-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Primed for 25bps Fed Hike

Highlights:

- Markets primed for 25bps hike from the Fed, focus on potential for softer messaging

- UK CPI clears way for further tightening from Bank of England

- ECB Watchers conference keeps CB speak thick and heavy

US TSYS: Consolidating Recent Sell-Off With Focus On FOMC Decision

- Cash Tsys trade in relatively narrow ranges, with the 9bp range for 2YY small compared to recent days, as they consolidate the cheapening of the past two sessions after smaller regional banks are seen as increasingly likely to have extended deposit guarantees if needed. The focus shifts to today’s FOMC decision with a 21bp hike priced and a clear majority of analysts looking for 25bp.

- 2YY -0.3bp at 4.164%, 5YY -2.1bp at 3.727%, 10YY -1.3bp at 3.596% and 30YY +0.0 at 3.732%

- TYM3 trades 2 ticks higher at 114-06, slightly off yesterday’s low of 114-02 and support at 114-01+ (Mar 17 low) after which lies the 50-day EMA of 113-13. Volumes are more subdued at 250k.

- FOMC: Decision (1400ET) before Chair Powell press conference (1430ET)

- Data: Only weekly MBA mortgage data (0700ET)

- Bill issuance: US Tsy $36B 17W bill auction (1130ET)

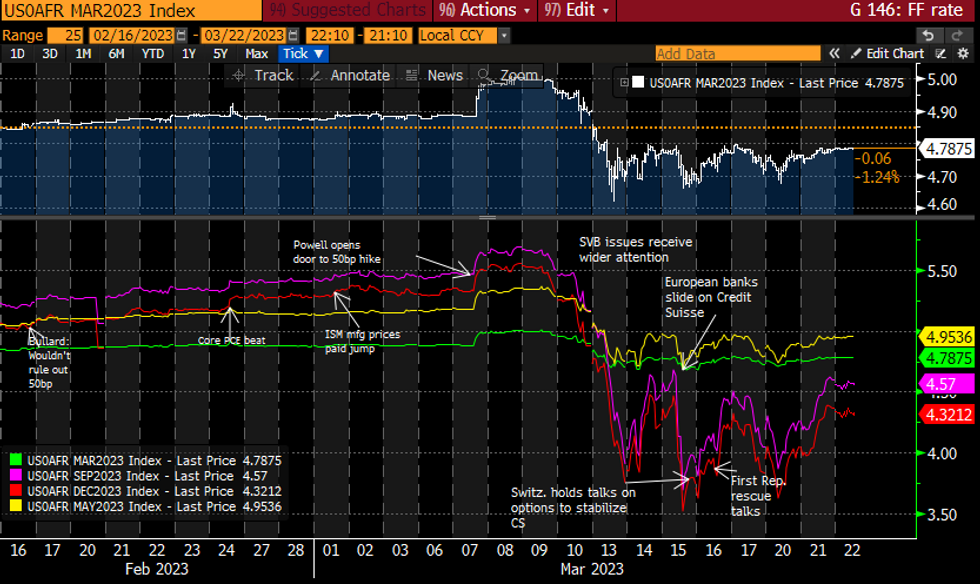

STIR FUTURES: Fed Rate Path Consolidates Recent Push Higher Pre-FOMC

- Fed Funds implied hikes have nudged higher for today’s FOMC decision with 21bp priced (+0.5bp).

- Beyond that only a minor easing from yesterday in broad consolidation of the push higher in 2H23 rates over the past two days after openness to increase deposits for smaller regional banks.

- Cumulative 38bp of hikes to a peak 4.95% in May (unch) before 64bp of cuts to 4.32% at year-end (-4.5bp). The latter sits at the higher end of the wide range of 3.5-4.5% seen since CS slid last week.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

MNI Central Bank Previews:

- FOMC Preview - Balancing Evolving Risks: https://roar-assets-auto.rbl.ms/files/52099/FedPre...

- SNB Preview - Liquidity Provision Should Clear Path for More Hikes: https://roar-assets-auto.rbl.ms/files/52126/MNISNB...

- Norges Bank Preview - 25bps Base Case, Further Tightening Hints Likely: https://roar-assets-auto.rbl.ms/files/52100/MNINBP...

- BoE Preview - Higher Feb CPI Seals Case for 25bps: https://roar-assets-auto.rbl.ms/files/52120/MNI%20...

- BCB Preview - Economic Crosscurrents Warrant Caution: https://roar-assets-auto.rbl.ms/files/52116/MNI%20...

