-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Offered, Stocks Buoyed as Fed Smoothly Absorbed

Highlights:

- Greenback offered, stocks buoyed on smooth absorption of Fed rate decision

- 25bps ECB hike looks nailed on, September messaging in focus

- USD/JPY vols surge ahead of Friday meeting

US TSYS: Twist Steeper Ahead Of Stacked Docket

- Cash Tsys have twist steepened with most of the curve trading modestly richer with only 20s and onwards cheaper. The front-end outperforms, with 2Y yields at ~4.825% for back close to yesterday’s lows early in the FOMC press conference before some retracement into the close.

- Today sees a heavy docket with important data releases after Powell’s focus on data dependency, the ECB decision and press conference, sizeable earnings releases both pre- and after-market, 7Y supply after small tails for 2s and 5s earlier this morning plus further hefty bill issuance. That’s all before the BoJ decision overnight.

- 2YY -2.7bp at 4.825%, 5YY -2.3bp at 4.094%, 10YY -0.4bp at 3.865% and 30YY +1.1bp at 3.946%.

- TYU3 trades 3+ ticks higher at 112-01 on typical but still subdued volumes of ~250k ahead of a stacked docket. An earlier high of 112-07 remained within resistance at 112-17+ (Jul 24 high) whilst lifting further off support at 111-17+ (Jul 25 low).

- Data: GDP/PCE Q2 1st release (0830ET), Prelim durable goods Jun (0830ET), Weekly jobless claims (0830ET), Trade balance Jun (0830ET), Wholesale and retail inventories Jun prelim/Jun (0830ET), Pending home sales Jun (1000ET), 1100ET Kansas City Fed mfg Jul (1100ET).

- Note/bond issuance: US Tsy $35B 7Y Note auction (91282CHR5) – 1300ET

- Bill issuance: US Tsy $70B 4W, $60B 8W Bill auctions – 1130ET

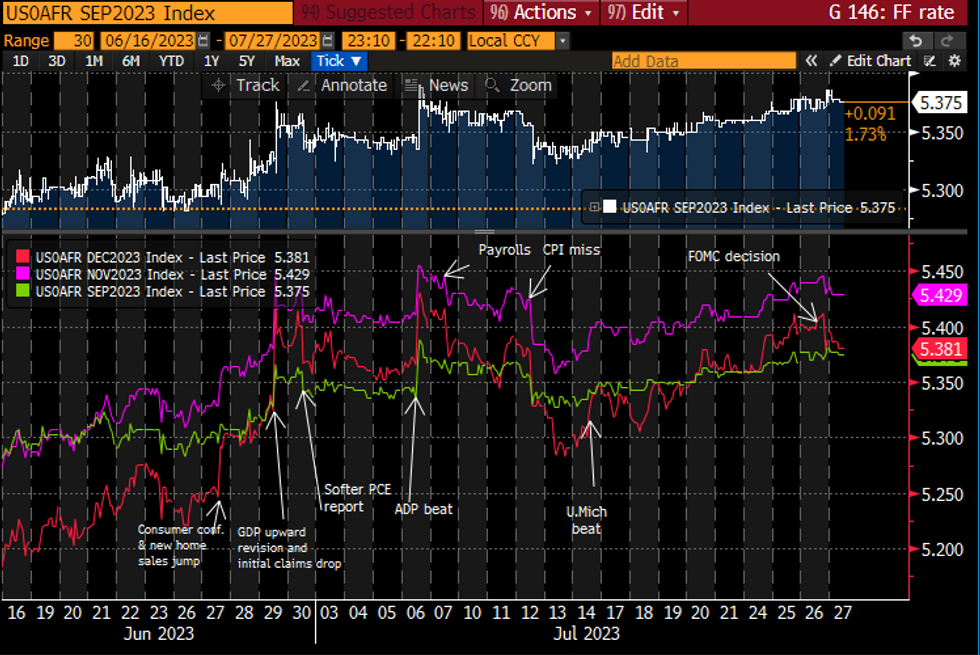

STIR FUTURES: Fed Implied Rates Maintain Mild Reaction To FOMC

- Fed Funds implied rates have only inched lower overnight, with slightly larger moves into 2H24 in a continuation of yesterday’s relatively mild reaction to the FOMC decision and press conference.

