-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Oil Following Equities North

HIGHLIGHTS:

- Equities extend rally, Europe up over 2%

- Oil follows stocks higher, WTI up near 10% off Friday lows

- US sovereign curve responds with bear flattening

US TSYS SUMMARY: 2Y Yield Above Pre-Omicron YTD High

- Cash Tsys have bear flattened this morning as equities and oil rise.

- 2Y yields are +2.2bps at 0.653%, 5Y +1.0bps at 1.216%, 10Y +0.2bps at 1.436% and 30Y -0.4bps at 1.766%.

- The 2Y has pulled back slightly off session highs but is now through the previous ytd high just before Thanksgiving, prior to the emergence of the Omicron variant.

- TYH2 futures sold off in early trading but are little changed on the day, down one tick at 130-20. It’s at the low end of the past few days range, with initial support seen at the 20-day EMA of 130-07+.

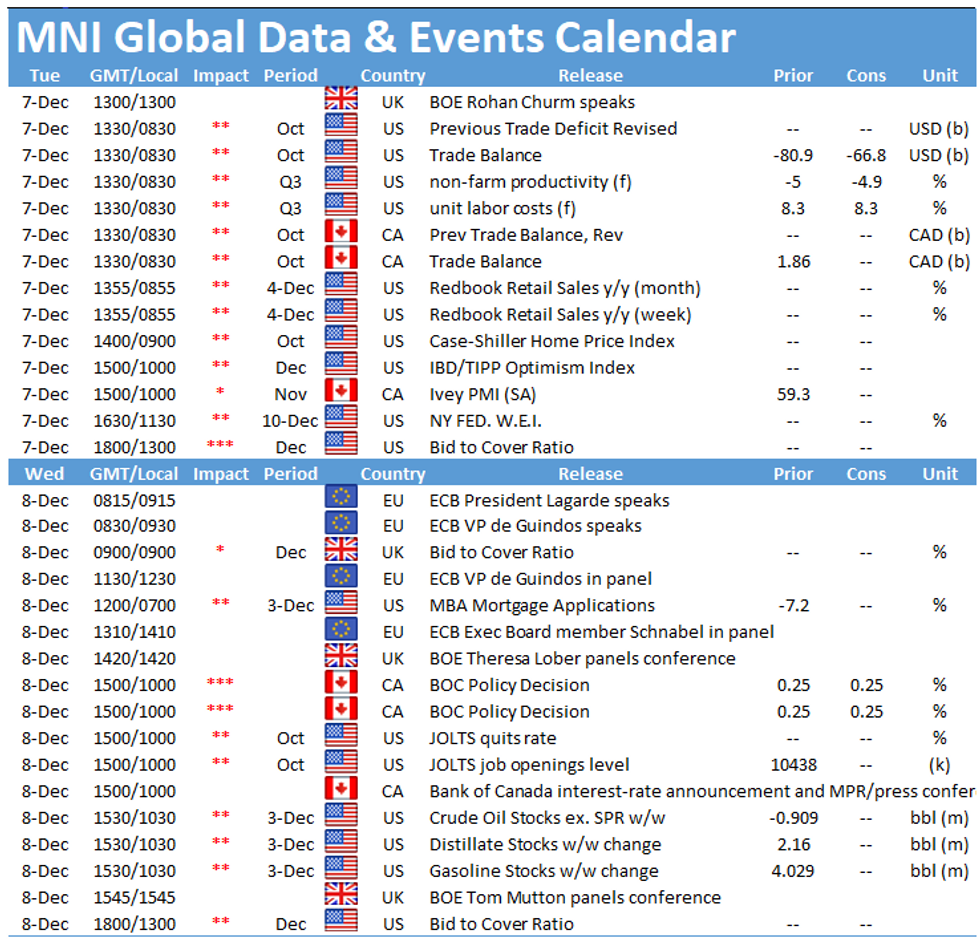

- The main data today are finalized Q3 unit labor costs and the October trade balance at 0830ET. The Fed is in media blackout ahead of the Dec 15 meeting.

- NY Fed buy-op: Tsy 22.5Y-30Y, appr $1.600B (1030ET).

- On the issuance front, we see a return to notes with $54B of 3Y today (1300ET). 10Y follows tomorrow and 30Y on Thursday.

EGB/GILT SUMMARY: Still Offered

European government bonds traded weaker from the open and, despite paring back earlier losses, EGBs/Gilts continue to trade below yesterday's close. Equities have rallied across the board, while FX performance against the USD has been mixed.

- Having initially opened lower, gilts have recovered some of the earlier losses with cash yields now 1-3bp higher on the day and the curve bear flattening.

- Bunds have traded in a similar fashion following the initial leg lower. The 2s30s spread is now 2bp narrower.

