-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - Risk-Off Theme Developing

HIGHLIGHTS:

- Risk-off theme, with JPY, Treasuries higher while equities, NZD lower

- NZD off near 2% as government look to curb house prices

- A heavy Fed slate, with Powell the highlight appearing alongside Treasury Sec Yellen

US TSYS SUMMARY: Gaining Amid Broader Safe Haven Bid

Treasuries have climbed steadily overnight Tuesday with the curve bull flattening as safe haven assets gained favor. Fed speakers (incl Chair Powell) and 2-Yr supply ahead.

- Risk-off triggers included planned Easter lockdown in Germany and, to a lesser extent, Turkish markets under pressure. Notable risk-off cross-asset moves include DXY dollar index +0.4%; S&P Futs -0.5%; WTI crude -3.5%.

- Jun 10-Yr futures (TY) up 12.5/32 at 131-30 (L: 131-14 / H: 131-31).

- The 2-Yr yield is down 0.6bps at 0.1412%, 5-Yr is down 4.2bps at 0.8205%, 10-Yr is down 6.2bps at 1.6329%, and 30-Yr is down 5.7bps at 2.3412%.

- Fed Chair Powell and Tsy Sec Yellen testify on the CARES Act before the House Fin Svcs Committee at 1200ET; nothing new in the pre-released testimony but Q&A will be watched.

- A long list of Fed speakers. 0900ET StL's Bullard; 1010ET Atl's Bostic; 1100ET Richmond's Barkin; 1330ET Gov Brainard; 1445ET NY's Williams; 1545ET Brainard again; 1620ET Bullard again.