- They show cumulative hikes of +4.5bp for Sep (-0.5bp) and +10bp for Nov (-0.5bp) for a terminal of 5.43%, not quite pricing 50/50 odds of the second hike the median FOMC member pencilled in at the June meeting.

- Cut expectations from the Nov terminal remain in familiar territory: 5bp to Dec’23, 61bp to Jun’24 and 135bp to Dec’24.

- A heavy session ahead with the ECB decision before a US docket including 1st readings for Q2 GDP and core PCE price index, prelim readings for durable goods/wholesales inventories and jobless claims all before the BoJ overnight.

Source: Bloomberg

Source: Bloomberg

STIR FUTURES: OI Suggests Fresh Longs Dominated SOFR Positioning Swings On Wednesday

SFRM3 finished incrementally lower on Wednesday, with preliminary open interest data suggesting that move was driven by a reduction of existing longs. The remainder of the quarterly SOFR strip finished firmer on the day, aided by Fed Chair Powell’s post-meeting rhetoric. That price action combined with preliminary open interest data pointed to the addition of fresh longs and trimming of net shorts from SFRU3 through the blues. The most notable net OI swing through the blues came in the form of fresh longs being added in the greens, with smaller additions seen in the whites and reds, while the blues saw a fairly small reduction of existing shorts in net terms.

| 26-Jul-23 | 25-Jul-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,118,259 | 1,120,384 | -2,125 | Whites | +11,262 |

| SFRU3 | 1,114,436 | 1,105,169 | +9,267 | Reds | +2,697 |

| SFRZ3 | 1,308,497 | 1,318,683 | -10,186 | Greens | +27,603 |

| SFRH4 | 871,180 | 856,874 | +14,306 | Blues | -1,134 |

| SFRM4 | 788,483 | 769,260 | +19,223 | ||

| SFRU4 | 755,403 | 752,571 | +2,832 | ||

| SFRZ4 | 745,166 | 758,589 | -13,423 | ||

| SFRH5 | 525,626 | 531,561 | -5,935 | ||

| SFRM5 | 504,480 | 489,644 | +14,836 | ||

| SFRU5 | 423,193 | 420,139 | +3,054 | ||

| SFRZ5 | 340,525 | 335,455 | +5,070 | ||

| SFRH6 | 247,968 | 243,325 | +4,643 | ||

| SFRM6 | 179,272 | 183,391 | -4,119 | ||

| SFRU6 | 148,772 | 147,275 | +1,497 | ||

| SFRZ6 | 169,917 | 169,467 | +450 | ||

| SFRH7 | 124,812 | 123,774 | +1,038 |

Overnight Option Vols: BoJ Meeting Redux

- Overnight USDJPY vols have surged sharply as the contract begins to capture the Friday BoJ; the contract has added close to 30 points to hit the highest level since the March and January BoJ meetings, both of which were preceded by fraught speculation of a YCC tweak, contrasting with very little sell-side expectations of such a move.

- Despite scant expectation of a policy change, markets remain highly volatile around the decisions: January's unchanged decision saw a ~300 pip intraday rally in spot - inline with break-even options pricing, while March’s more muted reaction still saw a rally of over 100 pips.

- This mirrors the lead-up to Friday’s BoJ, ahead of which overnight straddles are pricing a swing of ~225 pips – the widest break-even for the pair since March.

- Our BoJ preview sees only a small minority of the sell-side looking for a YCC change this week ( https://roar-assets-auto.rbl.ms/files/54914/BOJ%20... ), while MNI Policy understands that the meeting is likely to see a discussion on YCC, but no consensus for such a move.

Counteroffensive Launched In South But General Warns Of Slow Going

Multiple outlets reporting that Ukrainian forces have launched a major stage of their summer counteroffensive against Russian forces in the south of the country in the Zaporizhzhia oblast. The fog of war is obscuring the extent of the Ukrainian advances, believed to be focused on the village of Robotyne. Russian Defence Ministry spox Igor Konashenkov stated that a "massive" assault by three battalions of Ukrainian troops as well as tanks had been repelled, while Ukrainian Deputy Defence Minister Hanna Maliar states that Ukrainian troops are “gradually advancing” towards the cities of Melitopol and Berdyansk.

