-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Risk Proxies Outperform on China Property Package Report

Highlights:

- NFP watched for June hiking clues - consensus looks for 195k

- Risk proxies outperform on China property package report

- Fed media blackout kicks in this evening

US TSYS: Slightly Cheaper Ahead Of Key Payrolls Report

- Cash Tsys trade slightly cheaper with yields 1-2bps higher across major benchmarks ahead of today’s payrolls release, consolidating the move off yesterday’s ULC/ISM prices paid-driven richest levels.

- They saw little impact from the US Senate passing the US debt-ceiling bill, by 63-36 votes. President Biden will sign the legislation later today before delivering an address to the nation at 1900ET.

- 2YY +0.8bp at 4.349%, 5YY +1.2bp at 3.710%, 10YY +1.9bp at 3.614%, 30YY +1.8bp at 3.833%.

- TYU3 trades just 3 ticks lower at 114-20+ in a tight range of 114-19+ to 114-24 on unsurprisingly low volumes of 180k. The short-term bull cycle is still in play, with resistance at 115-00 (Jun 1 high) and then 115-06 (50-day EMA) whilst to the downside sits 114-00 (May 31 low).

- Data: Payrolls May (0830ET) – preview here

- Bill issuance: US Tsy $15B 1-Day CMB auction (1130ET)

- Fedspeak: None scheduled but potential for pop-ups. Media blackout begins midnight ahead of the Jun 13-14 FOMC.

STIR FUTURES: Fed Rates Little Changed Overnight Ahead Of Payrolls

- Fed Funds implied rates are little changed overnight ahead of payrolls, leaving less than one full hike priced for this cycle and not far off one cut from the current 5-5.25% range by year-end (for 39bps from implied terminal).

- Note that there is no Fedspeak scheduled before the blackout period goes into effect this weekend, with the recent dovish overtures from Governor (and Vice Chair-designate) Jefferson and ’23 voter Harker to reverberate.

- Cumulative changes from 5.08% effective: +7.5bp Jun (+0.5bp), +18bp Jul (+1bp), +11bp Sep (+0.5bp), -4bp Nov (+1bp), -21.5bp Dec (+0.5bp), -43bp Jan (-0.5bp).

Source: Bloomberg

Source: Bloomberg

MNI PAYROLLS PREVIEW - WATCHING HIKE, SKIP OR PAUSE CLUES

PAYROLLS PREVIEW (MNI): Watching Hike, Skip Or Pause Clues

Bloomberg consensus looks for further moderation in payrolls growth in May with 195k after 253k, but once again watch two-month revisions to see if they continue to unwind prior sizeable “beats”. Already at fresh multi-decade lows, the u/e rate could again be set up for a hawkish surprise judging by the primary dealer survey skew, something that doesn’t show in the broader Bloomberg survey. AHE seen moderating after April’s surprise strength, with any weakness watched after today’s surprise downward revisions for ULCs in Q422 and Q123.

FED: It's Probably A Hold In June, But ...

Notwithstanding a strong upside nonfarm payrolls surprise Friday, the most likely outcome for the June 13-14 FOMC meeting is the rate hold that was hinted at at the May meeting.

- Data and events since early May have - on balance - actually leaned to a hike decision. That includes stubborn core ex-housing services PCE prices (with some Fed officials suggesting that concerns over housing inflation are resurfacing, see our note here) and still-strong jobs growth (pending today's NFPs). Economic surprises have tilted to the upside overall. The two biggest lingering uncertainties - the debt ceiling and banking crisis - have respectively been resolved and have abated. Pricing still remains for a decent change of a 25bp June 14 hike.

- But other data have left room for doubt, and we can't help but notice that the more dovish readings this week have seemingly had a more outsized reaction vs the hawkish data (Thursday's unheralded downward revision in Unit Labor Costs eclipsed the very strong ADP private payrolls data for example).

