-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Rush Forward BoE Hike Expectations

HIGHLIGHTS:

- UK markets rush to bring forward expectations for a BoE rate hike

- Oil markets hit new cycle high as markets eye supply crunch this winter

- Data slate light on Monday, with a focus on key earnings later in the week

US TSY SUMMARY: Bear Flattening In Sympathy With UK Sell-Off

The Treasury curve is bear flattening to start the week, with global short-end FI selling off in sympathy with UK rate hike expectations being brought forward aggressively.

- 2-Yr yields hit a fresh cycle high (0.4436%) as the UK short-end blew out (2Y UK yields up most since 2010). The 2-Yr yield last up 4.1bps at 0.4355%, 5-Yr is up 5.4bps at 1.1798%, 10-Yr is up 4.2bps at 1.6125%, and 30-Yr is up 2.1bps at 2.0619%.

- Dec 10-Yr futures (TY) down 14/32 at 130-17 (L: 130-15 / H: 130-30), just under 700k traded.

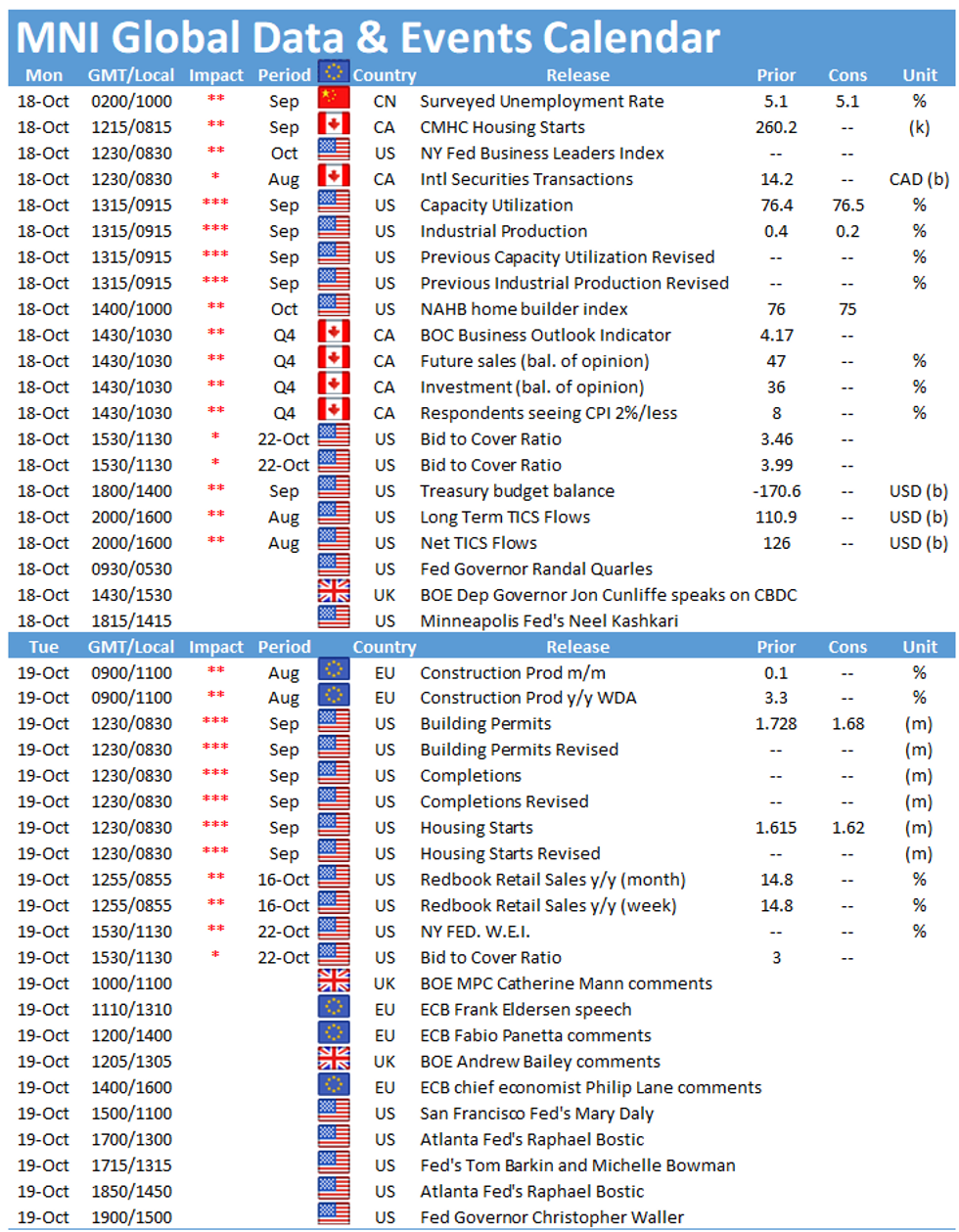

- The session's data highlight is Sept industrial production at 0915ET; we also get NAHB house prices at 1000ET. TIC flows at 2100ET as well.

- Minn Fed's Kashkari speaks at 1415ET. Earlier, Gov Quarles discussed digital assets (eg cryptocurrencies), nothing on current mon pol.

- In supply, $93B combined in 13-/26-week bill auctions at 1130ET. NY Fed buys ~$2.025B in 22.5-30Y Tsys.

EGB/GILT SUMMARY: Hawkish Bailey Triggers Bear Flattening

European sovereign bonds have traded weaker this morning, with gilts leading the charge following further hawkish rhetoric from the BoE over the weekend.

- BoE Andrew Bailey warned on Sunday that the central bank would 'have to act' in response to rising inflationary pressures. Bailey's comments reflect the broader shift in central bank thinking on inflation which has seen more Fed officials expecting a rate hike in 2022, and some ECB policymakers suggesting that the risks to inflation are tilting to the upside.

- The gilt curve has sharply bear flattened. Yields at the short end of the curve have pushed up 10-14bp on the day with the 2s30s spread now down 11bp.

- The shorter end of the bund curve has similarly underperformed the broader sell off. Cash yields are 4-7bp higher across much of the curve.

- BTPs have traded weaker with the belly of the curve underperforming.

