-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: Offshore Yuan Through 7.00

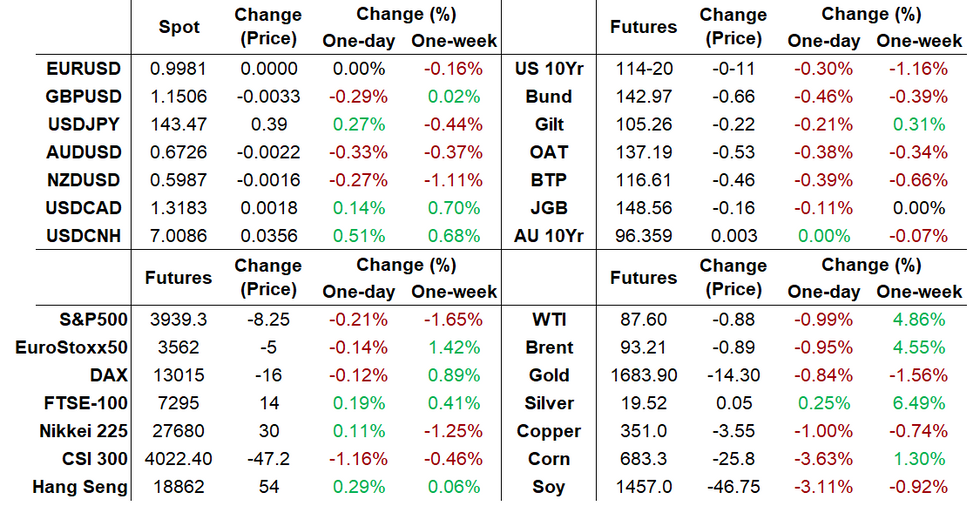

Highlights:

- Dollar reverses higher, stocks lower in late European trade after USDCNH breaks through 7.00

- Risk-off move exacerbated by headlines suggesting Russia-US tensions ratcheting up

- US data again in focus: retail sales, industrial production, jobless claims, and Philly Fed/Empire State readings

US TSYS: New Cycle Highs For Front End Yields As Rate Path Climbs

- Tsys cheapen with a tightly packed 4.5-5bp climb across the curve as yields maintain the post-CPI trend drift higher and the 2YY and 5YY post new cycle and in turn fresh post-2007 and post-2008 highs.

- The 2YY is supported by both a further climb in terminal rate expectations and an end-2023 rate closing in on 4%, whilst 2s10s is little changed at -37.5bps, still off lows closer to -50bps and potentially reflecting views of higher structural inflation.

- TYZ2 maintains a bearish outlook at 114-19+ (-11+ ticks), close to yesterday’s low of 114-17 under which sits a key support at 114-06 (Jun 14 low).

- Data: Retail sales, Empire & Philly, Jobless Claims, Int’l prices, IP and Inventories

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions – 1130ET

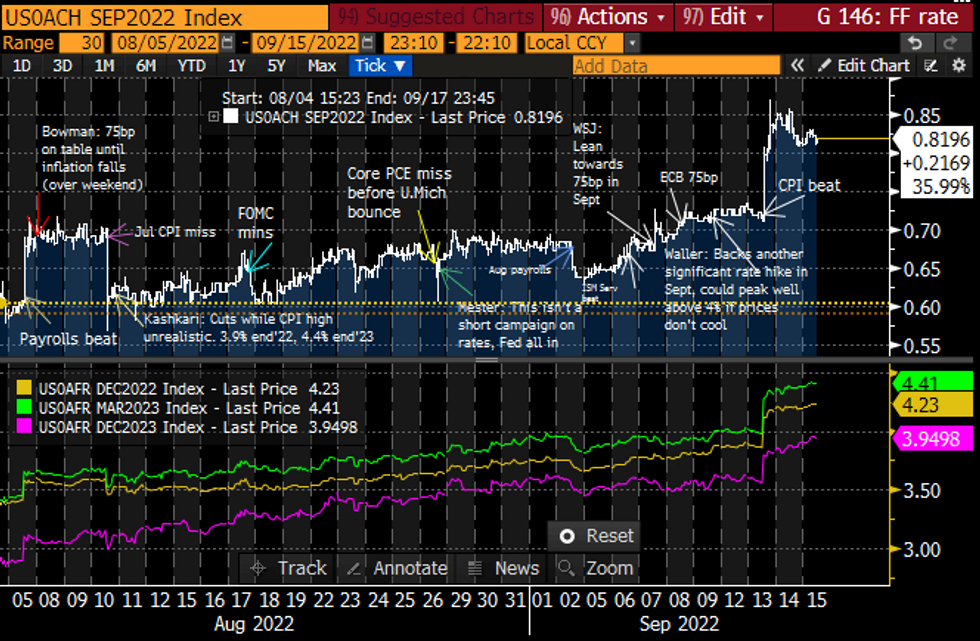

STIR FUTURES: Fed Rate Path Continues Higher For Longer

- Fed Funds implied hikes at 82bp (+0.5bp) for next week, maintaining just off recent highs of ~85bps post-CPI.

