-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - NZD Net Position Builds to Largest Long in Years

Highlights:

- Canadian CPI could confirm lowest trimmed mean since '21

- EUR/GBP, rate spread correlation breaking down

- NZD net position builds to largest in over five years

US TSYS: 2s10s Push To Fresh YTD Lows As US Desks Filter In

- Treasuries have rallied in recent trading, reversing flows from early in the European session as US desks filter in.

- It pushes push the front-end back to unchanged on the end and the longer-end to richer levels (cash yields now 0-1bp lower on the day), with 2s10s pushing lower to fresh YTD lows of circa -50bps.

- TYU4 has seen a high of 110-23 on still subdued cumulative volumes of 255k. It tests yesterday’s high of 110-22 in a continuation of the bullish pattern, and with resistance seen at 111-01 (Jun 14 high).

- The Conference Board consumer survey headlines data but there is also notable Fedspeak as well as the 2Y auction after last month’s 2Y saw the lowest bid-to-cover since 2021.

- Data: Philly Fed non-mfg Jun (0830ET), Chicago Fed national activity May (0830ET), FHFA and S&P CoreLogic house prices Apr (0900ET), Conf Board consumer survey Jun (1000ET), Richmond Fed mfg Jun (1000ET), Dallas Fed services Jun (1030ET)

- Fedspeak: Fed Gov Bowman on mon-pol & bank reform (0700ET, text + Q&A), Fed Gov Cook economic outlook (1200ET, text + Q&A) and Fed Gov Bowman recorded open remarks (1410ET, text) - see STIR bullet.

- Note/bond issuance: US Tsy $69B 2Y Note auction - 91282CKY6 (1300ET)

- Bill issuance: US Tsy $60B 42D CMB auction (1130ET)

Source: Bloomberg

Source: Bloomberg

STIR: Potentially Significant Fedspeak On The Docket

- Fed Funds implied rates are little changed overnight having softened late yesterday.

- Cumulative cuts from 5.33% effective. 3bp Jul, 19bp Sep, 28bp Nov, 48bp Dec and 62bp Jan.

- Today sees a limited Fedspeak schedule but potentially an important one with the first post-FOMC comments from permanent voters Bowman (leading hawk) and Cook (long-awaited comments).

- 0700ET – Gov. Bowman (voter) on mon pol & bank capital reform (text + Q&A). She last spoke on mon pol on May 17 (policy is restrictive but monitoring to see if its sufficiently so, willing to hike if inflation stalls or reverses, inflation to remain elevated for some time). She since then on May 28 said reserves are not yet approaching an ample level and would have supported slowed QT later or tapering its pace.

- 1200ET – Gov. Cook (voter) on economic outlook (text + Q&A) in a rare appearance on the subject matter. Her last notable mon pol remarks were back in March looking at two-sided risks to the rate outlook. She did however add on May 8 that she’s closely watching rising auto and credit card delinquencies.

- 1410ET – Bowman recorded opening remarks for cyber workshop.

US TSY FUTURES: OI Points To Mix Of Short & Long Setting On Monday

The combination of yesterday’s twist flattening of the curve and preliminary OI data points to a mix of net short setting (TU & FV) and net long setting (TY, UXY, US & WN).

- The net long setting in the long end was more prominent than the net short setting in the front end/belly.

| 24-Jun-24 | 21-Jun-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 4,139,729 | 4,128,215 | +11,514 | +439,031 |

| FV | 6,223,150 | 6,189,890 | +33,260 | +1,414,297 |

| TY | 4,334,029 | 4,290,687 | +43,342 | +2,818,969 |

| UXY | 2,055,525 | 2,044,109 | +11,416 | +1,030,139 |

| US | 1,641,993 | 1,638,486 | +3,507 | +469,164 |

| WN | 1,672,687 | 1,669,486 | +3,201 | +664,403 |

| Total | +106,240 | +6,836,003 |

STIR: OI Points To Mix Of Long Setting & Short Cover Across Much Of SOFR Futures Strip On Monday

The most meaningful Monday move in SOFR futures’ positioning came via net long setting in the very front end of the strip, with nearly 25K new net longs added across SFRM4 through SFRZ4.

