-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Cheapening Ahead of Early Close

Highlights:

- Treasuries retain cheapening theme ahead of early close

- Data deluge could provide final flash of activity before year-end

- JPY reversing BoJ strength, sinking against all others in G10

US TSYS: Post-GDP Cheapening Theme Continues With Further Data Ahead

- Cash Tsys have on balance maintained yesterday’s cheapening theme, with the front end outperforming core EU FI but longer end broadly in line. Little new macro drivers overnight with Japanese CPI as expected, with attention likely on important upcoming data releases after yesterday’s surprise GDP revision in the 3rd Q3 release.

- 2YY +1.3bps at 4.285%, 5YY +2.6bps at 3.829%, 10YY +2.8bps at 3.706% and 30YY +3.2bps at 3.771%.

- TYH3 trades 9+ ticks lower at 113-08 off a session low of 113-05+ having recently cleared support at 113-09+ (Dec 21 low) to next open the key short-term support at 112-11+ (Nov 21 low). Volumes have picked up recently but remain unsurprisingly depressed at just 120k.

- Data: Multiple potential market moving releases today with core PCE & income/spending and preliminary durable goods (0830ET) before final U.Mich consumer survey and new home sales (1000ET).

- No issuance and no Fedspeak scheduled. SIFMA recommends 1400ET early close.

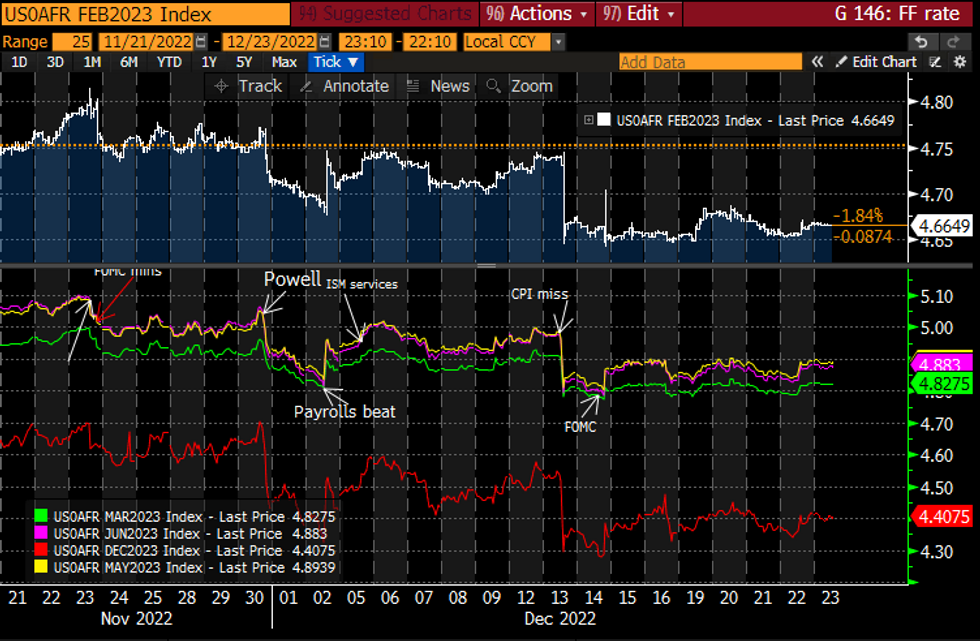

STIR FUTURES: Fed Rate Path Holds Yesterday’s GDP Climb

- Fed Funds implied hikes hold yesterday’s increase from stronger than expected US data, with a further string of important monthly releases ahead including PCE and durable goods.

- Sitting at 33bp for Feb, cumulative 49bp to 4.82% for March, terminal 4.89% May and 4.41% for end-23.

- The terminal is at the top end of the ~4.8-4.9% range seen since the US CPI miss ten days ago.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

EXCHANGE SCHEDULE:

UK

Equities: London Stock Exchange closes at 1230GMT

Fixed income: https://www.ice.com/publicdocs/futures/IFEU_Christ...

Europe

Euronext Cash Markets, Euronext Block, and the Euronext Derivatives Markets will be open throughout, with exception of Dublin, which closes between 13:28 – 13:30 CET

Eurex open as usual - full details here: https://www.eurex.com/resource/blob/2886140/a13cf7...

US

CME Christmas: https://www.cmegroup.com/tools-information/holiday...

CME NY: https://www.ice.com/publicdocs/futures_us/exchange...

ICE Christmas: https://www.ice.com/publicdocs/futures_us/exchange...

ICE NY: https://www.ice.com/publicdocs/futures_us/exchange...

NASDAQ: https://www.nasdaq.com/market-activity/2022-stock-...

NYSE: https://www.nyse.com/markets/hours-calendars

SIFMA: https://www.sifma.org/resources/general/holiday-sc...

FOREX: Markets in Consolidation Mode Ahead of Early Close

- JPY continues to backtrack a small part of the recent strength, and is the weakest amid a quiet G10 backdrop. USD/JPY is edging back toward the Y133.00 handle, still well shy of the week's opening level either side of Y136.00.

- Despite USD/JPY's strength, the greenback is similarly weaker, falling against all others in G10 to partially reverse the rally posted after yesterday's GDP upgrade.

- In a similar fashion, markets are squaring off recent weakness posted across high beta and growth-sensitive FX, helping put AUD and NZD at the top of the G10 pile.

