-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - UK Chancellor Outlines Sombre Budget

Highlights:

- Fed rate path nudges higher overnight, but within post-CPI range

- UK Chancellor outlines sombre budget, with spending growing at slower pace than the economy

- US housing/building permits and weekly jobs data in focus

US TSYS: Retracing Yesterday's Rally With Another Solid Docket Ahead

- Cash Tsys have on balance cheapened through the European session with relatively little spillover most recently from the UK Autumn Statement at typing (small bid), leaving yields firmly within yesterday’s rally-induced range. Should that remain the case, focus will quickly turn to Fedspeak starting with Bullard (’22 voter) at 0800ET and then housing, business activity and jobless claims data before issuance later in the session.

- 2YY +1.1bps at 4.365%, 5YY +2.6bps at 3.876%, 10YY +3.7bps at 3.727%, and 30YY +2.6bps at 3.866%. 2s10s of -63bp pulls back off yesterday’s multi-decade lows of -67bps.

- TYZ2 trades 7+ ticks lower at 112-31, off session highs of 113-09+ and yesterday’s high of 113-11, which now forms initial resistance.

- Fedspeak: Bullard (0800ET), Gov Bowman (0915ET), Mester (0940ET), Gov. Jefferson (1040ET) and 2 x Kashkari (1040/1345ET).

- Data: Housing starts (0830ET), Philly and Kansas Fed mfg surveys (0830/1000ET) plus usual weekly jobless claims.

- Issuance: US Tsy $15B 10Y TIPS re-open (91282ZCEZ0) – 1300ET

- Bill issuance: US Tsy $65B 4W, $55B 8W bill auctions – 1130ET

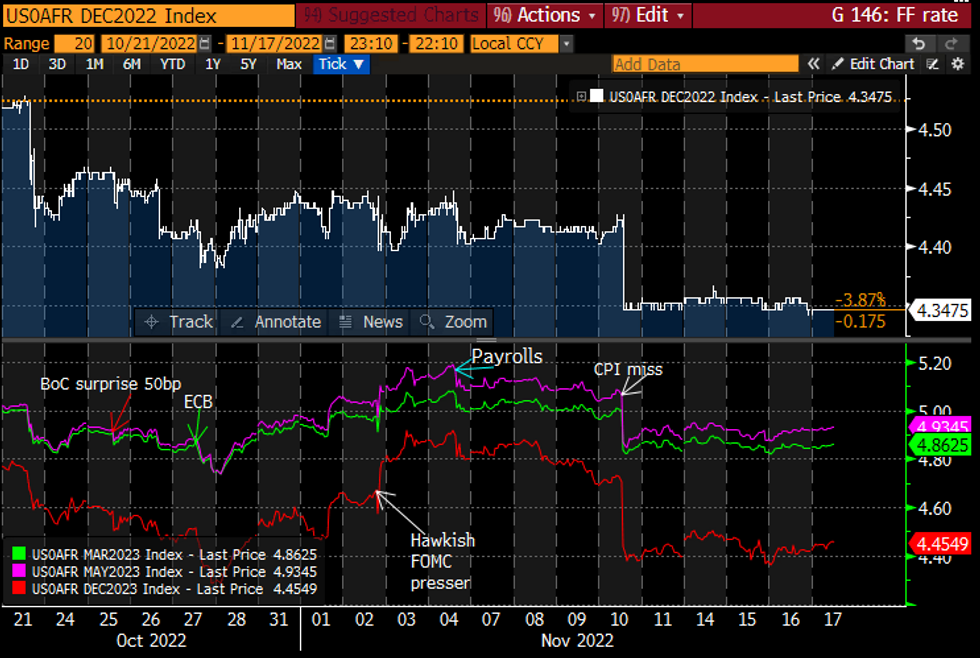

STIR FUTURES: Fed Rate Path Nudges Higher Overnight

- Fed Funds implied hikes remain in the post-CPI range though: 50bps for Dec (unch), cumulative 85bp to 4.79% Feb (+0.5bp), terminal 4.93% May’23 (+2bp) and 4.46% Dec’23 (+4bp).

- Latest from Gov. Waller yesterday: becoming more comfortable with 50bp for Dec but wants to see more data including PCE and payrolls.

- Heavy Fedspeak schedule: Bullard (’22, text), Gov Bowman (text), Mester on financial stability (’22), Gov. Jefferson (text) and 2 x Kashkari (’23).

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

UK: Chancellor-Public Spending To Grow, But Slower Than The Economy

Chancellor Jeremy Hunt: "...we are going to grow public spending – but we’re going to grow it slower than the economy. For the remaining two years of this Spending Review, we will protect the increases in departmental budgets we have already set out in cash terms."

