-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY Shows North of Y132 as Equities Trend Higher

Highlights:

- USD/JPY bumped north of Y132 as equities trend higher into the open

- STIR futures retrace Tuesday upside to price just 9bps of further Fed tightening

- White House preparing call for tighter rules on US midsize banks

US TSYS: Bull Steepening With Banking Regulation and Issuance In Focus Ahead

- Cash Tsys bull steepen in a reversal of yesterday’s bear flattening, with 2Y yields slipping from an intraday high of 4.115% in Asia hours to currently 4.025% as Fed rate expectations cool and a further hike in May is now seen as a less than a 50/50 shot.

- Banking discussions likely continue to headline after WaPo reports Biden has indicated a push for new regulation of mid-sized banks and with regulatory focused Fedspeak today, along with focus later in the session on note issuance.

- 2YY -5.3bps at 4.025%, 5YY -3.4bps at 3.630%, 10YY -2.5bps at 3.545% and 30YY -1.1bps at 3.759%. 2s10s -48bps.

- TYM3 trades 4 ticks higher at 114-24+ off early lows of 114-14+ with one of the more subdued sessions for cumulative volumes of recent weeks at 260k. The bear threat is still present with support at the 20-day EMA of 114-05, whilst to the upside sits resistance at 115-07+ (Mar 28 high).

- Data: MBA mortgage data (0700ET), Pending home sales for Feb (1000ET)

- Fedspeak: NY Fed Head of Supervision Dobbeck (0805ET), VC Supervision Barr (0830ET on community reinvt act, 1000ET at House)

- Note/bond issuance: US Tsy $22B 2Y Note FRN (91282CGF2) at 1130ET, $35B 7Y Note auction (91282CGS4) at 1300ET

- Bill issuance: $36B 17W auctions at 1130ET

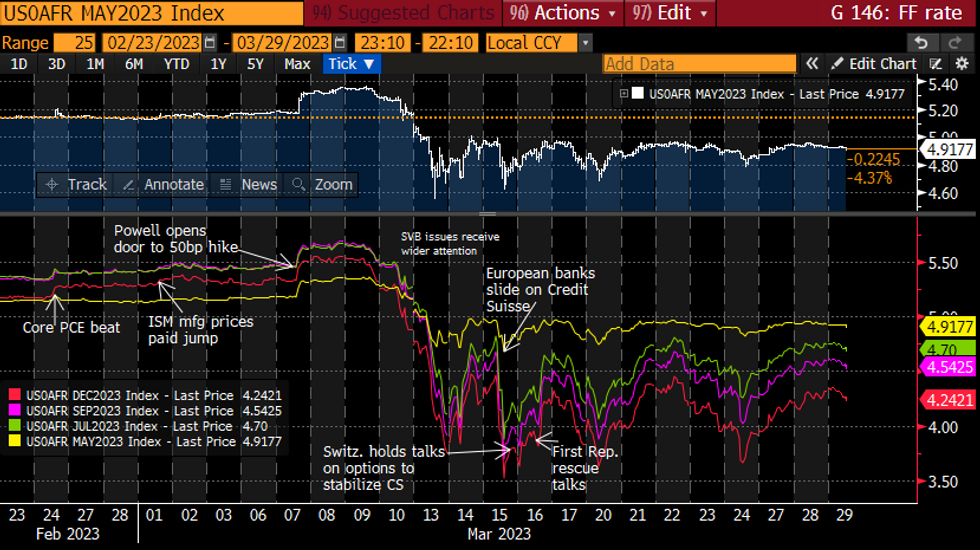

STIR FUTURES: Fed Rate Path Unwinds Yesterday's Climb

- The Fed Funds implied rate for the May FOMC has slipped over the past hour, in a sharper move catching up with an earlier drift lower in ECB pricing. It now prices just 9bp of further hikes from the current effective to a peak 4.92%.