- EURGBP pierced a bull trigger this week, edging higher yesterday and topping 0.8829, the Nov 9 high. The outlook remains positive and a clear break of 0.8829 would strengthen this condition. This would pave the way for a move towards 0.8858, the upper band of a MA envelope and 0.8907, a Fibonacci retracement.

- Asset markets see a series of early closes across Europe today, with UK markets closing after midday and US markets undergoing a half day. This could keep volumes and liquidity muted across a raft of US releases, with personal income/spending, prelim durable goods orders, Michigan confidence and new home sales releases all on the docket.

FX OPTIONS: Expiries for Dec23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0300(E754mln), $1.0400-15(E900mln), $1.0500(E1.4bln), $1.0550(E969mln), $1.0800(E1.6bln)

- USD/JPY: Y130.00-10($981mln), Y132.00($548mln), Y134.00($690mln), Y135.00($1.8bln)

- GBP/USD: $1.2000(Gbp860mln), $1.2100(Gbp511mln)

- AUD/USD: $0.6650-55(A$607mln), $0.6710-25(A$852mln)

- USD/CAD: C$1.3570-75($611mln), C$1.3665-75($933mln)

- USD/CNY: Cny6.8580($1.1bln), Cny6.9000($965mln), Cny7.0460($1.5bln)

BONDS: Bonds Have Extended Lower This Morning

- A light trading session for Govies as we head into Christmas.

- Bonds have nonetheless been under pressure, as well as Rate futures markets.

- Gilt has led futures lower in turn pushing the Gilt/Bund spread wider, by 3.3bps.

- Small outperformance in Treasuries futures, is still pushing the Tnote/Bund spread tighter.

- Support is seen at the 13/10/20 low, 128.28bps.

- Most UK Markets will be closing between 12.00 and 13.00GMT.

- Looking ahead, US, PCE core deflator, prelim Durable Goods, while Michigan will be final reading.

- Gilt futures are down 50 today at 100.58 with 10y yields up 5.0bp at 3.637% and 2y yields up 4.5bp at 3.622%.

- Bund futures are down -0.38 today at 134.93 with 10y Bund yields up 2.8bp at 2.385% and Schatz yields up 4.8bp at 2.588%.

- BTP futures are down -0.33 today at 110.50 with 10y yields up 2.9bp at 4.497% and 2y yields up 2.6bp at 3.109%.

- OAT futures are down -0.37 today at 129.18 with 10y yields up 3.1bp at 2.925% and 2y yields up 5.6bp at 2.570%.

EQUITIES: Thursday Pullback Sees Equity Futures Trim Week's Gains

EUROSTOXX 50 futures remain above their recent lows. Price tested resistance at 3880.00 on Thursday, the 20-day EMA and a key short-term resistance. A clear breach of this hurdle would suggest potential for a stronger recovery. Gains are considered corrective - for now. A reversal lower and a break of 3753.00, the Dec 20 low, would confirm a resumption of the recent downtrend. The bull trigger is at 4043.00, Dec 13 high. S&P E-Minis trend signals are bearish and this week’s low prints reinforce this condition. The contract is trading above its recent lows. Short-term gains would be considered corrective with resistance at 3942.55, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery. On the downside, a reversal lower would confirm a resumption of the downtrend. The focus is on 3778.45, a Fibonacci retracement.

- Japan's NIKKEI closed lower by 272.62 pts or -1.03% at 26235.25 and the TOPIX ended 10.23 pts lower or -0.54% at 1897.94.

- Elsewhere, in China the SHANGHAI closed lower by 8.565 pts or -0.28% at 3045.866 and the HANG SENG ended 86.16 pts lower or -0.44% at 19593.06.

- Across Europe, Germany's DAX trades higher by 21.14 pts or +0.15% at 13938.49, FTSE 100 higher by 5.89 pts or +0.08% at 7475.67, CAC 40 down 0.35 pts or -0.01% at 6519.4 and Euro Stoxx 50 up 1.08 pts or +0.03% at 3825.3.

- Dow Jones mini up 56 pts or +0.17% at 33272, S&P 500 mini up 2.75 pts or +0.07% at 3852.75, NASDAQ mini down 2 pts or -0.02% at 11054.

COMMODITIES: Gold Remains Above Weekly Lows Despite Sharp Sell-Off

Trend conditions in WTI futures remain bearish. However, recent gains have highlighted a bullish corrective cycle and Thursday’s climb signals an extension of this phase. The contract has cleared the 20-day EMA, at $77.00. Price has tested resistance at $79.64, the 50-day EMA and a key hurdle for bulls. A break of this level would strengthen the short-term bullish outlook. Initial key support has been defined at $73.40, the Dec 16 low. Trend conditions in Gold remain bullish and the recent move lower is considered corrective. Key short-term support to watch is $1765.9, Dec 5 low. The yellow metal recently breached $1810.0, Dec 5 high, to resume the uptrend. This maintains the positive price sequence of higher highs and higher lows and opens $1842.7, a Fibonacci retracement. On the downside, a break of $1765.9 would signal scope for a deeper pullback.

- WTI Crude up $1.07 or +1.38% at $78.52

- Natural Gas down $0.04 or -0.7% at $4.964

- Gold spot up $4.48 or +0.25% at $1797.05

- Copper up $4.3 or +1.14% at $379.95

- Silver up $0.17 or +0.73% at $23.7409

- Platinum up $12.22 or +1.24% at $995.63

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/12/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/12/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.