- Further out, net short cover was seen in SFRH6 through SFRU7.

- This came as comments from San Franciso Fed President Daly (’24 voter) emphasised the potential for cuts on the back of any unexpected deterioration in the labour market, putting her somewhere on the neutral-to-dovish area of the 2024 dot plot.

- This supported SOFR futures into the close, with some weakness in equities also factoring in.

- FOMC-dated OIS saw a modest dovish move on the same factors, pricing ~46bp of ’24 cuts late on Monday vs. ~44bp late on Friday.

| 24-Jun-24 | 21-Jun-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM4 | 1,239,784 | 1,232,165 | +7,619 | Whites | +21,020 |

| SFRU4 | 1,153,492 | 1,148,130 | +5,362 | Reds | +730 |

| SFRZ4 | 991,529 | 980,446 | +11,083 | Greens | -15,446 |

| SFRH5 | 811,959 | 815,003 | -3,044 | Blues | -7,505 |

| SFRM5 | 701,658 | 703,659 | -2,001 | ||

| SFRU5 | 624,493 | 619,587 | +4,906 | ||

| SFRZ5 | 810,695 | 804,507 | +6,188 | ||

| SFRH6 | 560,148 | 568,511 | -8,363 | ||

| SFRM6 | 481,288 | 486,140 | -4,852 | ||

| SFRU6 | 417,264 | 422,056 | -4,792 | ||

| SFRZ6 | 358,411 | 362,835 | -4,424 | ||

| SFRH7 | 245,923 | 247,301 | -1,378 | ||

| SFRM7 | 217,072 | 221,796 | -4,724 | ||

| SFRU7 | 179,981 | 184,404 | -4,423 | ||

| SFRZ7 | 168,476 | 167,419 | +1,057 | ||

| SFRH8 | 116,149 | 115,564 | +585 |

CANADA: MNI Canada CPI Preview: Core CPI Metrics Watched For Back-to-Back Cut Clues

- We have published and e-mailed to subscribers the MNI Canada CPI Preview.

- Please find the full report including MNI analysis and views from nine sell side analysts here: https://roar-assets-auto.rbl.ms/files/64972/CanadaCPIPrevJun2024.pdf

GBP: EURGBP correlation with STIR spreads changed since ECB; GBPUSD correlation holds

- Prior to the June ECB meeting, EURGBP had been trading broadly in line with the 2-year ahead STIR spread (as can be seen in the bottom chart below). There had been some small divergences but in general the correlation had held pretty well since the beginning of the year. Through this time, UK-US rate differentials have also been driving GBPUSD.

- However, since the ECB meeting the correlation between Euribor-SONIA spreads and EURGBP seems to have broken down with GBP stronger against EUR than would be expected. At the same time (and it has only been three weeks), GBPUSD's correlation with SONIA-SOFR spreads has remained just as strong.

- Of course, this also informs us that the euro is trading weaker against USD than rate differentials would have suggested - but the resilience in the correlation between GBPUSD and UK-US spreads remains notable.

CANADA: Conservatives Score Shock By-Election In Blow To PM Trudeau & Liberals

The centre-right main opposition Conservative Party of Canada (CPC) has scored an unexpected win in the by-election for the Toronto-St. Paul riding, which took place on 24 June.

- In an extremely close contest, CPC candidate Don Stewart won 42.1% of the vote to the 40.5% recorded for the centre-left Liberal Party of Canada (LPC)'s Leslie Church. Toronto-St. Paul, covering the area north and northeast of Downtown Toronto, has been held by the LPC since the 1993 general election that swept away the Progressive Conservatives as a party. It turning blue for the first time since then will come as a notable blow to the LPC and PM Justin Trudeau.

- The next federal election is not due until October 2025 at the latest, but having fought in three election campaigns and facing record-low opinion polling there is speculation that Trudeau could step aside before then in order to allow a new Liberal leader (Fin Min Chrystia Freeland seen as the heir apparent) to gain some experience and set out their agenda before the vote.