- Into 2H23, meetings have reversed a little over half yesterday’s rate increases, with 28bp of cuts to Sep (up 4bps on the day) and 58bps of cuts to Dec (up 6.5bps).

- Banking-focused Fedspeak today, with NY Fed Head of Supervision Dobbeck (0805ET, text + Q&A) before further remarks from VC Supervision Barr after his Senate appearance yesterday. It follows most recent WaPo headlines this morning that the White House is preparing to call for federal banking regulators to impose new rules on midsize banks.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

WaPo: White House Preparing To Call For New Rules On Midsize Banks

The Washington Post has reported that the White House is, “preparing to call for federal banking regulators to impose new rules on midsize banks” to prevent future bank emergencies similar to that of Silicon Valley Bank.

- According to WaPo sources, WH appears unlikely to call for reversal of the 2018 bipartisan deregulation law which some lawmakers have argued contributed to the collapse of SVB.

- WaPo: “The exact details of the White House’s recommendations are not clear, but they will try to reestablish rules for banks with between $100 billion and $250 billion that were deregulated by Congress and the Fed during the Trump administration…”

- Measures may include imposing higher capital requirements on banks, requiring banks to maintain greater cash reserves, requiring more frequent stress tests from federal regulators, and mandating plans for an “orderly dissolution in the event of a crisis.”

- Todd Phillips, a former attorney at the FDIC, said: “The White House can’t tell [Congress] what to do, but they can ask very nicely. Silicon Valley was not going to be stress-tested until 2024 under the Fed’s tailoring provisions — that’s just insane for a bank of its size.”

CANADA: Macro Takeaways From Budget

- Yesterday’s Budget revealed deficits now projected across the forecast horizon in a change from the small surplus projected for 27/28, now narrowing only to 0.4% GDP in FY 27/28 from a little changed 1.4% GDP projected for the upcoming 23/24.

- The trend deterioration in public finances came from a combination of adverse economic developments and sizeable, but not unexpectedly so, new policy actions.

- However, of some consolation for the BoC, the majority of the larger of these new policy actions come later in the forecast horizon, something Mostafa Askari, a former senior finance department official, sees as not adding inflationary risks (MNI Interview here)

- One of the more surprising aspects from a macro perspective was a projected increase in net debt for FY 23/24 from 42.4 to 43.5% GDP, although FM Freeland was keen to point out that the fiscal anchor of declining debt over the medium-term remains intact.

- Net debt is projected to remain at the bottom of the G7 range.

EUROPE ISSUANCE UPDATE

Greece Syndication: 5-year GGB - Spread set- Size: EUR Benchmark (MNI expects E2.5-3.5bln), spread set at MS+90bps

- Initial guidance was MS+95bps area, orderbooks in excess of E15.9bln (inc E1bln JLM interest)

- Timing: Books open / today's business

- IGCP buys:E340mln of the 4.95% Oct-23 OT (ISIN: PTOTEAOE0021) at 101.080.

- E500mln of the the 5.65% Feb-24 OT (ISIN: PTOTEQOE0015) at 102.420.

NOK: Markets Watch Several Factors That Could Cement NOK Bounce

- While convincingly remaining the poorest performer in G10 YTD, NOK is over 4% off cycle lows vs. The USD and near 2% off the lows vs. The EUR this week. NOK has benefited from the bounce in the oil price, the relative stabilisation of the financial stability backdrop and retracing expectations of tightening from the Fed, ECB relative to the Norges Bank in March.

- Markets watch several factors for possible further strength in the NOK, namely the next wave of corporation tax payments (due April 15th) as well as this Friday's FX purchases update from the Norges Bank. SEB write that the Norges Bank will lower FX purchases further from current rate of NOK 1.7bln due to lower than expected oil & gas prices and a higher non-oil budget deficit and could eventually switch from NOK selling, to NOK buying in the coming months.