- Hunt: "And we will then grow resource spending at 1% a year in real terms, in the three years that follow. Although departments will have to make efficiencies to deal with inflationary pressures in the next two years, this decision means overall spending in public services will continue to rise, in real terms, for the next five years."

- Hunt: "....the Prime Minister and I both recognise the need to increase defence spending. But before we make that commitment it is necessary to revise and update the Integrated Review, written as it was before the Ukraine invasion."

- Says defence spending will remain at at least 2% of GDP.

- Confirms no return to 0.7% of GNI target for overseas aid spending, remains at 0.5%.

UK: OBR Forecasts

- OBR forecast for UK inflation 9.1% this year, 7.4% next year.

- "This year, we are forecast to borrow 7.1% of GDP or £177bn; next year, 5.5% of GDP or £140bn; then by 2027-28, it falls to 2.4% of GDP or £69bn. As a result, underlying debt as a percentage of GDP starts to fall from a peak of 97.6% of GDP in 2025-26 to 97.3% in 2027-28."

- "I also confirm two new fiscal rules:

- the first is that underlying debt must fall as a percentage of GDP by the fifth year of a rolling five-year period.

- The second, that public sector borrowing, over the same period, must be below 3% of GDP.

- The plan I’m announcing today meets both rules. Today’s statement delivers a consolidation of £55bn and means inflation and interest rates end up significantly lower."

FOREX: Greenback Creeping Higher Ahead of Housing, Labour Market Data

- The greenback is making uniform gains across G10 Thursday, with the USD Index within range of the Wednesday high ahead of NY hours. Market action has been few and far between overnight, with the greenback gaining despite Fed's Waller late yesterday outlining his growing preference for a 50bps move from the FOMC in December.

- GBP trades moderately well ahead of the UK Autumn Statement, with UK Chancellor Hunt expected to outline a stark budget of tax rises and spending cuts to address the loss of market credibility and the outsized energy support guarantee for households.

- AUD is the weakest currency so far, with NOK not far behind as equities and commodity markets sit lower ahead of the US Open.

- Focus turns to US housing starts and building permits data for October as well as the weekly US jobless claims release. The central bank speakers slate is similarly busy, with scheduled appearances from BoE's Pill, Tenreyro, ECB's Villeroy as well as Fed's Bullard, Bowman, Mester and Kashkari.

FX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E978mln), $1.0300-05(E815mln), $1.0500(E590mln)

- USD/JPY: Y140.00-10($1.3bln)

- AUD/USD: $0.6300(A$1.4bln)

- USD/CAD: C$1.3300($1.0bln), C$1.3700($1.0bln)

- USD/CNY: Cny7.3000($2.0bln)

Price Signal Summary - USDJPY Bear Flag Reinforces The Current Bearish Condition

- In FX, the EURUSD technical condition remains bullish following recent gains. A positive price sequence of higher highs and higher lows on the daily chart and a bullish moving average set-up highlights positive market sentiment. An extension would open 1.0536, the late June high. Short-term pullbacks would be considered corrective. Firm support lies at 1.0094 the Oct 27 high. Initial support lies at 1.0272/0163, the Nov 14 / 11 lows respectively.

- The GBPUSD outlook remains bullish but it is worth noting that the trend is nearing overbought territory - prices on Tuesday, pierced the 3.0% 10-dma envelope which was followed by a pull lower in spot. A short-term pullback would be considered corrective. Tuesday’s high of 1.2028 is the trigger for a resumption of gains. Firm support lies at 1.1504, the 50-day EMA.

- Short-term trend conditions in USDJPY remain bearish. The latest pause in the downtrend appears to be a bear flag formation, reinforcing the current downtrend. A resumption of weakness would open 137.37, the Aug 29 low. The pair has pierced 138.64, 61.8% of the Aug 2 - Oct 21 bull leg. A clear break of this key Fibonacci retracement would also reinforce bearish conditions. The 50-day EMA at 143.96 remains a key short-term resistance.|

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/11/2022 | 1830/1930 |  | EU | ECB Lagarde at F. v. Metzler Dinner | |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari | |

| 18/11/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 17/11/2022 | 0105/2005 |  | US | Fed Chair Jerome Powell | |

| 18/11/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/11/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/11/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/11/2022 | 0830/0930 |  | EU | ECB Lagarde Speech at European Banking Congress | |

| 18/11/2022 | - |  | EU | COP 27 Ends | |

| 18/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 18/11/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/11/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/11/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/11/2022 | 1715/1715 |  | UK | BOE Haskel Panels Ditchley Economics Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.