- At present, Pierre Poilievre's CPC lead opinion polls by just under 20%, with the LPC now battling the left-wing New Democratic Party (NDP) for second place. Poilievre also leads in preferred PM polling, while the gov'ts net disapproval rating stands around a record low of -40%. All of this points towards a change in gov't from a LPC minority to a CPC majority at the next election.

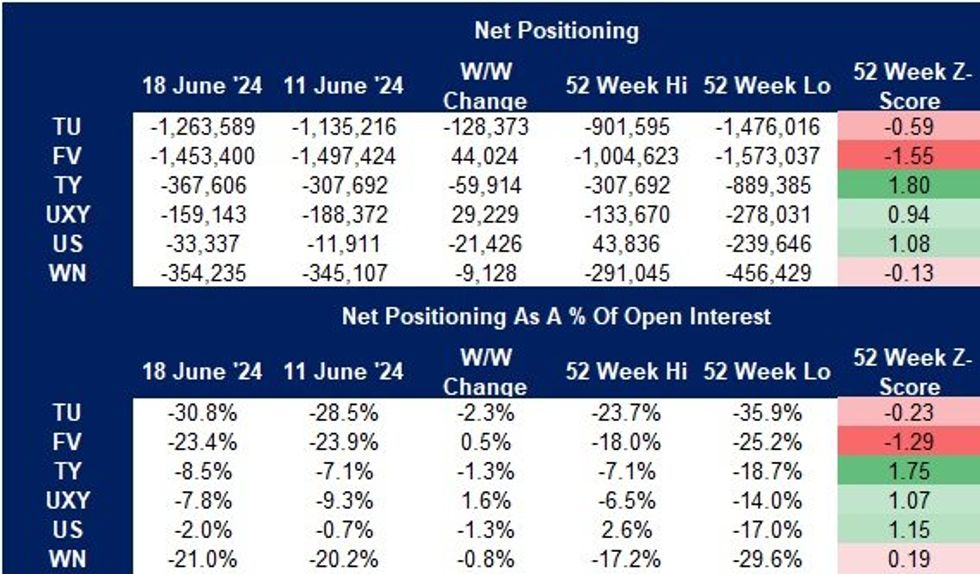

US TSY FUTURES: CFTC CoT Shows Hedge Funds Extending Record TU Net Short

The latest CFTC CoT report (covering the period through Jun 18) showed hedge funds extending already record net short positioning in TU futures, despite a dovish move in FOMC-dated OIS pricing over the survey period

- Conversely, the same cohort’s prior net short position in SOFR futures vanished, as they flipped back to net long positioning.

- Softer-than-expected CPI & PPI readings likely drove the move in their SOFR positioning, providing the major inputs for the dovish adjustment in Fed pricing.

- The survey period also captured the latest FOMC decision, as well as the onset of the French political uncertainty.

- Asset managers extended their overall net long duration position, although trimmed net longs in FV & UXY futures.

- Overall, the report showed a mix of non-commercials extending some existing net shorts (TU, TY, US & WN) and trimming some existing net shorts (FV & UXY).

- CFTC CoT positioning measures will be skewed by basis trades.

Source: MNI - Market News/CFTC/Bloomberg

Source: MNI - Market News/CFTC/Bloomberg

NZD Position Boosted to Multiyear Highs, Asset Managers Switch to Net Long

- The net NZD position shot higher in the week-ending Jun 18th, with the outright position now the highest since 2018 at over 20k contracts. The W/W net improvement equates to 18.1% of open interest and is comfortably the biggest weekly change in positioning for several months. Both the asset manager and leveraged funds categories saw NZD positioning improve - and notably the asset manager class switched to a net long.

- This tips the NZD Z-score to 2.76, by a distance the most positive among all currencies surveyed. The shift in positioning comes as a result of new longs, rather than aggressive short-covering, with outright shorts still within the YTD range.

- Markets built the net short in JPY and net long in GBP, while the AUD short and MXN were trimmed. EUR positioning abated from a small net long to neutral.