- As we noted in the May FOMC meeting review, the bar to a June hike was set pretty high by Powell and co, and if there is any ambiguity, the default decision will be a hold as the Fed bides time to get more information about the trajectory of the economy. That's both because most FOMC members, including the very senior leadership, genuinely believes that in its modal scenario it has caught up with the inflation tide, and the risks are more finely balanced between over- and under-tightening. There's also a hint of hoping for a "soft landing" while inflation drifts back toward target.

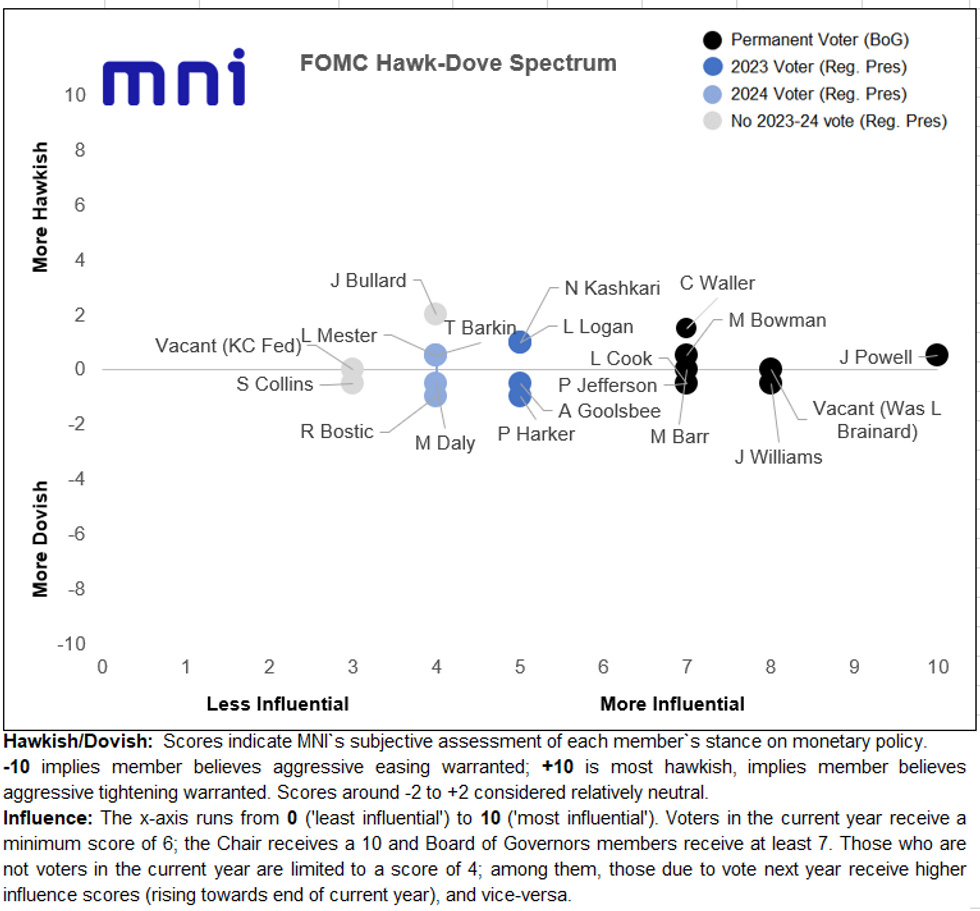

- Some officials disagree: we'd eye Mester, Bullard, Kashkari, Logan, Bowman, and Waller as the most likely candidates to back a June hike. (Ironically, Logan was one of the first - back in February - to signal she could support a "skip".)

- But that's a minority of 6 out of 17 active participants (noting the vacant seat for Brainard and, effectively, the KC Fed), and while we think Powell is genuinely willing to listen to arguments, he has seemed amenable to "skip" a meeting. Williams and Jefferson are also on board with a hold, and as it stands they will have support from others including Harker, Daly, Cook, Goolsbee, Bostic, and Collins.

- Barkin sounds uncomfortable with the inflation outlook but we'd guess he's agnostic about whether a hike is necessary this month or can wait until July. Barr is neutral but will go with the Chair's decision - as our Policy Team noted in yesterday's excellent article on the divisions within the FOMC on the June decision, the Fed hasn't seen a governor dissent since 2005 - which is why soon-to-be Vice Chair Jefferson's call for a "skip" was an important development.