- The ECB's Vasle and de Cos will speaker later today.

- The European data calendar was light this morning.

FOREX: GBP Fails to Find Support From Higher Front-End Rates

- Once again, much focus was paid to the higher front-end of the UK Gilt curve, with money markets bringing forward pricing for the expected beginning of a tightening cycle from the BoE. Despite the move in UK fixed income, GBP is seeing no reprieve, with the currency strictly mid-table against the rest of G10.

- Nonetheless, GBP/USD 3m risk reversals capture the date of a possible BoE rate hike and remain heavily in favour of puts over calls, reinforcing the narrative that GBP may not benefit from the imminent beginning of higher rates.

- Early trade saw a return lower for EUR/USD, partially reversing some of the strength seen late last week off the 2021 low of 1.1524.

- The greenback is the best performing currency in G10 ahead of the NY crossover, returning the USD Index back above the 94.00 handle, although remains well off the best levels of last week at 94.561.

- Data points are few and far between across Europe, with focus turning to US industrial production data at 1415BST/0915ET. There are a series of CB speakers, with BoE's Cunliffe, Fed's Quarles & Kashkari on the docket, although none speak directly on monetary policy.

EUR/GBP Failing to Keep Up With Widening Gap in EZ/UK Rate Expectations

- Once again, much focus on the higher front-end of the UK Gilt curve and money markets bringing forward pricing for the expected beginning of a tightening cycle from the BoE. Money markets now pricing circa 25bps for December this year, with rates seen reaching 1% by November 2022.

- Despite the move in UK fixed income, GBP is seeing no reprieve, with the currency strictly mid-table against the rest of G10.

- This isn't a new phenomenon, with sell-side commenting on the divergence between FI / FX, with some speculating higher rates in the near-term will crimp a consumer already exposed to high energy and import prices and a greater tax burden in 2022.

- Forward-looking GBP/USD 3m risk reversals capture the date of a possible BoE rate hike and remain heavily in favour of puts over calls, reinforcing the narrative that GBP may not benefit from the imminent beginning of higher rates.