- Full update here:

EUROPE ISSUANCE UPDATE:

Italy auction results

* E2.5bln of the 3.20% Jan-26 BTP Short Term. Avg yield 3.48% (bid-to-cover 1.46x).

* E1bln of the 0.40% May-30 BTPei. Avg yield 1.68% (bid-to-cover 1.60x).

* E1.25bln of the 2.40% May-39 BTPei. Avg yield 2.26% (bid-to-cover 1.55x).

Germany auction results

* E4.5bln (E3.646bln allotted) of the 2.90% Jun-26 Schatz. Avg yield 2.8% (bid-to-offer 1.93x; bid-to-cover 2.39x).

Finland syndication: Final terms

* USD1bln (the bottom of the EUSD1-2bln range MNI had expected) of the Jul-34 USD RFGB. Books in excess of USD1.1bln, spread set at SOFR MS+55bps (~CT10+15.8bps), in line with yesterday's IPT.

Lithuania syndication: Mandate

* "The Republic of Lithuania has mandated Deutsche Bank, HSBC and Societe Generale for a potential EUR-denominated benchmark 7-year Reg S only transaction, to be launched in the near future, subject to market conditions." From market source

* E3.0bln is planned to be sold via EMTNs at syndication, so we look for another E1.5bln transaction.

* We expect the transaction to take place tomorrow.

FOREX: GBP/USD Awaits Cues for Any Extension of Possible Reversal

- GBP/USD's progress off the Monday low has the pair again testing 1.2700. Further gains through 1.2724 would form the beginnings of a reversal pattern off the recent low and support at the 50-dma. With UK opinion polling still pointing to a sizeable majority for the Labour Party and the Bank of England inside the pre-election media blackout, focus will rest on the USD Index, which is consolidating yesterday's downtick, and has opening a small gap with recent highs.

- The fade in the USD Index so far this week has provided scant relief for USD/JPY. The JPY spot trade-weighted index trades within close proximity to the pre-intervention low, keeping the strength of the currency a key concern for the Japanese authorities. For now, the technical trend in USD/JPY remains bullish, but the intraday volatility noted during the Monday session shows markets remain subject to corrective pullbacks.

- JPY is the firmest in G10 alongside GBP so far Tuesday, with NOK the weakest.

- Focus for the duration of the Tuesday session rests on the Canadian CPI release, at which markets expected M/M CPI to moderate to 0.3% from 0.5% and the trimmed mean down to 2.8% from 2.9%.

Expiries for Jun25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.2bln)

- USD/JPY: Y158.75($530mln), Y160.00($1.3bln)

- AUD/USD: $0.6665-75(A$859mln)

- USD/CNY: Cny7.3000($506mln)

E-Mini S&P Continues to Trade Close to Recent Highs

- The trend condition in Eurostoxx 50 futures remains bullish. A corrective cycle is in play and this has resulted in a pullback from the May high. Recent weakness has seen price breach 4988.00, Jun 11 low, highlighting potential for a deeper retracement and has exposed 4846.00, Apr 19 low and a key support. The recovery from the Jun 14 low is potentially an early bullish signal. Resistance to watch is at 5039.84, a Fibonacci retracement.

- The uptrend in S&P E-Minis remains intact and the contract continues to trade closer to its recent highs. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support to watch lies at 5458.51, the 20-day EMA.

Bear Threat in Gold Remains Present Following Friday's Sell-Off

- WTI futures are trading at their latest highs and the current bull phase remains intact. The recent move higher has resulted in a break of $80.11, the May 29 high and a key resistance. The clear breach of this hurdle cancels a bearish theme and paves the way for $82.24, a Fibonacci retracement point. Initial firm support to watch is $78.65, the 20-day EMA. A break would be seen as an early potential reversal signal.