- Conversely, Danske Bank write that they continue to favour playing NOK rallies tactically, as markets once again look set to re-price Fed rate hikes, which provides headwinds for NOK. They add that while they remain longer-term bullish NOK, they emphasize the attractive returns of short NOK positions, which acts as a hedge for any risk-off backdrop.

FOREX: USD/JPY Either Side of Y132 as Risk Recovers

- JPY is backtracking against all others in G10, helping aide a solid bounce in USD/JPY to trade either side of Y132.00 at the NY crossover. The risk backdrop is generally improving, with US equity futures trending higher overnight and indicating a solid open on Wall Street later today. The underlying driver for equity strength remains the continued retrenchment of concerns over the global banking sector and a surge in equity prices in Asia, following a 10% rally in tech giant Alibaba shares as they outlined a restructure.

- At the other end of the table, CHF is outperforming, reversing a large part of the Tuesday weakness to keep EUR/CHF well off any material test of parity. The 50-dma of 0.9926 remains first support, a level that continues to provide a solid anchor for prices.

- The USD Index is slightly firmer, snapping back a small part of the week-to-date losses, although recent ranges are being largely respected.

- The data calendar is relatively light going forward, with focus on the pending home sales release for February. The central bank speaker slate is busier, with Fed's Barr, BoE's Mann, BoC's Gravelle due during market hours, while ECB's Schnabel follows after the US close.

FX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0680-85(E1.0bln), $1.0780-00($2.5bln), $1.0850(E549mln), $1.1000-20(E1.3bln)

- USD/JPY: Y128.00-10($585mln), Y130.75($630mln), Y131.60-80($1.0bln)

- AUD/USD: $0.6650(A$681mln), $0.6800(A$566mln)

- USD/CNY: Cny6.8000($1.2bln), Cny6.9100($1.7bln)

EQUITIES: Eurostoxx Futures Consolidate Below 4164.00 Key Resistance Level

- Eurostoxx 50 futures are consolidating. The contract remains below 4164.00, the Mar 22 high. The recent pullback threatens a bull theme and signals the end of what appears to have been a corrective bounce. A resumption of weakness would open 4009.50, 61.8% of the Mar 20 22 rally. A move below the 4000.00 handle would expose 3914.00, the Mar 21 low and a bear trigger. Key short-term resistance is 4164.00. A break of this level would be bullish.

- S&P E-Minis remain below last 4073.75. The pullback from last week’s high means that price has - so far - failed to remain above pivot resistance at the 50-day EMA - the average intersects at 4019.45. A clear break of the average is required to strengthen bullish conditions. Support lies at 3937.00, the Mar 24 low. A breach would instead open 3897.25 next, the Mar 20 low. 4073.75, the Mar 22 high, is the bull trigger.

COMMODITIES: WTI Futures Extend Higher, Breaching Resistance at the 20-Day EMA

- WTI futures have traded higher this week. Price has breached resistance at the 20-day EMA which intersects at $72.60. The break is a short-term bullish development and a continuation higher would expose the 50-day EMA, at $75.04. This average represents the next key resistance point. On the downside, initial firm support lies at $66.82, the Mar 24 low. A break of this level would be bearish.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. Note too that price action since Mar 20 appears to be a pennant - a continuation pattern. This reinforces bullish conditions and signals scope for an extension higher near-term. The recent test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 marks a firm support, the Mar 17 low - a break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2023 | 0930/1030 |  | UK | Bank of England FPC Report/minutes | |

| 29/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/03/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/03/2023 | 1400/1000 |  | US | US House Financial Services Hearing | |

| 29/03/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 29/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/03/2023 | 1630/1230 |  | CA | BOC Deputy Gravelle speech "The market liquidity measures we took during COVID" | |

| 29/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/03/2023 | 1850/1950 |  | UK | BOE Mann Panellist at NABE | |

| 29/03/2023 | 2045/2245 |  | EU | ECB Schnabel Panels NABE Conference | |

| 30/03/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/03/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2023 | 0800/1000 | *** |  | DE | Hesse CPI |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.