- OAT yields are 1-2bp higher across much of the curve.

- BTPs have underperformed core EGBs on the day with yields up 2-4bp.

- The final estimate of Q3 GDP for the euro area was inline with the initial print in Q/Q terms (2.2%) and was a touch higher in Y/Y terms (3.9% vs 3.7% previously). German industrial production for October came in stronger than expected (2.8% M/M vs 1.0% survey, -0.6% Y/Y vs -2.9% expected).

- Supply this morning came from the UK (Gilts, GBP1.5bn), Germany (Schatz, EUR3.277bn allotted), Spain (Letras, EUR4.539bn), the Netherlands (DSL, EUR2.1bn) and Belgium (TCs, EUR1bn).

- There are no European central bank speakers lined up for today and a light US data slate this afternoon.

EUROPE ISSUANCE UPDATE

Germany allots E3.277bln 0% Dec-23 Schatz, Avg yield -0.71% (Prev. -0.71%), Bid-to-cover 1.11x (Prev. 1.00x), Buba cover 1.36x (Prev. 1.26x)

UK DMO sells GBP1.50bln 1.25% Jul-51 Gilt, Avg yield 0.871% (Prev. 1.332%), Bid-to-cover 2.42x (Prev. 2.05x), Tail 1.0bp (Prev. 1.1bp)

Netherlands sells E2.1bln 2.00% Jul-24 DSL, Avg yield -0.688%, Price 107.07

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXG2 173.5/172ps 1x1.4, bought for 14 in 1k vs selling RXF2 173.5/172ps 1x2 at 12 in 1.5k

RXG2 171.5/170ps, bought for 23 in 2k

OEF2 134/133.5ps 1x2. Bought for 2 in 1.5k

OEF2 133.5p, sold at 13.5 in 3.5k

0RU2 100.25/99.87ps 1x2, bought for 0.75 in 2k

UK:

SFIG2 99.55/99.45/99.35p fly, bought for 1.5Covers the February BoE meeting

FOREX: Equity Bounce Extends, Pressuring JPY to Weekly Low

- Equity markets across Asia rallied well, feeding through into a uniformly positive session so far for European stocks. The evident risk appetite has also filtered into currency markets, with the JPY among the session's poorest performers and printing fresh weekly lows. USD/JPY's rally has put the pair through yesterday's 113.55, opening 113.96 as the near-term target. Monday's close above the 50-dma has lent further support.

- At the other end of the table, AUD is stronger, putting AUD/USD briefly back above the $0.71 handle following the RBA rate decision, in which the bank appeared confident that the new omicron variant would fall short of impacting the economy in the same manner as prior strains.

- EUR/USD has been sold off the overnight highs of 1.1298 as the pair re-initiates an inverse correlation with continental equity markets. The puts the pair in close proximity to first support of 1.1236 - the Nov30 low.

- Data releases are few and far between Tuesday, with US/Canadian trade balance numbers the sole highlight. Similarly, the speakers slate is quieter with the Fed having entered their media blackout period at the end of last week.

AUD: Demand for AUD Hedging Via Options Surges Following RBA Decision

- Solid demand for AUD hedging via options so far Tuesday - with volumes helped higher by the RBA's confidence in the face of the new omicron risk and the subsequent rally in spot.

- One of the larger structures trading following the RBA decision is consistent with a 0.7205/0.7100 call spread rolling off on Dec20 - and thereby capturing a tumultuous week of CB decisions, including the Fed on Dec15. Trade would break-even on spot strength through ~0.7135. The options buyer paid a net premium of approx 78 AUD pips for the position.

FX OPTIONS: Expiries for Dec07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1325-30(E518mln), $1.1350-70(E1.6bln), $1.1535-50(E650mln)

- USD/JPY: Y113.90-00($1.0bln)

- GBP/USD: $1.3250(Gbp452mln)

- AUD/USD: $0.7100(A$1.0bln), $0.7200(A$606mln)

- USD/CAD: C$1.2735-55($1.4bln)

Price Signal Summary: Risk-On Sentiment Reverses Recent Trends

- In the equity space, S&P E-minis continue to recover and extend the bounce from last week’s low of 4492.00 on Dec 3. The contract is back above the 50-day EMA. The focus is on resistance at 4681.85, 76.4% of the Nov 22 - Dec 3 downleg. Initial support to watch is today’s low of 4587.25. EUROSTOXX 50 futures have rallied sharply higher today. The contract has breached resistance at 4186.00, the Dec 1 high and price is also through both the 20- and 50-day EMAs. Attention is on 4251.20, the 61.8% retracement of the recent downleg between Nov 18 - 30 ahead of the 76.4% level at 4311.70.