- Gold continues to trade below resistance and a bear threat remains present. A sharp sell-off on Jun 7 reinforced a short-term bearish theme. The yellow metal has pierced the 50-day EMA, at 2318.4. A clear break would confirm a resumption of the reversal from May 20 and open $2277.4, the May 3 low. Clearance of this price point would also strengthen a bearish theme. Initial firm resistance is $2387.8, the Jun 7 high.

| Date | GMT/Local | Impact | Country | Event |

| 25/06/2024 | 1100/0700 | Fed Governor Michelle Bowman | ||

| 25/06/2024 | 1230/0830 | *** | CPI | |

| 25/06/2024 | 1230/0830 | ** | Philadelphia Fed Nonmanufacturing Index | |

| 25/06/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 25/06/2024 | 1300/0900 | ** | S&P Case-Shiller Home Price Index | |

| 25/06/2024 | 1300/0900 | ** | FHFA Home Price Index | |

| 25/06/2024 | 1300/0900 | ** | FHFA Home Price Index | |

| 25/06/2024 | 1400/1000 | *** | Conference Board Consumer Confidence | |

| 25/06/2024 | 1400/1000 | ** | Richmond Fed Survey | |

| 25/06/2024 | 1430/1030 | ** | Dallas Fed Services Survey | |

| 25/06/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 25/06/2024 | 1600/1200 | Fed Governor Lisa Cook | ||

| 25/06/2024 | 1700/1300 | * | US Treasury Auction Result for 2 Year Note | |

| 25/06/2024 | 1810/1410 | Fed Governor Michelle Bowman | ||

| 26/06/2024 | 0130/1130 | *** | CPI Inflation Monthly | |

| 26/06/2024 | 0600/0800 | * | GFK Consumer Climate | |

| 26/06/2024 | 0600/1400 | ** | MNI China Liquidity Index (CLI) | |

| 26/06/2024 | 0600/0800 | ** | PPI | |

| 26/06/2024 | 0645/0845 | ** | Consumer Sentiment | |

| 26/06/2024 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 26/06/2024 | 1000/1100 | ** | CBI Distributive Trades | |

| 26/06/2024 | 1040/1240 | ECB's Lane speech at Bank of Finland MonPol conference | ||

| 26/06/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 26/06/2024 | 1400/1000 | *** | New Home Sales | |

| 26/06/2024 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 26/06/2024 | 1530/1130 | ** | US Treasury Auction Result for 2 Year Floating Rate Note | |

| 26/06/2024 | 1700/1300 | * | US Treasury Auction Result for 5 Year Note | |

| 26/06/2024 | 2000/2100 | BBC Leaders Head-to-Head debate | ||

| 27/06/2024 | 2350/0850 | * | Retail Sales (p) | |

| 27/06/2024 | 0130/1130 | Job Vacancies | ||

| 27/06/2024 | 0700/0900 | ** | Economic Tendency Indicator | |

| 27/06/2024 | 0730/0930 | *** | Riksbank Interest Rate Decison | |

| 27/06/2024 | 0800/1000 | ** | M3 | |

| 27/06/2024 | 0800/1000 | ** | ISTAT Business Confidence | |

| 27/06/2024 | 0800/1000 | ** | ISTAT Consumer Confidence | |

| 27/06/2024 | 0800/1000 | ** | PPI | |

| 27/06/2024 | 0900/1100 | ** | EZ Economic Sentiment Indicator | |

| 27/06/2024 | 0900/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 27/06/2024 | 1100/0700 | *** | Turkey Benchmark Rate | |

| 27/06/2024 | 1215/1415 | ECB's Elderson speech on Banking Supervision at Allen & Overy | ||

| 27/06/2024 | 1230/0830 | *** | Jobless Claims | |

| 27/06/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 27/06/2024 | 1230/0830 | *** | GDP | |

| 27/06/2024 | 1230/0830 | * | Payroll employment | |

| 27/06/2024 | 1230/0830 | ** | Durable Goods New Orders | |

| 27/06/2024 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 27/06/2024 | 1400/1000 | ** | NAR Pending Home Sales | |

| 27/06/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 27/06/2024 | 1500/1100 | ** | Kansas City Fed Manufacturing Index | |

| 27/06/2024 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 27/06/2024 | 1900/1500 | *** | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.