FED: How To Communicate That A Hold Isn't A Final Hike

With a sizeable divide on a hike vs hold likely, the June FOMC meeting will be about keeping rates steady but communicating that the Fed isn't necessarily done hiking yet.

- The "skip" approach that appears to have gained ground this week is a compromise underlining that the burden of evidence has - since the May meeting - shifted to those who see further tightening as necessary. Those on the FOMC who see the job as done will expect to see further evidence to that effect over the subsequent six weeks. But they can be persuaded. Likewise, the doves expect their approach to be vindicated by further disinflation progress.

- Indeed, the two main choices at June's meeting is whether to 1) hold rates while retaining a hiking bias into July or 2) hike 25bp with less of a hiking bias.

- The main reason to galvanize communications around a bias of future hiking is not just to placate the hawks, but to ensure that expectations of a cut don't increase with any hint that the next move is implicitly seen by the FOMC to be downward. The Statement will reflect this caution, probably by maintaining the current language intact ("In determining the extent to which additional policy firming may be appropriate...") And Powell will keep the door clearly open to a July hike pending the data.

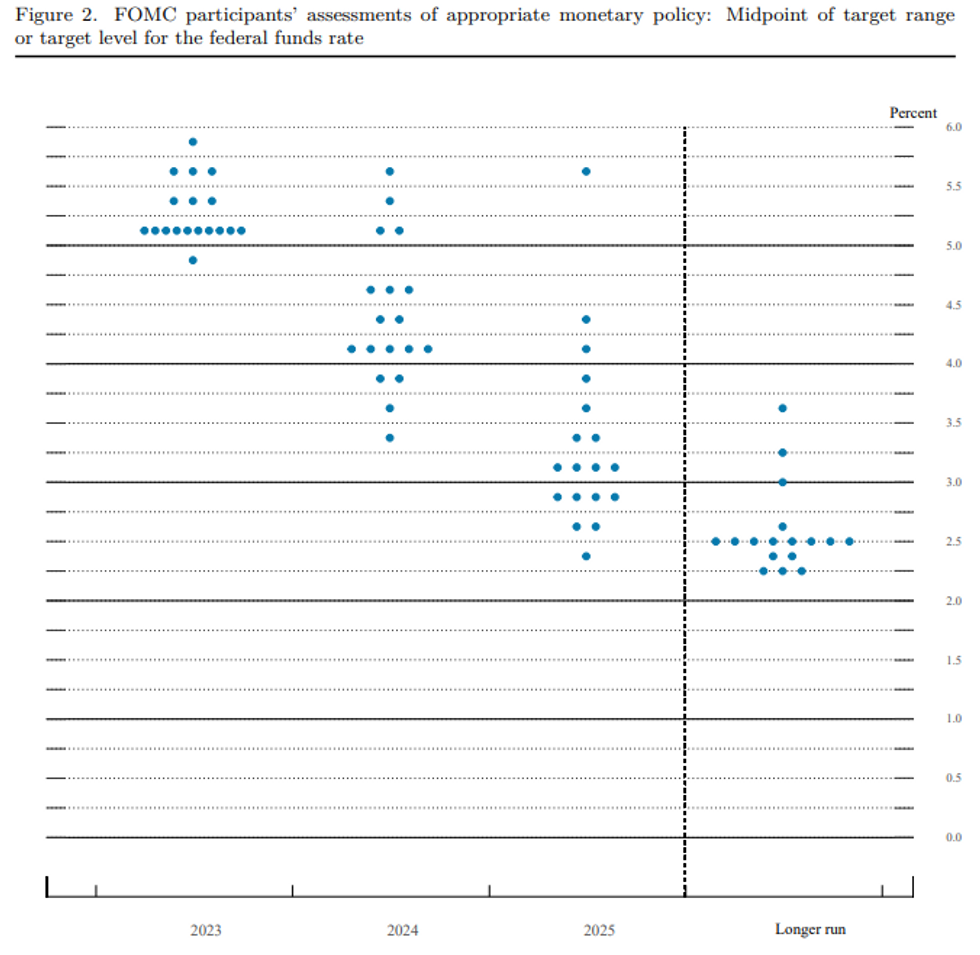

- It's less clear whether we end up with a higher median 2023 end-year rate Dot in the June SEP which would even more clearly signal a hiking bias. A 25bp hike in June would mechanically force a 25bp shift higher to 5.4% from 5.1% (where it has been for the last 2 updates), but apart from that, the numbers on the Committee make it tricky to see a shift higher.

