-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - NZD Hits 2021 Low as RBNZ Blinks

HIGHLIGHTS:

- NZD hits 2021 low as RBNZ blinks in face of rising COVID cases

- EUR/USD circling key support as single currency remains weak

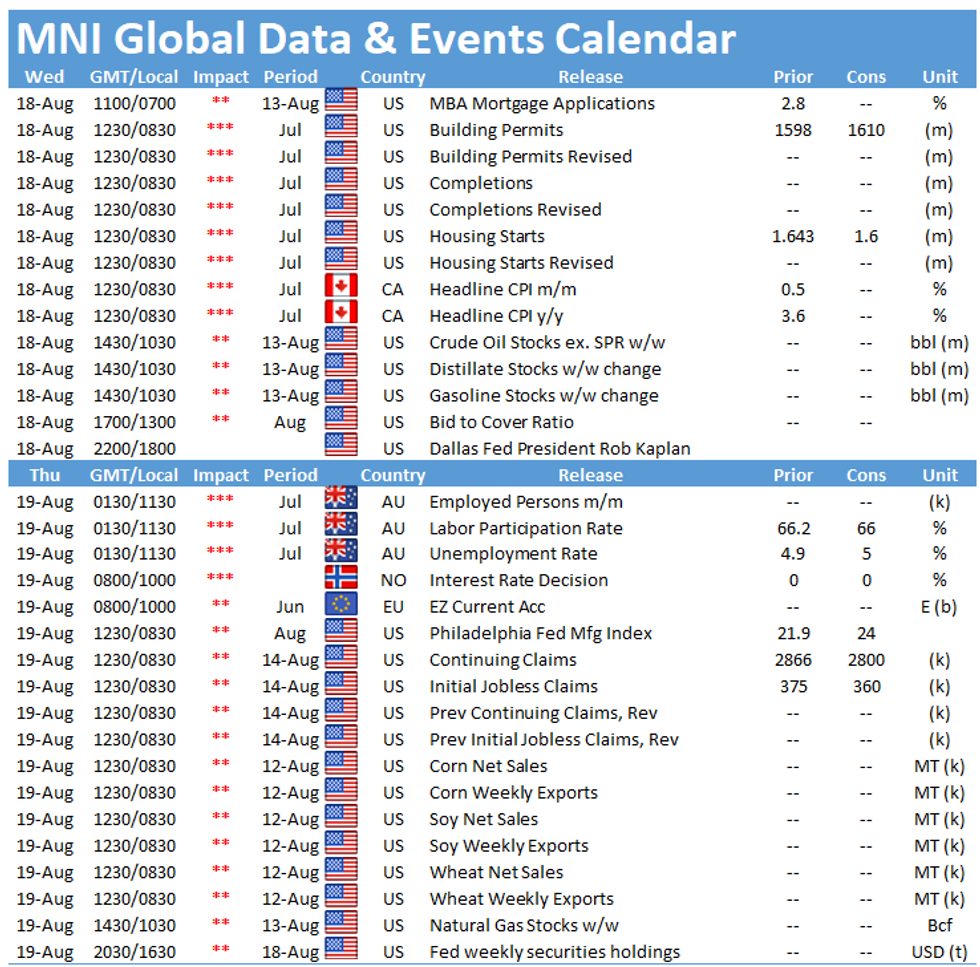

- Fed minutes, US housing starts/building permits and Canadian CPI on the docket

US TSYS SUMMARY: Long End Underperforming Ahead Of FOMC Minutes And 20Y Supply

Treasuries have been trading without much direction early Wednesday, as we await 20Y supply and the FOMC minutes release later for Fed guidance on asset taper / rate hikes.

- After touching session lows in late Asia-Pac hours, Tsys in sympathy with global core bonds gained in London trading following softer-than-survey UK CPI, combined with equities paring an early rise.

- Very much within narrow ranges though: Sep 10-Yr futures (TY) down 1/32 at 134-07.5 (L: 134-03.5 / H: 134-10). And volume nothing special (~250k TYU1 traded).

- Cash curve trading mixed, with longer-end underperformance ahead of supply: The 2-Yr yield is down 0.4bps at 0.2094%, 5-Yr is down 0.5bps at 0.762%, 10-Yr is up 0.2bps at 1.2634%, and 30-Yr is up 0.6bps at 1.925%.

- The July FOMC meeting minutes are released at 1400ET; before that, at 1200ET, St Louis Fed Pres Bullard discusses the US outlook at an online event.

- A lighter day on the data front vs Tuesday: MBA Mortgage Apps at 0700ET, with building permits and housing starts at 0830ET.

- Supply highlight is $27B of 20Y Bond at 1300ET; also $30B 119-Day bill sale at 1130ET. NY Fed buys ~$8.425B of 2.25-4.5Y Tsys.

EGB/Gilt Summary: FOMC Minutes in Focus

- Core fixed income has drifted higher through the European morning session but remains within yesterday's ranges and Treasuries, Bunds and gilts all remain below the levels seen prior to yesterday's retail sales data (which saw fixed income sell-off despite coming in below consensus expectations).

- The highlight of the morning session was UK inflation data that saw headline CPI and core CPI both come in two tenths below expectations, but RPI came in two tenths above expectations. There has been little market reaction to the release, with inflation still expected to pick up later this year. Even UK inflation breakevens have not risen on the back of higher RPI data.