- CBRT Preview - Risks of Cut to 'Adequate' Key Rate: https://roar-assets-auto.rbl.ms/files/52121/MNICBR...

- BSP Preview - +25bps Likely: https://roar-assets-auto.rbl.ms/files/52127/BSP%20...

EUROPE ISSUANCE UPDATE:

German auction result- Today's 10-year Bund auction was ok with the lowest accepted price above the pre-auction mid-price. The bid-to-cover was weaker than on 22 February, but with a similar amount allotted to the last auction, there was still a similar proportion of quality bids. In terms of price action after the auction, we saw the 2.30% Feb-33 Bund fall the LAP of 99.80.

- E5bln (E4.224bln allotted) of the 2.30% Feb-33 Bund. Avg yield 2.32% (bid-to-cover 1.16x).

FOREX: GBP on Top as CPI Revives Confidence in Rate Hikes

- UK inflation data kickstarted the European session with a solid beat on expectations: headline Y/Y CPI rose to 10.4%, well ahead of the 9.9% analyst consensus, while the core measure similarly topped forecast (6.2% vs. Exp. 5.7%). Services inflation remained a key driver, with restaurants and hotels prices accounting for the largest upward effect on the headline.

- The release saw markets further bake in expectations of a 25bps hike at Thursday's BoE meeting - a prospect that was on much shakier footing this time last week. Suitably, GBP rallied, putting GBP ahead of all others in G10 to put GBP/USD briefly ahead of resistance to print 1.2286.

- The greenback is edging lower, slipping against most others despite a shakier equity backdrop that indicates a lower open on Wall Street later today. The USD Index trades within range of this week's lows and the lowest level since mid-February. Markets keep a close eye on key resistance at the 1.08 handle for EUR/USD - a break above which could help the next leg lower for the dollar.

- Focus Wednesday remains on the FOMC rate decision, at which markets look for a 25bps rate rise from the Fed, as the markets hone in on any clues for the sensitivity of the Fed's tightening cycle to the ongoing banking woes across the US.

FX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E916mln), $1.0620-25(E612mln), $1.0660-80(E1.4bln), $1.0715-35(E1.2bln), $1.0775(E646mln), $1.0810(E564mln)

- USD/JPY: Y132.00($519mln), Y132.45-55($826mln), Y134.00($712mln), Y134.22-25($511mln)

EQUITIES: Equity Futures Partially Retrace Some of Tuesday's Gains

- The Eurostoxx 50 futures outlook remains bearish, however, the strong recovery from Monday’s low of 4057.00 has resulted in a break of both the 20- and 50-day EMAs. A continuation higher would signal scope for 4184.50, a Fibonacci retracement. Key resistance and the bull trigger is at 4268.00, the Mar 6 high. On the downside, a reversal lower and a breach of 3914.00 would resume the recent downtrend.

- S&P E-Minis have continued to climb as the contract extends the recovery from 3839.25, Mar 13 low. Key short-term resistance to watch is the 50-day EMA at 4025.43. The average was breached yesterday and a clear break would strengthen a short-term bullish theme and signal scope for a climb towards 4119.50, the Mar 6 high. A failure to hold on to recent gains would refocus attention on key support at 3839.25, the Mar 13 low.

COMMODITIES: WTI Future Gains Considered Technically Corrective

- WTI futures remain vulnerable and recent short-term gains are considered corrective. The contract traded to a fresh low Monday. Last week’s sell-off resulted in the break of key support at $71.10, the Dec 9 low. The break lower confirms a resumption of the medium-term downtrend. Note too that price has also cleared the psychological $70.00 handle. Attention is on $62.43, the Dec 2 2021 low. Initial resistance is at $69.83, last Friday’s high.

- A strong rally in Gold last week saw the yellow metal trade to a fresh YTD high of $1989.4. This confirmed a resumption of the uptrend that started in late September 2022. Monday’s gains resulted in a print above the psychological $2000 handle and this further strengthens bullish conditions and opens $2034.0 next, a Fibonacci projection. The latest pullback is considered corrective, last Friday’s low of $1918.3 marks firm support.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 23/03/2023 | 0830/0930 | *** |  | CH | SNB PolicyRate |

| 23/03/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/03/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/03/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 23/03/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/03/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/03/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2023 | 1500/1600 |  | EU | ECB Lane Panels Peterson Institute Conference | |

| 23/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.