- The last SEP in March showed 7 dots above the 5.1% that was eventually reached in May. A solid 10 of 18 were right at 5.1% (1 at 4.75-5.00% suggested someone thought March's would be the last hike). Recall that these projections were made in the midst of the banking crisis, and when a hold was considered. Even with this backdrop, there was some analyst expectation that the median would rise to 5.4%.

- June's SEP could well see a final rise to 5.4%: the most hawkish 7 of the 18 will remain above 5.1%, and they need to be joined by 2 others to move the dot higher (by 1/8 percentage point to 5.25%, splitting 5.125 and 5.375). 8 of them could be Mester, Bullard, Kashkari, Logan, Bowman, Waller, Barkin, and the KC Fed stand-in.

- Getting to 9 let alone 10 will probably be dependent on inflationary data the next couple of weeks including today's payrolls and the June 13 CPI reading.

- In this way we could see the data influencing a hawkish message delivered through the Dots signaling a lean toward a July hike, but not necessarily a hike itself.

Source: Federal Reserve March Summary of Economic Projections

Source: Federal Reserve March Summary of Economic Projections

USD/CNH Shows Below CNH7.0700 On Latest Hope Re: Chinese Property Stimulus

The previously covered BBG sources piece, suggesting that “China is working on a new basket of measures to support the property market after existing policies failed to sustain a rebound in the ailing sector,” allows USD/CNH to register a fresh session low at CNH7.0670, before a tick away from session extremes to leave the cross at ~CNH7.0700 at print.

- As we noted earlier, the rebound in Chinese equities on Friday (see more on that here) already provided CNH with some reprieve after the recent tumultuous run for the yuan.

- Property stimulus hopes had already factored into the gains for Chinese property developer equities ahead of the weekend (along with the broader bid in stocks), but CNH, DM equities, oil, copper and G10 FX have still reacted to the latest news flow.

- Current USD/CNH levels would just about allow the cross to end its run of 3 consecutive weekly moves higher (last week’s closing level is CNH7.0739). When it comes to meaningful support levels, our technical analyst doesn’t see much until the 20-day EMA (CNH7.0355).

EQUITIES: Stocks on Solid Footing Pre-Payrolls

- S&P E-minis trend conditions remain bullish and the contract is trading closer to its recent highs. The bounce from 4114.00, the May 24 low, means that support around the 50-day EMA has remained intact.

- Eurostoxx 50 futures traded lower Wednesday and cleared the 50-day EMA and support at 4252.00, the May 25 low. Price has also pierced support at 4233.00, the May 4 low and a key short-term level. A clear break of 4233.00 would signal a potential reversal and highlight a stronger bearish theme.

COMMODITIES: WTI Futures Hold Bearish Pattern Pre-OPEC

- The bear cycle in Gold remains intact and short-term gains are - for now - considered corrective. The yellow metal has this week pierced trendline support drawn from Nov 3 2022. A clear breach of this trendline, at $1944.7, would reinforce bearish conditions and open $1903.5.

- WTI futures remain in a bear mode position. The strong sell-off this week has resulted in a break of support at $69.39, the May 15 low. The clear breach strengthens bearish conditions and paves the way for weakness towards $63.90, the May 4 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2023 | 1230/0830 | *** |  | US | Employment Report |

| 02/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/06/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/06/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/06/2023 | 0130/1130 |  | AU | Business Indicators | |

| 05/06/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/06/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/06/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/06/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/06/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/06/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/06/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/06/2023 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 05/06/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/06/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2023 | 1400/1000 | ** |  | US | Factory New Orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.