- Looking ahead, the FOMC Minutes will be the highlight later today, with some market participants looking for hints as to whether Jackson Hole will bring tapering talk, or if that decision is to be pushed later into the year (or even next year).

Sep Bund futures (RX) up 19 ticks at 176.99 (L: 176.71 / H: 177.08)

- 2-Yr yield down 0.6bps at -0.742%

- 10-Yr down 1.3bps at -0.484%

- 30-Yr down 1.3bps at -0.034%.

Sep Gilt futures (G) up 13 ticks at 129.99 (L: 129.88 / H: 130.11)

- 2-Yr yield down 1.1bps at 0.138%

- 10-Yr down 1.1bps at 0.551%

- 30-Yr down 1bps at 0.933%.

EUROPE ISSUANCE UPDATE

- Germany allots E827mln 0% Aug-50 Bund, Avg yield -0.04% (Prev. 0.31%), Bid-to-cover 1.63x (Prev. 1.12x), Buba cover 1.97x (Prev. 1.33x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXZ1 172.00/176.00 combo bought for 13 in 1k (+put, -call)

0EH2 99.375/99.125 put spread bought for 6.5 in 31k

UK:

2LU1 99.375/99.125 1x2 put spread sold at 3.5 in 5k

Norges Bank Preview: Final Pause Before September Hike

- With inflation, growth and the progression of the pandemic & vaccination drive well within the Norges Bank's confidence bands, the Bank are likely to double down on the September meeting for rate lift-off. This leaves August's decision as a final pause before an extended tightening cycle.

- In June, the board specifically name-checked September as the most probable meeting at which to start normalizing rates. The accompanying policy statement made clear that the conditions needed for a return to "economic normalization" are fast approaching, and as such, higher policy rates are needed across the forecast horizon

- This language is expected to be re-affirmed this month, with the board strengthening communication around the phrase "the policy rate will most likely be raised in September". It's this messaging element that will be a market focus this month, with no new rate path projections or economic forecasts accompanying the August decision.

- Full preview here: https://roar-assets-auto.rbl.ms/documents/11592/MNINBPrevAug21.pdf

FOREX: NZD Downside in Focus as RBNZ Blink in Face of COVID Spread

- Following further confirmation of COVID spread in New Zealand, the RBNZ opted against any change to policy, keeping rates unchanged at 0.25%. This prompted broad selling pressure in NZD/USD down to 0.6870, but this losses were swiftly reversed as the bank pointed toward October as the next meeting at which rates will likely be raised.

- The USD traded softer overnight, but ranges have been relatively contained - typified by EUR/USD's 20 pip bounce off the overnight lows of 1.1702. The low print in the pair is worth watching, showing signs that markets are putting key support at 1.1704/02 under pressure. A break through here in European or US hours would be more notable, opening losses toward 1.1603 and putting the pair at the lowest level since November last year.

- UK inflation data was mixed, with CPI coming in below forecast while RPI beat expectations. Most CPI measures missed by 0.2ppts or so, pressing GBP/USD toward the overnight lows, but the weakness has largely been erased ahead of the NY crossover.

- US housing starts, building permits & Canadian CPI are the data highlights. FOMC minutes are also due.

FX OPTIONS: Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E707mln), $1.1850(E587mln)

- USD/JPY: $110.00-20($2.0bln)

- AUD/USD: $0.7405(A$712mln), $0.7480(A$2.6bln)

- USD/CNY: Cny6.55($561mln)

Price Signal Summary - EURUSD Resumes Its Downtrend

- In the FX space, EURUSD resumed its bearish theme yesterday and has probed 1.1704 - the 2021 low printed in March. A clear break would leave rates at the lowest levels since November 2020 and open 1.1603, the Nov 4, 2020 low. EURJPY has cleared 128.60, the Jul 20 low. The break confirms a resumption of the current downtrend and signals scope for weakness towards 127.88, 38.2% retracement of the Oct '20 - Jun rally

- On the commodity front, Gold remains firm with the focus on the next important resistance at $1798.2, the 50-day EMA. A break would strengthen bullish conditions. WTI futures support lies at $65.01, Jul 20 low. This level represents a key pivot point.

- On the equity front, S&P E-minis dips are considered corrective. The focus is on 4481.75, 1.00 projection of the Jun 21 - Jul 14 - 19 price swing. Support at the 20-day EMA held yesterday and the level to watch today is 4411.75, yesterday's low. EUROSTOXX 50 futures remain in a clear uptrend despite this week's pullback. The focus is on the 4262.07 2.0% 10-dma envelope. Firm support is at 4153.00, Jun 17 high.

- In FI, support to watch in Bunds is at 176.21, the Aug 11 low. Trend conditions remain bullish. Gilt futures outlook is bullish too and attention is on 130.72, Aug 4 high and the bull trigger. The support to watch is unchanged at 129.10, Jul 22 low.

EQUITIES: Stocks Modestly Softer Shortly Following the Open

- European equity trade a touch negative shortly following the open, with France's CAC-40 underperforming slightly (off 0.3%). Spain's IBEX-35 hold just above water, but is edging lower at typing.

- Europe's energy sector is worst off, with the likes of Royal Dutch Shell, BP and Repsol all lower as oil benchmarks hold close to recent lows.

- Defensive healthcare and utilities names are making gains, underscoring the modest risk-off feel that's been present in markets from the Monday open.

- The US consumer remains a focus for the Wednesday session, with Lowe's, Target and TJX earnings all due today following on from Walmart's report yesterday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.