- The Ukrainian counteroffensive was launched seven weeks ago, but so far has met effective resistance from Russians who have dug into heavily fortified defensive positions. Speaking to the BBC the officer in charge of Ukraine's counteroffensive in the south, General Oleksandr Tarnavskyi, stated that the mine fields and defensive fortifications make it difficult for his forces to advance swiftly.

- BBC: "Gen Tarnavsky says his forces are doing "hard and painstaking work". He says "any defence can be broken but you need patience time and skilful actions [...] Slow or not, the offensive is taking place and it will definitely reach its goal [...] If the offensive were not successful, I wouldn't be talking to [the BBC] now."

- A major breakthrough by Ukrainian forces would come as a major concern for Russia. Should Ukrainian forces reach the Black Sea, it could see large numbers of Russian troops in the Kherson oblast and Crimea cut off following the damage inflicted on the Kerch bridge linking Crimea to the Russian mainland.

Map of Ukrainian Counteroffensive

Source: Institute for War, WaPo

Source: Institute for War, WaPo

FOREX: Wave of Post-Fed USD Weakness Prompts Fresh Support Across G10

- The greenback is weaker against all others in G10 across early Thursday trade, as markets absorb the Fed decision and remain soothed by the general fade in peak Fed market pricing since Powell's press conference. The softer USD has aided gains in EUR/USD and GBP/USD, allowing for prices to partially erase the mid-July pullback.

- The JPY is similarly weaker ahead of the BoJ decision on Friday. Implied JPY vols have surged considerably, with overnight contracts hitting the best levels since January and the last contentious BoJ decision - at which YCC tweaks were again speculated. EUR/JPY is firmer, bouncing well off the 154.89 low and steering clear of any test on the 50-dma support of 153.78.

- Markets wade through several key risk events later Thursday, with the ECB decision expected to result in another 25bps step for the governing council, however the September guide will be in focus given the partial pricing of further tightening.

- Tier one US data also crosses, with advance Q2 GDP from the US as well as weekly jobless claims. Lastly, the earnings cycle continues, with MasterCard, Bristol-Myers Squibb, McDonald's and Ford among the key releases.

FX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-60(E2.2bln), $1.0970-80(E1.8bln), $1.1025-30(E1.2bln), $1.1100-05(E2.2bln), $1.1150(E832mln), $1.1250(E1.2bln)

- USD/JPY: Y139.50($700mln), Y140.00($852mln), Y141.00($690mln), Y142.00($927mln)

- EUR/GBP: Gbp0.8650(E1.0bln)

- AUD/USD: $0.6729-30(A$771mln)

- USD/CNY: Cny7.2000($2.4bln)

EQUITIES: Stocks Plumb New Heights As Fed Soothes Markets

- The E-mini S&P contract remains in a bull mode condition and is trading higher. Attention is on the top of the bull channel drawn from the March 13 low - the top intersects at 4632.89 today. A clear channel breakout would strengthen bullish conditions.

- Eurostoxx 50 futures recovered from yesterday’s lows and remain in consolidation mode. Despite a brief period below it yesterday, support at the 50-day EMA remains intact for now. The average intersects at 4353.80.

WTI Strength Marks Resumption of Bull Cycle

- Gold conditions remain bullish for now and this week’s recovery signals the end of the recent correction. Last week’s print above $1985.3, the May 24 high, reinforces a bull theme. A stronger resumption of gains would pave the way for a climb towards $1998.1.

- The uptrend in WTI futures remains intact and this week’s climb confirmed a resumption of the bull cycle. The break above $77.15, the Jul 13 high signals scope for an extension towards the next key resistance at $81.44, the high on Apr 12 / 13.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/07/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/07/2023 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 27/07/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/07/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/07/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/07/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/07/2023 | 1230/0830 | *** |  | US | GDP |

| 27/07/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/07/2023 | 1245/1445 |  | EU | ECB President Lagarde post-rate meet press conference | |

| 27/07/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/07/2023 | 1400/1000 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/07/2023 | 1415/1615 |  | EU | ECB Lagarde speaks on the ECB Podcast | |

| 27/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/07/2023 | 1700/1300 |  | US | Fed proposal on capital | |

| 28/07/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/07/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 28/07/2023 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/07/2023 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/07/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 28/07/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 28/07/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/07/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/07/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/07/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/07/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/07/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/07/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/07/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/07/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 28/07/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.