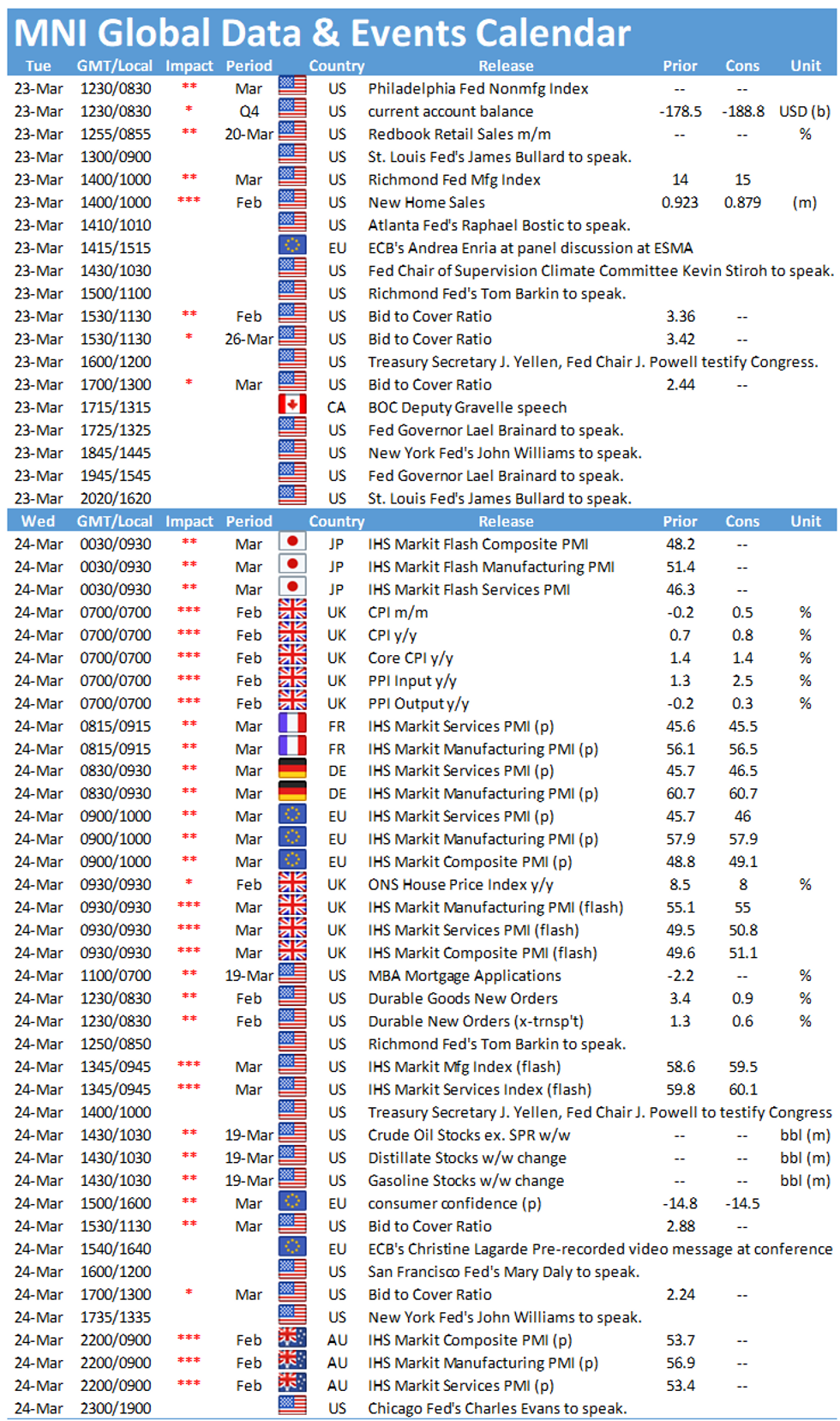

- Data relatively limited: current account balance at 0830ET and new home sales / Richmond Fed manufacturing at 1000ET.

- 2Yr supply ($60B) of note at 1300ET; there's also a $34B 52-wk bill auction at 1130ET. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY - Risk Off Start

Markets are characteristically risk off this morning with European sovereign bonds rallying, equities and commodities trading lower and the US dollar gaining against G10 FX.

- Gilts opened stronger and have been steadily grinding higher through the morning with cash yields now 2-4bp lower on the day and the belly of the curve marginally outperforming.

- It is a similarly story for bunds where yields are 1-4bp lower and the curve has bull flattened.

- BTPs have firmed with the curve 2bp flatter.

- The US National Institute of Allergy and Infectious Diseases has queried AstraZeneca's vaccine trial data, which it claims has used outdated data that may not give a complete view of how effective the jab is. This marks the latest setback for the most conflict-ridden vaccine, which is struggling to gain acceptance in Europe.

- A committee of MSPs have accused the Scottish First Minister Nicola Sturgeon of misleading parliament, contradicting the outcome of an independent inquiry which yesterday cleared the SNP leader of wrongdoing.

- Supply this morning came from the UK (Gilts, GBP2.25bn) and the Netherlands (DSL, EUR1.775bn).

EUROPE ISSUANCE

UK DMO sells GBP2.25bln of 1.75% Jan-49 Gilt, bid-to-cover 2.19x, average yield 1.295%. Another wide tail at auction of 1.2bps

Dutch DSTA sells E1.775bln 2.50% Jan-33 DSL, average yield -0.149%

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXK1 166.5p, bought for 3 and 4 in 3.75k

RXM1 RR 170/174 combo, bought the call for 13 in 1k

ERU1 100.37/100.25ps, bought for half in 7.5k

FOREX: Markets in Risk-Off Mode as Lockdown Extensions, Vaccine Ire Weigh

- JPY and USD are among the strongest currencies in G10 so far Tuesday, with growth proxies and antipodeans lagging. AUD and NZD are among the morning's worst performers.

- EUR/USD saw a sharp spell of weakness alongside the European open, with markets moving in a risk averse fashion as traders digested the extension of the German lockdown restrictions in the face of stubbornly high news cases.

- Over-arching USD strength has weighed in most major pairs, with GBP/USD breaking below 1.38 to open next support at 1.3779. Further ire over the UK's vaccine supply continues to take focus, with a decision set to be made by the European Union later in the week.

- Focus turns to February new home sales from the US and a busy central bank speaker slate. BoE's Bailey, Haldane & Cunliffe are due as well as ECB's Villeroy. The Fed docket is busier, with 8 speeches scheduled from Fed members - most notably Fed's Powell, who appears alongside Treasury Secretary Yellen in front of the House Financial Services Committee.

- JPY the latest currency this morning to break higher, with USD/JPY slipping to new session lows and briefly showing below the Y108.50 mark.