- In FX, EURUSD continues to pull away from last week’s high. 1.1383, the Nov 30 high is the key resistance to watch where a break is required to suggest potential for a stronger recovery that would open 1.1514, Nov 5 low. The bear trigger is unchanged at 1.1186/85, Nov 24 and Jul 1, 2020 low. GBPUSD trend signals continue to point south with attention on support at 1.3195, Dec 1 low. A break would confirm a resumption of the downtrend and open 1.3165, 38.2% retracement of the Mar ‘20 - Jun ‘21 upleg. 1.3379 is resistance, the 20-day EMA. USDJPY is firmer this morning. Yesterday’s price action appears to be a bullish engulfing reversal. If correct, it suggests the pair has found a base. The 20-day EMA at 113.71 is being tested. A clear break would reinforce the reversal pattern and open the November high of 115.52. Key support is 112.53, the Nov 30 low.

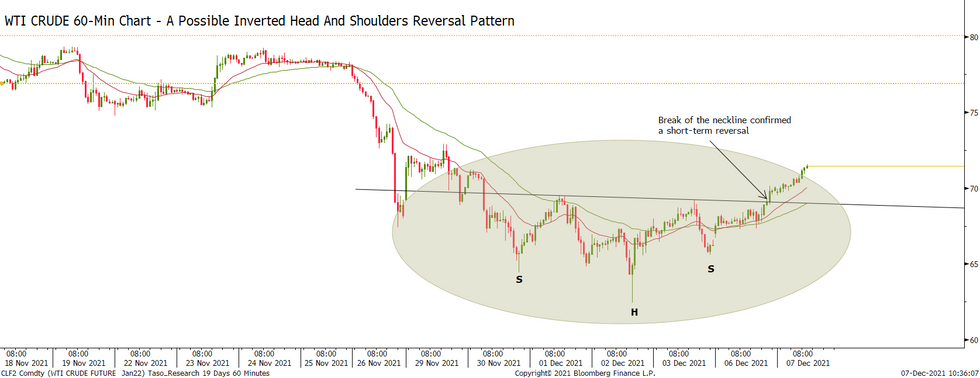

- On the commodity front, Gold remains vulnerable. Attention is on the base of the bull channel at $1763.0, drawn from the Aug 9 low. This level represents a key short-term support. WTI futures are firmer. On the 60-min chart, the move higher has confirmed an inverted head and shoulder reversal, reinforcing the current bull cycle, suggesting scope for stronger gains near-term. Attention is on $73.18, the 20-day EMA. Initial support lies at $65.60, the Dec 3 low.

- In the FI space, Bund futures remain in an uptrend. The focus is on 175.02 1.382 projection of the Nov 11 - 22 - 24 price swing. Support is at 173.31, Dec 2 low. Gilts maintain a bullish tone. The 127.00 handle has been breached and this opens 127.36 Sep 7 high. Initial firm support is at 125.44, Nov 26 low and a gap high on the daily chart.

EQUITIES: Stocks Surge For Second Session

- Equity markets traded well across Asia-Pacific hours, with the Hang Seng and Nikkei 225 finishing with gains of between 1.9 to 2.7%. European indices followed suit, opening higher and pushing the EuroStoxx50 over 2.5% into the green ahead of the NY crossover.

- This puts the cash EuroStoxx50 at the best levels since end-November as markets look to continue erasing the Omicron-inspired gap lower posted on Nov26. The tech and consumer discretionary sectors are leading the way higher. Semiconductor names are surging, with the rally again based on a repricing of expectations as (very) early Omicron data suggests that while the new strain may be more transmissible, it may result in fewer hospitalizations and fatalities.

- In futures space, Wall Street is building on the strong Monday close, with the e-mini S&P higher by 60 points or so a few hours out from the bell.

COMMODITIES: Oil Following Equities North

- WTI and Brent crude futures sit in firm positive territory in early trade, with both benchmarks adding at least 2.5% and extending the rally off the Friday lows to close to 10%. Surging equity markets (US stock futures are pointing to a solidly positive open later today) are dragging the commodity complex higher, putting WTI at the best levels since Nov29. This puts prices in close proximity to the 100-dma of $72.77/bbl.

- Last week's rebound in WTI is resulting in a stronger short-term recovery. On the 60-min chart, the move higher has confirmed an inverted head and shoulder reversal, reinforcing the current bull cycle and suggesting scope for stronger gains near-term. The climb is considered corrective and is allowing a recent oversold condition to unwind.

- Gold remains above last week's lows. Short-term conditions however remain bearish, having recently pulled back from $1877.2, the Nov 16 high. Price has breached both the 20- and the 50-day EMAs and attention is on the base of a bull channel at $1763.0 today.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.