- Chart below shows EUR/GBP failing to keep pace with a widening gap in EZ/UK rate expectations:

FX OPTIONS: Expiries for Oct18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-20(E757mln), $1.1655(E551mln)

- AUD/USD: $0.7425(A$640mln)

- USD/CAD: C$1.2450($740mln)

Price Signal Summary - Treasuries Resume Their Downtrend

- In the equity space, EUROSTOXX 50 futures are trading near recent highs and holding onto the bulk of last week's gains. The focus is on 4200.50, Sep 24 high. S&P E-minis are holding onto the bulk of last week's gains. Futures have cleared the 50-day EMA and the focus is on resistance at 4472.00, Sep 27 high. It's an important short-term resistance and a break would signal potential for stronger gains near-term. The 50-day EMA at 4390.54 is the support to watch.

- In FX, EURUSD remains below resistance at 1.1627, the 20-day EMA. Recent gains are considered corrective and the primary trend remains down. A strong break above the 20-day EMA is required to suggest scope for a stronger correction. The bear trigger is 1.1524, Oct 12 low. GBPUSD has recently moved through its 50-day EMA, extending the uptrend from Sep 29. The next resistance is at 1.3795, 76.4% retracement of the Sep 14 -29 downleg. USDJPY Remains firm. Last week's key technical development was the breach of 113.41, a multi-year trendline drawn from the Dec 1975 high. This reinforces bullish conditions and opens 114.50/83, 1.382 projection of Apr 23 - Jul 2 - Aug 4 price swing and the 2.0% 10-dma envelope (upper band).

- On the commodity front, Gold has failed to hold onto recent highs and Friday's sharp reversal lower highlights a developing bearish threat. Short-term resistance has been defined at $1800.6, the Oct 14 high. An extension lower would expose support at $1746.0, Oct 6 low. WTI trend conditions remain bullish and futures have resumed their uptrend. The focus is on $84.00 next.

- In the FI space, the primary trend remains down and short-term gains are considered corrective. Recent Bund weakness has exposed 167.98, 2.382 projection of the Sep 9 - 17 - 21 price swing. Resistance is at 169.97, 20-day EMA. Gilt futures remain in a downtrend. A resumption of weakness would refocus attention on 123.27, 2.00 projection of the Aug 31 - Sep 17 - 21 price swing. Resistance is at 125.40, the 20-day EMA. Treasuries are weaker today and have resumed their downtrend. Sight are on 130-17 next, 1.618 projection of the Aug 4 - 11 - 17 price swing.

EQUITIES: European Indices Defensive, But No Sharp Retracement

- Cash equity markets across the continent are modestly lower, with the EuroStoxx50 lower by 0.7% - with similar losses seen across Italian, French and Spanish markets. The UK's FTSE-100 is lower, but losses are limited to 0.2% or so.

- Consumer discretionary and IT names are the poorest performing sectors, with consumer staples and real estate not far behind. Europe's financials sector is the sole group in the green, with Eurozone banks benefiting from higher yields across the curve.

- US futures markets are trading similarly lower, with the e-mini S&P off around 20 points to remain anchored by the 50-dma at 4432.00. Nonetheless, the outlook remains broadly constructive following the rally off the Wednesday low last week, with markets eyeing the Sep27 high at 4472.00 as the first upside level.

- The US earnings cycle continues this week, with highlights this week including Tesla, Intel, Verizon Communications and Netflix all on the docket. Full schedule found here: https://marketnews.com/mni-us-earnings-schedule-focus-shifts-to-healthcare-as-reports-pick-up

COMMODITIES: Oil Markets Edge Higher Still on Crunch Concerns

- Concerns over a supply crunch in winter remains the focus for energy markets, with a spokesperson for the German economy ministry today saying Germany's gas reserves have dropped to 70% of capacity from 75% previously - underlining the pressures that many European countries could face in the coming months.

- The Russian energy minister Novak stated that the country was ready to meet the requirements of increased supply, but no European Union nation has been forthcoming with any request for extra gas.

- Oil markets are positive early Monday, with WTI crude futures hitting another cycle high at $83.73/bbl. The move to fresh highs maintains the bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $84.97 next, a Fibonacci projection.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.