- As has been the case with moves earlier this morning (EUR's break lower, CHF's break higher) the move hasn't been triggered by any specific newsflow or headline, with markets erring bearishly from the off. E-mini S&P hitting new daily lows to coincide with JPY strength here.* Key near-term support for USD/JPY undercuts at 108.34, the Mar10 low.

FX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-1.1900(E638mln), $1.2000-05(E617mln)

- USD/JPY: Y107.95-108.05($2.45bln), Y108.12($1.8bln)

- EUR/GBP: Gbp0.8600(E556mln-EUR puts), Gbp0.8620-30(E887mln-EUR puts)

- EUR/CHF: Chf1.0978-80(E780mln-EUR puts)

- AUD/USD: $0.7750(A$1.3bln)

- AUD/JPY: Y83.10-15(A$587mln)

- AUD/NZD: N$1.0785-90(A$2.2bln - A$2.1bln of AUD puts)

- NZD/USD: $0.6850(N$759mln-NZD calls)

Price Signal Summary - Equities and Oil Retrace Lower

- In the equity space, E-mini S&P remain vulnerable following last week's selling pressure from 3978.50, Mar 18 high. The support to watch today is 3875.00, Mar 19 low. A break would confirm a breach of the 20-day EMA and reinforce short-term bearish conditions.

- In the FX space:

- EURUSD is weaker this morning and the risk remains skewed to the downside. The key directional triggers this week are:

- Key support and bear trigger at 1.1836, Mar 9 low

- Resistance at 1.1990, Mar 11 high

- USDJPY remains in an uptrend. Attention is on 109.56, 76.4% of the Mar 2020 - Jan downleg and an important pivot resistance.

- Watch support at 108.34 Mar 10 low.

- GBPUSD is weaker this morning. The pair has cleared 1.3779, Mar 5 low and the bear trigger. Note this also confirms a breach of the 50-day EMA and a bull channel base drawn off the Nov 2 low. The focus is on 1.3700 and below.

- EURUSD is weaker this morning and the risk remains skewed to the downside. The key directional triggers this week are:

- On the commodity front, a bullish theme in Gold remains in place following the recovery that started Mar 8. The focus is on $1781.4, the 50-day EMA. Support is at $1719.3, Mar 18 low. Oil contracts remain vulnerable. The bear trigger in Brent (K1) is $61.45, Mar 18 low. In WTI (K1), it is at $58.28, also the Mar 18 low.

- In the FI space:

- Bunds (M1) are firmer this morning and approaching resistance. The key directional triggers are:

- 170.52, Mar 18 low

- 172.20, Mar 11 high and the bull trigger.

- Gilts (M1) are trading higher too ahead of resistance at 128.33, Mar 16 high. A break of this hurdle is required to signal scope for a stronger recovery. The bear trigger remains 126.79, Mar 18 low.

- Treasuries (M1) remain in a downtrend and gains are considered corrective. Resistance is at 132-09, Mar 17 high.

- Bunds (M1) are firmer this morning and approaching resistance. The key directional triggers are:

EQUITIES: Edging Lower In Early Trade

- Asian stocks closed lower, with Japan's NIKKEI down 178.23 pts or -0.61% at 28995.92 and the TOPIX down 18.7 pts or -0.94% at 1971.48. China's SHANGHAI closed down 31.93 pts or -0.93% at 3411.509 and the HANG SENG ended 387.96 pts lower or -1.34% at 28497.38.

- European equities are weaker too, with the German Dax down 57.25 pts or -0.39% at 14530.26, FTSE 100 down 12.34 pts or -0.18% at 6726.1, CAC 40 down 23.34 pts or -0.39% at 5968.48 and Euro Stoxx 50 down 11.48 pts or -0.3% at 3807.04.

- U.S. futures are off slightly, with the Dow Jones mini down 100 pts or -0.31% at 32519, S&P 500 mini down 11.25 pts or -0.29% at 3918.75, NASDAQ mini down 20.25 pts or -0.15% at 13051.5.

COMMODITIES: Oil Underperforms On Demand Concerns

- WTI Crude down $0.93 or -1.51% at $60.62

- Natural Gas down $0.02 or -0.85% at $2.555

- Gold spot down $0.27 or -0.02% at $1736.97

- Copper down $2.45 or -0.59% at $412.3

- Silver down $0.2 or -0.77% at $25.5726

- Platinum down $10.47 or -0.88% at $1177.77

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.