- Continued increase for later meetings though, with a cumulative 151bps for Sep & Nov (+2bp), terminal now 4.41% in Mar’23 (+2bp) and a flattening with 3.95% for Dec’23 (+5bp on day, +13bp since post-CPI close).

- Heavy docket today including retail sales, the first Sep business surveys and jobless claims plus additional inflation focus with import prices (ex-oil cons. -0.6% M/M).

FOMC-dated Fed Funds futures implied Sept FOMC hike (white) and specific rates at subsequent meetings (bottom panel)Source: Bloomberg

FOMC-dated Fed Funds futures implied Sept FOMC hike (white) and specific rates at subsequent meetings (bottom panel)Source: Bloomberg

EGBs/GILTS: Gilts outperform on inflation expectations data

- Gilts are the outperformers this morning, with early weakness being partially reversed following the release of BOE/Ipsos inflation expectations data which showed that 5-year ahead inflation expectations had fallen to 3.1% in August from 3.5% in May (and the survey was conducted way before there was any substantial talk of energy price caps). We think that for members who were on the fence between 50bp and 75bp this data, along with yesterday's spot inflation data will sway a decision towards 50bp.

- Bunds are weaker on the day.

- Dec 22 US T-Note future is down 11.5/32 at 114-19.5, having traded in a range of 114-18 to 115-01.

- Dec Bund futures (RX) down 73 ticks at 142.9 (L: 142.8 / H: 143.63)

- Dec Gilt futures (G) down 33 ticks at 105.15 (L: 104.87 / H: 105.47)

- Dec BTP futures (IK) down 52 ticks at 116.55 (L: 116.39 / H: 117.12)

- Italy / German 10-Yr spread 0.4bps tighter at 228.2bps

Kremlin Spox: Long-Range Missiles Will Cross "Red Line"

Per Reuters, Kremlin spox Maria Zakharova has told reporters that any move by the United States to supply Kyiv with long-range missiles will cross a "red-line" and make the US a "party to the conflict."

- The hawkish comments are likely in response to speculation that Washington may be considering changing tack on providing Kyiv with Army Tactical Missile Systems (ATACMS) - a missile system with a range of nearly 200 miles - capable of striking targets within Russian territory.

- The WSJ reported on Monday that Ukrainian military officials sent Washington a formal request to consider ATACMS in future shipments of arms to Kyiv.

- The Biden administration has previously ruled out supplying such systems due to fears that use by Ukraine could escalate the conflict.

- This week there has been speculation that the Pentagon may revaluate this position after a Ukrainian counterattack engendered optimism that more advanced weapons could hasten an end to the conflict. The success of the counterattack has been largely attributed to the increased use of US supplied High Mobility Artillery Rocket System (HIMARS), a missile system that the Pentagon was initially hesitant to include in military aid packages to Kyiv.

EUROPE BOND ISSUANCE

Spain auction results

- E863mln of the 2.15% Oct-25 Obli. Avg yield 1.875% (bid-to-cover 2.8x).

- E2.065bln of the 0% Jan-27 Bono. Avg yield 2.228% (bid-to-cover 1.85x).

- E1.246bln of the 0.50% Apr-30 Obli. Avg yield 2.51% (bid-to-cover 2.18x).

France auction results

- E2.699bln of the 0% Feb-27 OAT. Avg yield 1.84% (bid-to-cover 2.68x).

- E4.524bln of the 0.75% Feb-28 OAT. Avg yield 1.96% (bid-to-cover 2.65x).

- E2.775bln of the 0% Nov-29 OAT. Avg yield 2.01% (bid-to-cover 2.06x).

- E655mln of the 0.10% Mar-25 OATi. Avg yield -1.14% (bid-to-cover 4.47x).

- E417mln of the 0.10% Jul-38 Green OATei. Avg yield 0.15% (bid-to-cover 3.43x).

- E178mln of the 0.10% Jul-53 OATei. Avg yield 0.12% (bid-to-cover 4.74x).

FOREX: Offshore Yuan Breaks Above 7.00

- USDCNH breaks the 2022 high and highest since July 2020.

- Policy divergence with the Fed continues to weigh, ahead of the Fed next week, as well as investors putting cold water on growth outlook. Market participants will look at 7.0302 resistance.

- The Japanese Yen is once again on the back foot overnight and in early trade, after the Japan trade deficit increased further overnight.

- After gaining 1.64% yesterday against the Dollar, USDJPY is up 0.25% at the time of typing.

- The Pound is the slight worst performer against the USD, down 0.28%, but the Greenback trades mixed in G10, in the green versus GBP, JPY, NOK, and in the red against CHF EUR, NZD and CAD.

- EUR has been supported in early trade, and trading near session high against CHF, GBP, JPY, AUD, CNH, CAD.

- There's 1.3bn at 1.0000 worth of option expiry for today, which could act as a magnet.

