a stronger reversal lower would refocus attention on the bear trigger which lies at $70.31, the Dec 9 low. Trend conditions in Gold remain bullish and the recent move lower is considered corrective. Key short-term support to watch is $1765.9, Dec 5 low. The yellow metal breached $1810.0 last week, Dec 5 high, to resume the uptrend. This maintains the positive price sequence of higher highs and higher lows and opens $1842.7, a Fibonacci retracement. On the downside, a break of $1765.9 would signal scope for a deeper pullback.

- WTI Crude up $0.53 or +0.7% at $76.59

- Natural Gas up $0.21 or +3.89% at $5.531

- Gold spot down $3.87 or -0.21% at $1814.39

- Copper up $0.5 or +0.13% at $380.3

- Silver down $0.26 or -1.07% at $23.9073

- Platinum down $13.04 or -1.29% at $999.52

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/12/2022 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2022 | 0700/0800 | ** |  | SE | PPI |

| 22/12/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 22/12/2022 | 0720/0220 |  | ID | Indonesia Central Bank Rate Decision | |

| 22/12/2022 | 0745/0845 | * |  | FR | Retail Sales |

| 22/12/2022 | 0900/1000 | * |  | NO | Norway Unemployment Rate |

| 22/12/2022 | 1000/1100 | ** |  | IT | PPI |

| 22/12/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 22/12/2022 | - |  | UK | House of Commons Recess Starts | |

| 22/12/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 22/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 22/12/2022 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 22/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.