- Looking ahead, out of the US Retail Sales and IP are the notable data.

FX OPTION EXPIRY

Of note:

EURUSD 1.3bn at 1.0000.

USDCNY 5.61bn at 6.95/7.00.

EURGBP 1.15bn at 0.8600.

EURUSD 2bn at 1.0000 (wed)

- EURUSD: 0.9990 (280mln), 1.0000 (1.3bn), 1.0017 (241mln), 1.0020 (439mln), 1.0050 (1.14bn).

- EURGBP: 0.8600 (1.15bn).

- USDCAD: 1.3200 (365mln).

- AUDUSD; 0.6755 (252mln), 0.6800 (235mln).

- USDCNY: 6.95 (1.15bn), 6.97 (1bn), 7.0 (3.46bn).

Price Signal Summary - Gold Bears Remain In The Driver’s Seat

- In the equity space, S&P E-Minis remain vulnerable. The sharp sell-off Tuesday, threatens the recent recovery. Attention is on the key short-term support at 3900.00, Sep 7 low and a bear trigger. A break would strengthen a bearish case and signal scope for deeper pullback. Tuesday’s high of 4175.00 represents an important near-term resistance. EUROSTOXX 50 futures faced strong resistance on Tuesday. The sharp move lower threatens the recent short-term recovery and signals the end of what has likely been a corrective cycle. A deeper pullback would refocus attention on a key short-term support at 3429.00, the Sep 5 low. Tuesday’s high of 3685.00 is the short-term bull trigger.

- In FX, EURUSD traded sharply lower Tuesday and remains inside its bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0122 and is a key resistance. A close above this level would highlight a channel breakout. For bears, an extension lower would expose the bear trigger at 0.9864, the Sep 6 low. GBPUSD reversed lower Tuesday, reinforcing bearish conditions and signalling the end of the recent corrective bounce. Key support at 1.1412, Mar 20 2020 low, has recently been pierced. A clear break would strengthen bearish conditions and resume the broader downtrend. Initial resistance is at Tuesday’s high of 1.1738. USDJPY key short-term resistance at 144.99, Sep 7 high, remains intact - for now. The trend outlook is bullish and a break of 144.99 would confirm a resumption of the uptrend. This would open 145.28 and 146.03, the 2.618 and 2.764 projection of the Aug 2 - 8 - 11 price swing. Initial firm support is at 141.51, Sep 9 low. A strong support also lies at the 20-day EMA, at 140.48.

- On the commodity front, Gold remains in a downtrend and has traded lower today. The focus is on $1681.0, the Jul 21 low and a key bear trigger. A break would confirm a resumption of the broader downtrend. Initial firm resistance is at $1735.1, Monday’s high. In the Oil space, WTI futures continue to trade closer to recent highs. The latest recovery is considered corrective and a bearish threat remains present following the sharp sell-off between Aug 30 - Sep 8. Firm resistance is seen at $91.71, the 50-day EMA. A reversal lower would refocus attention on $81.20, the Sep 8 low and bear trigger.

- In the FI space, Bund futures remain in a clear downtrend. A bearish price sequence of lower lows and lower highs remains intact, clearly highlighting current sentiment. The focus is on the 142.00 handle. Gilts remain vulnerable and touched a fresh trend low of 104.47 yesterday. Attention is on 103.87, 2.00 projection of the Aug 22 - 24 - 26 price swing.

COMMODITIES / EQUITIES

Equities:

- Asian markets closed mixed: Japan's NIKKEI closed up 57.29 pts or +0.21% at 27875.91 and the TOPIX ended 2.97 pts higher or +0.15% at 1950.43. China's SHANGHAI closed down 37.623 pts or -1.16% at 3199.919 and the HANG SENG ended 83.28 pts higher or +0.44% at 18930.38.

- European equities are weaker: German Dax down 11.92 pts or -0.09% at 13028, FTSE 100 up 24.3 pts or +0.33% at 7285.96, CAC 40 down 21.64 pts or -0.35% at 6225.6 and Euro Stoxx 50 down 5.37 pts or -0.15% at 3567.56.

- U.S. futures are a little lower: Dow Jones mini down 34 pts or -0.11% at 31115, S&P 500 mini down 7.5 pts or -0.19% at 3940, NASDAQ mini down 40.25 pts or -0.33% at 12101.5.

Commodities:

- WTI Crude down $0.66 or -0.75% at $89.26

- Natural Gas down $0.46 or -5% at $8.715

- Gold spot down $10.59 or -0.62% at $1703

- Copper down $3.15 or -0.9% at $352.25

- Silver down $0.25 or -1.3% at $19.6313

- Platinum down $2.53 or -0.28% at $913.59

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 15/09/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/09/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/09/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2022 | 1400/1000 | * |  | US | Business Inventories |

| 15/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/09/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/09/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/09/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/09/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 16/09/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 16/09/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/09/2022 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/09/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/09/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 16/09/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.